Crop Protection Market Development: Expectations for 2026

Editor’s note: In this article, Derek Oliphant of AgbioInvestor shares expectations for the development of the global crop protection market in 2026. Market values are Agbiolnvestor’s estimates of the value of crop protection products used on the ground in the agricultural year, expressed in U.S. dollar terms at the ex-manufacturer level. For northern hemisphere countries, the agricultural year is approximately October to September; for example, 2025 refers to the value of products used on the ground between October 2024 and September 2025.

North America

The latest survey of key crop areas in the U.S. in 2025 shows that the area under maize is estimated to have increased by 9% over the previous year, while the soybean area is estimated to have fallen by 6.8%. The latest forecasts for U.S. agricultural trade for 2026 show that the agricultural trade deficit is expected to fall by $5.5 billion, amounting to $41.5 billion.

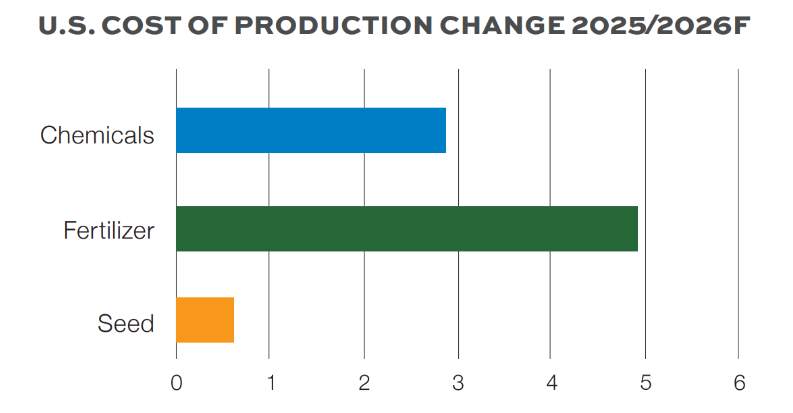

The figure below shows the USDA forecasts for increases in costs of production for agrochemicals, fertilizer, and seeds for U.S. growers in 2026, averaged across all key crops.

An increase of more than 5% in fertilizer costs is expected to limit spending on crop protection chemicals, although an increase of around 2.6% is expected next year. These elevated input prices are currently exerting pressure on U.S. maize growers in particular, with penalties on imports, such as antidumping or countervailing duties, resulting in higher prices for fertilizers, pesticides, and other inputs.

In Canada, the total planted area in the country is forecast to increase by 0.3% in 2025/26. Crop prices are forecast to generally decline in 2025/26, with prices for most tracked crops forecast to fall, including wheat and canola.

In 2025, farm economics continued to be challenging in both the U.S. and Canada. Any improvement in weather conditions can be expected to be a positive, while the much improving inventory situation can also be expected to benefit crop protection product sales, particularly from the supply side as there has been a notable shift toward just-in-time purchases in the U.S. in particular. AgbioInvestor’s preliminary estimates for the value of the crop protection market in North America in 2025 suggest an increase of 1.2% to $11,846 million in nominal terms.

While economics of production remain an issue in 2026, USDA forecasts suggest that crop protection chemical spending will increase by 2.6% in the U.S. Increased insect pressure, which has been noted recently, can be expected to benefit insecticide sales, although reduced grower incomes can be expected to limit fungicide sales potential. For herbicides, the continued rise in maize areas but decline for soybean is expected to benefit actives such as acetochlor, S-metolachlor, and mesotrione at the expense of widely used soybean herbicides, primarily in herbicide tolerant systems, such as 2,4-D and glufosinate, as well as pyroxasulfone.

Central and South America

In Brazil, the total planted area in 2025/26 is forecast to increase by 3.1%, driven by area increases for most key crops. Total production is also forecast to increase in 2025/26, albeit at a lower rate than planted areas, rising by 1.0% to record levels.

The Argentinian Ministry of Agriculture’s latest estimates for the planted areas of key crops for the 2025/26 season indicate area expansions for wheat (+1.5%), sunflower (+12.5%), maize (+11.4%), and cotton (+8.7%).

For Central and South America in 2025, while agrochemical prices and commodity prices remain low by historical standards, higher areas of key crops in Brazil and Argentina and generally improved weather conditions were positives for market development. Despite this, mainly due to continued pricing impacts, AgbioInvestor’s preliminary estimates for the value of the crop protection market in Central and South America in 2025 suggest a decline of 7.5% to $21,502 million in nominal terms.

Looking ahead to 2026, stabilization in agrochemical and commodity pricing is a positive, while weather conditions are expected to be more favorable, despite some concerns over early season dryness in parts of Brazil. Pest pressure is expected to be relatively high, while expectations for higher areas of key crops in Brazil and Argentina are significant positive drivers for the market moving forward. Brazil is also continuing to benefit from strong export demand from China, with the country now substantially ramping up its imports of Brazilian sorghum, in addition to continuing high demand for maize and soybean. There are also expectations that growth will continue in other countries in the region where fruit and vegetable production takes precedence over row crops.

Asia Pacific

The area planted with kharif (autumn) crops in India is 2.5% greater than at this stage last year. Crop area expansions have been observed for rice, pulses, coarse cereals, and maize. Indian farmers responded to above-average monsoon rainfall recently by accelerating planting operations for summer-sown crops, including rice, soybeans, cotton, and maize.

The monsoon season is crucial for Indian agriculture, providing 70% of the rainfall needed for farms, aquifers, and reservoirs. Since the start of the monsoon season, the country has received 6% more rainfall than usual.

In China, the harvest of the 2025 winter wheat crop, which accounts for around 90% of total annual output, recently concluded under relatively favorable conditions in key producing regions, with adequate water supplies for irrigation.

China’s National Bureau of Statistics recently published its latest production figures for chemical pesticide active ingredients, with cumulative national production for 2025 reaching 3.423 million tonnes by October, representing a 10.5% increase over the previous year. In the full year of 2024, annual cumulative production of pesticide active ingredients reached the highest level on record, at approximately 3.675 million tonnes. Linear regression analysis of historical data and associated margins of error projects total 2025 output at between 4.015 and 4.331 million tonnes by year-end, setting a record for annual production, if realized.

For 2025, while the crop protection market in Asia Pacific continues to be hampered by low agrochemical prices, recovery can be expected in markets where weather was less positive in 2024, such as India, Australia, and China. In addition, continued progress can be expected in developing markets in the region, notably those where exports are a key focus.

AgbioInvestor’s estimate for the value of the crop protection market in Asia Pacific in 2025 is an increase of 1.9% to $19,328 million in nominal terms. In constant currency terms, this equates to an increase of 2.9%.

Some notable new active ingredients have been introduced in Asia Pacific markets in recent months that provide growers in the region with access to new technologies, including products offering novel modes of action. These include FMC’s tetflupyrolimet in South Korea for the management of resistant grass weeds in rice; BASF’s fenmezoditiaz in India for use on rice; and Insecticides India, in collaboration with Nissan Chemical, now offering metazosulfuron in India, also for use on rice. More recently, BASF has introduced cinmethylin in Indonesia; Syngenta has launched Incipio (isocycloseram) in Pakistan for use on rice; Insecticides India, in collaboration with Corteva, has launched triflumezopyrim in India for rice plant hopper control; and the herbicide tolpyralate has been launched in India by UPL and Godrej Agrovet.

Looking ahead to 2026, with more positive weather conditions in key markets such as India and China and the positive impact from new product introductions, further recovery can be anticipated, particularly as the worst effects of agrochemical price declines are expected to have been felt. Indications suggest prices are much more stable for most agrochemicals, and indeed there is the potential for key products, such as glyphosate, to rise in price during the year.

Europe

The crop protection market in Europe in 2025 was relatively positive in local currency terms, benefiting from a return to more normal, positive weather conditions. Despite this, extended dryness in eastern and southern parts, notably Bulgaria and Romania, impacted crop production and yield potential, particularly on summer crops. AgbioInvestor’s estimates for the value of the crop protection market in Europe in 2025 show a decline of 0.7% to $13,632 million in nominal terms.

A significant driver of value growth in Europe in recent years, which can be expected to accelerate as uptake expands, has been new product introductions such as the herbicides bixlozone and cinmethylin and the fungicides mefentrifluconazole and fenpicoxamid.

For 2026, weather is again expected to be the main influencer on the crop protection market during the year. Expectations for recurring hot and dry conditions in summer will limit application potential on the main summer crops of maize, sunflower, and soybean, while any recurrence of the conditions experienced on the winter crop in 2024 would be expected to have a severe impact on market potential. Provided weather conditions are at least normal during the year, the market could return to growth based on stable agrochemical and commodity pricing and the boost from new product introductions. However, the commercial potential of several key active ingredients is expected to be impacted by EU regulations in 2026 (notably flufenacet and tebuconazole, as well as methoxyfenozide), which will hamper growth somewhat.

Middle East and Africa

The South African Ministry of Agriculture, Forestry, and Fisheries’ most recent estimate of planted areas and production for 2024/25 summer crops in the country suggests that the total planted area of the key summer crops is expected to be flat against the previous year. Total summer crop production is expected to increase by 25.9%.

The value of the crop protection market in the Middle East and Africa (MEA) in 2025 is expected to be negatively affected by the ongoing low agrochemical prices from China, with the region being heavily reliant on the country as a source of low-cost generic material. In addition, weather continues to have a severe effect on agricultural production in the region, with dry conditions experienced during much of the year. On a more positive note, the region has been a focus of new product development and introductions, including for biological products and seeds in recent years.

An increasing focus on biologicals and newer chemical introductions can partly be attributed by the desire of many growers in the region to target export markets, notably in the EU, where harvest intervals and maximum residue levels (MRLs) could prove to be a barrier for produce treated with conventional chemical products. AgbioInvestor’s estimates indicate that the value of the crop protection market in MEA increased by 1.3% in nominal terms 2025 to a value of $2,517 million. This reflects a rise of 3.2% in constant currency terms.

Stability in agrochemical pricing from China means that the worst effects of the severe price declines on the value of the market have essentially now been felt. Growth is now more tied to local weather conditions in key markets, many of which continue to be hampered by hot and dry conditions. Some positivity could be realized through a switch in product usage, with many countries in the region looking to the EU as an export market, thus limiting product use in order to meet MRL requirements for export to the EU. As a result, many growers in these export-focused sectors will look to mirror product usage much more in line with EU regulations. Often there is an inherent value uplift through this alteration in product usage, with many of the products now allowed in the EU being more recent, and relatively more expensive, introductions, with low-cost broad-spectrum products now much more limited (e.g., mancozeb, chlorothalonil, chlorpyrifos).