Overview of the Indian Crop Protection Market

Agriculture is the backbone of Indian economy with 52% of the population engaged in agriculture and related activities. But the sector’s share in Indian economy has declined to 13.7% in terms of GDP because of higher growth rates of the industrial and services sector, which needs to be addressed considering its importance in our Socio-economic development. Indian Agriculture has been facing grave challenges for many years. The most important being “sustained development in proportion to the exploding population”. Even after the Green Revolution in mid 60s, we are still not fully self-sufficient in Agriculture. The growth rate of agriculture is not able to cope up with rapidly growing population. Land under agriculture is limited but number of people being fed on the piece of land is constantly increasing. Due to inadequate irrigation facilities, lack of proper crop protection measures, poor seed quality of food grains, the output is far below world average.

Water shortage is a major problem in one part of the country while crops are damaged year after year due to flood in some other parts of the country. Of the total cultivable land merely 40% area is covered by irrigation and rest 60% depends on monsoon. On an average, farmers’ income has come down by 3 per cent in 2014-15 and by 4 per cent in 2015-16 due to crop losses as a result of shortage of rainfall. During 2014 and 2015, monsoon shortage was around 12 per cent and 14 per cent from the long period averages. In 2016-2017, the Southern State Tamil Nadu faced the worst water crisis and rainfall shortage (62% deficit) in recent times resulting in heavy loss of paddy crops (800 hectares of paddy withered) in the Cauvery delta region and added misery to the farmers of this region.

For many decades various plans are only on paper and not implemented effectively. It is a pity that the farmers are dependent on monsoon even now and the technologies like drip irrigation have not reached the farmers in many parts of the country for adequate water supply to crops and in the same way flood water is not channelized for proper irrigation to avoid damage to crops. There is much to be done by introducing innovative technologies to face the natural calamities and mere compensation and insurance for crop losses will not bring substantial growth in agriculture and relief to farmers.

The second imperative challenge faced by the Indian agriculture is the colossal losses caused by the insect pest attack on the crops. About 20% crop production is lost due to insects, weeds and diseases but still Indian Crop protection chemicals usage is one of the lowest and erratic in the global scenario even though there is no dearth for agricultural scientists and technologists in the country.

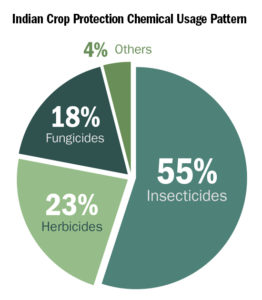

The per capita consumption of pesticides in India is 0.6 Kg/ha as compared to 3kg/ha of world average. The main reason for low per capita consumption of pesticides in India is low purchasing power of farmers and small land holdings. There are signs of change in this scenario due to the entry of big food products retailers and manufacturers. In order to increase yield and ensure food security for its enormous population, extensive crop protection measures are very essential. Indian Crop protection chemical usage pattern for decades has not changed much with insecticides contributing to 55%, followed by herbicides 23%, fungicides 18% and the rest other products such as bio-pesticides, plant growth regulators except in recent years herbicide and fungicide usage is on the increase. This contributes to the higher production of fruits, vegetables and soybean.

The per capita consumption of pesticides in India is 0.6 Kg/ha as compared to 3kg/ha of world average. The main reason for low per capita consumption of pesticides in India is low purchasing power of farmers and small land holdings. There are signs of change in this scenario due to the entry of big food products retailers and manufacturers. In order to increase yield and ensure food security for its enormous population, extensive crop protection measures are very essential. Indian Crop protection chemical usage pattern for decades has not changed much with insecticides contributing to 55%, followed by herbicides 23%, fungicides 18% and the rest other products such as bio-pesticides, plant growth regulators except in recent years herbicide and fungicide usage is on the increase. This contributes to the higher production of fruits, vegetables and soybean.

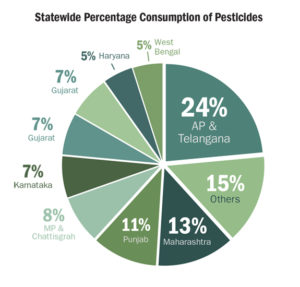

Andhra Pradesh & Telegana, Punjab, Maharashtra lead in consumption of crop protection chemicals followed by other states. Madhya Pradesh has been benefited a lot by proper crop protection usage and emerging as one of the important Soybean producing region not only in the country but globally. A rise in the usage of agrochemicals has also been observed in West Bengal where the purchasing power of farmers had been low.

The estimated consumption of crop protection products in FY15 in terms of value is around 2.25 billion USD and the expected growth in the coming years is 7% annually. Export of pesticides also comes to almost equal value with a slightly higher growth rate expected in the near future.

Agrochemical industry has come a long way in the last four decades and could cater to the needs of farmers with hundreds of products for crop protection. Till 80s, Indian farmers were far behind their counter parts with old products of MNC and then Indian companies with their R& D skill came out with number of generic molecules at cheaper costs affordable by majority of farming community.

India could become self-sufficient in many food crop production because of this development, a fact which could not be denied. But then came the situation where the cost of manufacturing of technical products is very much cheaper in China as compared to that of India. This can be attributed to vast number of manufacturing units in China with cost effective technology for production of active ingredients, availability of raw materials and halting production of pesticide technical by MNCs in various countries and shifting their units in massive scale to China. Therefore Indian companies have no option left with except importing in many cases rather than to manufacture. Patent compliance also restricts manufacture of latest molecules and so MNCs have an upper hand in providing new formulation products. Indian companies could only co-market a few products under arrangement.

At this juncture, the ministry of agriculture has proposed some sweeping changes in registration guidelines for curbing imports of technical that are registered by Indian companies for indigenous manufacturing. This is to encourage the Indian technical manufacturers and to support the Indian Government’s call for “MAKE IN INDIA”. But the reality is different and the Indian manufacturers are not yet geared up to manufacture many technical for which they have registration to manufacture. Without giving sufficient time to the Industry to strengthen their manufacturing capabilities, if the proposed rules are implemented now, there will be a big supply vacuum of many products. This may have a negative impact on the Indian agriculture and the pesticide industry. The Indian registration authorities & the Industry should analyse the situation thoroughly and come out with practical solution for registration of import of molecules as well as for indigenous manufacturing keeping in view of the above facts. This will enable the farmers to get new products at affordable cost and also illegal imports be curbed substantially.

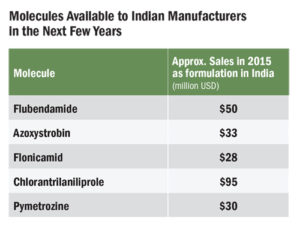

The need of the hour is Indian companies should be more aggressive in research and development to come out with cost effective commercial manufacturing process for novel molecules like Chlorantrilaniliprole, Flubendamide (patent expires in a few years) among others.

Industry should concentrate more on development of new formulations that are eco-friendly and production of effective bio-pesticides, PGRs, bio-stimulants, micro nutrients so that farmers have access to these products that will boost the crop yield and enrich the soil condition. Government agencies, Universities and Industry should come together in imparting proper knowledge on the usages and effectiveness of crop protection products and more importantly should dispel the myth about the crop protection chemicals (as evils) from the mind of the public. One should not forget that the inherent strength of India is agriculture and the same should be nurtured. “GROW IN INDIA” is equally an important agenda.