Mixtures, Formulations Dominate New Patents

In 2014, the agrochemical crop protection industry was worth about $55 billion at the distributor level, and it is forecast to continue to grow at 2% to 3% per year over the next three to five years. Intellectual Property Rights (IPR), in the form of patents and data protection for registrations, are fundamentally important to the dynamics of the agrochemical industry and dictate the balance between the R&D sector (innovator companies) and the generic sector.

There are approximately 500 agrochemical active ingredients manufactured from organic synthesis that account for over 90% of the total market. During the last 15 years, agrochemical innovation has declined and now only four to eight new AIs are introduced into the market each year. However, there has been a significant increase in the number of new products reaching the marketplace primarily as a result of mixture products. The majority of new patent applications for agrochemical products are not for the discovery of new AIs but for secondary patents such as mixture, formulation and process.

These mixture products and new formulations can also be granted patent protection which has resulted in significant segmentation of the market and protection from generic competition. Mixture products are developed for a number of technical reasons including:

• Resistance and resistance management

• Newer AIs tend to have a narrower spectrum of activity compared to older products and therefore mixing with other AIs of differing mode of activity is required to provide a full control spectrum – especially fungicides.

Analysis of AIs on patent in Enigma Marketing Research’s (EMR) AgriBase database shows that herbicides have on average the most number of mixture products (5-6 per AI), followed by fungicides (4-5 per AI) and then insecticides (1-2 per AI). It is interesting to note that for insecticides the opportunity to segment the market via mixtures is more limited, thus the market is more vulnerable to generic competition, and as a result, patent litigation on insecticides has tended to be on process patents.

Mixture products also provide the originator company with greater protection from generic competition as:

• Mixtures segment the market and create greater number of branded products making it harder for generics to take

market share.

• Many mixture products contain other patent protected active ingredients.

• Many mixture products have received patent protection in their own right as a result of so-called synergistic activity.

Since 2000, EMR has published a series of eight reports titled “New off-patent/generic agrochemicals.” These reports have identified and profiled over 180 major commercial AIs at a time when basic patent protection was due to expire. In the latest report, EMR also identifies patent-protected mixture products.

For those companies planning to enter the European market there is an added complication of patent term extension or Supplementary Protection Certificates (SPCs). SPCs were introduced in 1993 for pharmaceuticals when the EU recognized that a significant erosion in effective patent term existed for pharmaceuticals resulting in insufficient market exclusivity period in order to recoup the substantial R&D costs. In 1997 as a result of extensive lobbying by the agrochemical R&D sector, SPCs were introduced for agrochemicals.

SPCs extend the life of a patent for up to a maximum of five years and are granted in Europe on a national basis. Any company planning to enter the EU market must establish when patents for the AI, mixture products or other secondary patents expired, if SPCs were granted and whether these have now expired.

In order to extend its services EMR has acquired the global rights from Cabinet Alice de Pastors (CAP) for a database which identifies SPCs for agrochemicals. The database was first established in 1997 and is updated on a monthly basis for 31 European countries.

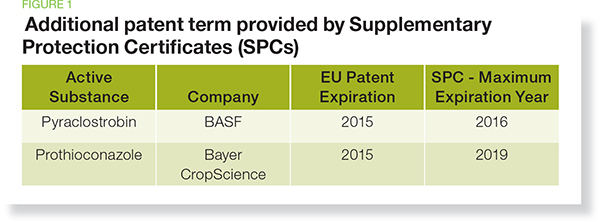

Figure 1

Two AIs, prothioconazole and pyraclostrobin, demonstrate the difficulties generic manufacturers face when assessing the requirements for market entry. For both AIs the standard 20-year patent term expires in 2015, but in the EU SPCs are in force in some countries extending protection well beyond this term (see Figure 1).

Prothioconazole is a triazolinthione fungicide discovered and developed by Bayer CropScience for use as a foliar spray on cereals (wheat, barley and rye), canola/oilseed rape, peanuts, pulses, soybeans, rice, sugar beet and field grown vegetables. It is also used as a seed treatment.

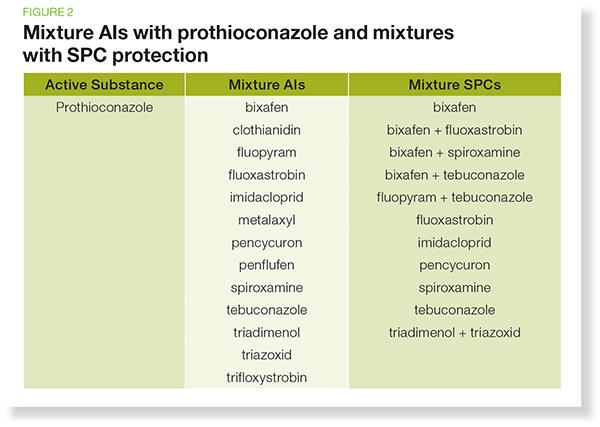

Figure 2

Prothioconazole mixture products account for over 80% of the EU market. Figure 2 identifies a number of mixture AIs with prothioconazole and identifies those with SPC protection.

As the examples of prothioconazole and pyraclostrobin demonstrate, it is not sufficient just to determine when the patent for the AI expires, it is essential that would-be generic suppliers assess any extended IPR for mixture products, process patents, data protection and many other aspects before attempting to enter the market.