Natural Selection-by-Regulation: Survival of China’s Fittest Glyphosate Producers

Fang Lin

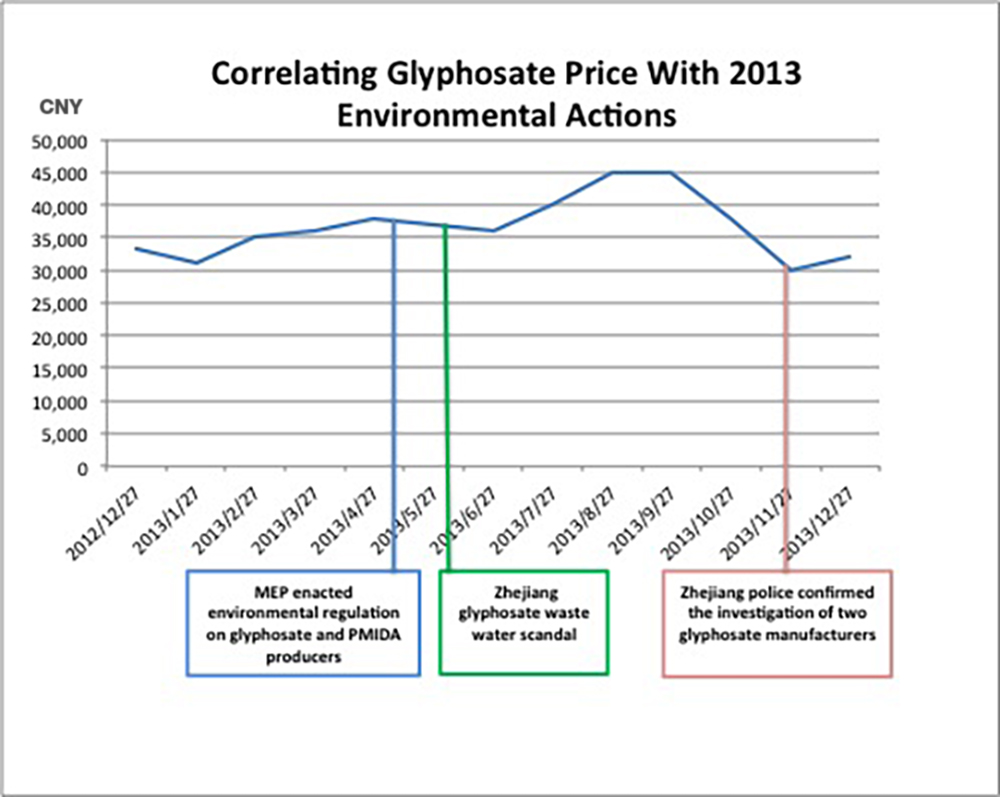

In June 2014, the price of Chinese produced glyphosate was CNY 30,000 per ton – a significant decrease from April’s average price of CNY 36,000 and a mere shadow of the heights witnessed during 2013’s glyphosate rush. It would be reasonable to point the finger at poor overseas sales performances. However, upon closer scrutiny, the failure of China’s Minister of Environment Protection (MEP) to stabilize production volume is probably the telling factor. It requires both China’s government and domestic industry to profoundly rethink China’s domestic development strategy. The Chinese government has been almost powerless in reigning in the massive fluctuations in the value of its domestically produced glyphosate and has laid the foundations for massive regulatory reform in hopes of changing this situation.

Global Demand and Policy Failures

The relationship between South American demand and Chinese glyphosate prices was highlighted by a sharp decline in consumption and the inevitable negative impact on glyphosate prices. In response to declining sales, China’s knee-jerk reaction has been to attempt to reduce overall supply with the aim of stabilizing the price. China’s glyphosate industry and the price of its glyphosate exports have been victims of China’s high-volume/low-quality production paradigm. A dispersed production base divided into the hands of hundreds of small production operations has made price fixing almost impossible.

Stabilizing Value Means Controlling the Supply

The government’s solution to this problem is to centralize production and ultimately control supply variables – a natural selection-by-regulation designed to thin China’s glyphosate production herd, allowing only the fittest producers to survive. The supposition is that increased regulatory standards and greater regulation of production certification will force substandard glyphosate exporters out of business and thereby consolidate the remaining supply into the hands of a fewer higher-capacity glyphosate producers. The knock-on effect here would be greater control over supply and obviously greater control over price. In a nutshell the new regulations now require that glyphosate producers voluntarily subject themselves to rigorous review and inspection of production facilities and waste disposal systems. Compliant glyphosate (PMIDA) producers are included in MEP’s “List of Compliant Glyphosate (PMIDA) Producers.” The new regulations seem to be working perfectly with only four companies included in the draft list, which accounts for about 20% of China’s production capacity:

- Zhenjiang Jiangnan Chemical Co., Ltd. (wholly owned by Wynca)

- Nantong Jiangshan

- Jiangsu Youth Chem (controlled by Jiangsu Yangnong)

- Hubei Taisheng Chemical Co., Ltd. (originally controlled by Jinfanda, but recently transferred to Hubei Xingfa Chemical, a phosphorus chemical company)

It Didn’t Work Before. Why Would It Work Now?

The government is moving cautiously with glyphosate reforms after taking similar actions in the past which ultimately proved futile. Three years ago, the MEP took similar measures on the citric acid industry, whose problems mirrored those of the glyphosate industry with a high number of small-scale producers diluting supply. SMEs were forced out of the market by MEP’s regulations and the compulsory measures of other authorities. When the industry reform was complete, six indigenous producers remained, accounting for over 95% of total production in 2013. In spite of these reforms, citric acid production was still overproduced by almost 500,000 tons per year. Export values have decreased in the past two years and nearly all the producers are selling at a loss at present.

The major differences between the citric acid and glyphosate industry reforms are the absence of substantial coordinated measures by other governmental authorities, rendering the current glyphosate environmental regulations optional for Chinese producers. In this instance the government is testing the waters before diving head-first into full-scale reform and ultimately repeating its past mistakes.

In June 2013 Wynca and Jinfanda were reported to be under investigation for allegedly discharging glyphosate pollutants into the Beijing-Hangzhou Grand Canal through a chemical warehousing and transporting company.

Expansion Plans Fly in the Face of Regulatory Goals

Alarmingly, the investment plans of several producers spell danger for the success of glyphosate reforms. Hebang, Fuhua Tongda, Wynca and other producers in Jiangsu and Inner Mongolia will expand capacity by anywhere from 50,000 to 100,000 tons per year. With these facilities operational, production volume will increase somewhere in the range of 400,000 to 500,000 tons in the next five years. The other worry for China is that if it makes its industry overly competitive it will price itself out of the market and give opportunities to rivals in India or other countries. It was also reported that a production facility with a 30,000-ton-per-year capacity will be established in Russia, cementing an assertion that glyphosate reforms are unlikely to curtail production to any significant degree, and are ultimately destined to follow in the unsuccessful footsteps of citric acid reforms.

A major problem for China’s citric acid and glyphosate industries – which is endemic among Chinese industry as a whole – is the lack of a unified industry front. Domestic competition is cutthroat and individual company profits usually come at the expense of the integrity of the national industry.

So the major questions still remain. When the Chinese government finally decides to make reforms mandatory will these reforms stabilize glyphosate prices? Historical precedent has shown that they won’t. The expansion plans of Chinese major producers are highly likely to offset the decrease in volume, stimulated by removal of the contribution SMEs have in terms of export volume. Until these producers cooperate towards a mutually beneficial goal we can expect Chinese glyphosate price stability to continue to be at the mercy of global demand.