Agribusiness in Mercosur: Why New Strategies Are a Must in a Uncertain World

The current state Mercosur’s international relations are faced with many challenges.

In addition to Russian-Ukraine war’s impact globally, the war between Israel and Hamas, as well as between Iran and Israel, are presenting concerns. In parallel, the U.S. and China continue to have differences and fears for conflict in the Asia Pacific are increasing.

During 2024, there will be more than 100 elections of parliaments and more than 60 for presidents around the globe. Commercial and trade relations are affected by politics and geopolitical issues as well as economic growth. The trade relations of Mercosur with the central economies, like China, are influenced by these political and geopolitical events.

Mercosur International Agreements

The Southern Common Market (Mercosur for its Spanish initials) is a regional integration process, established by Argentina, Brazil, Paraguay, and Uruguay on the 26 March 1991, and subsequently joined by Venezuela and Bolivia. In the case of Venezuela, this country is suspended because political issues associated with the Maduro government, and Bolivia is still complying with the accession procedure to become a full member.

When we talk about Mercosur, we must take in account that is one of the most closed trade groups in the world, not only in terms of the number of free trade agreements, but also, non-tariff measures and average tariffs, double the rest of the world’s tariffs. For our region it is especially important to sell out production, and it is a key point that we continue promotion from private associations and industrial chambers.

In terms of the international agenda of Mercosur, the block recently closed an agreement with Singapore. It has open negotiations with Canada, the European Free Trade Association (EFTA), the European Union (UE), South Korea, and Lebanon. The most important negotiation for the region is with the EU, but recently at the Macron and Lula meeting in Brazil, it was confirmed that the agreement between EU and MERCOSUR, will not go ahead, at least in the short and medium term. In the south economic block, and also from the U.S. side, a free trade agreement between these two actors is not in agenda.

Because of the limited results of Mercosur in the international agenda and taking in account the new failure of the negotiations with the EU, the region is re-strategizing exports. The first option for our region, and for Uruguay, is China, which continues being the main market of exports of all the South American countries.

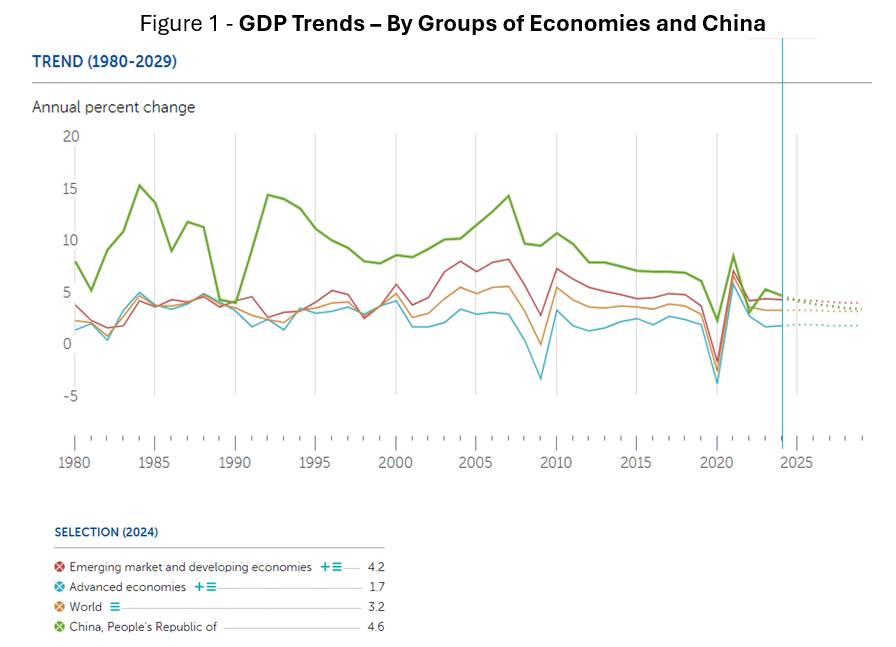

Although the growth of China will be lower than before, it is still higher than EU and the U.S. (around 4.5% for 2024 and 2025). Many businesses are focused in trying to deepen the relationship between Mercosur and China during this new stage of China economy.

Source: IFM

The reaction of Mercosur to China, in the latest political meeting of Mercosur countries plus Bolivia and Chile, we can confirm that the biggest economy of Asia is not in the agenda of Mercosur. We can see full of good intentions in the topic of the negotiations of FTA, but we cannot see any results. Next July, Paraguay will transfer the temporary presidency to Uruguay for the next six months, so it is a good challenge for Uruguay to try to launch a dialogue between China and Mercosur.

The relations between Mercosur and China have to be very pragmatic because Paraguay has diplomatic relations with Taiwan, and the new government of Milei shows deep differences with China. In the case of Brazil, beyond the strong economic and political relations of Brazil with China (both countries are members of BRICS), Lula administration is far away to sign an FTA with the Asia economy. That is the reason Uruguay is demanding the flexibility of Mercosur to advance with China in a bilateral agreement, for which it has already signed a feasibility agreement.

New Agenda

Regardless of the strategy with China, opening the economy to other regions is necessary. For example, Mercosur can deepen the relation with India which will grow more than 6% their gross domestic product (GDP) and is becoming big purchasers of food. Also, we should not forget Africa economies and the 10 countries of the ASEAN (Association of South-East Asian Nations) that were created in the 1960s and have enormous potential in economic and population growth.

The Mercosur region, which produces food, should be a key area of the world, where businesses need to increase efforts. Mercosur, as a block, is trying to start conversations with Indonesia. This is a good start, but conversations need to go further in building relationships with Thailand, Malaysia, the Philippines, and Vietnam (the block close already an FTA with Singapore). We are talking about 600 million people that need to assure their food security. Pacific Asian economies will explain more than 60% of the increase of GDP in the next decades. Latin America countries and Mercosur members will benefit in supporting these consumers.

New Strategies

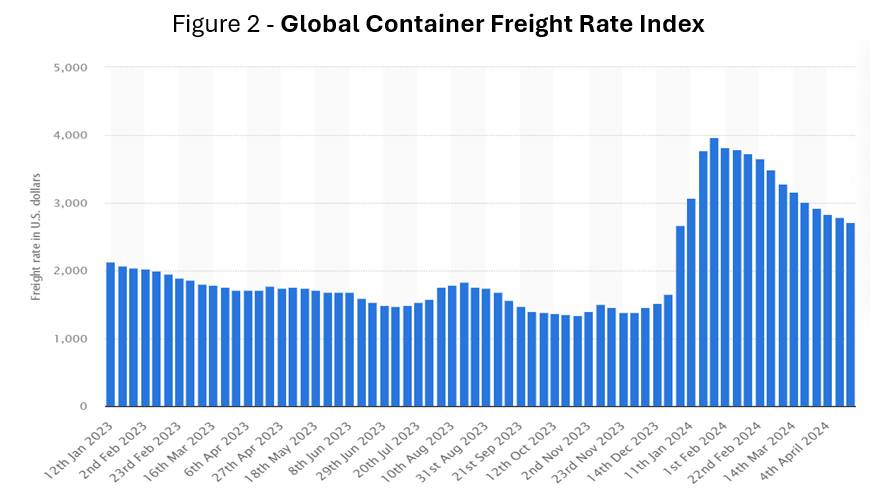

We need to promote new strategies for a new world, especially for the new global context, environmental crisis, new logistics difficulties (prices of freights from Asia to South America are at historic levels), and future incidents expected could generate new increases of the price in any moment. Uncertainty is here to stay.

Source: Statista.

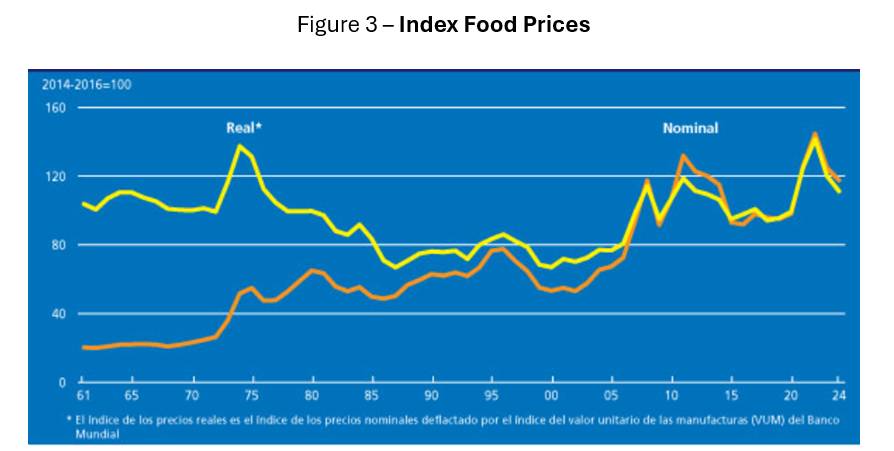

The way Mercosur farmers mitigate the risks is important, such as exploring new crops and future contracts that allow to fix prices earlier. Growers accessing insurance or even increasing the irrigation in crops, these solutions were unthinkable years before — now these are possible. A good example is the evolution of the grain market, which depends on many factors, including operators throughout the supply chain, and also geopolitical problems that affect freight costs.

Geopolitical Problems

Freight costs that increased due to war in the Middle East, in Ukraine and Russia, challenges in climate change, the use of new strategies in crops, biological products, and use of technology growth in agriculture, will be especially important.

We must assume that the international context will maintain prices of commodities and logistics at high levels, but with fluctuations.

Source: FAO.

Relationships Between Supply Manufacturers in China and India with Overseas Distributors

If there is overcapacity of production, it is not a big deal. If there is a lack of a certain active ingredient, it will be a key factor for the development of the business. To face those difficulties, it is important to know each other. During the pandemic, companies that have regular relationships with the chain were able to endure the crisis. This proved that having a deep understanding of each other will solve many problems that could happen.

We are living in an uncertain world, which forces us to deploy new strategies and imagine different scenarios to continue operating. The challenge is for governments, but also for the private sector.