China Price Index: The Transformation of China and Its Agrochemical Industry

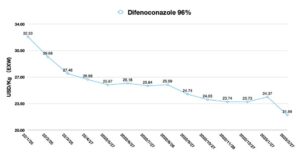

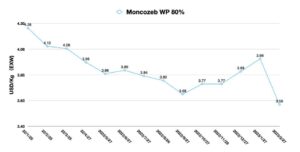

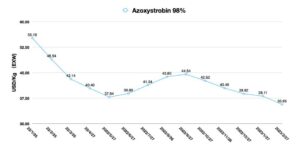

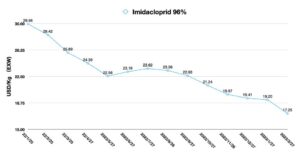

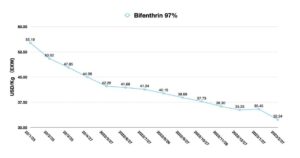

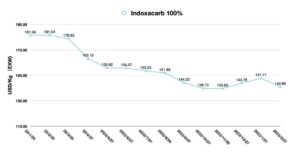

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also outlines why agchem companies like Nutrichem are well positioned to take advantage of China’s shift to a tech-based society.

China’s National People’s Congress concluded on March 13. A significant point was the reform plan of China’s organizational structure. The focus is on two aspects: One is the re-establishment of the Ministry of Science and Technology to manage the chain of science and technology innovation through a state-wide system; the other is the establishment of the State Administration of Financial Supervision to reform the financial regulatory system. China is promoting a deeper integration of science and technology innovation and the financial system. Establishing an ecosystem that supports science and technology is the cornerstone of a strong country. This organizational change will be the turning point of China’s development in the next decade.

China will transform from a “resource-processing manufacturing base” to an “innovation-based” society providing an historic opportunity for technocrats at the top of the government, Chinese basic researchers, and Chinese companies driven by innovation.

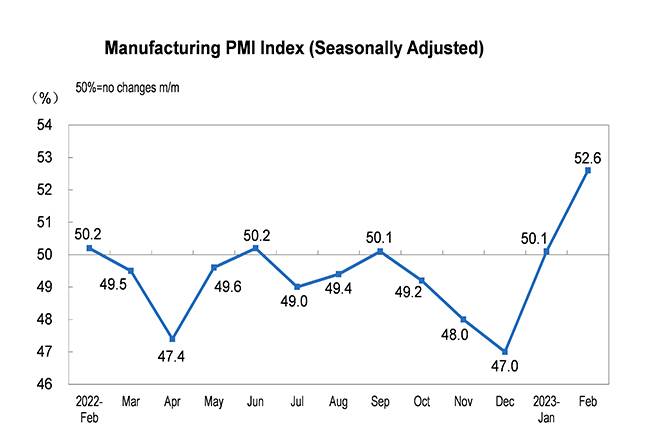

In February 2023, following the release of the COVID-19 restrictions, China’s resilience was quite evident. Overall, China is gradually recovering, from the service sector to the manufacturing sector. However, due to sluggish overseas market demand, channel inventories are already occupying at high levels after the bullwhip-effective purchases in the first half of 2022. As a result, overseas procurement managers are being very cautious in 2023. However, it is reassuring to note that China’s manufacturing PMI has rebounded significantly, and market demand is flooding into China supply — depending on product.

Source: China National Bureau of Statistics

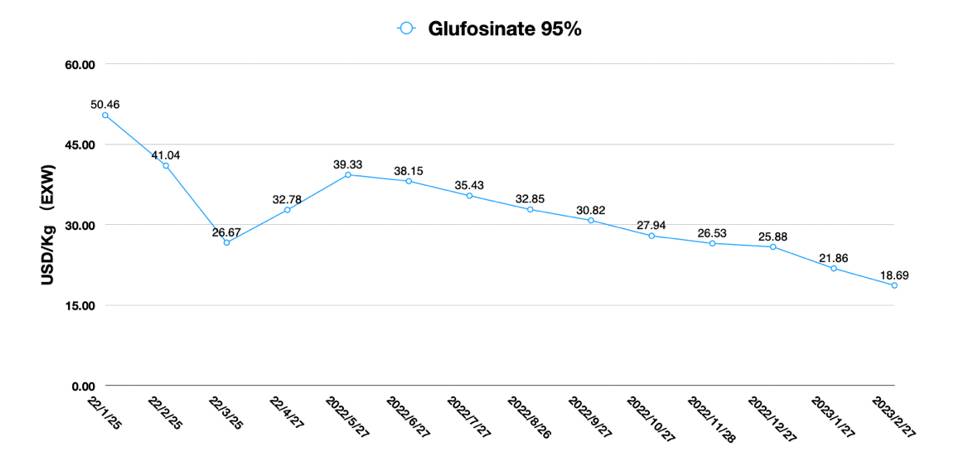

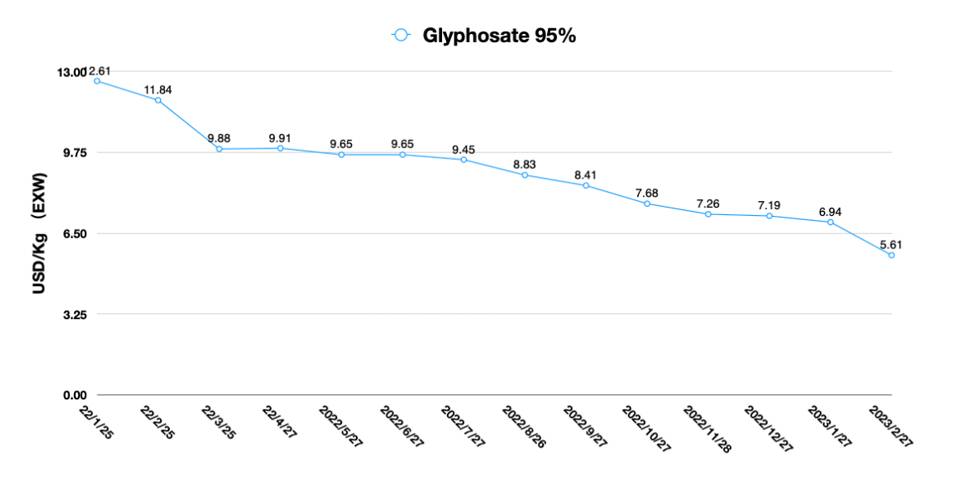

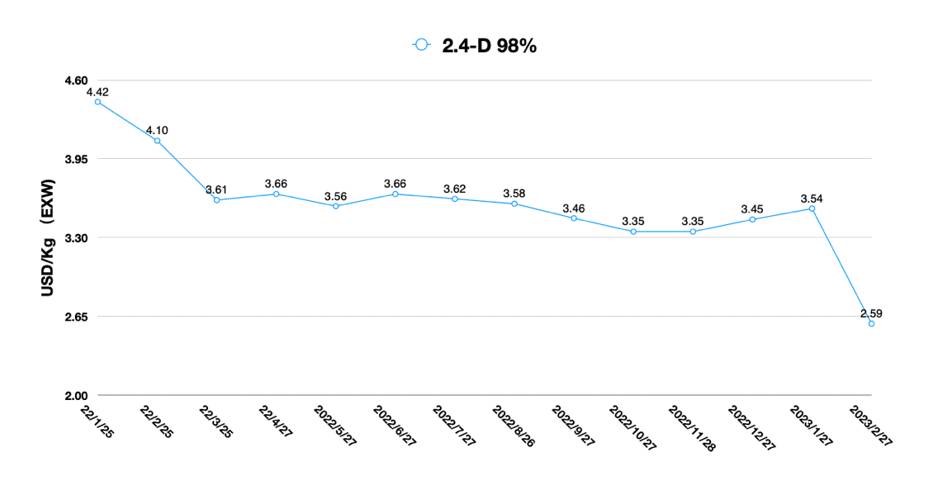

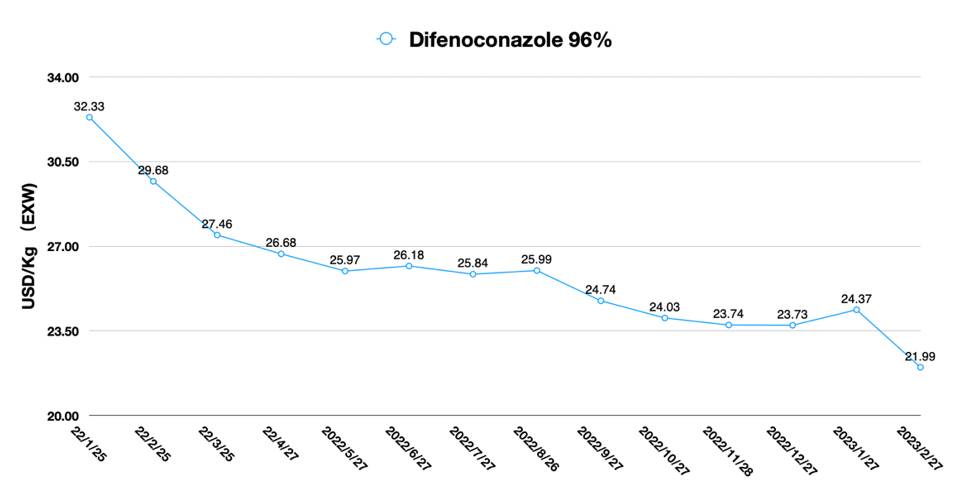

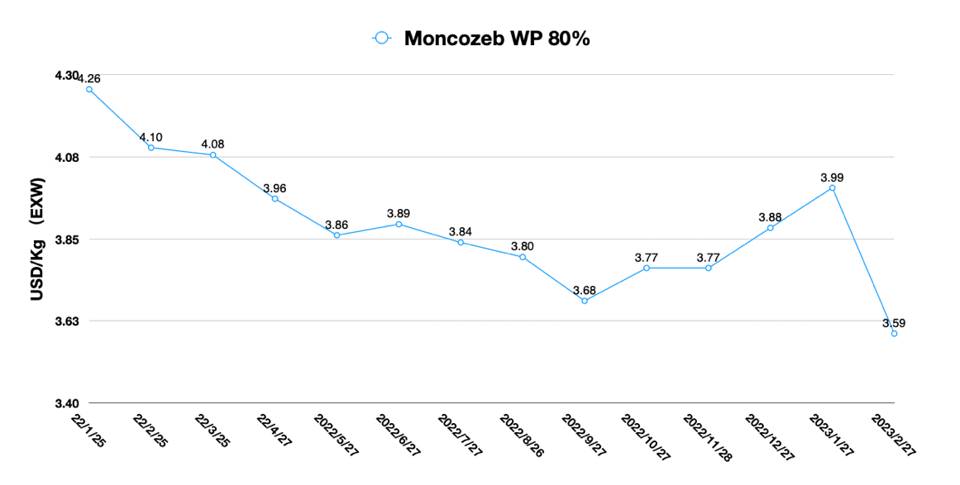

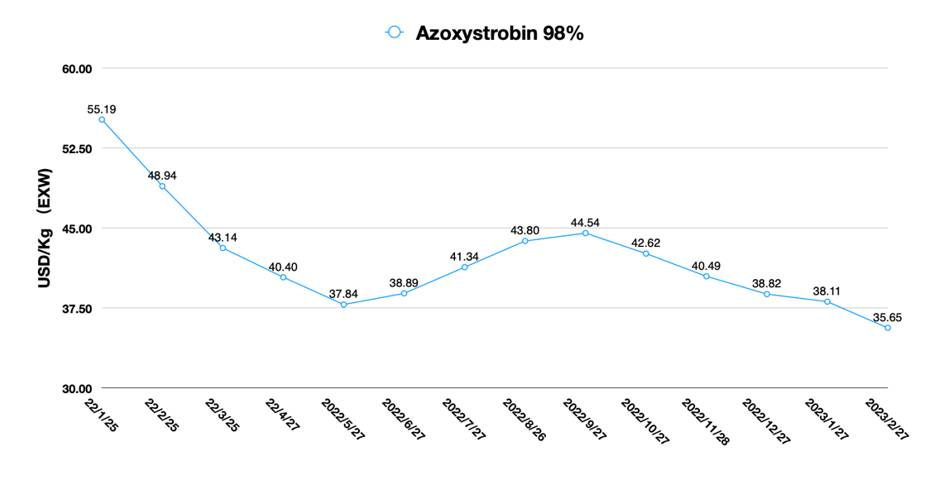

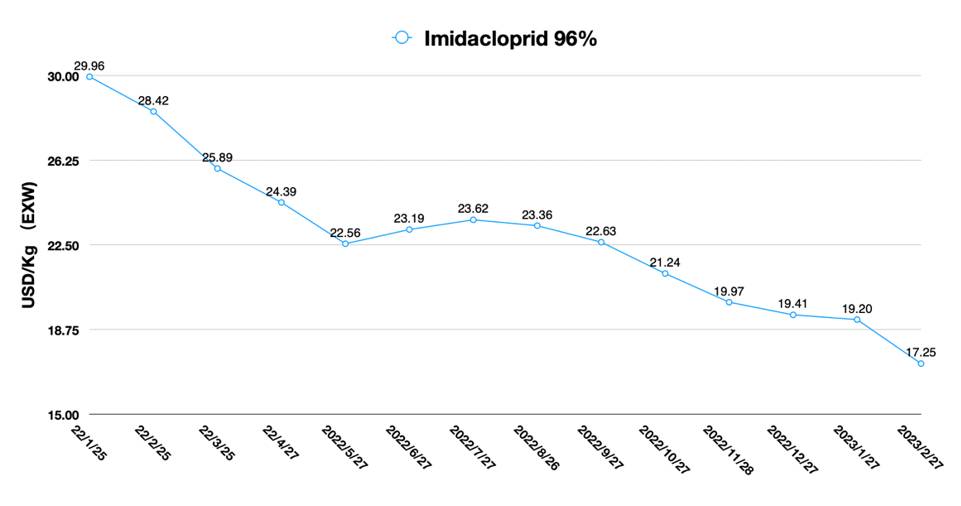

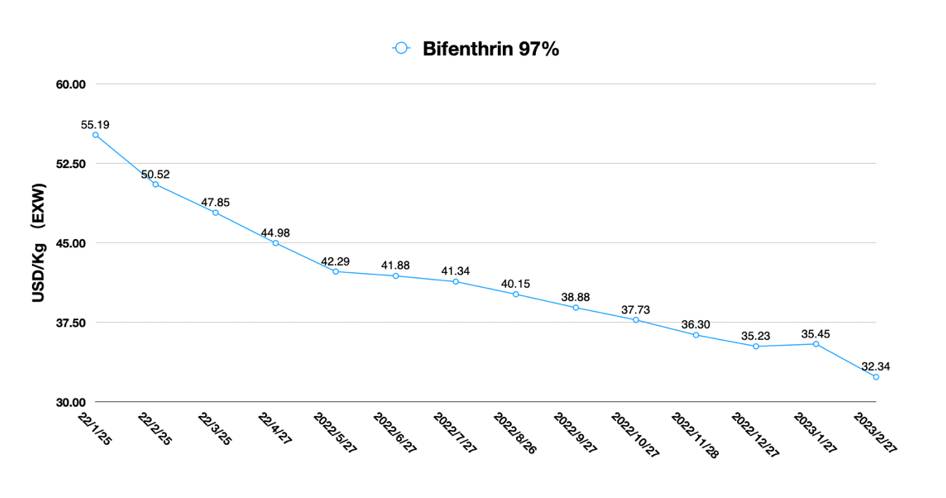

With regards to the Chinese pesticide industry, a price war is on the horizon due to overcapacity for those products where China has a supply chain advantage. India’s supply has had a degree of impact on Chinese pesticide suppliers. To face this challenge, Chinese agrochemical companies are actively laying out novel AIs with high R&D investment. China’s technology-oriented agrochemical companies, represented by Nutrichem, have largely improved their corporate strategies and internal governance changes in the past three years under the impact of the COVID-19. “Change management” is making a new transformation in China’s agrochemical industry.

On 24 March 2023, Nutrichem announced its 2022 annual financial results. In FY 2022, the company’s revenue exceeded CNY 8.1 billion (approximately US $1.17 billion). This represents an 11.39% increase in revenue compared to the same period in 2021. What is striking is the 118.11% increase YOY 2021 in net profit attributable to equity holders of the company in 2022. The weighted average return on net assets reaches 19.56%. It can be said that Nutrichem had an eye-catching performance in 2022.

The company’s significant increase in profitability, in addition to its efforts to resolve the impact of unfavorable factors, is due to the integrated synergistic strategy of “research, production, supply, and marketing.” It ensures the supply of raw materials, stabilizing the output of production capacity, consolidation, and deepening marketing strategy.

The new process of decision making, reducing costs, and increasing efficiency by focusing on improving product gross margin, and dynamically ensuring product profit room. This is the essential factor that allowed the company to break through to a new record high.

Why was Nutrichem able to achieve such growth in 2022? What is the secret of Nutrichem’s growth under the impact of the COVID-19 control?

As one of the leading agrochemical companies in China, Nutrichem has four fundamental competitive advantages:

- Nutrichem has a relatively balanced, multi-product line. It mainly has strong market competitiveness in triazinone herbicides, diphenyl ether herbicides, and amide herbicides, together with novel processes of other key fungicides. Due to the cyclical nature of the pesticide industry, multiple product lines can resist the uncertainty of market risk for the company’s performance. For Nutrichem, the “product and financial performance-oriented” business strategy is the cornerstone of its success.

- Nutrichem combines trading products with self-produced products to fully satisfy customers’ needs. In the context of the integration of the whole agrochemical industry value chain, Nutrichem has made a decisive shift from an asset-light business model to a technology-based investment business model. Through its professional business team, it has been able to fully transfer the value of its portfolios to the B2B downstream customers’ supply value chain. The landing of its advantageous projects into production can give a positive signal to the customer’s supply chain system, which builds a solid supply guarantee in China. Positive interaction brings additional competitive advantage to customer satisfaction. Nutrichem was previously affected by the “Xiangshui Incident” in Lianyungang, Jiangsu Province, which impacted the key production facilities in Yancheng South, resulting in the need for the company to rearrange its entire supply chain, increase investment in new production capacity, and gradually write down production base assets that do not have advantages on which such as environmental protection and regulation.

- Nutrichem benefited from changes in its corporate governance. Through the transformation of its organizational structure, Nutrichem gradually shifted from a sales-oriented internal decision-making mechanism to an integrated decision-making mechanism led by R&D. Nutrichem’s R&D expertise finally can contribute into its revenue directly. More importantly, Nutrichem can transfer the R&D value to the customer’s supply chain in a complete and timely manner.

- Nutrichem’s growth is mainly based on its continuous investment in R&D. From 2020, Nutrichem invests an average of 200 million CNY (around US $28.99 million) per year. From 2020 to 2021, Nutrichem invested close to US $100 million in R&D. Taking the improvement of Azoxystrobin process as an example, Nutrichem has invested continuously for nearly 10 years, excluding human resource costs and company R&D costs. This continued investment in its own superior products is the soul of Nutrichem growth.

An old Chinese proverb says that “a glimpse of a spot reveals the whole picture.” It means that the whole picture can be deduced from the details of a thing. In China’s pesticide industry, Nutrichem is a special case, but the reason for its business success is also common to the whole Chinese pesticide industry (and even the Chinese chemical industry).

In 1935, the Japanese scholar Kaname Akamatsu first proposed the “Flying Geese Paradigm,” which refers to the process by which an industry flourishes and declines in different countries as the industry shifts. This theory was used to describe the shift of industrialization in East Asian countries in the 1970s. At that time, China was portrayed as a following goose and its 1.4 billion people were portrayed as a productive society with abundant, highly qualified, and cheap labor. The biggest flaw in this theory is that it ignores the growth mindset of Chinese society. In a Chinese society that generally values education, the abundant, highly qualified labor is a group with an enthusiasm for growth not only of knowledge but also for a better personal life. After generally receiving training from multinational companies on quality control, the average labor force can even assemble quality-checked German branded famous cars.

After three years of the COVID-19 epidemic, many people may have overlooked one important key point. China is gradually forming a “technology-based” society. As Zhang Xiaoyu mentioned in his book Technology and Civilization, the world’s largest single market, the world’s most experienced and highly qualified labor supply, and the most complete industrial chain based on it fundamentally distinguishes China from the other “following geese.” The question for everyone around the world is: Where will this “maverick” goose of China fly?

China’s industrialization and modernization has transferred the value of 1.4 billion people’s labor into the global industrial chain. And this continuous supply has been going on for decades. The ability of industrialization to absorb China’s population has allowed China to emerge peacefully as an important part of the world economy. Along with the gradual accumulation of wealth, industrialization, and modernization simultaneously elevated the lives of Chinese people to unprecedented levels.

However, because of China’s aging population and the fact that it has not traditionally been a consumer-oriented society, China’s growth challenges have come earlier and are more complex than those of the developed West. China’s gradual shift to a “technological” society, influenced by Confucianism, will bring about another social change. From a greater focus on basic science in basic education to the dominance of technocrats in government, and a shift in Chinese companies from monolithic manufacturing to industrial upgrading in the context of social responsibility, these favorable factors will make “sustainable” growth in China more realistic.