China Price Index: Asset Revaluation and Innovation Breakthrough — The Journey of Mutual Empowerment Between Syngenta Group and China’s Industrial Chain

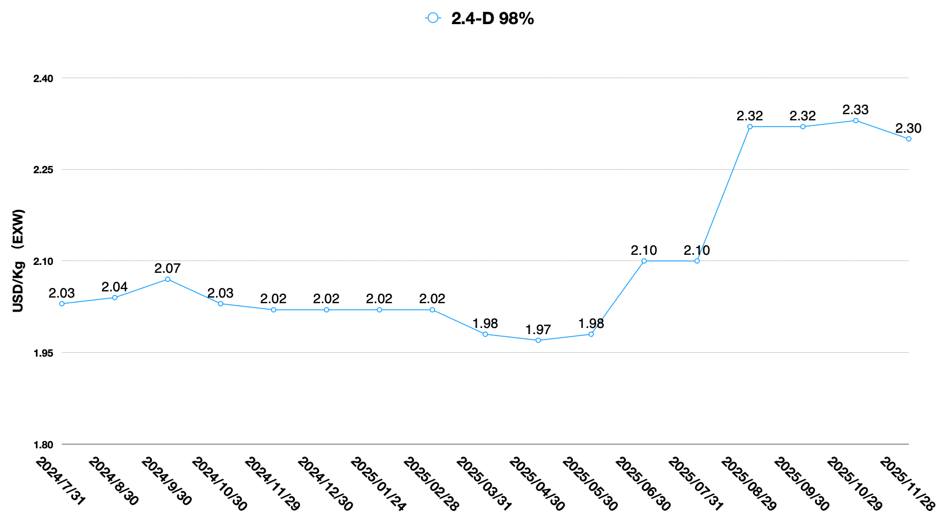

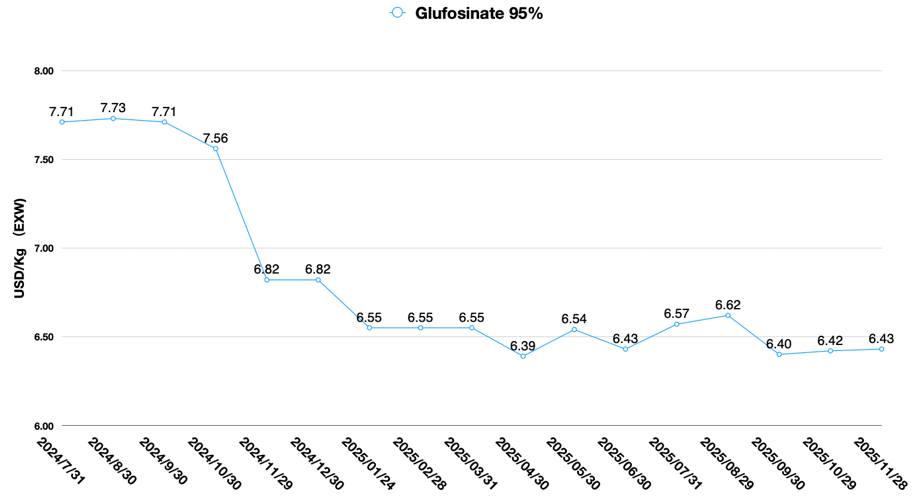

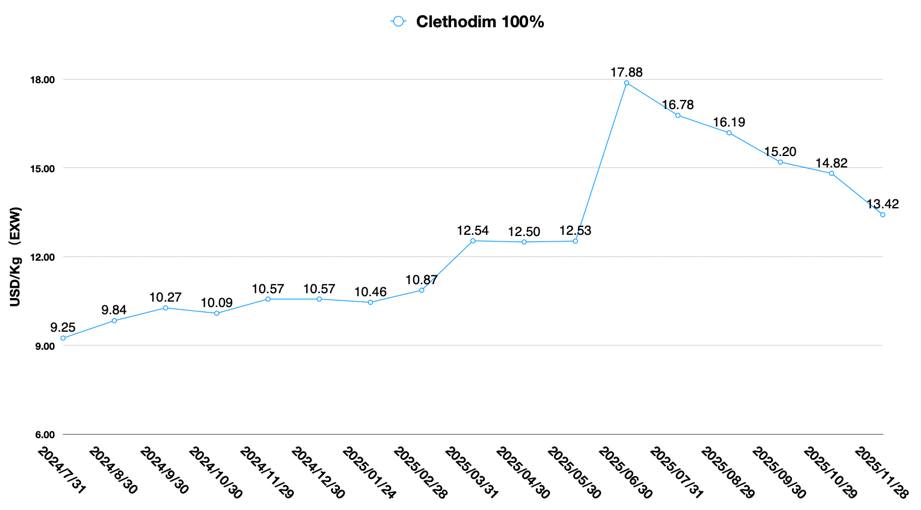

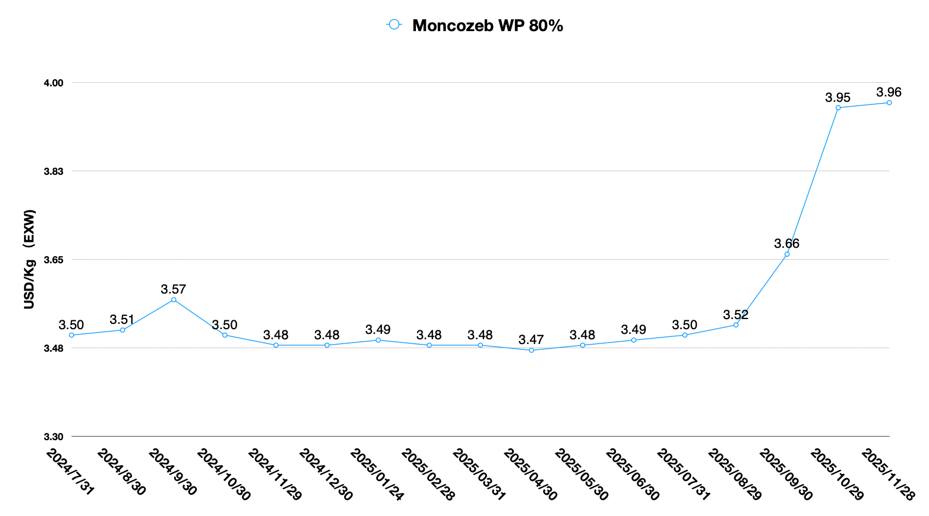

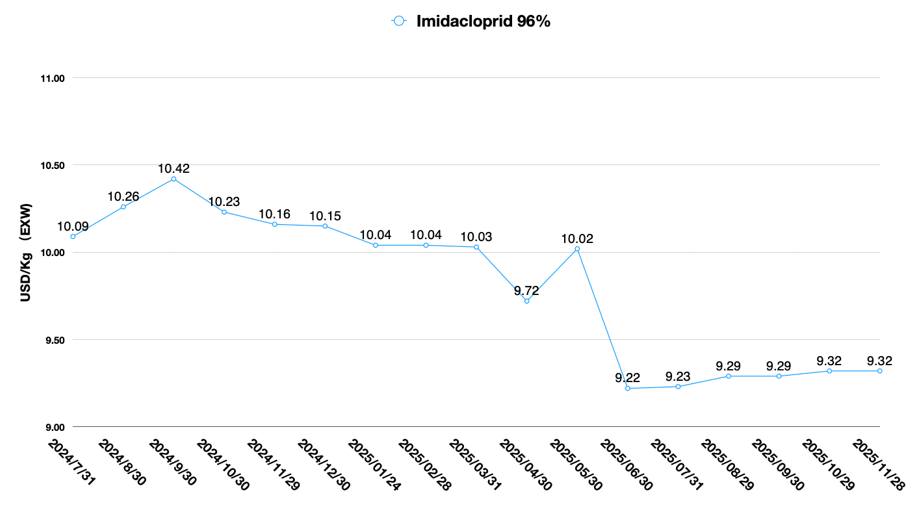

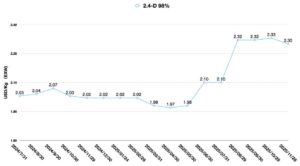

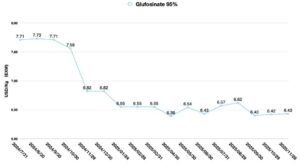

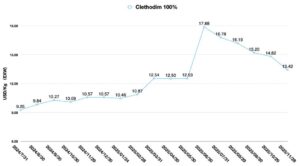

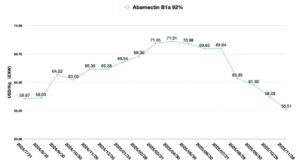

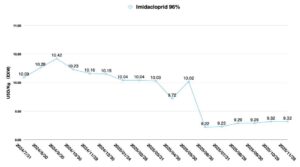

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his China Price Index. Below he also examines how China’s supply chain, RMB revaluation, and Syngenta’s innovation drive asset repricing trends growth worldwide.

According to Morgan Stanley, it can be predicted that, by 2030, China’s market share in global exports will reach 16.5% fueled by its edge in advanced manufacturing and high-growth sectors, reported by CNN. On Dec. 8, the General Administration of Customs of the People’s Republic of China released foreign trade data for the first 11 months of this year. China’s trade surplus surpassed 1 trillion U.S. dollars for the first time. Private enterprises have become the core pillar driving the steady growth of China’s foreign trade, accounting for 57.1% of the country’s total foreign trade volume.

Due to trade frictions between China and the United States, regions embracing global supply chains have become important partners of China’s manufacturing industry. Among trading partners, ASEAN countries have emerged as China’s largest trading partner. The total trade volume between China and ASEAN reached 6.82 trillion yuan, registering a year-over-year increase of 8.5%, and ASEAN currently accounts for 16.6% of China’s total foreign trade value.

Ms. Mo Nan Zhang, a researcher at the China Center for International Economic Exchanges (CCIEE), mentioned in a report that “China’s exports to the EU increased by 14.8% in November this year, and ties between China and the EU have become closer. For the EU, the possibility of trade disputes with China is on the rise. The trade structure between China and the EU is shifting from the original ‘vertical division of labor’ to ‘horizontal division of labor.’ For example, the top 10 traded products exported from China to the EU are actually highly similar to those exported from the EU to China. Therefore, the convergence of trade structures, including the competitiveness of industrial structures, may trigger trade frictions between China and the EU.”

Capital Flows, RMB Revaluation, and Long-Term Market Confidence

However, there is a fundamental difference between the choices of politicians and capital. Capital pursues efficiency and return on investment more. The weight of capital’s consideration for China — with its efficient production, logistics, and cost advantages in upstream raw materials — is increasing. For this reason, we are seeing more European enterprises regard China as the most important partner in their upstream supply chains. As a single market with high growth potential globally, capital’s layout in China demonstrates a more long-term perspective.

In the crop protection sector, BASF and Syngenta are clearly stepping up efforts to leverage the advantages of China’s supply chain and compete globally relying on China’s industrial chain. It can be said that whoever controls China’s supply chain will ultimately win in the long-term competition. The direct investments made by BASF and Syngenta in China are typical cases of enterprises “voting with their feet to make the right choice.”

In addition to supply chain advantages, China has been strengthening the exchange rate over the past period to stimulate export trade. The People’s Bank of China has a strong willingness to stabilize the RMB exchange rate. However, against the backdrop of China’s full participation in the global industrial chain, manufacturing upgrading has made it unnecessary for China to deliberately maintain a low exchange rate today. The RMB/USD exchange rate breaking 7 is likely to be a high-probability event in 2026. A strong RMB is, to a certain extent, intertwined with the appreciation of Chinese assets, showing a spiral upward trend. After the value of the RMB is redefined, Chinese assets may also be revalued by global investors.

From a macroeconomic perspective, the value of the RMB has been undervalued since the start of the China-U.S. trade war. However, amid a historical context of heightened global geopolitical uncertainty, the RMB and related Chinese assets are reappearing on the radar of global investors.

Syngenta Group’s Strategic Positioning in China and Global Crop Protection

In China’s agrochemical sector, the asset drawing significant market attention is Syngenta Group. The Syngenta group recently announced its plan to launch an IPO in Hong Kong. The birth of this aircraft carrier-like crop protection giant is likely to exert a profound impact on the global crop protection market.

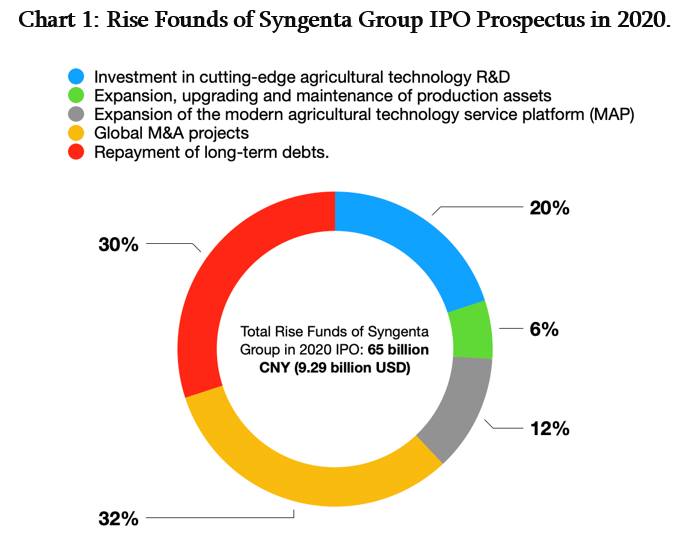

In 2020, Syngenta Group sought to list on China’s A-shares. At that time, the group’s prospectus stated that the fundraising amount would reach a record 65 billion yuan. Among this sum, 13 billion yuan was earmarked for cutting-edge agricultural technology R&D, 3.9 billion yuan for the expansion, upgrading and maintenance of production assets, 7.8 billion yuan for expanding the Modern Agricultural Technology Service Platform (MAP), 20.8 billion yuan for global mergers and acquisitions (M&A) projects, and the remaining 19.5 billion yuan for the repayment of long-term debts.

In 2020, Syngenta Group sought to list on China’s A-shares. At that time, the group’s prospectus stated that the fundraising amount would reach a record 65 billion yuan. Among this sum, 13 billion yuan was earmarked for cutting-edge agricultural technology R&D, 3.9 billion yuan for the expansion, upgrading and maintenance of production assets, 7.8 billion yuan for expanding the Modern Agricultural Technology Service Platform (MAP), 20.8 billion yuan for global mergers and acquisitions (M&A) projects, and the remaining 19.5 billion yuan for the repayment of long-term debts.

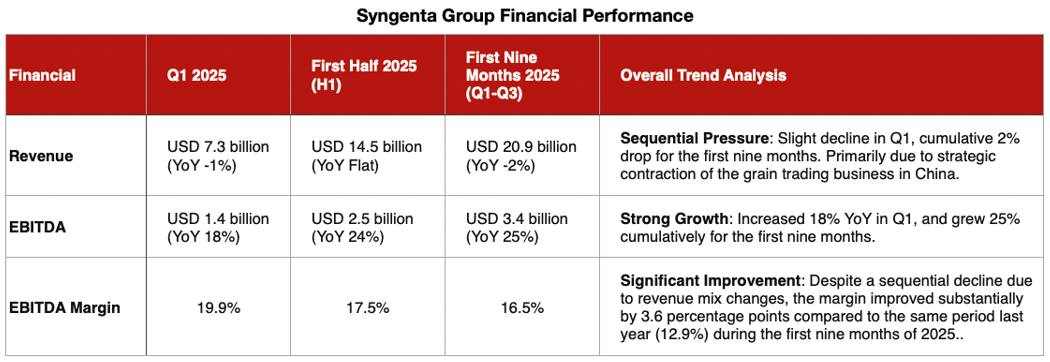

In the first three quarters of 2025, although Syngenta Group’s operating revenue reached 20.9 billion U.S. dollars, a year-over-year decrease of 2%, its EBITDA stood at 3.4 billion U.S. dollars, a year-over-year increase of 25%. Despite a significant drop in grain trading, Syngenta’s strong product pipeline in crop protection sector — such as the successive launches of innovative crop protection products like Plinazolin (isocycloseram) and Tymirium (cyclobutrifluram) — has provided support for the group’s future growth. In the seed sector, X-Terra wheat hybrid varieties entered the commercialization phase. In China, the world’s most highly competitive red ocean crop protection market, Syngenta has still maintained robust growth, which fully demonstrates the success of its China strategy.

Amid the highly competitive market environment, Syngenta Group has adopted a wiser approach to life cycle management. It starts with research on China’s supply chain and penetrates deep into end-market competition. Supply chain, market strategy, and core product life cycle management can be described as the most core strategic cornerstones of Syngenta Group in the crop protection sector.

In addition, against the backdrop of China’s food security, Syngenta Group China is strengthening the stickiness of its collaboration with the Chinese market and farmers through the integration of artificial intelligence (AI) and the MAP platform. Regarding its core moat, Syngenta undoubtedly remains focused on the combination of patented compound product lines and seed technology innovation. Thanks to China’s extensive application scenarios in the “AI+”, as well as consumers’ and farmers’ high acceptance of “AI+”enabled products and services, Syngenta also maintains competitiveness in integrating crop protection with other technological innovation iterations.

Internal Synergies: Yangnong, ADAMA, and Supply Chain Integration

Within Syngenta Group, the business overlap between Syngenta and ADAMA is likely a common concern among investors. In 2025, ADAMA — also part of Syngenta Group — has seen a significant recovery in recent performance. In the North American market, ADAMA’s sales increased by 15% in the first nine months of 2025. In high-value markets, compared with Chinese generic pesticide enterprises, ADAMA still has the strength to maintain a midrange product positioning. However, in some highly competitive markets with low entry barriers, such as Southeast Asia, this advantage of ADAMA is not obvious.

In Europe, North America, and Argentina, ADAMA launched COSAYR (CTPR), which will have a direct impact on FMC’s CTPR profit margin. Leveraging China’s highly competitive CTPR supply, ADAMA may be able to achieve a high return on investment during the high-margin window period of the CTPR market.

Since Chinese manufacturers lack the ability to formulate correct channel sales strategies, ADAMA still holds certain first-mover advantages in breaking through registration barriers, market penetration capabilities, and motivating channels to expand market share. However, compared with Chinese generic manufacturers such as Rainbow, ADAMA’s higher operating expenses may be a key point that the company needs to continuously optimize.

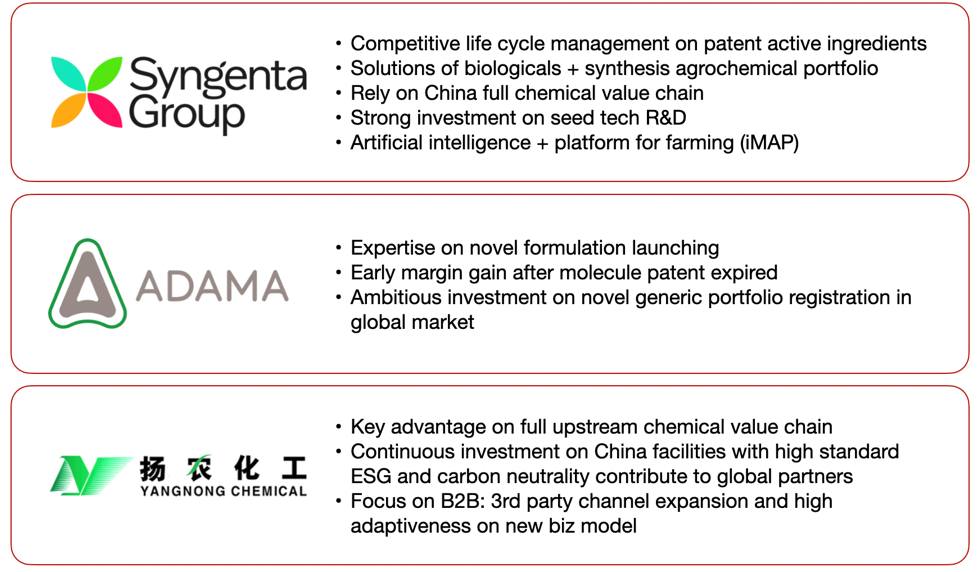

Regarding the issue of business overlap between Syngenta and ADAMA, we need to conduct a meticulous analysis rather than apply preconceived notions. From the perspective of ADAMA’s product line, Syngenta focuses more on the R&D of innovative compounds and seed technologies and is gradually shifting toward biological + chemical crop protection. ADAMA, however, has long pursued the critical window period after the expiration of patent compounds to achieve sustained growth.

Essentially, the overlap in the business strategies of the two companies is not very high. If any overlap exists, it is likely mainly in upstream supply chain management and the sales end. Therefore, after Syngenta’s listing, there may be new integration moves in the upstream supply chain and sales end management between Syngenta and ADAMA. If integration occurs, Syngenta Group could have a strong possibility of leveraging procurement volume to obtain active ingredients at lower costs. Combined with organizational restructuring and optimization as well as strict control of sales expenses, the overall operational efficiency of Syngenta Group will be rapidly improved.

On the other hand, closely relying on China’s upstream full industrial chain advantage is Syngenta Group’s most competitive moat. This moat, built on China’s full industrial chain strength, may be as capable of fending off external competition as Syngenta’s innovation. Yangnong Chemical is currently the core active ingredient manufacturing enterprise within Syngenta Group. Characterized by production efficiency and full industrial chain layout, Yangnong Chemical can be regarded as one of the sources of Syngenta Group’s global competitiveness.

Jiangsu Youjia Crop Protection, a subsidiary of Yangnong Chemical, has recently obtained environmental impact assessment (EIA) approval for its USD 4 million investment in constructing production facilities with an annual capacity of 4,000 Mt of difenoconazole and 100 Mt of bisulflufen.

Bisulflufen is a trifluoroethyl sulfide-based systemic acaricide firstly discovered by Shenyang Sinochem and later developed by Yangnong Chemical for industrialization. On Nov. 21, 2024, Sinochem Crop Care, a subsidiary of Yangnong Chemical, launched a new generation of acaricide product with brand ″Weijing″ (15% Bisulflufen SC) in Hefei, Anhui Province, China.

In December 2025, Yangnong also initiated the EIA for its 100 Mt/a indaziflam TC project. In Q2 of 2024, Phase I of Yangnong’s Huludao Youchuang Base, with capacity of 5,000 Mt/a clethodim, commenced production. Amid the challenging environment where clethodim prices in China remained firm and other suppliers began breaking contracts to pursue excess profits, Yangnong won the trust of more customers with an attitude of open cooperation, thereby effectively integrating capacity release with market demand.

In addition to production, Yangnong has also actively laid out diversified channels. At the end of January 2024, SinoAgri and Yangnong Chemical held a strategic cooperation exchange meeting, jointly signed a strategic cooperation agreement, and officially became strategic partners. The two parties reached a consensus to leverage the R&D and production advantages of both parties in technological innovation and pesticide creation and achieve comprehensive strategic cooperation in areas such as technical ingredients, intermediates, formulations, and international market development.

In summary, the three key components of Syngenta Group’s crop protection segment have distinct positioning. While there may be slight business overlap in different markets, their respective profit streams cover almost all aspects from the supply chain to innovation.

Yangnong focuses more on B2B business and is positioned at the uppermost stream of the supply chain. Its profit mainly stems from the full industrial chain layout and operational efficiency. Although Yangnong is in the upstream of Syngenta Group’s supply chain, it is not limited to Syngenta Group as its sole marketing and sales channel.

For Yangnong, market share and full-capacity operation are its fundamental goals. These two aspects reinforce each other and drive the overall performance of Yangnong Chemical. Economies of scale can be said to be the source of Yangnong Chemical’s profits. In terms of product categories, Yangnong is not confined to existing products; hot products such as clethodim and patented compounds are also its key investment directions.

ADAMA mainly leverages its investment in data packages to capture high profits market. The company is more inclined to find the optimal point for maximum return on investment between market capacity expansion and sustained price declines. In addition, ADAMA’s investments are more focused on the market of innovative nonpatented compound formulations.

Finally, Syngenta Group focuses on the excess profit margins brought by the lifecycle management of high-investment, high-return patented compounds.

Talent, Innovation, and the Long-Term Revaluation of Chinese Assets

In addition, Syngenta Group’s investment in and cooperation for innovation are significantly deeper than those of other multinational corporations. Notably, Syngenta Group has not only integrated deeply into China’s supply chain but also actively collaborated with Chinese innovative talents and scientific research institutions, forming a communication mechanism that has lasted for more than a decade. The main areas of Syngenta Group’s cooperation with China focus on biological innovative platforms, RNAi biopesticides, biostimulants, abiotic stress and plant health, biosynthesis, receptors, computational chemistry, etc. These basic researches are not known to other competitors. However, once Chinese innovations emerge, they will bring disruptive changes to Syngenta Group’s competitiveness in the global market.

Asset valuation itself is an extremely complex and systematic “project.” Many investment institutions may overlook an important influencing factor — talent — when conducting due diligence.

As mentioned in a recent article by The Economist, “An exodus just now, as the world’s two largest economies (U.S. and China) are locked in bitter trade conflict, will erode one of America’s biggest advantages in its technological rivalry with China: its ability to lure and keep superstars.”

China not only adopts an open attitude toward talent introduction but also has a capital market that is more friendly to overseas returnees starting businesses in terms of capital investment.

Once, American innovation led the world, mainly because the U.S. had the most efficient capital market globally. In China, a high school student could not obtain an investment of up to 20 million U.S. dollars, but this was possible in the U.S. However, Chinese capital and listing regulators are changing.

China Securities Regulatory Commission has issued new policies to encourage the listing of unprofitable enterprises with core innovative competitiveness. It has provided better entrepreneurial opportunities for global talents. As Chinese capital becomes more tolerant, regulators are increasing their tolerance for risks brought by decision-makers with strong science and engineering backgrounds. When Chinese capital begins to take risks, miracles may happen.

In China’s market with a massive industrial chain scale, Chinese capital and entrepreneurs are targeting multinational corporations like Syngenta Group for cooperation. Therefore, we should not only focus on the current value of assets but also predict their subsequent appreciation potential. Furthermore, international capital may even engage in in-depth cooperation with Chinese investors and innovative teams — from the startup phase to seed round financing, then to Series C financing, and even integration into the innovation segments of multinational corporations.

While the cooperation model between pharmaceutical innovation and multinational corporations is most mature in the life sciences field, in the crop protection sector, with Syngenta’s successful listing, the potential for Chinese innovative teams to become high-quality growth-oriented assets of Syngenta Group may be surprising.