China Price Index: From Regulation to Revolution — How China’s New Pesticide Policy Is Reshaping Global Agriculture

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his China Price Index. Below he also discusses how China’s new pesticide export policy is transforming its agrochemical industry — driving innovation, boosting global competitiveness, and redefining agriculture’s next growth frontier.

On November 3, 2025, the Department of Crop Production Management under China’s Ministry of Agriculture and Rural Affairs issued the “Letter Soliciting Opinions on the Administrative Provisions for Pesticide Registration for Overseas Use Only,” establishing specific regulations for the registration management of pesticides intended solely for use outside China. This marks another significant refinement in China’s pesticide export policies since the implementation of the “Announcement on Matters Related to the Registration of Pesticide Products for Export Only” in 2020.

The most significant changes include the following four points:

- Export-only registrations: Allowing the registration of active ingredients not registered to China for export purposes.

- Formulations: Relaxing restrictions on formulation ratios, active ingredients, and content levels to better meet overseas market demands.

- Toxicology requirements: Substantially reducing requirements for toxicological data.

- Review period: Shortening the technical review process to six months

For years, Chinese enterprises have had sufficient reserves of active ingredients (AIs) and formulation technologies with patents approaching expiration. However, since some compounds have not been registered within China, if Chinese enterprises choose to be the first to register a compound molecule, the cost of registering the corresponding AI will be extremely high. This limitation has long constrained the competitiveness of Chinese enterprises in the global market. The recent significant adjustment to the EX registration policy by ICAMA has, to a certain extent, rekindled hope for Chinese enterprises.

According to data released by ICAMA, the total volume of China’s pesticide exports in the first half of 2025 reached 2.24 million metric tons, representing a year-on-year (YoY) increase of 17.5%. The export value amounted to USD 8.519 billion, up 14% YoY. Overall, both the volume and value of China’s pesticide exports returned to a stable level in 2025. As the prices of China’s pesticide technical materials remain low compared to 2022 and overseas distribution channels continue to clear, farmers’ confidence in investing in agriculture inputs has begun to recover. Although there is still a long way to go for global agriculture to return to normal, the positive overseas demand has provided a turnaround for many technical material manufacturers to maintain their performance.

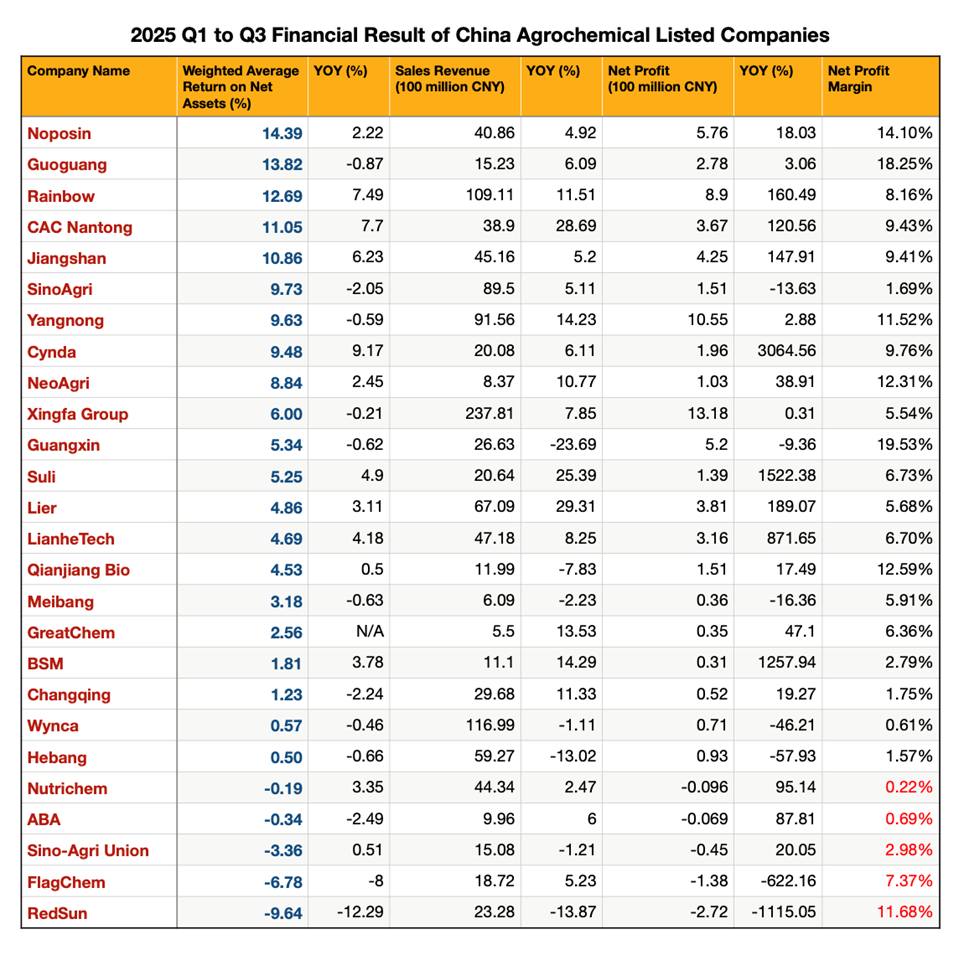

In the first three quarters of 2025, the sales volume of Lier Chemical, CAC Nantong and Suli increased by nearly 30%. The net profits of enterprises including Cynda, Lier Chemical, Rainbow, CAC Nantong, Jiangshan, Suli, BSM and Lianhe Tech surged by over 100% compared with the same period last year. Cynda achieved a remarkable performance growth driven by the rising price of clethodim. Meanwhile, Lansheng, another leading supplier of clethodim, is preparing to go public in China.

While the growth in sales volume and net profit is certainly important, when we rank various enterprises by their Weighted Average Return on Assets (ROA), some enterprises with excellent operation and management will stand out. The core purpose of ROA is to measure the efficiency of an enterprise in generating profits by utilizing all its assets, reflecting the comprehensive effect of asset utilization. A relatively high ROA indicates that an enterprise can gain more profits with the same amount of assets and has stronger asset operation efficiency. This metric mainly reflects the rationality of an enterprise’s asset allocation and its profit potential.

Observing China’s listed pesticide companies through the lens of Weighted Average Return on Assets turns out to be especially insightful.

During the COVID-19 pandemic, Noposin entered China’s blueberry industry chain, and the company’s ROA ranked first in the industry by 2025. After linking agriculture into the crop protection value chain, Noposin has clearly found a development path completely different from that of other Chinese pesticide enterprises. Once known for its pesticide sales team of over 1,000 people, Noposin has now successfully connected blueberry products applying its own solutions directly to Chinese consumers. Compared with typical farmer-focused (ToC) of other pesticide companies, Noposin’s strategy transformation appears far more sustainable, driven by the differentiated value of its final product portfolio.

Crop protection companies deliver indirect value, while Noposin, like an amplifier, has successfully transformed the agronomic technologies of crop protection into the direct demand of the emerging blueberry industry and gained higher profits. Even more noteworthy, this integrated business model, extending from crop protection to planting management, logistics, post-harvest technology, and end-user sales, is replicable and scalable.

In China, a country where the agricultural product industry is underdeveloped and the scale effect of planting is weak, Noposin has clearly learned successful experience from overseas fresh markets. Perhaps the next focus for the industry will high-value crops like grapes, citrus or kiwifruits.

Rainbow’s performance in the first three quarters of 2025 can be described as “light and agile”. Thanks to its investment in global crop protection market registrations, Rainbow’s advantage in distribution with China agrochemical sourcing has become even more prominent.

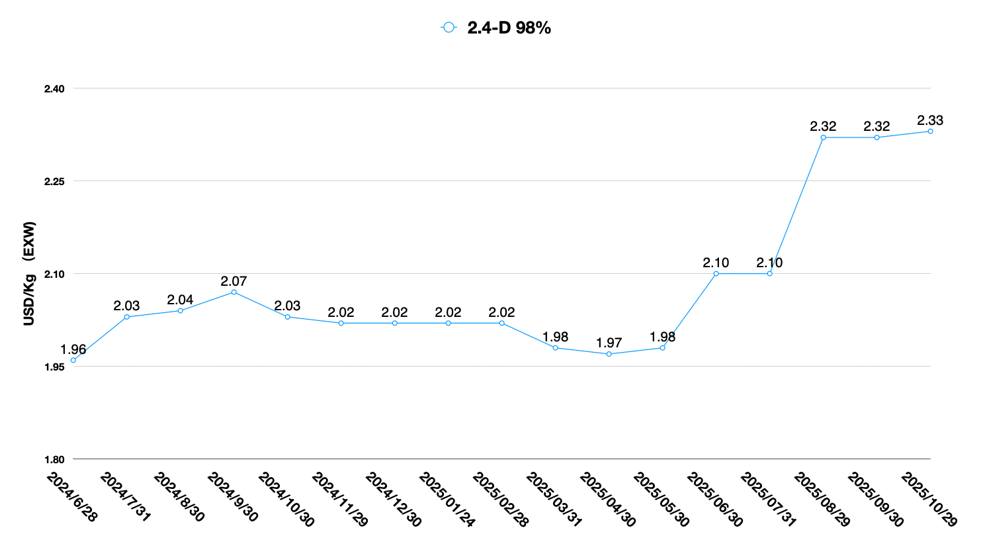

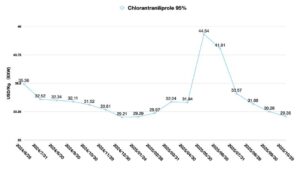

CAC Nantong has mainly benefited from the sustainable profits brought by the rigid demand for non-patented products such as 2,4-D. Meanwhile, the company has recently launched its branded products based on the patented compound Cyproflanilide This provides Chinese growers with a new solution to tackle resistance issues posed by pests like the rice stem borer and intractable pests on fruits and vegetables. After a decade of efforts since venturing into the field of innovative compound development, CAC Nantong has finally achieved fruitful results with the launch of mature products. For CAC Nantong, the team with backgrounds from multinational corporations has finally secured a key patented compound for lifecycle management. This will serve as the core driving force for CAC Nantong’s development over the next five years.

Photo Source: CCPIA

As a Chinese pesticide industry practitioner, I am delighted to see the emergence of highly competitive innovative products in the Chinese market. This also indirectly confirms my previous prediction that by 2035, the R&D of innovative compounds in China will gradually form a scale. Behind it, the sufficient industrial capital and abundant R&D talents in China are the key cornerstones.

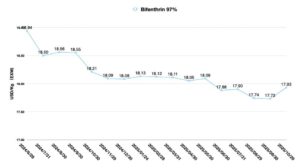

The increase in technical grade pesticide prices is a key factor driving the performance growth for many Chinese enterprises. Both Lansheng and Cynda have benefited from the price surge of Clethodim caused by short-term supply shortages. For Lansheng, the sustainable contribution of Clethodim to its performance aligns perfectly with the pace of its listing in the China stock. Ample cash flow and steadfast investment in production capacity will greatly enhance the competitiveness of its upcoming products, such as Lansheng’s Cyantraniliprole and Fluxapyroxad.

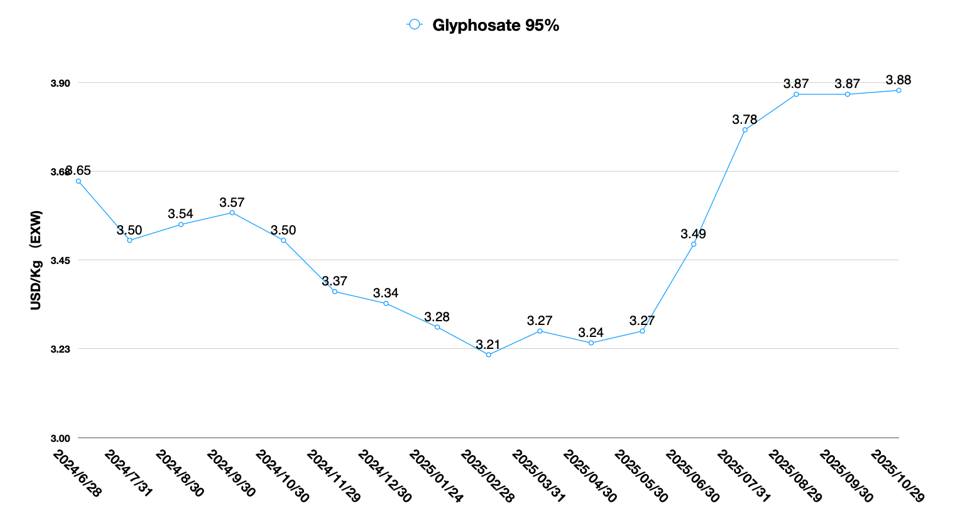

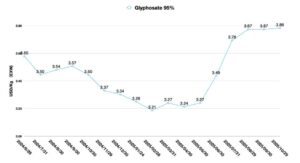

Glyphosate enterprises such as Jiangshan, Xingfa and Fuhua mainly rely on their glyphosate business to support corporate development. The phosphate resources supporting these glyphosate enterprises have, to some extent, reduced their production costs. For some glyphosate enterprises that purchase PMIDA intermediates externally, this competitive advantage may become an insurmountable moat.

With in-depth cooperation with BASF, Lier Chemical’s business development has gradually shown a diversified trend. Although multinational corporations are extremely price-sensitive to their core Chinese suppliers amid performance pressure and market competition, a diversified customer structure can help Lier achieve performance growth. It is undeniable that Lier’s development route is more inclined to a cluster model like BASF. Leveraging its advantages in downstream channels, Lier can fully utilize the upstream raw material and intermediate industrial chain. In terms of asset utilization, Lier’s strategic decisions remain correct.

Yangnong Chemical achieved the steadiest development in 2025. The smooth commissioning of its Clethodim production capacity in Huludao has provided Yangnong with a new business growth driver. Meanwhile, through business integration and active adaptation to China’s carbon neutrality strategy, Yangnong has offered solid support for its cooperation with multinational corporations.

Since 2025, China’s pesticide market has exhibited two key characteristics : mature supply and high competition. Mature supply means that companies have become more focused on their product line layouts. Leading industry enterprises such as Lansheng, Chengxin, Yangnong Chemical, Lier Chemical and Fuhua have already established highly comprehensive layouts for their core product pipelines. These enterprises collectively demonstrate advantages in the upstream industrial chain, core technologies, and efficient supply chain services.

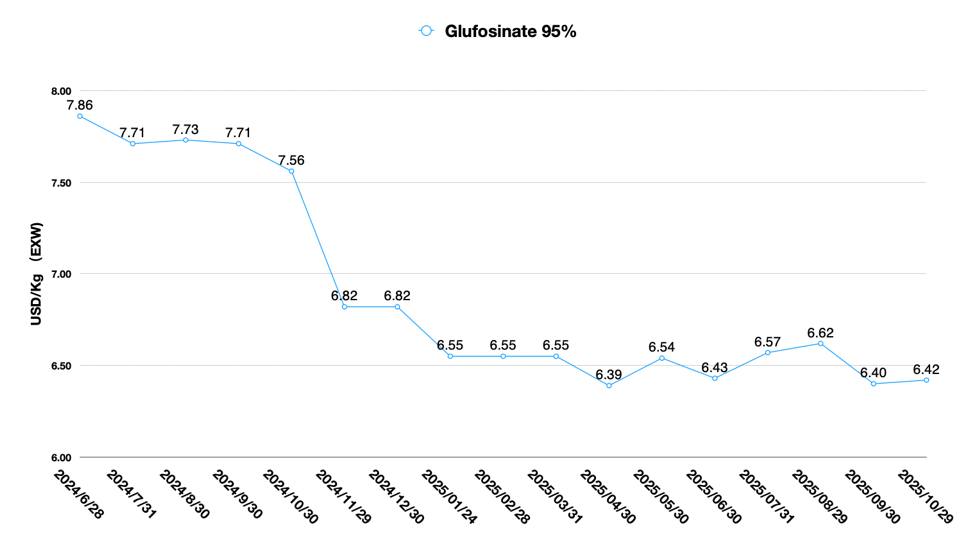

In some core product categories — such as clethodim, atrazine, glyphosate and glufosinate — their competitive moats are strong enough to fend off other competitors. New market entrants are using process R&D as a strategic breakthrough as exemplified by the recently rising Jinxianda. Chinese enterprises have also become more mature in industrial chain layout, process development, and supply chain services.

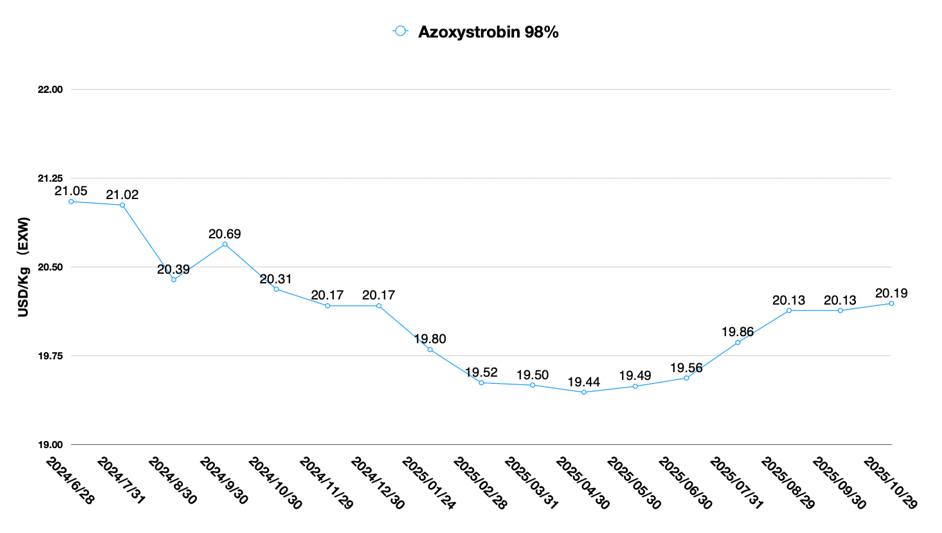

High competition means that pesticides such as saflufenacil, pyroxasulfone, cyantraniliprole, as well as SDHI fungicides including bixafen and fluopyram, have become the focus of the industry. Companies are actively preparing registration documents. Meanwhile, registration in overseas markets has become the preferred choice for many enterprises with sound cash flow. Like Rainbow’s ToC strategy, due to the long-term inability to gain additional profits from the B-end market, more enterprises’ pursuit of profits is accelerating their pace of going global. In fact, the price-sensitive procurement strategies adopted by multinational corporations are accelerating Chinese enterprises’ expansion into overseas markets.

The transformation of China’s pesticide market seems to have just begun. Some enterprises are on the decline, while others are embarking on a new journey. Changes in China’s pesticide supply reshape the global crop protection market like a butterfly effect every six months.

However, some issues are also quite worrying. On the one hand, Chinese pesticide enterprises generally lack an in-depth understanding of the market and competition, and they are universally deficient in cognition regarding pricing, marketing and channel management. This is mainly due to systemic deviations in the Go to Market strategy formulation mechanism of some enterprises, which exist from the top management to the grassroots employees. Moreover, the misleading from overseas consultants hired by some enterprises has further exacerbated such deviations.

On the other hand, senior management of multinational corporations (MNCs) have insufficient anticipation of the impact of Chinese supply on the global market. Employees at MNC headquarters are trapped in information cocoons, unable to obtain first-hand supply chain information from China to make correct decisions. This has left some MNCs with chemical pesticides as their core competitiveness is struggling to cope with changes in overseas markets. Sadly, the Chinese supply chain sector can predict changes in the competitive landscape of overseas markets at least two years in advance.

Additionally, senior management of some MNCs still cannot accept the fact that Chinese supply holds an absolute advantage. The significance of this fact is not that MNCs cannot compete with Chinese enterprises, but rather that it has greater strategic implications — helping companies answer a critical question: “How to leverage the advantages of Chinese supply to find breakthroughs for their long-term development?”. As distributors, it is now easier to find partners in China than it was 40 years ago when China had just initiated its reform and opening up. Controllable costs and high-quality supply services enable some new teams to start businesses and achieve success through China’s industrial chain.

Meanwhile, in addition to changes among Chinese enterprises, the progress of cooperation between MNCs and China supply has also surged.

On October 7th, 2025, BASF’s Zhanjiang Integrated Site achieved two major milestones: the successful commissioning of the butyl acrylate plant, and the completion of mechanical completion for the ethylene complex as well as all integrated petrochemical plants.

By 2028, the total investment in BASF’s Zhanjiang Integrated Site is expected to reach approximately 8.7 billion euros. Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF Group, stated that the adjusted EBITDA of the Zhanjiang Integrated Site is projected to range from 1 billion euros to 1.2 billion euros by 2030. In the medium and long term, this site will play a pivotal role in strengthening BASF’s core businesses, and most of its plants are scheduled to start operations before the end of 2025.

Photo Source: BASF

In November 2025, Clariant announced the establishment of a joint venture company specializing in new-type flame retardants with Fuhua. This new joint venture will focus on developing innovative halogen-free flame retardants. The new project aims to research and develop a new generation of phosphorus-based flame retardants, provide solutions for multiple industries such as building materials, automotive, electrical and electronic sectors, and directly address the increasingly stringent technical and regulatory environment in these fields. The signing of this strategic joint venture agreement is the result of joint innovation and R&D strategic cooperation between Clariant and Fuhua.

Photo Source: Fuhua

Compared with BASF and Clariant, the so-called “firm out-of-China strategy” adopted by some MNCs seems feeble and ineffective. Multinational corporations are stateless entities. Regardless of the direction of geopolitics, MNCs have only one eternal belief: delivering returns to investors through the value generated by growth. The outcome of geopolitics is highly unpredictable, but deviations in corporate decision-making may bring catastrophic consequences to their product assets and corporate performance.

Competition exists everywhere. In October 2025, Rainbow announced the official opening of its new Partner Production Center in Champaign, Illinois. Covering an area of approximately 30 acres, this modern production base is designed to strengthen the crop protection supply chain in North America. In contrast to Rainbow, which has deeply integrated supplies from China, for some multinational corporations and other U.S. distributors, coping with Rainbow’s competition in North America will become extremely tough in the future if they abandon supplies from China.

In my opinion, the new regulations issued by China’s pesticide regulatory authorities are likely to be a key tipping point for China’s pesticide industry during the 15th Five-Year Plan period. This is because China’s pesticide export registration policy will enable more capable Chinese suppliers to go global, just like Rainbow. However, I also make a wish: perhaps China’s pesticide regulatory authorities can reconsider the issue of data mutual recognition between China and OECD, allowing more multinational corporations to bring their optimal solutions into the Chinese market. For I have always believed that free and highly competitive markets can support China to become one of the world’s most influential crop protection markets.