China’s Dicamba Exports to Leap Over 200% in 2015

China’s exports of dicamba technical are on course to rise over 200% in 2015 as a “virtuous circle” of factors send demand for the herbicide soaring, according to analysts CCM.

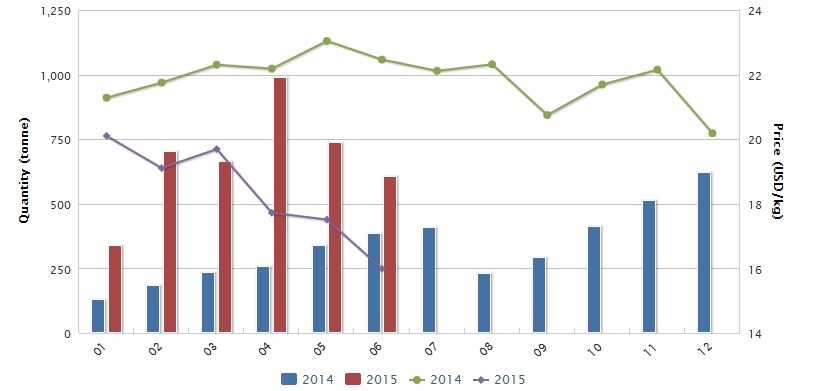

Figure 1: Export volume and price of 98% dicamba technical in China, January 2014-June 2015; source: China Customs and CCM

China exported more dicamba technical during H1 2015 alone than during the whole of 2014, according to China Customs data, with most of the demand coming from the U.S., Argentina, Germany, Australia and Chile.

And Chen Zaoqun, editor of Herbicides China News, predicts that overseas demand for dicamba will accelerate further during H2:

“The demand will continue to grow,” said Chen. “In previous years, demand for dicamba has generally been higher in H2 than in H1, because demand from South America always rises in the second half of the year due to the start of their main planting season.”

Why Chinese dicamba exports are rising so quickly

CCM’s research indicates that there are three main factors behind the recent surge in Chinese exports – increasing crop resistance to glyphosate around the world, China’s rising of export rebates for dicamba technical, and increased supply from China thanks to a string of recent capacity expansions.

- Glyphosate’s loss is dicamba’s gain

Demand for dicamba is increasing as an increasing number of farmers begin to switch from glyphosate.

Glyphosate is by far the most popular herbicide in the world, with China alone producing over 500,000 tonnes of it each year. But crop resistance to glyphosate is becoming an increasingly serious problem, leading many growers to look for alternative solutions.

Dicamba has many qualities that make it an ideal substitute for glyphosate, according to Professor Li Xiaogang of Hunan Agriculture University:

“As an effective herbicide with low toxicity, dicamba has a strong, rapid and moderate-lasting effect on plants at even small dosages,” said Li. “Most importantly, even after a long period of application, weeds shows little resistance to it.”

Mixed formulations of dicamba and glyphosate are also becoming popular as a tool for combating glyphosate resistance, which is pushing up demand for dicamba further. Analysts xnynzw.com predict that global demand for dicamba-glyphosate mixed formulations will reach 30,000 tonnes by 2017.

- China is encouraging exporters with higher tax rebates

China’s decision to increase export tax rebates from 9% to 13% for 481 pesticide products, including dicamba, from January 1, 2015 has also had a major impact in driving up exports.

According to Chen, the policy has been effective in encouraging exporters and helping improve the competitiveness of Chinese pesticides abroad:

“The almost full tax rebate has helped improve manufacturers’ gross profit margins and market demand for dicamba”, said Chen. “Manufacturers have found that they can make more profits by exporting than through domestic sales.”

“Exporters have also been more inclined to lower their export prices for dicamba technical due to the higher tax rebates, which has in turn increased demand for Chinese dicamba further,” added Chen.

Chinese export prices have also been forced down further by the aggressive tactics of Jiangsu Yangnong Chemical Group Co., Ltd., the leading Chinese dicamba exporter, which has attempted to use its cost advantages to undercut its competitors.

Yangnong Chemical’s average export price for dicamba technical during the first six months of 2015 was almost 30% lower than its competitors, according to China Customs data, which forced its rivals to lower their prices, too.

- Chinese manufacturers are expanding their dicamba production capacity

Another big factor behind the leap in Chinese exports has been the dramatic growth in China’s production capacity for dicamba.

Several manufacturers have completed large capacity expansions during the last two years, leading China’s overall capacity to grow from 3,200 t/a in 2013 to 12,700t/a this year, a 297% increase, according to CCM.

The most dramatic example of this has been Yangnong Chemical, which now accounts for around 40% of Chinese exports by itself following its recent capacity expansion. If you include exports from its subsidiary Youth Chemical Co., Ltd., Yangnong Chemical accounted for 73% of Chinese dicamba technical exports during H1 2015.

“It’s a virtuous circle. As demand rises overseas, the suppliers will try to keep their pace. And as the supply of dicamba increases, and exports will surely grow”, commented Chen.

For more information about CCM, please visit http://www.cnchemicals.com or get in touch with us directly by emailing [email protected] or calling +86-20-37616606.