Índice de Preços da China: Ajustes na Capacidade Estrutural Impulsionam a Volatilidade dos Preços do Glifosato e do Glufosinato

Nota do editor: O escritor colaborador David Li oferece um instantâneo das tendências atuais de preços para os principais herbicidas, fungicidas e inseticidas no mercado agroquímico chinês em seu Índice de preços da China. Abaixo, ele também discute como os preços do glifosato estão se recuperando em meio à oferta mais restrita, por que o glufosinato enfrenta dificuldades com a fraca demanda e mudanças na regulamentação, além de outras tendências importantes que moldarão as decisões de compra de agroquímicos em 2025.

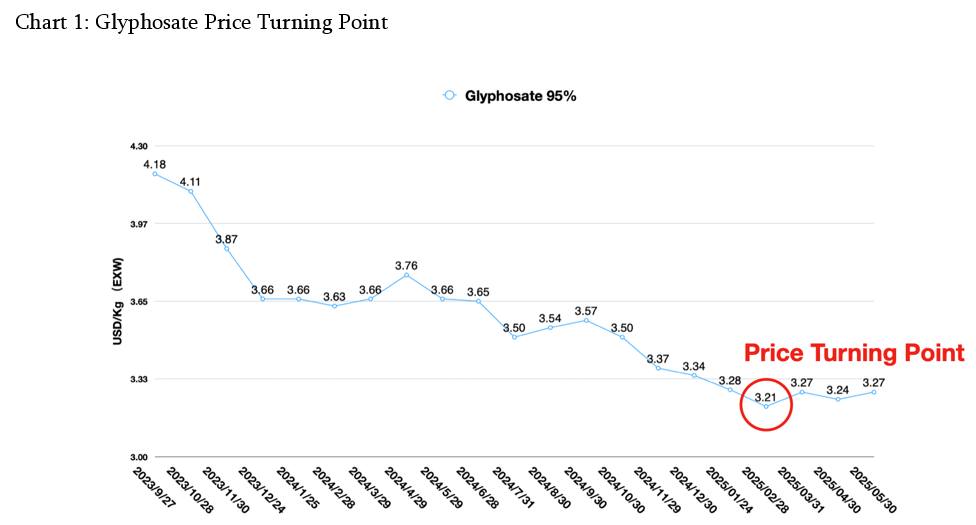

Decisões de compra são quase impossíveis de serem tomadas quando o preço está no fundo do poço e, sendo mais realista, o comportamento de compra ocorre antes ou depois dos pontos de inflexão do preço. Como compradores, precisamos apenas reconhecer onde ocorreram os verdadeiros pontos de inflexão.

Recentemente, a volatilidade do lado da oferta de pesticidas tem aumentado na China. Em termos de matérias-primas básicas, a tensão no fornecimento de piridina continua. Os produtores de pesticidas a jusante têm se concentrado em estocar em etapas, resultando em certa tensão de programação para produtos a jusante de piridina. Portanto, o preço do ingrediente ativo de pesticidas a jusante de piridina está apresentando uma tendência de estabilização em forma de U. Por exemplo, o preço atual do paraquate está sob alta pressão de custo, de modo que os principais produtores de paraquate estão programando a produção basicamente para o final de julho.

A partir de agosto de 2025, os estoques domésticos da China e as compras no hemisfério norte no segundo semestre do ano podem impactar positivamente a oferta de paraquate. A capacidade da planta chinesa pode ficar aquém da demanda externa e afetar o fornecimento de paraquate na temporada de compras de 2025/2026, que deverá apresentar preços cada vez mais altos, visto que o fornecimento de paraquate é dominado principalmente pela produção uniforme. Agosto pode ser o melhor momento para clientes estrangeiros estocarem matéria-prima de paraquate na China. Até o final de 2025 e o início de 2026, quando o estoque de inverno da China se sobrepõe à demanda da América do Norte, o preço do paraquate AI EXW da China pode retornar ao nível de 2,5 USD/Kg.

O mercado de bromo está relativamente estável. O fornecimento de bromo está sendo afetado pela fase de inspeções de proteção ambiental, e o estoque do mercado está sob alguma pressão. No entanto, a liberação de capacidade a longo prazo ainda é relativamente otimista. Alguns produtos a jusante estão entrando na entressafra, especialmente a temporada de compras na América do Sul, que termina antes do final de julho, portanto, o ambiente de transações do mercado está tranquilo. Este também é o principal motivo pelo qual o preço do diquate se estabilizou após um período de tensão para exportação.

Além do impacto das matérias-primas upstream nos preços da IA chinesa, as empresas chinesas de pesticidas estão, em geral, ajustando suas taxas de operação em 2025. Isso aumenta a probabilidade de preços mais altos para o mercado fornecedor. Um novo equilíbrio entre oferta e demanda está gradualmente se formando.

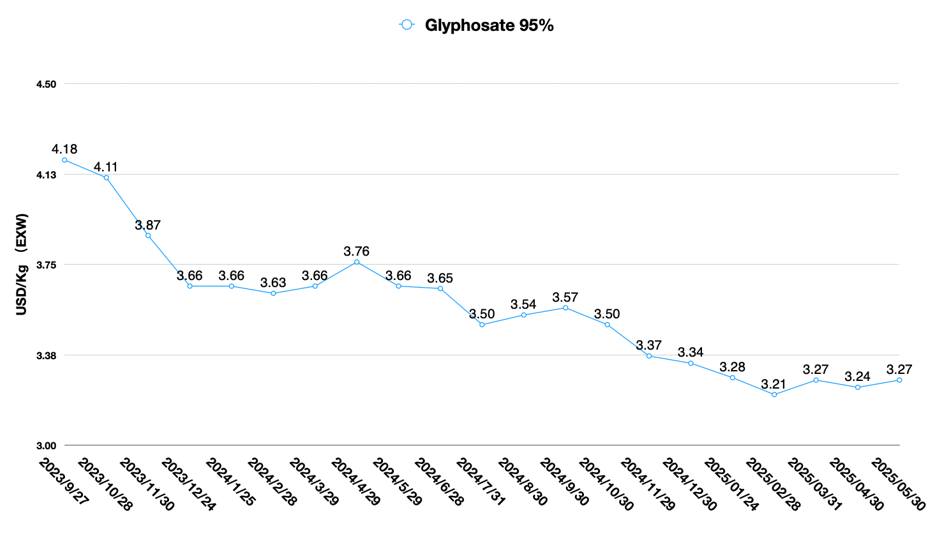

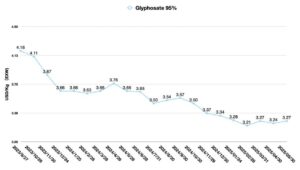

Glifosato Os preços na China têm apresentado uma tendência de alta nos últimos tempos. Isso se deve principalmente à redução de estoques no mercado fornecedor e à liberação concentrada de demanda na América do Sul. Os compradores brasileiros migraram de compras just-in-time para compras pontuais de grandes quantidades. Isso teve um impacto significativo nos produtores chineses de glifosato. O agendamento do lado da oferta levou a uma redução gradual nos preços do glifosato na China a partir de fevereiro de 2025, após atingirem o fundo do poço. Espera-se que os preços do glifosato permaneçam estáveis até agosto.

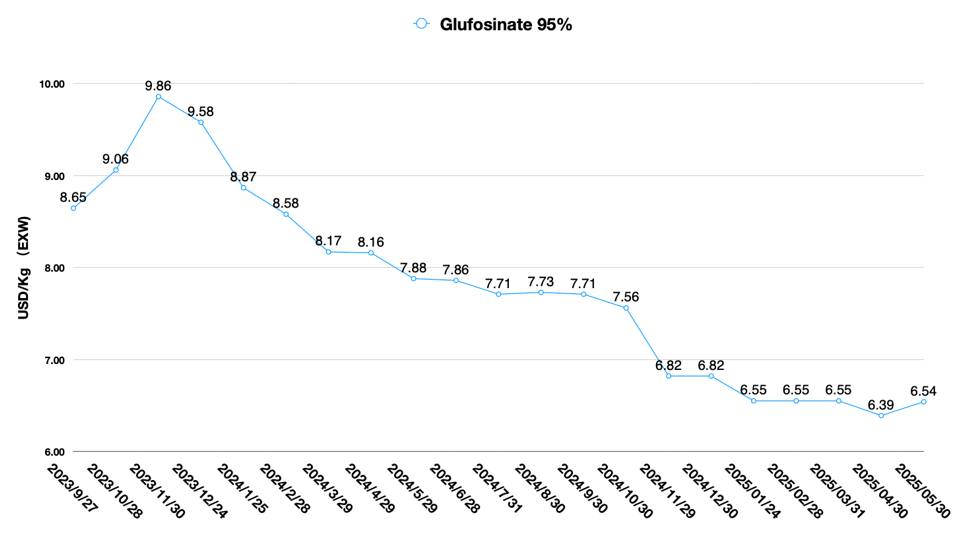

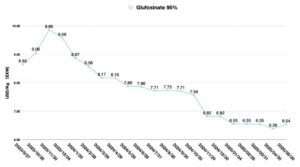

Para o fornecimento de glufosinato Na China, a competição de mercado é caótica. A demanda externa está fraca e a chamada tendência de substituição do glifosato pelo glufosinato é improvável. Clientes estrangeiros são mais propensos a utilizar o glufosinato para o manejo da resistência em campo.

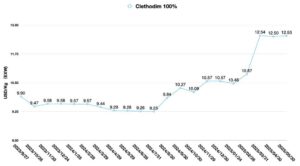

Por exemplo, a combinação de glufosinato com cletodim é uma coformulação comumente utilizada. O preço do principal ingrediente ativo, como o cletodim, na coformulação aumentou acentuadamente, o que também levou a um aumento no preço dos produtos de marca com glufosinato e cletodim no mercado externo. Consequentemente, a relação custo-benefício da formulação de glufosinato no mercado diminuiu.

No curto prazo, não há possibilidade de um aumento significativo na oferta de glufosinato. Isso também afeta o aumento da demanda no mercado de glufosinato. No geral, o preço baixo contínuo do glufosinato não pode ser trocado por um aumento no volume de vendas, visto que os diversos fatores que afetam a demanda estão se tornando mais complexos.

Por outro lado, vale ressaltar que a China está desenvolvendo um padrão para o teor de cloro em formulações de glufosinato. No futuro, as formulações de glufosinato do mercado chinês terão que ser formuladas a partir do IA e não diretamente do MUP não purificado (a ICAMA estipula que os MUPs também devem, em princípio, ser formulados a partir do IA).

Com o aumento das exportações de produtos formulados da China, o governo chinês está intensificando seus esforços para monitorar a qualidade das formulações e gerenciá-la em conjunto com a Alfândega Chinesa. Com a introdução do padrão chinês para íons cloreto em formulações de glufosinato, os clientes estrangeiros que compram formulações de glufosinato também fortalecerão o monitoramento do teor de íons cloreto nas formulações de seus fornecedores. Espera-se que a qualidade das formulações de glufosinato chinesas se desenvolva ainda mais em direção à padronização e à alta qualidade. Portanto, o preço das formulações de glufosinato chinesas também terá uma certa margem de variação.

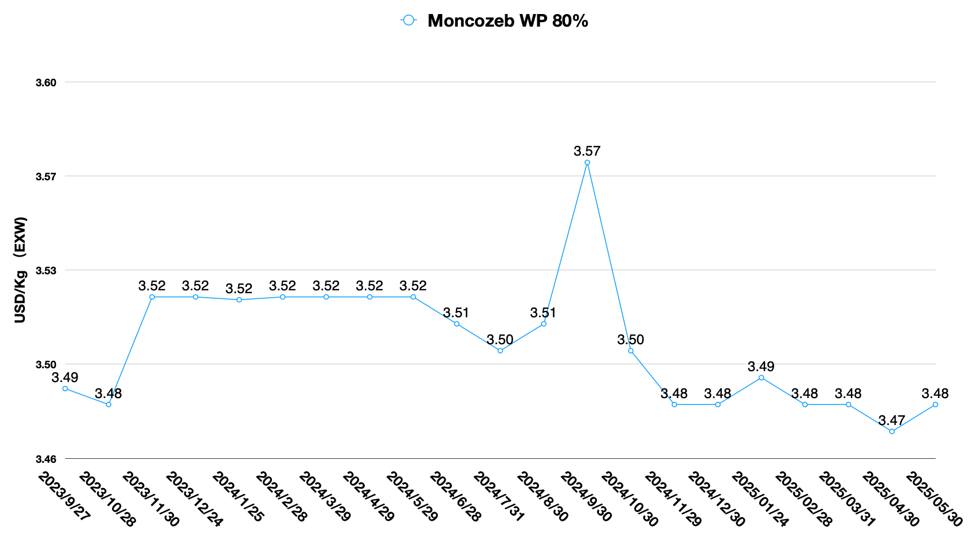

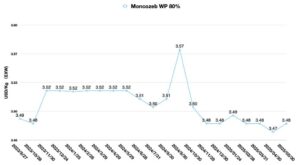

Assim como os herbicidas, a produção de mancozebe na China se mantém relativamente estável. Os preços do moncozebe na China também se mantiveram firmes, com a demanda da América do Sul continuando a aumentar. A oferta spot de moncozebe no mercado chinês está baixa, com os clientes sul-americanos migrando de pedidos just-in-time fragmentados para pedidos de longo prazo em 2025, garantindo assim a oferta. Este é o principal fator que influencia a tendência contínua de alta dos preços do moncozebe.

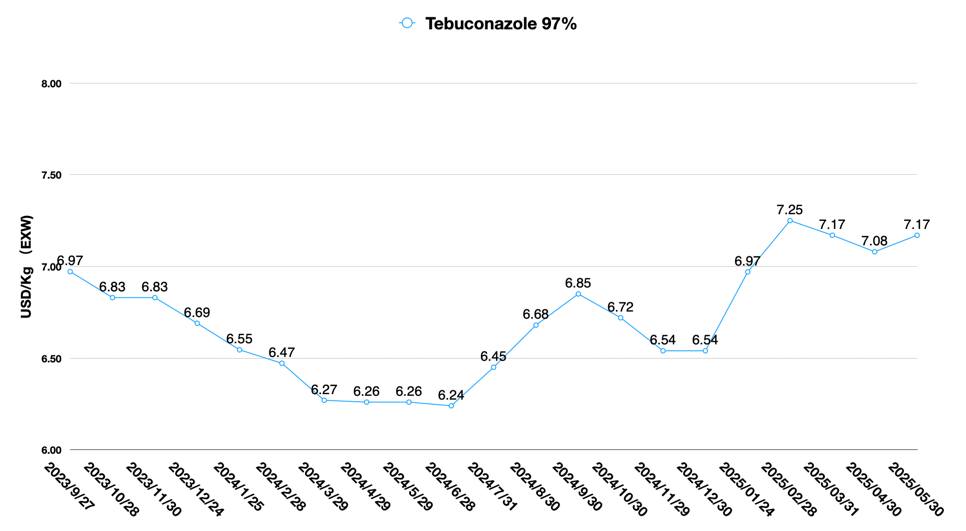

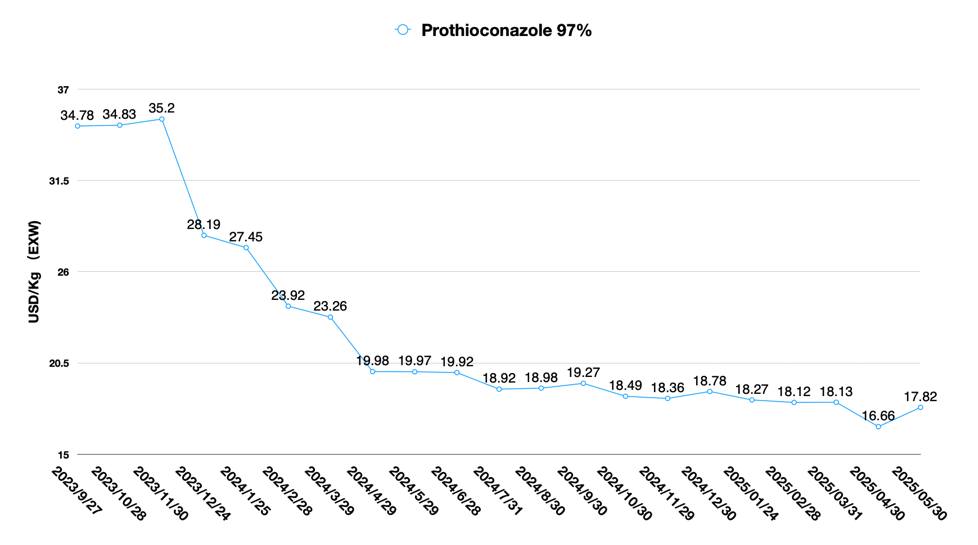

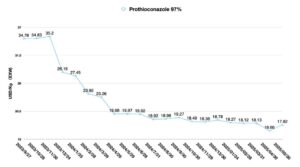

A oferta restrita de 1,2,4-triazol diminuiu, de modo que os preços dos fungicidas triazólicos permaneceram, em geral, estáveis. Os preços do protioconazol estão enfrentando grandes desafios devido à liberação gradual da capacidade de produção fornecida pela China. Espera-se que o preço deste produto continue em baixa em 2025-2026, e o preço do protioconazol ainda pode ter espaço para queda.

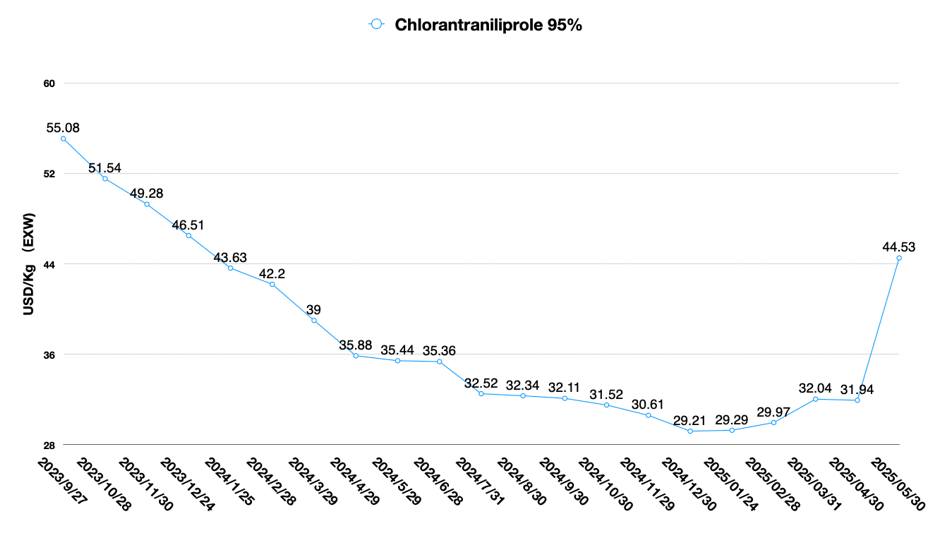

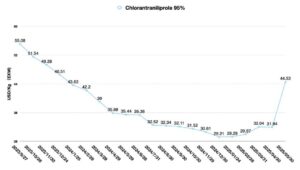

No caso dos pesticidas, a maior atenção foi dada ao impacto da Explosão química de Youdao em clorantraniliprole (CTPR) na China. O impacto do acidente no preço do CTPR AI é indireto, visto que a taxa de utilização da Youdao Chemical não era muito alta antes da explosão. Atualmente, há oferta suficiente do principal intermediário ácido K no mercado chinês, mas o gargalo de fornecimento é a K amina. Os intermediários de nitrificação a montante da K amina não são capazes de garantir a produção suficiente de matéria-prima por vários fabricantes devido à natureza perigosa da produção. A escassez de intermediários de nitrificação a montante da K amina pode continuar a sustentar o preço do CTPR na China. Em particular, o preço do CTPR na China pode atingir o pico após o lançamento da demanda de armazenamento de inverno no mercado chinês local no final de 2025.

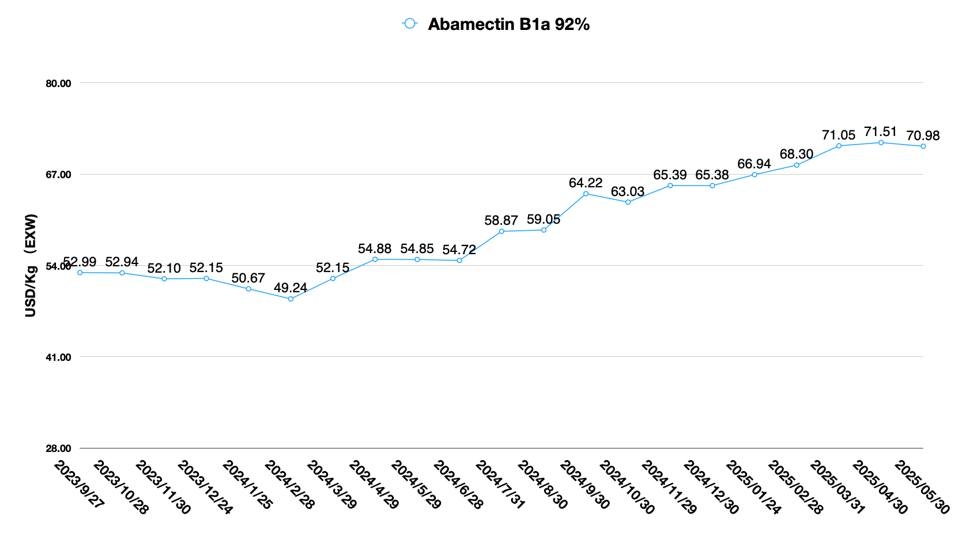

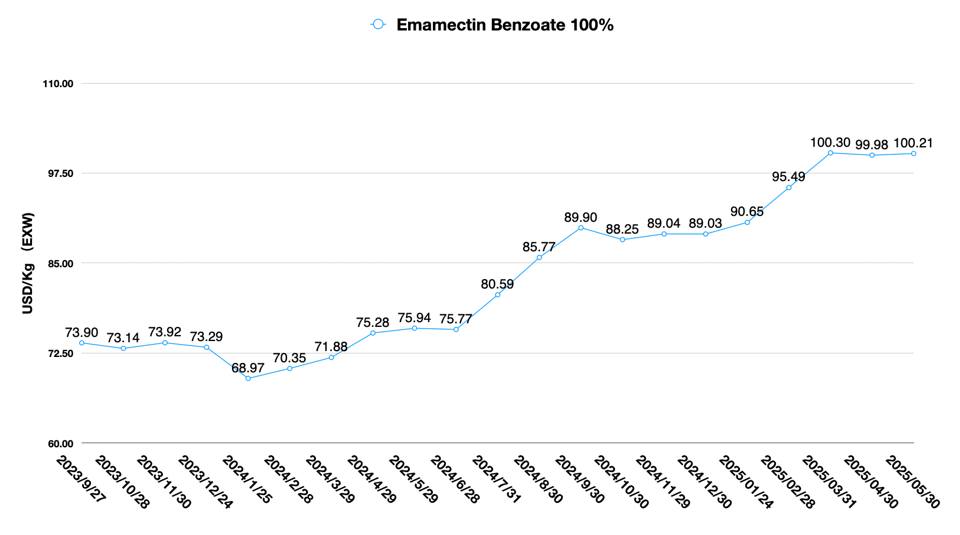

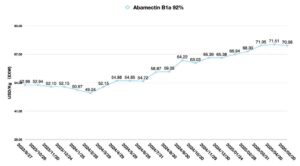

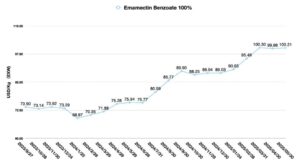

Os produtores chineses de abamectina estão em um equilíbrio apertado em termos de ajuste da taxa de operação, o que continua a elevar os preços do produto no país. Os produtores de benzoato de abamectina estão enfileirando pedidos de produção, e as altas ofertas estão em um jogo acirrado com a demanda do mercado. O custo dos inseticidas piretroides está em alta, principalmente devido ao aumento no custo dos principais intermediários.

Em comparação com o mesmo período do ano passado, o padrão e a situação do fornecimento de IA na China estão passando por uma mudança profunda. Com a saída da capacidade de produção de pequeno e médio porte, a concentração da indústria chinesa está avançando com grande eficiência.

No entanto, preços baixos não são condição suficiente para fornecedores de primeira linha. Analisando a situação geral das empresas chinesas, a independência em P&D tecnológico, bem como o apoio de toda a cadeia industrial de matérias-primas a montante, são a base da capacidade de desenvolvimento sustentável das empresas. Além disso, avanços em mercados de alto valor e o aumento da oferta de serviços estão permitindo que as empresas chinesas de pesticidas, com estratégias de longo prazo e visão de globalização, escapem da armadilha da concorrência de preços baixos no Mar Vermelho.

Ainda mais promissor é o fato de que a administração de pesticidas da China está fortalecendo a proteção dos direitos de propriedade intelectual. O respeito à propriedade intelectual e as penalidades por roubo de propriedade intelectual de processos de outros fornecedores chineses serão mais propícios ao surgimento de inovação contínua na indústria chinesa de pesticidas. O estabelecimento de padrões de qualidade e o controle de impurezas essenciais estão ajudando ativamente os clientes estrangeiros a obter produtos chineses de melhor qualidade. Isso demonstra a responsabilidade da segunda maior economia do mundo.

O único aspecto insatisfatório é que o processo de aceitação mútua de dados (MAD) entre a China e o exterior está basicamente paralisado no momento. Os novos produtos patenteados de empresas multinacionais não podem ser comercializados na China. Em vez disso, as empresas chinesas de pesticidas só podem escolher laboratórios BPL estrangeiros para a preparação de dados BPL. A interrupção do credenciamento de laboratórios BPL chineses por organizações internacionais é a principal razão para a situação difícil do MAD. Em um ambiente econômico e geopolítico global altamente incerto, remover as barreiras entre o mundo e a China é mais propício para compensar os riscos de ambos os lados do que "construir um muro de separação".

Em meados de 2025, compreender profundamente o mercado de fornecimento de pesticidas da China e influenciar o fornecimento do país está se tornando um componente estratégico importante para empresas multinacionais. A volatilidade dos preços e a complexidade dos fatores de influência estão em uma dupla hélice. A gestão de risco e a previsão de preços estão sendo ponderadas no mesmo nível.