China Price Index: A Different Path for Chinese Companies Amid Brazil’s Crop Protection Crisis

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his China Price Index. Below he also discusses how Chinese companies are adapting their strategies amid Brazil’s distribution crisis, shifting global supply chains, and mounting pressure from multinational corporations.

As the largest market for Chinese pesticide companies, Brazilian crop protection distributors appear to be facing a severe crisis. Following a period of capital investment and market euphoria, financial pressures and operational risks are now prompting Chinese suppliers to approach the development of the Brazilian market with greater caution.

According to the news from GlobeNewswire, Lavoro Limited, the first U.S. listed pure-play agricultural inputs retailer in Latin America, announced today that its subsidiary, Lavoro Agro Holding S.A. has reached an out-of-court restructuring agreement with a number of its principal product suppliers that provides for the extension of payment terms and secures future product supply for a muti-year period in order to help mitigate further supply chain disruption.

The principal suppliers party to the Agreement include BASF, FMC Agrícola, UPL Brasil, EuroChem, and Ourofino, and are committed to supporting Lavoro Brazil’s out-of-court negotiated reorganization plan (EJ Plan).

Gaining competitiveness from China’s upstream supply chain and mitigating supply chain volatility risks are critical to the operations of multinational corporations (MNCs) and national distributors. Business competition begins at the upstream supply chain system and concludes with product asset lifecycle management.

As a downstream entity for MNCs and Brazilian national distributors, Lavoro appears to struggle in directly accessing the flexibility and direct support of the upstream supply chain, facing dual pressures: MNCs’ pushing inventory into the channel and Chinese distributors entering the ToC market.

It is evident that the management team underestimated the harsh realities of supply chain and market competition. Even if Brazilian market demand recovers by 2025, crises similar to those faced by Lavoro would not be entirely resolved.

The field crop is the target market that Chinese enterprises focus on most. The challenges in developing the Brazilian market and the intense competition in a completely saturated market are forcing Chinese enterprises to shift their competitive strategies.

China’s New Molecules

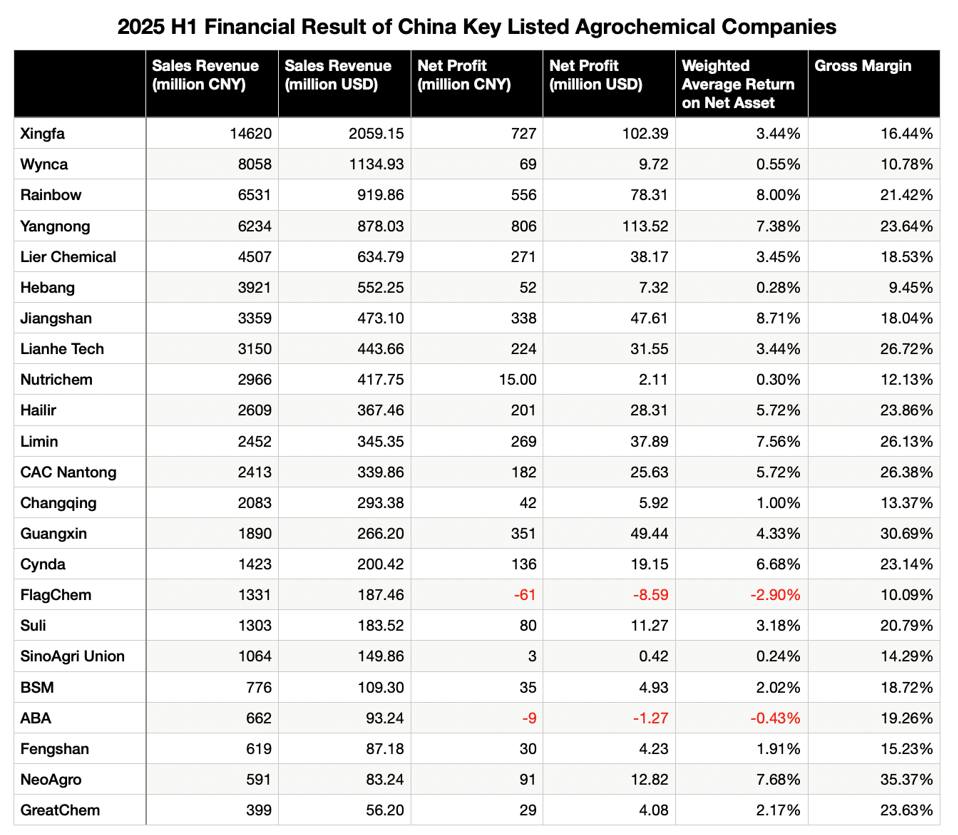

The demand from MNCs remains the top priority for Chinese suppliers. However, based on the first-half 2025 performance of China’s listed pesticide companies, those relying on MNCs’ demand and firmly executing B2B business models did not achieve high weighted average return on assets.

While financial considerations necessitate ongoing investment in new capacity and cash flow management, from a corporate health perspective, steadfastly serving multinationals cannot guarantee Chinese suppliers achieve excess profits during the crop protection industry’s downturn.

Focusing on new molecules and those with expiring patents is one strategy Chinese companies are using to overcome challenges. However, for certain compounds nearing patent expiration, the overcapacity planned by Chinese enterprises remains a persistent issue.

Take the industry-watched SDHI fungicides, saflufenacil and pyroxasulfone, as examples, Chinese suppliers’ “paper capacity” has already far exceeded the global field consumption of technical grade products as tracked by Kynetec. Yet, the competitive edge of Chinese suppliers in producing these near off-patent compounds requires time to prove. I am often asked: Which companies will ultimately prevail in this capacity investment race? One certain factor is that multinational corporations’ choices will determine the future supply landscape.

For multinational corporations, cost savings are always the key performance indicator (KPI) for strategic procurement teams. Consequently, B2B businesses struggle to find a balance between multinationals’ savings targets and Chinese suppliers’ margin requirements. If such a balance point exists, the bottom line for long-term cooperation might be multinationals committing to large-scale procurement volumes in exchange for Chinese suppliers refraining from entering the multinationals’ core markets.

As is widely recognized, the crop protection market is a mature market. The key to success in this market lies in securing stable cash flow and generating profits through the launch of new product assets. Against the backdrop of sluggish development of subsequent patented compounds by multinational corporations and the impact of Chinese formulation companies on the global high-value crop protection market, product lifecycles are rapidly shifting toward the long-tail phase.

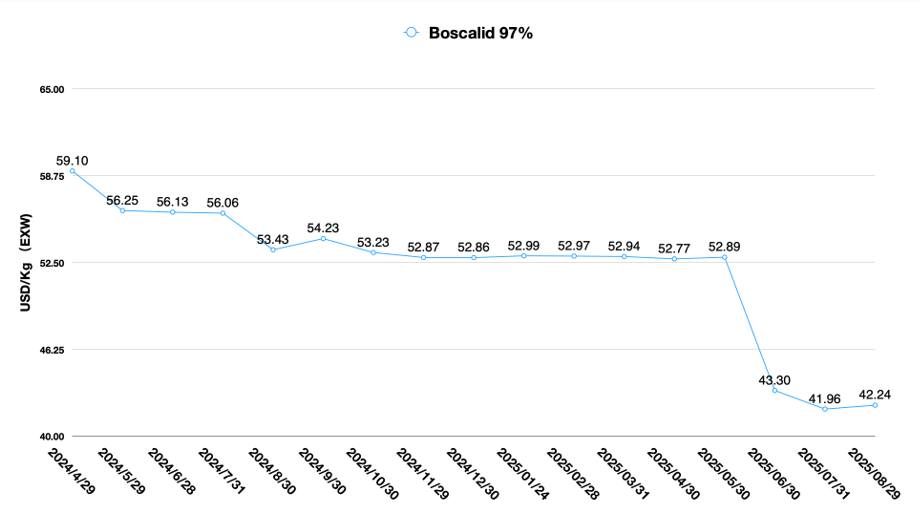

In the process of maintaining product lifecycles, MNCs have limited defensive strategies. For instance, regarding Bayer’s fluopyram, while Bayer can offer brand product discounts and preemptively license generic manufacturers to establish market presence, its defensive strategy for preserving product value remains notably inadequate. Initiating local active ingredient production in China before the patent expires may represent the optimal approach. Reducing production costs for patented active ingredients could potentially create greater scope for multinational corporations to implement defensive market strategies.

Chinese patented compounds may become viable options for MNCs seeking to introduce new products in the future. However, substantial research remains necessary regarding metabolite data and the toxicological profiles of impurities in these compounds.

Consequently, navigating the path for introduced Chinese patented compounds to progress through Phase II and Phase III into Phase IV represents a shared challenge for Chinese enterprises and multinational corporations aiming to introduce these patented compounds into the global market.

Key issues that currently require consideration in the supply chain system characterized by both cooperation and competition among MNCs, distributors, and Chinese suppliers include:

- How to increase the return of investment (ROI) of product assets?

- How to delay the transition of product assets into the long-tail phase?

- How to develop and successfully execute defensive protection strategies for product assets in their growth and maturity phases?

Given the current state of the global crop protection market, Chinese suppliers may struggle to deliver a perfect solution. Beyond price competitiveness and the reliability of supply guarantees, Chinese companies offer limited value to MNCs in terms of product asset value.

Policy Changes

China’s anti-involution policies provided some support for the sustainable development of the overall chemical industry in 2025. Recent policy statements indicate a shift in focus from “preventing low-price disorderly competition and promoting the orderly exit of backward production capacity” to “addressing disorderly corporate competition and advancing capacity management in key industries.”

This evolution in policy language reflects the Chinese government’s efforts to enhance policy adaptability and enforceability in response to changing market conditions. The neutral phrasing of anti-involution policies indicates a greater emphasis on dual mechanisms of market regulation and policy guidance in implementation. The exit of inefficient, non-competitive capacity will help the Chinese pesticide industry operate slightly above the break-even point.

Rebalance and Resistance

It is anticipated that the global chemical industry will likely experience a significant recovery by mid-2026. Rebalancing supply and demand across the chemical industry’s upstream and downstream sectors will support Chinese enterprises in maintaining reasonable profit margins.

The shortcoming is that we cannot simply view industry trends as the development of individual enterprises. The lack of long-term strategy among Chinese pesticide companies remains an obvious problem. Product homogenization is at the root of this issue.

For ToB businesses dealing in active ingredients (AIs), achieving product line differentiation is challenging. For companies engaged in ToC operations, a more pragmatic product strategy involves pursuing Me-Too registrations for generic formulations benchmarked against MNCs’ branded products. Substituting multinational brands with Chinese generic formulations represents the most realistic option for Chinese manufacturers.

However, formulation innovations by Chinese enterprises fail to truly reach the farmer level. This is primarily because developing innovative combination formulations and optimizing formulation types inherently constitute investments in “product assets”. Without access to global sales channels, Chinese pesticide companies struggle to invest in product assets with genuine market potential. A key challenge lies in defining this market potential. Such product assets should be positioned as “innovative combination formulations with differentiated positioning.” The value associated with these product assets should be “providing farmers with effective resistance management solutions.”

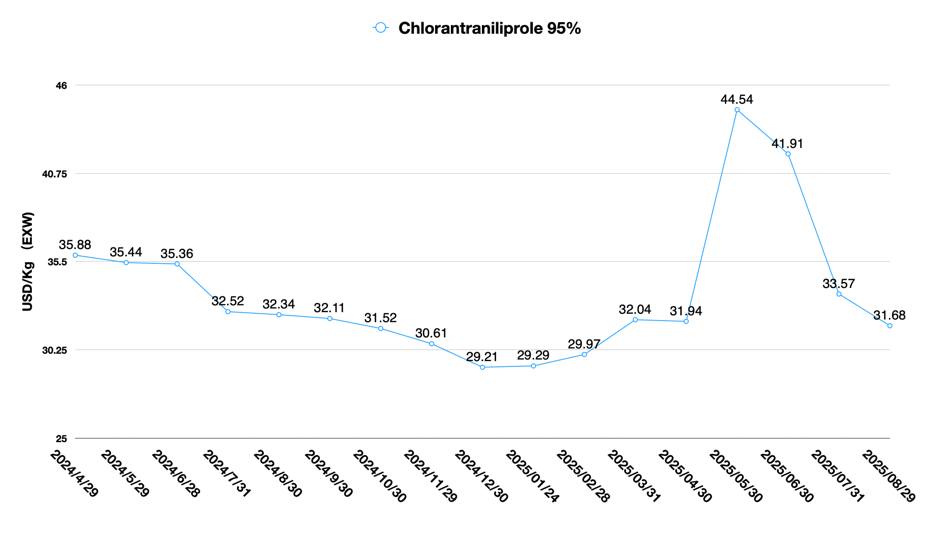

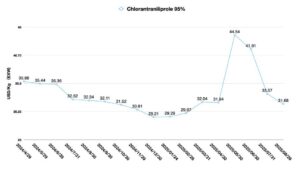

Resistance management is currently a key focus in global markets. Patent compounds from multinational corporations typically feature high efficacy and low application rates. However, to maintain sales performance, regional distributors may encourage farmers to apply multiple treatments. In the Chinese market, due to farmers’ limited agronomic knowledge, resistance to highly effective compounds like chlorantraniliprole and cyantraniliprole has grown rapidly. In the Chinese market, the single formulation of chlorantraniliprole has essentially lost its intrinsic value for field promotion. Only differentiated combination formulations represent the direction for future development.

Therefore, whether viewed from the perspective of me-too formulations or compounds nearing patent expiration, global farmers exhibit a relatively low willingness to pay (WTP) for Chinese generic formulations. Chinese enterprises find it challenging to command significant premiums based on product assets. This may explain why Chinese companies frequently position themselves in the mid-to-low-end product market.

For product assets, the product itself is merely a necessary factor. Product pricing, associated logistics and agronomic services, and digital tools are the essential sufficient conditions that underpin the value of product assets. Even if Chinese pesticide companies can reach farmers, they cannot deploy their limited sales teams to provide agronomic and logistics services across entire regions or countries. Cultural differences between China and other nations further widen the gap in mutual trust. Consequently, identifying market growth margins remains an almost impossible task for the sales efforts of Chinese pesticide companies.

By 2025, the fiercely competitive landscape in China’s pesticide active ingredient supply market is unlikely to change. The technological and process advantages between companies may have narrowed to micrometer-level differences, and the low-profit for active ingredient products will persist. More critically, the profit window for near off-patent expire patented compounds is steadily shrinking after market launch. High-pressure competition in active ingredient supply has become the norm.

Formulation sales currently represent the primary profit growth driver for China’s pesticide enterprises. Starting in 2026, the number of overseas registrations for formulations from Chinese companies will increase significantly, particularly in high-value markets. Within the global crop protection market, the substitution rate of Chinese-produced generic formulations for multinational corporations’ generic products will accelerate.

According to Wall Street Journal, Corteva is mulling a breakup that would separate its seed and pesticide businesses into two separate companies, according to people familiar with the matter. The company has a market value of around $50 billion and could unveil its plans soon, assuming the talks don’t hit any last-minute snags, the people said.

Corporate unwinding may facilitate more rational allocation of limited resources within enterprises. The separation of Corteva’s seed and crop protection businesses will enhance capital allocation flexibility. The seed division’s technology investments will attract more risk-tolerant capital. Meanwhile, risk-averse investors prioritizing cash flow may favor the crop protection segment. Naturally, mitigating the massive litigation facing Bayer’s Roundup in the U.S. may also be a significant factor driving Corteva’s spin-off.

Multinational corporations are advancing toward the goal of spinning off their crop protection businesses for separate listings by 2025 to optimize the market value of their conglomerates. Changes in corporate architecture will also drive transformations in corporate governance and management structures. Beyond products and profit centers, corporate governance and optimized resource allocation are key factors in enhancing corporate vitality.

In terms of corporate governance, Corteva’s approach to strategic thinking offers valuable lessons for Chinese pesticide companies. Choosing the right strategy is far more important than selecting which product assets to invest in. Because product asset investment is the outcome, while long-term strategy is the true vision.

- What is our winning vision?

- In which areas will we compete?

- How will we win in our chosen competitive domains?

- What capabilities must we possess to achieve victory?

- What management systems need to be established to ensure these capabilities are implemented?

By 2025, Chinese enterprises must find a way forward. But that path may not necessarily come from external sources. Rather than pursuing some imagined corporate direction, Chinese entrepreneurs would do well to study the mindset of high-performing multinational corporations and their relentless drive for internal management transformation. After all, competitiveness and the creation of opportunities are typically homogenous.