Grain Production Increases Drive Brazilian Crop Protection Market

By Erica Franconere

Kleffmann Group

Brazil is recognized worldwide as the greatest consumer of crop protection products (CPP) and represents approximately 18% of the global demand. The extension of productive cropland by more than 240 million hectares and the tropical climate are the main drivers for the intensive use of agrichemicals.

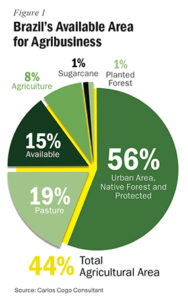

During the past five years, while CPP usage increased 14%, total grain production increased 40% during the same period, suggesting growers are aware of the necessity to produce more with fewer inputs. According to Carlos Cogo Consultancy, there are about 128 million hectares available for agriculture.

During the past five years, while CPP usage increased 14%, total grain production increased 40% during the same period, suggesting growers are aware of the necessity to produce more with fewer inputs. According to Carlos Cogo Consultancy, there are about 128 million hectares available for agriculture.

Producing more with fewer inputs became even more important approach in 2014, after internal political crises significantly impacted the economy. The devaluation of local currency (real) and an increase in taxes and interest rates negatively affected growers’ profits. In addition, a recession decreased credit availability. As a result barter operations and future contracts gained importance as a means to minimize losses. Cost reduction, however, seems to be the most effective way to balance cost production.

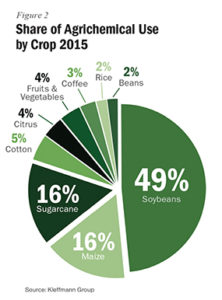

Those factors contributed to Brazil’s CPP industry suffering a 22% drop in sales in 2015 compared to 2014, which led to a 10% drop globally. According to Kleffmann surveys, that drop is the first decrease the worldwide CPP market has seen this decade after five years of continuous growth. Brazilian AMIS panels of 2015 estimates the end-user market value was $11.5 billion, which represents almost 700,000 tonnes of agrichemicals used by farmers on 60 million hectares. About 81% of of those products were sprayed over soybean, sugarcane, and maize production areas (Fig. 2).

Soybean cropland in Brazil has been increasing 5% each year during the last three harvests, especially for pasture, rice, and summer maize. Despite the area growth, the 2015/16 soybean market decreased 1% in sales, mostly because of the reduction of insecticide applications due to the increase of Bt varieties (Intacta). Therefore, caterpillars have lost some importance over pest management, while stink bugs’ treated area increased almost 30% compared to 2014/15 cycle.

Insecticides were the most relevant segment in terms of revenue in 2014/15 harvest, when Intacta area represented 19% of the total cropland. When Bt biotechnology cultivated area doubled, fungicides took over the title as the largest segment in soybean crop protection management. Fungicide sales rose 10%, driven by the increase in number of applications, as treatment costs decreased 6%. In the 2014/15 harvest, not all growers did three fungicide sprayings, but in 2015/16 cycle, at least 18% of soybean area received four fungicide applications. Soybean rust remains the main target, with 83% of planted area treated for the disease.

Finally, herbicide sales presented the most significant increase: 24% compared to the previous harvest. Despite price reduction of the most-used non-selective products, growers invested 18% more in herbicide management per hectare, largely due to increased dose rates in order to control resistant weeds. Therefore, treated-area growth followed the increase in cultivated area, but the amount of herbicides used was almost 10% greater. With only 4% of soybean cropland cultivated with conventional varieties, glyphosate remains the most used active ingredient, representing about 60% of the volume.

On the other hand, the sugarcane CPP market saw a 3% sales increase, even though the area cultivated remained the same. The main driver was the increasing number of applications, especially insecticides. In the 2013 season, only 65% of the area was sprayed twice with insecticides, while in 2015, almost 60% of the area received three applications.

The impact of government regulations — the prohibition of pre-harvest burning in the state of Sao Paulo, for example — has had an effect on sugarcane pest management. Since mechanized harvest has reached nearly 85% of cultivated area, more straw has been left over the soil surface, promoting favorable conditions for the dissemination of soil pests like borer and root leafhopper, which in turn leads to more applications.

For about 60% of the area treated against borer (the most significant of which is Cotesia flavipes) growers used biological products for control. Recently, sugar mills have been increasing the use of agrichemicals as a complementary way of borer treatment. Although biological control is also relevant for root leafhopper — at one point 30% of the crops were treated with Metarhizium spp. — agrichemical control has been the main treatment.

Herbicides are the largest crop protection segment in the sugarcane market, representing 52% of revenue in the 2015 season. Herbicides saw a 7% drop in value when sugar mills began using more generic products in the tank mix to lower application costs. But the volume sprayed over sugarcane has increased 5%.

Among weeds, Brachiaria decumbens is the most significant, infesting 60% of cultivated area of sugarcane.

The cultivated area of maize increased 5% in 2014/15 season compared to the previous one, while CPP market saw almost 20% revenue growth. Most of that growth was due to intensive “technification” of the winter harvest. Herbicides continue to be the most significant segment, but have increased at a considerably slower rate than others due to the adoption of glyphosate-resistant hybrids. The result is a reduction of selective product use.

Roundup Ready (RR) hybrids were planted over 43% of the total maize area, considering both summer and winter harvests, which led to an increase in glyphosate use. The high adoption rate is not surprising as the cost for herbicides per hectare in RR hybrids can be up to 15% lower than conventional varieties.

Maize growers, unlike soybean growers, are not as concerned about weed resistance because they haven’t totally stopped using selective herbicides. Maize is usually cultivated in rotation with soybean, so growers are aware of the necessity to change active ingredients as well. But it can’t be taken as a general truth, so it is expected that the use of selective herbicides in maize will increase, especially in the Midwest, where growers are using post emergence glyphosate in greater areas.

About 85% of maize area was cultivated with Bt hybrids in 2014/15 season. Despite that, insecticide sales increased 38%, because some traits proved ineffective in avoiding caterpillar damage. In general, growers showed a preference for CPP products against caterpillar pests over Bt hybrids. They simply reduced the number of sprayings when compared to non-Bt hybrids.

At the same time, growers made more applications against stink bugs and other sucking insects, especially in winter maize. Acephate, the most used active for control of stink bugsl, had a significant price increase as well. The combination of these two factors resulted in a doubling of the stink bugs market compared to last year.

The adoption of fungicides is significantly higher in winter maize compared to summer maize (86% vs. 48% of cultivated area, respectively). Although summer maize growers tend to spend more on fungicides, fungicide-treated area in winter maize is five times greater, which has led to a general increase of 28% in product sales. Moreover, rust remains the disease most in need of control. Some 60% of total maize area receives at least one application, though leaf spot (Phaeosphaeria spp.) has gained importance recently.

The vast majority of maize growers also grow soybean crops, so they use similar products in terms of crop protection management. That’s why ready mixtures of strobilurins and triazoles are the most used products for both soybean and maize rust.

In spite of the political and economic crisis the country has faced the last two years, mostly due to corruption scandals, the agriculture sector is holding together. Brazil’s GDP in 2015 decreased almost 2%, but the reduction would probably have been greater if not for the agribusiness sector, which increased 4% due to record grain production. That trend might not last in the coming years unless growers change the way they have been running their businesses.

Growers’ principal objective must be cost reduction in order to gain competitiveness and enlarge profitability. Most inputs (crop protection products and fertilizers) are imported, so the only path to higher profits is by optimizing resources. In addition, precision farming has become a major trend among Brazilian growers. Brazilian Agricultural Department (MAPA) has estimated that in 2020, grain production will reach 275 million tonnes, so average yield should increase 38%.

The Brazilian government has raised the amount of financial resources to agribusiness for the next harvest (2015/16) by 20%, most of it to help commercialization and strengthen family growers. That is also a way to prevent inflation: average growers organized into family business provide 70% of agricultural goods for internal market supply.

Brazil, “the barn of the world,” is the greatest soybean, beef and poultry meat exporter and the greatest exporter and producer of sugar, coffee, and orange juice. Brazilian growers and ranchers are willing to increase production even more, and that is a great opportunity for those involved in agribusiness segment worldwide.

Franconere is an agronomist, with a Master’s Degree in Animal Production. She has 10 years of professional experience with marketing intelligence and strategic planning. Contact her at [email protected].