Crop Protection Market Pressure Leading to Supplier Consolidation

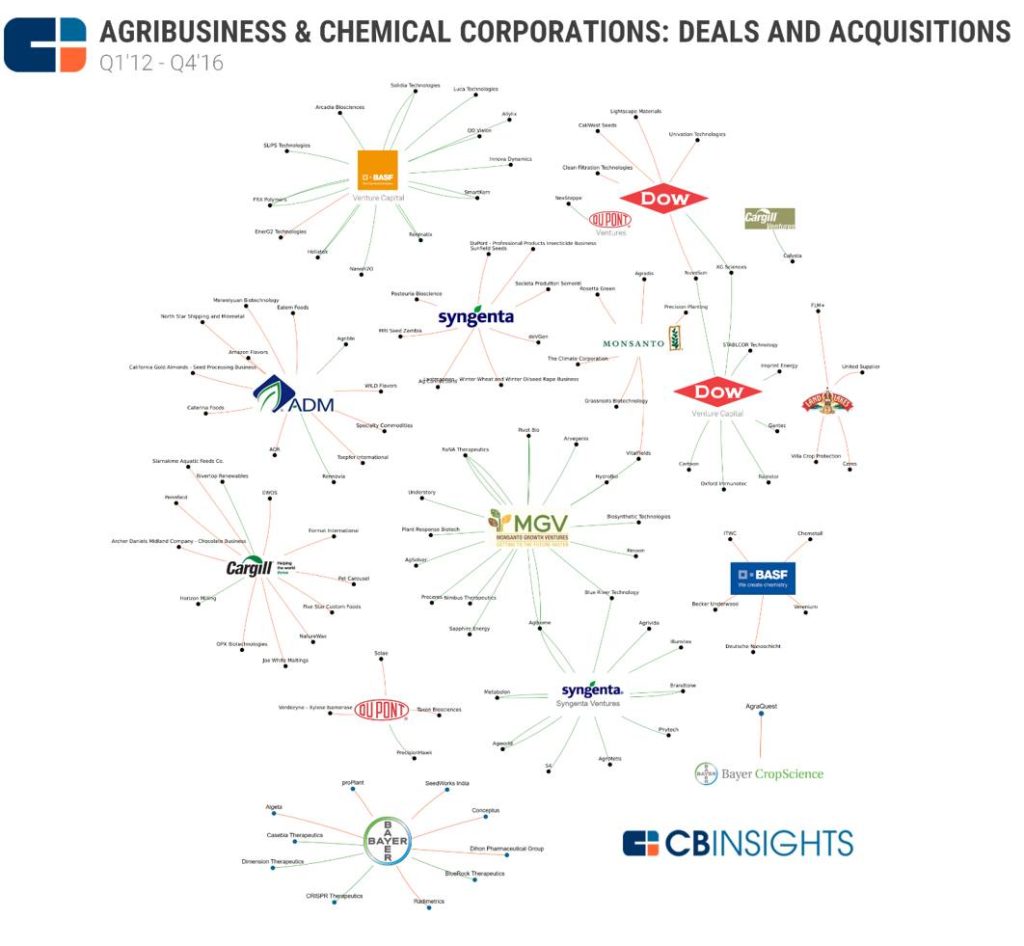

Unless you’ve been completely out of touch with the agricultural marketplace the past two years, you know that one of the major trends impacting today’s crop protection supplier industry is consolidation. From the Big Six companies that dominated the crop protection supplier landscape at the start of the 2010s, there will soon be only a Big Four left in their place, with several other smaller players jockeying for position.

.

While this might seem completely unprecedented in its scope, V.M. (Jim) DeLisi, Owner of Fanwood Chemical (which provides detailed agrichemical import and export reports, technical marketing of custom manufacturing services, and regulatory services), said the crop protection products marketplace has seen this kind of “consolidation” on a semi-regular basis for many decades now. “Major mergers in this sector have occurred about every 15 years since 1970,” said DeLisi, speaking at the 2017 AgriBusiness Global Trade Summit in Las Vegas, NV. “In fact, 40 to 60 agrichemical companies that were doing business during in 1970 disappeared or ended up part of one of the current mega companies since that time.”

While this might seem completely unprecedented in its scope, V.M. (Jim) DeLisi, Owner of Fanwood Chemical (which provides detailed agrichemical import and export reports, technical marketing of custom manufacturing services, and regulatory services), said the crop protection products marketplace has seen this kind of “consolidation” on a semi-regular basis for many decades now. “Major mergers in this sector have occurred about every 15 years since 1970,” said DeLisi, speaking at the 2017 AgriBusiness Global Trade Summit in Las Vegas, NV. “In fact, 40 to 60 agrichemical companies that were doing business during in 1970 disappeared or ended up part of one of the current mega companies since that time.”

As for why the industry is witnessing this latest round of mergers in 2017, you need look no further than current conditions in the overall agricultural market. “The largest driver of agriichemical mergers is the market price for crops such as corn and soybeans,” said DeLisi. “Corn prices in 2008 were $8 per bushel. In 2016, they were $3 per bushel. So in essence, the agricultural market lost $15 billion in value between 2008 and 2016. These kinds of losses have impacted ALL the suppliers to this market. And it’s put most growers in a kind of ‘survival mode’ when it comes to spending money and looking for ways to increase their profits.”

In many cases, this means growers are looking to crop protection/seed companies for new innovations/products to help manage increasingly aggressive/resistant pests/weeds, he said. “New product development costs, for both seeds and chemicals, are in the range of $300 million to $500 million in development and registration globally,” said DeLisi. “Only the latest companies have the resources and leverage to both finance and then recapture this level of investment in an attempt to ‘stay ahead of the weeds and bugs.’ Mergers were chosen as the path to increased revenues to allow for more research and development expenditures while protecting shareholder value.”

The New Big Players

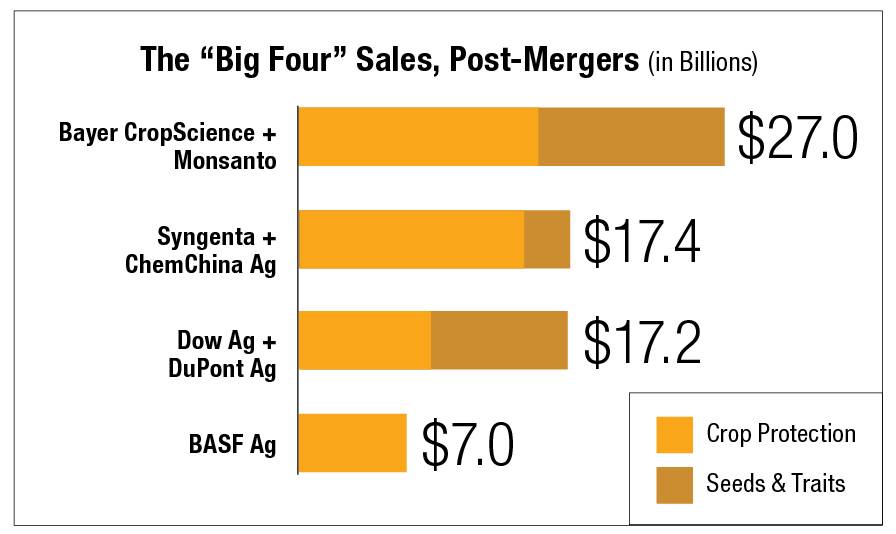

With this latest round of mergers now several years in the making, said DeLisi, the new big crop protection suppliers have begun to take form. By far the biggest player will be the combination of Bayer CropScience and Monsanto, which will have sales of more than $27 billion (not counting a few anticipated divestitures that will be required by regulatory agencies around the world). Virtually tied for second place will be the combination of Syngenta and ChemChina ($17.4 billion) and the DowDuPont “merger of equals” ($17.2 billion).

The remaining player in this new “Big Four” structure is BASF. Although the company is the largest in terms of overall revenues among the companies in this grouping, its percentage of crop protection sales stands at only $7 billion.

But this could change, said DeLisi, given the company’s track record in other markets. “BASF doesn’t like to be a No. 4 player in any market it does business in, and at the very least, the company seems ready to purchase some assets such as glufosinate if Bayer/Monsanto parts with them,” he said. “It’s also been reported that BASF has a fair amount of money to spend on an acquisition of its own — somewhere in the neighborhood of $50 billion!”

After the legacy Big Four companies, the clear No. 5 in the new crop protection supplier world order will be FMC Corp. During the course of divestitures required for Dow and DuPont to complete their merger and receive regulatory approval, FMC stepped in to purchase several proprietary products along with research and development assets from DuPont. “These acquisitions, coupled with FMC’s 2014 purchase of Cheminova, easily place the company in fifth place among crop protection suppliers,” said DeLisi.

As for the rest of the companies that will make up the new crop protection supplier Top 10, DeLisi said there are currently six candidates. “These include, in no particular order, Nufarm, which is headquartered Australia; United Phosphorous Ltd. from India; the U.S.’ Platform Ag, which is the merger of Chemtura, Arysta, and Apriphar, Albaugh, headquartered in the U.S.; Sumitomo Agrochemicals from Japan, and AMVAC, another U.S. company,” he said.

More Mergers to Come?

Part of the reason this list isn’t set in stone just yet is because of the potential divestitures that still might occur as the largest crop protection companies combine and re-evaluate their product line-ups. “Smaller companies will benefit from large company spin-offs and divestitures as well as market demands for competition,” said DeLisi. “You also have to assume that there will still be some sorting out among these ‘next’ companies as they continue to chase after the new Big Five in terms of revenues and product innovations.”

There could also still be a big crop protection supplier merger in the offing. “Now that ChemChina has completed its acquisition of Syngenta, there is again talk about the newly combined company perhaps merging with another large Chinese crop protection player, SinoChem,” said DeLisi. “If these two companies do get together, it would create a business with revenues in excess of $100 billion. That would exceed BASF when you consider total company size in this market.”

In conclusion, DeLisi said the agricultural industry should be prepared for plenty of “domino effects” from all these moves within the crop protection sector. “These changes will impact other sectors such as equipment, seed, and fertilizer in the long term,” he said. “And you can expect these mergers will further consolidate the distribution portion of the agricultural industry as everyone up-and-down the entire supply chain looks to get as many profits as they can out of it.”