Índice de Preços da China: Perspectivas de Fornecimento de Agroquímicos na China para 2026

Nota do editor: O escritor colaborador David Li oferece um instantâneo das tendências atuais de preços para os principais herbicidas, fungicidas e inseticidas no mercado agroquímico chinês em seu Índice de preços da China. Below he also outlines how China’s agrochemical industry is entering a pivotal shift as policy, pricing, and competition reshape global pesticide supply through 2026 and beyond.

According to statistics released by the General Administration of Customs of the People’s Republic of China, China’s total foreign trade import and export volume reached 45.47 trillion yuan for the full year, representing a year-on-year increase of 3.8%. Specifically, exports stood at 26.99 trillion yuan (up 6.1% year-on-year), while imports amounted to 18.48 trillion yuan (up 0.5% year-on-year).

As the world’s only full-industry-chain supply hub covering all product categories, China has fully demonstrated the resilience of its supply. Against the backdrop of the temporary de-escalation of China-U.S. trade frictions, cooperation between the global market and China’s supply system was further strengthened in 2025.

According to estimates from SPM, China’s pesticide export volume further increased in 2025, registering a year-on-year rise of approximately 16-18% compared with 2024.

Driven by the inventory destocking in the global crop protection market and farmers’ growing caution against the risk of fluctuations in agricultural product prices, growers have become more inclined to opt for cost-effective products, not inferiors. Sales of generic pesticide products manufactured by China’s leading enterprises remained robust. Correspondingly, the scale of pesticide consumption in the global crop protection market has been expanding amid intensified competition.

Although lingering low prices have weighed on the operating performance of some Chinese agrochemical enterprises, the market share of Chinese pesticide products has been on the rise across all key global markets.

It is an indisputable fact that competition in the global crop protection market has intensified. While multinational corporations (MNCs) have maintained stable market shares, generic crop protection products are rapidly expanding their influence among end users (i.e., farmers) by virtue of their ultrahigh cost effectiveness.

The shifts in end-market demand, coupled with the development of China’s pesticide industry, are creating a ripple effect and accelerating changes across the global generic crop protection market. Given that the transformation cycle of the Chinese market stands at six months, coupled with global registration barriers as well as the fiscal year cycles and strategic planning timelines of multinational corporations, the transformation cycle of the global crop protection market is likely to range from three to four years.

Policy Direction, Industrial Transformation, and Capacity Rationalization

Fundamentally, China’s development is guided by national strategies and policies, and inter-industry collaboration within the industrial system has become increasingly sophisticated. At the national policy level, the 15th Five-Year Plan for China’s pesticide industry is soon to be launched. The guidance direction of industrial policies dictates the future layout strategies of enterprises, while the market, acting as a regulatory tool, leverages price mechanisms to influence corporate behaviors.

Amid the upgrading of China’s supply chain toward high-end sectors, the positive leading role of this mature industrial system is evolving into a national competitive advantage.

Industrial transformation stands as a core strategic initiative for China’s development over the next five years. Due to the delegation of approval authority for pesticide production capacity in China and the surging demand for safety stock during the COVID-19 pandemic, most Chinese pesticide enterprises misjudged future market demand. While their business performance improved substantially before 2023, many enterprises pursued aggressive capacity investment, resulting in the inevitability of overcapacity challenges that the Chinese market has to address in the post-COVID-19 era.

New mechanisms will be established by regulatory authorities for the monitoring and early warning of newly added production capacity. From the enterprise perspective, investments in new production capacity will become more prudent, with investment strategies aligned to the future market landscape and technological advancements. It is not difficult for us to delineate the blueprint for China’s future high-end manufacturing — namely, a manufacturing system that integrates high efficiency with full satisfaction of market demand.

China’s pesticide industry policies are likely to be adjusted under the 15th Five-Year Plan, with the core direction shifting from mere expansion of production capacity to high-efficiency production.

| Conclusion Point | Key Details |

|---|---|

| Industry Transition | Shifting from overcapacity/price wars to sustainable, innovation-driven model with 10–15% profit margins. |

| Policy Framework | 15th Five-Year Plan drives balanced industrial clusters, digital transformation (informatization), and agricultural modernization. Open to new molecules from MNC soon. |

| Strategic Shifts | Capacity investments focus on upstream resource control (phosphorus, sodium cyanide, pyridine) and TC-to-formulation sales transition. |

| Policy Catalysts | “Anti-involution” campaign curbs price wars; export tax rebate adjustments favor domestic formulation exports. |

| Competitive Imperatives | Success requires quality focus, eight- to 10-year brand building, strategic MNC partnerships, and vertical integration. |

| Perspectivas de mercado | Global high-value markets (NA/EU) and high volume market (Brazil) prioritized; consolidation accelerates with large enterprises capturing >50% market share. |

Supply Chain Upgrading, Export Policy Shifts, and Overseas Expansion

First will come the upgrading of production equipment. This will be followed by the widespread application of artificial intelligence in manufacturing processes. Following the Youdao Chemical incident, the direction of Chinese enterprises adopting continuous reaction technology has remained unchanged; however, the incident itself has prompted China’s pesticide industry system to further deploy digital control mechanisms to precisely monitor chemical reaction processes.

In terms of infrastructure, China will leverage its inherent production efficiency to substantially improve atom utilization rates. Building on this foundation, Chinese enterprises will further increase investment in the R&D of patented compounds.

In addition, phasing out export subsidies, stimulating domestic consumption, and the revaluation of the RMB will be the key pillars of China’s future policies. Recently, the State Taxation Administration and the Ministry of Finance of China announced the abolition of export VAT refunds for certain downstream pesticide products of the phosphorus chemical industry, effective April 1, 2026.

This policy aims to regulate the utilization of China’s nonrenewable resources; on the other hand, it signifies that China’s top policymakers are shifting the policy focus from supporting exports to boosting domestic consumption. While export VAT refunds are a common practice in global trade, designed to avoid double taxation and facilitate cross-border trade, and are adopted by many countries, the issue of insufficient domestic demand may carry greater weight in China’s current development stage.

The policy of abolishing or reducing export tax rebates may just be the start, and it is highly probable that the scope of this policy will be expanded to cover other chemical intermediate categories.

Offshoring production capacity was once a hot topic in the Chinese market, but offshoring capacity to avoid potentially steep tariff costs is no longer the preferred strategy for most Chinese agrochemical enterprises. According to a report by O economista, “China’s stock of outbound foreign direct investment (FDI) stood at just 17% of its GDP in 2024, much of it in infrastructure and resources projects in developing countries, compared with 38% for America and 57% for Japan.” The report also stated, “China’s stock of overseas fdi accounts for just 4% of the global total, about half that of the Netherlands.”

While China’s future FDI boasts enormous potential, fundamentally speaking, the internationalization of Chinese enterprises cannot be achieved merely through production capacity internationalization. Geopolitical influences will become a key dominant factor after 2026. As European countries and Canada adjust their policies toward China, Chinese enterprises will have more options available for overseas investment.

Nevertheless, the key weakness of Chinese enterprises remains evident, primarily stemming from their insufficient familiarity with overseas markets. That said, as upstream raw material supporting systems mature and the construction of overseas chemical industry clusters advances, capacity investment cases like CAC Nantong’s project at the China-Egypt TEDA Cooperation Zone could serve as valuable references for Chinese enterprises.

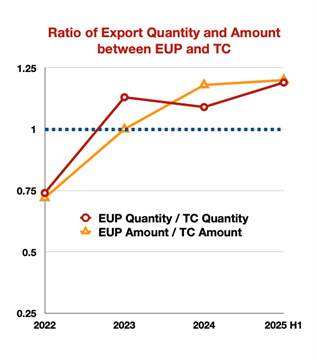

Against the backdrop of increasing investments by Chinese enterprises in formulation registration and branding, overseas expansion of branded products will become their preferred strategy in the future. Starting from 2023, the export volume and value of formulations by Chinese pesticide enterprises have generally surpassed those of technical materials.

Against the backdrop of increasing investments by Chinese enterprises in formulation registration and branding, overseas expansion of branded products will become their preferred strategy in the future. Starting from 2023, the export volume and value of formulations by Chinese pesticide enterprises have generally surpassed those of technical materials.

One reason was the improved quality of China’s generic formulation products, which have been widely adopted across various countries. Moreover, it stems from the continuous flattening of overseas distribution channels in the postpandemic era, which has heightened the interest of emerging distribution platforms in procuring formulations. This approach allows them to save the time required for building overseas production facilities, along with the substantial construction and production costs involved.

Nevertheless, it takes at least eight to 10 years for a brand of agricultural inputs to truly establish its influence. This is dictated by the nature of crop-growing cycles, and building such brands requires greater patience on the part of the management teams of Chinese enterprises.

Pricing Dynamics, Investment Trends, and the Road Beyond 2026

Fluctuations in the prices of China’s pesticide market are the top concern for distributors and MNCs. In the short term, while China’s pesticide industry has been adhering to the guidelines of the anti-involution, corporate competition is nonetheless still subject to market forces. Under the B2B business model, technical pesticide manufacturers lack product differentiation; thus, the supply-demand balance keeps fluctuating around the critical point.

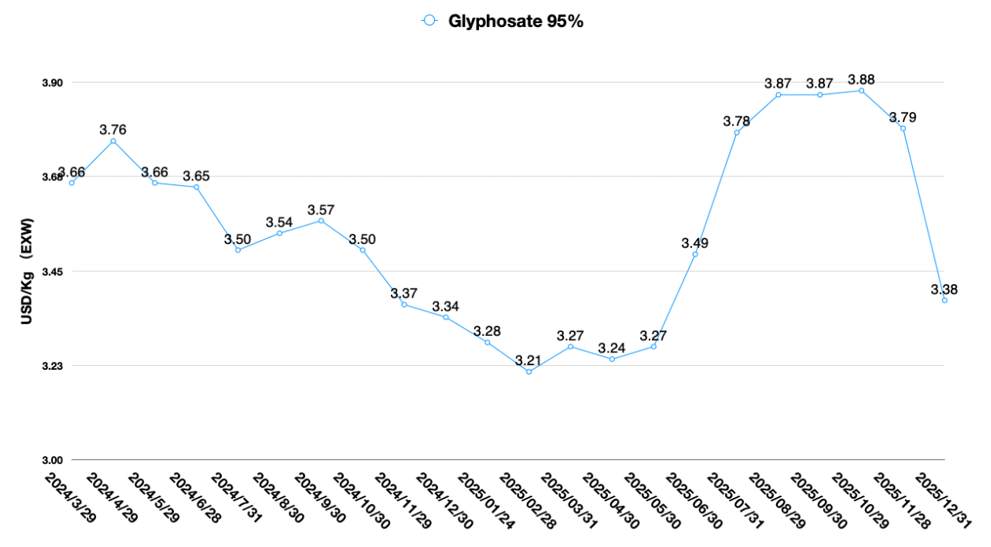

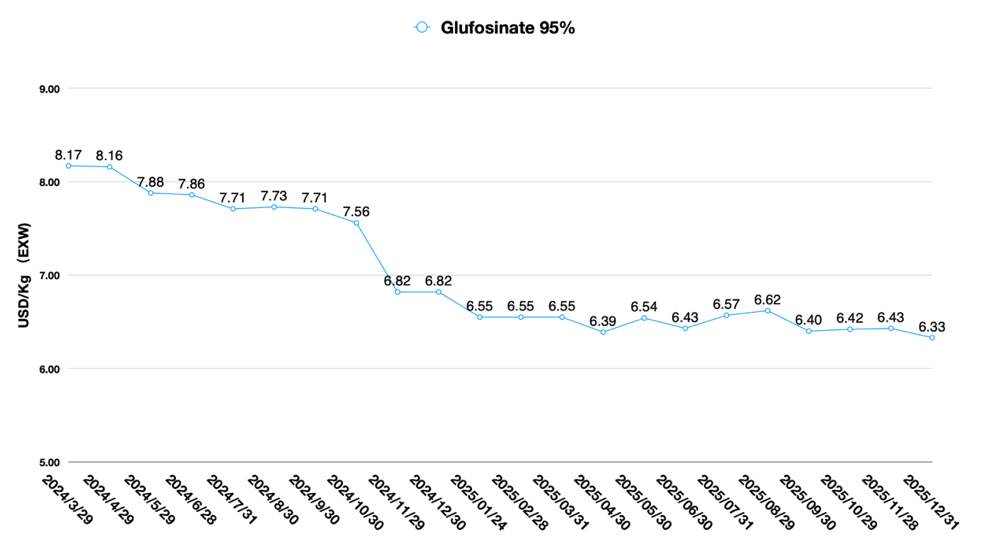

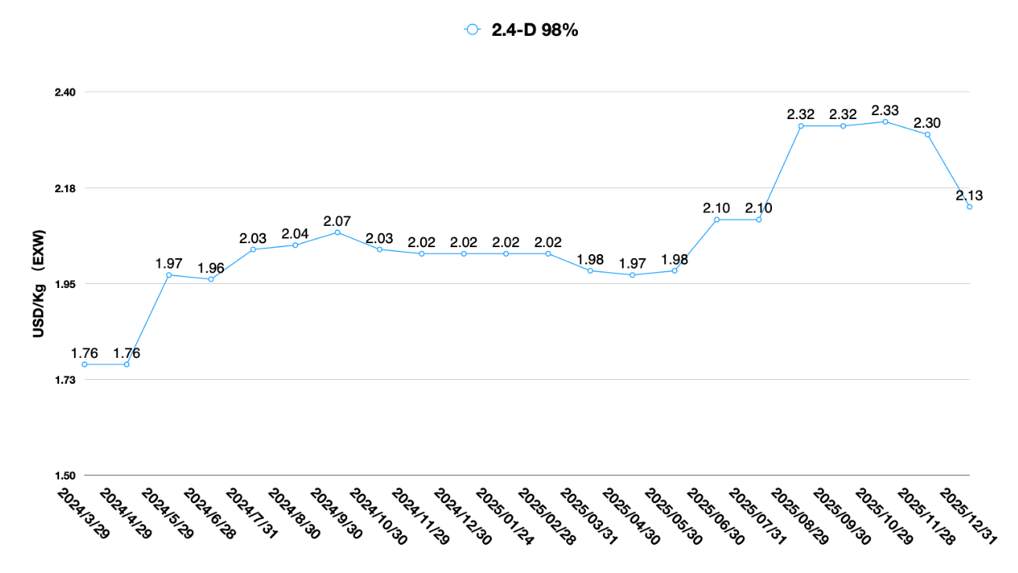

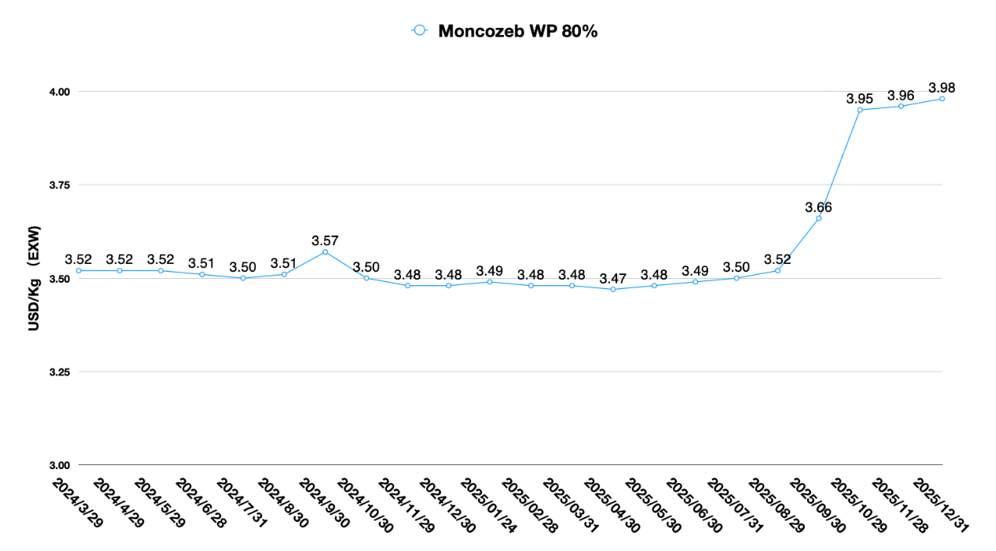

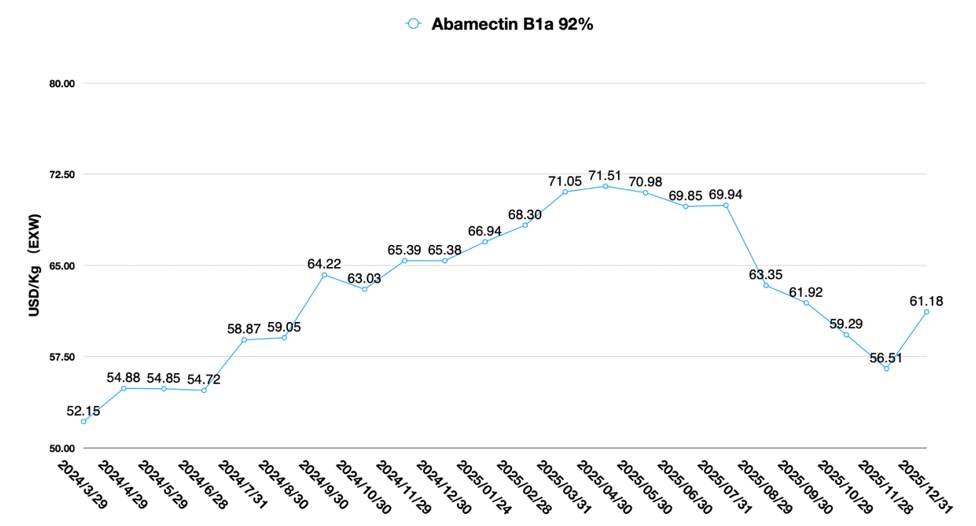

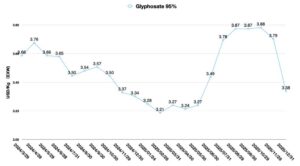

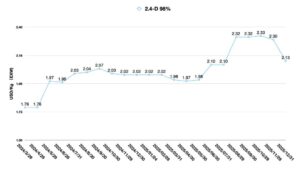

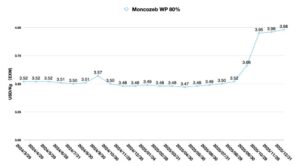

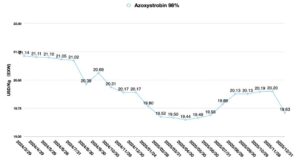

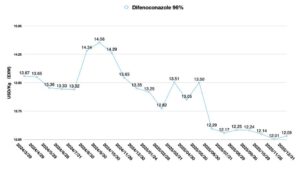

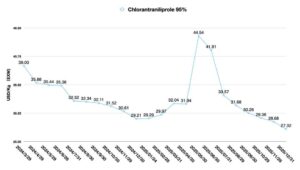

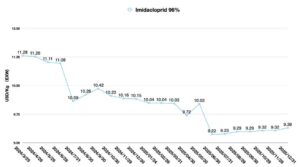

It is projected that the prices of Chinese pesticide products will remain within a stable range in 2026. However, considering the impacts of RMB appreciation and short-term geopolitical uncertainties, the USD-denominated prices of Chinese pesticide products will continue to show an upward trend.

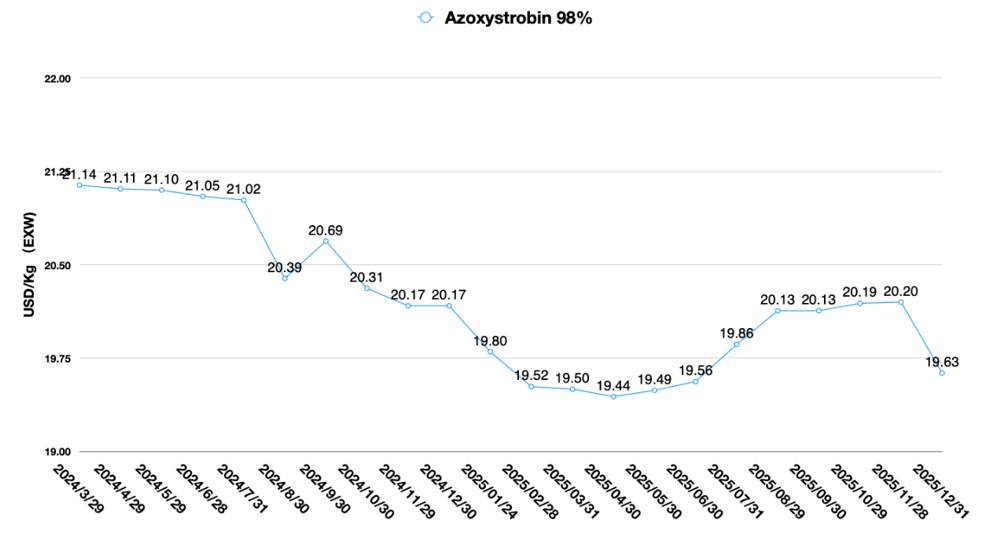

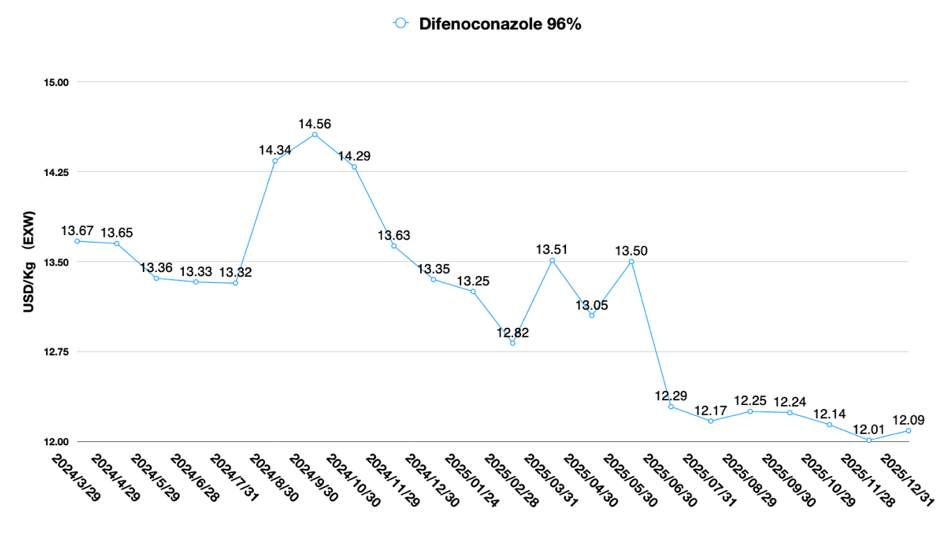

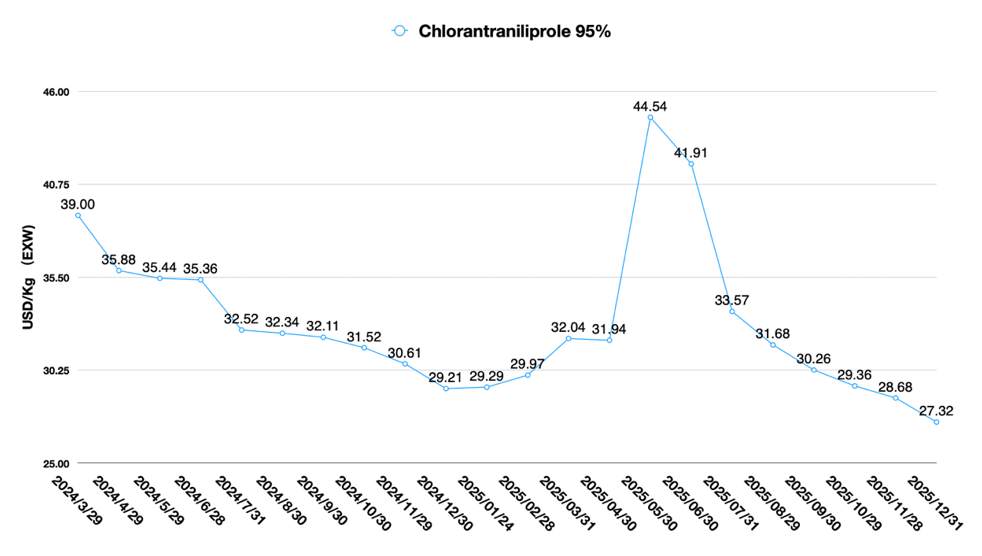

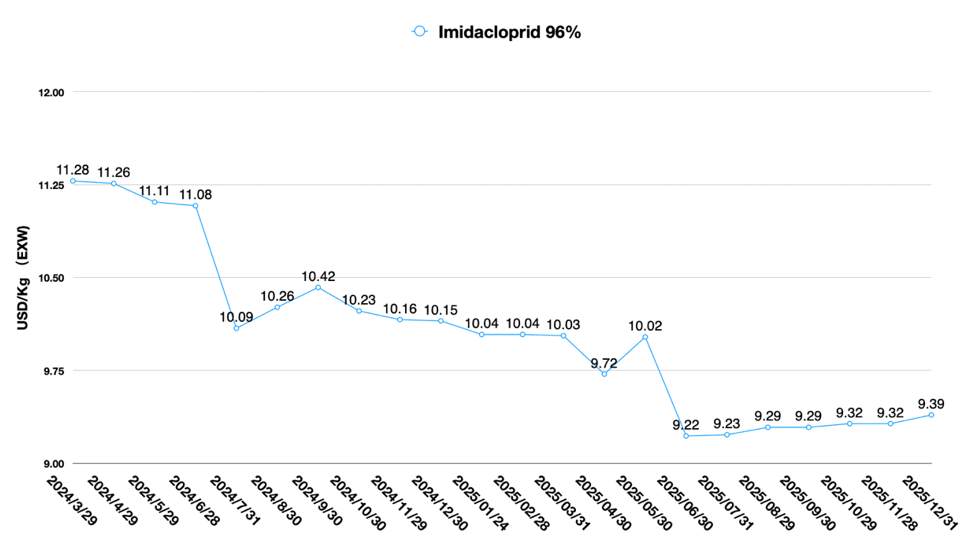

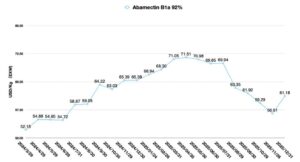

The intense competition among Chinese enterprises is shortening the time window for off-patent compounds to maintain a “high-price and high-margin” status. The impact of the Youdao Chemical incident on the price of CTPR TC was only temporary: After peaking at 44 USD/kg EXW, it dropped to 33 USD/kg EXW in just two months. Similarly, the price of topramezone TC has plummeted from 200 USD/kg EXW in 2024 to less than 71 USD/kg EXW at present.

While the decline in technical pesticide prices from high levels is a combined result of ample supply of upstream raw materials and the commissioning of downstream production capacity, such price volatility serves as a warning to investors: When evaluating return on investment, it is essential to forecast the future supply dynamics of the Chinese market to inform investment evaluation.

The capacity of China’s pesticide supply market will not drop significantly in the future, even though the country is promoting anti-involution among enterprises and avoiding price wars. However, amid intensifying market competition and hesitancy driven by uncertainties in the global agricultural economy, the scale of investment in new production capacity in China will decline and become very cautious.

In regard to capacity investment, Chinese enterprises will follow four key trends:

- Leading enterprises with stable competitiveness and financial support, as well as fast-growing enterprises, are relatively proactive in production capacity investment: Enterprises with stable margins maintain sound development, such as Yangnong Chemical, Xingfa Group and Guangxin. The same applies to enterprises that are about to launch their IPO processes, including Lansheng and Jiuyi.

- Capacity investment is concentrated on enterprises’ core competitive products, such as clethodim TC from Lansheng, and glufosinate as well as CTPR from Chengxin and Lier.

- Enterprises with inherent resource advantages: Crop protection inputs essentially rely on resource advantages. For instance, sodium cyanide from Hebei Chengxin, and upstream phosphate resources of Jiangshan, Xingfa, and Fuhua.

- Enterprises adhere to the full-industry-chain layout strategy: Examples include Lansheng’s investment in building a 15,000 Mt/a 3-chloroallyloxyamine capacity (an intermediate of clethodim), and GreatChem’s layout of key upstream fluorinated intermediates for SDHI.

From a Chinese cultural perspective, 2026 will be a year of fundamental transformation.

The competitiveness of China’s supply capacity is advancing steadily despite challenges, building on its full-industry-chain advantages, low-cost raw material supply, low energy consumption, and firm carbon emission reduction goals — with no let-up in its pace. The characteristics of stability and sustainability have made China’s supply chain the preferred choice for global partners.

Over the past five years, Chinese enterprises have also accumulated experience in navigating global political environments and cultural shocks. Unlike the previous five years, they are more inclined to cooperate with regional distribution channels and enter markets with precision rather than only price war.

Amid the inability of MNC’s bureaucratic systems to cope with high-efficiency competition, the sustainable profitability of Chinese pesticide enterprises will continue to strengthen. Their gradual and targeted launch of end-user formulation products will also create more favorable development space for emerging global agricultural technology service providers. The combination of competitive prices and high quality of Chinese formulation products will be sought after in markets worldwide beyond 2026.

Meanwhile, with increased R&D investment by Chinese enterprises and the highly collaborative nature of the Chinese pesticide industry, more patented compounds will be launched, for example, from Jiangshan, FlagChem, KingAgroot, and Zhejiang Udragon. These may not be the optimal solutions, but at a certain stage, Chinese patented compounds will offer new perspectives on addressing the resistance issues faced by farmers worldwide.

Naturally, biological products will not be left behind. Diverse Chinese biological products will mainly focus on the cash crop sector. Providing targeted solutions for various cash crops will be the key focus of Chinese enterprises. In terms of biological products, the main advantages of Chinese enterprises lie in abundant raw material options — such as a series of active ingredients extracted from traditional Chinese medicinal materials by Chengdu NewSun — and a sufficient supply of nucleopolyhedrovirus active ingredients from China producers.

If we must identify certain shortcomings of China’s pesticide industry in 2026, they are likely to focus on the following aspects:

- Lack of an international perspective in channel management and product line market strategies, as well as insufficient service awareness (compared with Indian pesticide enterprises); urgent need to strengthen local team building and compliance management; uphold the field efficacy of Chinese branded formulations as the lifeline of enterprises; steadfastly pursue brand building and actively leverage digital marketing tools;

- In line with China’s 15th Five-Year Plan for the pesticide industry, carry out equipment upgrading, extensively apply artificial intelligence in chemical production, and improve atom utilization rates;

- Chinese enterprises need to increase investment in Good Laboratory Practice data packages for their patented pesticide products to break through global registration barriers; meanwhile, as a major agricultural country and one of the most promising agricultural markets with growth potential, China’s efforts to remove data barriers for the registration of MNC’s patented compounds in China and strengthen the protection of intellectual property (IP) rights for such compounds will further facilitate cooperation between Chinese regulatory authorities and their counterparts worldwide;

- For biological products, penetrate the global market through patient field trials and provide verifiable field efficacy data demonstrating yield increases or reductions in farmers’ losses;

- Adopt an outcome-oriented approach to identify the margins of market demand growth and actively support the development of emerging overseas channels.