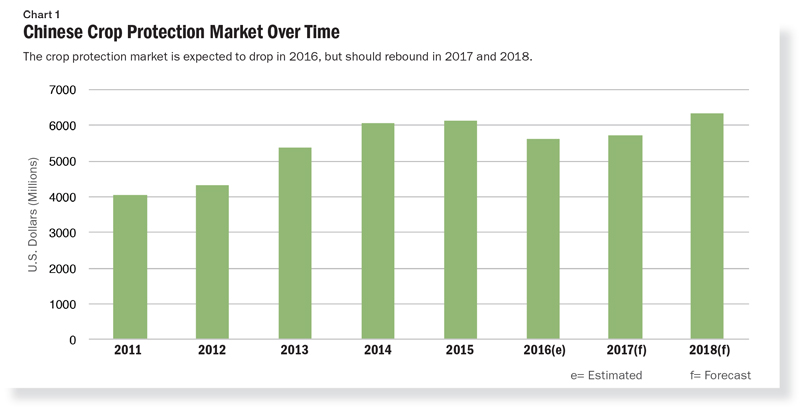

Chinese CP Market Saw Negative Growth in 2016 — Where Is the Market Headed?

For the first time in years the Chinese crop protection (CP) market is expected to experience negative growth in 2016. In 2015, positive volume growth compensated for the overall loss of value. As a result the market remained flat with slight growth of some 1.5% year-on-year. Channel loading for a number of years in light of positive market growth for a continued period led to surplus stocks that were partly consumed in 2015 and 2016.

Growers in China followed a rather cautious approach with their agchem purchases as a result of the pressure on their incomes exerted by continuously low commodity prices for key agricultural produce. Although global price movements only slowly transition into single country markets, domestic producer prices in China followed the general trend. This paired with higher than usual stock-to-use ratios for key commodities such as corn and rice created additional doubts in grower’s minds, leading to a slower paced de-stocking of inventories lower down the retail chain. Consequently, this demand “recession” was passed on upstream to the other links of the distribution chain, leading to the negative performance of the major industry players across the board.

On average in the first half of 2016 — comparing industry sales figures to 2015 for the same period — average growth of the leading agchem market multinational players stood at -6.86%. Emerging and tier 2 players such as FMC achieved growth figures of +7.86% in contrast.

Source: Kleffmann Group

This said, one needs to consider that the overall global market turnover contribution of the top 6 companies (at present) is roughly 63% — a negative growth of 6-7% for this group has clearly resounding effects on overall global market outcome. The growth further down the “tier” level is nevertheless crucial to compensate for a significant chunk of the lost market value. Same is true for China, where negative growth in the overall industry, especially demand driven, was somewhat compensated for by smaller tier 3 players with a diversified product portfolio.

After the first half of 2016, the outlook for China for the rest of the year was showing negative market growth well beyond -10%. As Kleffmann’s proprietary market surveys with the end users of agchem products (growers) reveal, the situation looks slightly “less worse” — with negative market growth staying below -10% on a year-on-year comparison.

Farmers switched from corn to soybean and where possible opted for higher value crops such as rice and vegetables. Agchem use in high value crops remained strong and even increased slightly — showing in higher spend / ha. Multinationals managed growth in the F&V sectors with farmers more keen on buying quality over quantity. In other less CP intensive crop segments (less fungicide and insecticide focused) — farmers were less selective and bought CP products on a more as needed basis. Preventive use was less than usual. The “better than expected” second half of 2016 — was due to the value-driven effect of higher prices for key commoditized active ingredients (e.g. imidacloprid, glyphosate, and 2,4-D — to name a few) as well as demand picking up slowly.

It remains to be seen whether the price increases are temporary and only a result of seasonally higher fossil energy prices in China. China’s ever-stricter environmental policy is surely another driver behind the recent price spikes for key agchem commodities.

Agchem stocks are slowly returning to normal levels and can be expected to trigger a slight market recovery, which should be visible in the first half of 2017. The market in absolute terms, however, is starting from a much lower base in 2017 and will only manage to climb back to market values of 2013 — staying below $6 billion at ex-factory level, estimated for the harvest year and calculated using average year exchange rate.

Chinese currency is further devaluing against the dollar, which might also inflict some momentum into international demand, helping the market stabilize again through a revival of exports. Times also seem to have changed for generics — they have to be more selective about their focus, as not everything that is put on the market is a success anymore.

Moreover, environmental regulations and registration hurdles continue to exert additional pressure on commoditized active ingredients taking established products away from the emerging producers.

Pressure on niche segments and products such as biopesticides — which were for years seen as drivers of the future market — can also be expected. Biopesticides in particular are to be closely watched and analyzed for their success or otherwise in times of market downturn.

Dr. Bob Fairclough is the team leader for Kleffmann Group’s agricultural input market trend information and consulting unit amis AgriGlobe. He is an editorial advisor to AgriBusiness Global. Dr. Nomman Ahmed is the Regional Manager of Asia/Pacific for syndicated grower level market research in crop protection and seed at Kleffmann Group. He is also a senior analyst of Kleffmann’s agricultural input market trend information and consulting wing — amis AgriGlobe. His peer-reviewed publications address agricultural economics, climate change economics and agrichemicals. He is a regular contributor to AgriBusiness Global and can be reached at [email protected].