M&A Matures Brazil’s Bioinputs Market: Innovation Meets Global Strategy

The mergers and acquisitions (M&A) landscape in Brazil’s agribusiness has entered a new stage of maturity, with biological inputs now standing at the center of strategic transactions. Once dominated by rapid expansion and opportunistic growth, the market is now guided by selectivity, financial discipline, and clear value propositions. For investors, the country has become a hub of opportunity – driven by its unrivaled agricultural scale and the urgency to modernize the input supply chain.

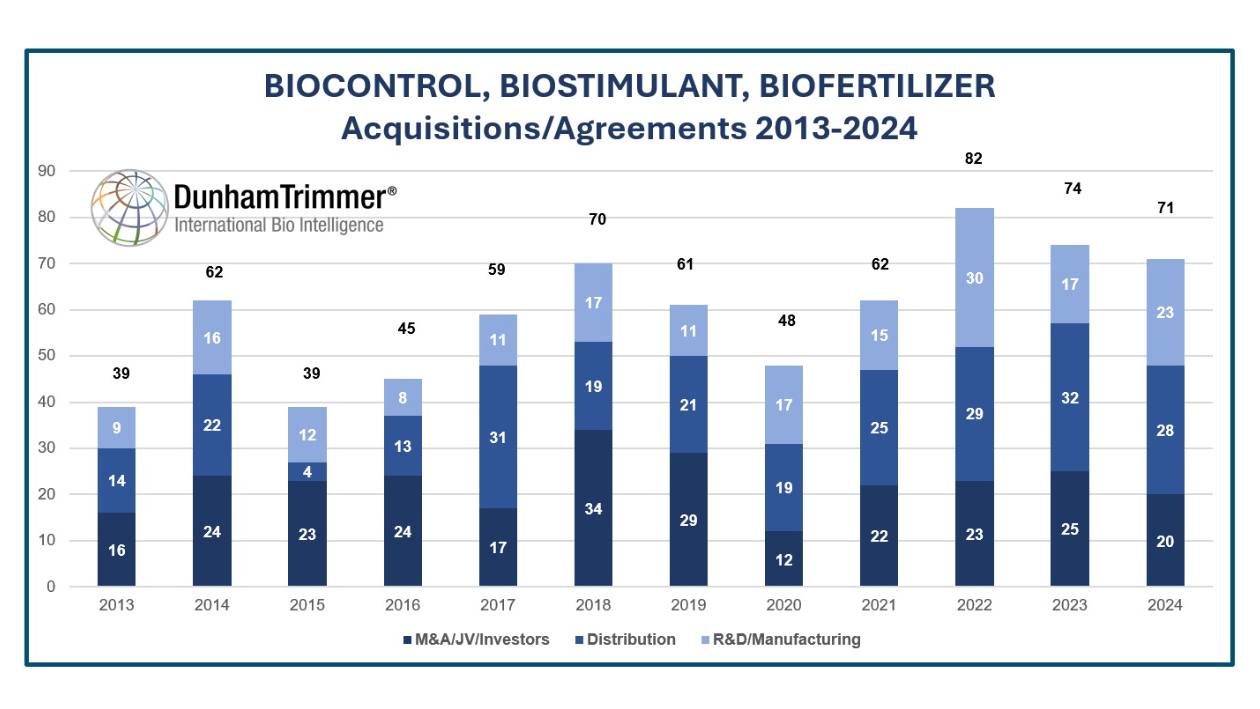

“I believe investors today are not chasing size or headlines; they are looking for companies with strong governance, robust financials, and tangible competitive advantage,” says Ignacio Moyano, Vice President of Market Development for Latin America at DunhamTrimmer, in an exclusive interview. “Biotechnology and bioinputs have become core targets precisely because they combine innovation with scalability potential. Solutions such as biocontrol, biostimulants, and precision technologies align directly with sustainability agendas investors cannot ignore.”

Transparency as a Value Accelerator

From the NDA signing to due diligence and deal closure, the steps of M&A are familiar. But the speed is defined by preparation, Moyano explains. “When numbers are clear, governance is structured, and processes are well documented, deals can close in under a year. Conversely, weak records and dispersed data slow everything down.” Transparency, he says, is not just a matter of compliance but also a real driver of valuation.

In recent years, the sector has displayed two parallel forces: consolidation among large distributors, often multinational players seeking capillarity, and increasing specialization through deals with startups focused on biofertilizers, biocontrol, and digital agriculture. Notable cases, such as Corteva’s move with Puna Bio, illustrate this “innovation premium” shaping the market.

For large corporations, M&A serves as a shortcut to technology and market access without the risks and delays of in-house development. For small and mid-sized innovators, it offers the bridge from laboratory breakthroughs to field adoption. “M&A moves innovation from the lab to the farm, providing scale in logistics, compliance, and distribution that a startup alone could hardly sustain,” adds Moyano.

Looking forward, he sees more discipline defining transactions: “Investors want resilient, proven companies, not fireworks. Partnerships and joint ventures will also gain strength, allowing risk sharing and accelerating product adoption.”

Global Dynamics: The DunhamTrimmer Perspective

Rick Melnick, COO & Managing Partner at DunhamTrimmer, underscores that the current transformation of the Brazilian bioinputs sector is part of a wider global repositioning. While Europe and North America show high levels of maturity, with growth rates moderating, Latin America remains one of the fastest-expanding markets. Brazil, in particular, is viewed as both fascinating and challenging: a vast cultivated area, unique soil and pest complexities, and government-driven adoption policies create an environment as promising as it is intricate.

“Brazil’s market is already huge yet still in its infancy,” Melnick explains. “Many players there are still finding their way, and success is virtually impossible without local expertise and representation. That’s why Ignacio Moyano’s arrival at DunhamTrimmer was such a perfect fit. He brings deep local knowledge, understanding of the regulatory environment, and the networks needed to help companies bridge the gap between strategy and execution.”

Melnick emphasizes two pillars where DunhamTrimmer has positioned itself uniquely: go-to-market strategy and due diligence. “We are often the first call investment groups make when they need to assess an M&A opportunity in the biologicals space. But equally important, we help clients refine their strategy for entering markets, especially in Latin America, where timing and positioning make all the difference.”

Beyond Brazil, the company sees steady opportunity in Europe, where regulatory frameworks and sustainability imperatives continue to drive adoption, and in North America, where consolidation accelerates innovation cycles. Still, Latin America – with Brazil and emerging players such as Peru – anchors the firm’s growth outlook.

Spotlight on ABIM 2025

The next major stage for DunhamTrimmer’s global agenda is ABIM 2025 (Annual Biocontrol Industry Meeting), the world’s premier forum for the biological crop protection industry, held annually in Basel, Switzerland. For the company, ABIM is not just a networking hub—it is where strategy, reputation, and partnerships converge.

“This is the event where we connect with our European and international clients face-to-face,” notes Melnick, who has attended every ABIM since 2010. “It is as much about business development as it is about reconnecting with industry colleagues we may only see once a year. ABIM has grown in step with the industry itself—and remains the single most important stage for biocontrol globally.”

In 2025, DunhamTrimmer will be present at Hall 4.0, Booth 038, with packed schedules of meetings with existing clients and prospective partners. The firm expects to generate as many new leads there as at any other event, alongside the Biostimulants World Congress.

By showcasing its leadership in due diligence and highlighting its strengthened Latin American presence through Moyano, DunhamTrimmer aims to demonstrate how it connects global innovation with local expertise. “Companies entering this industry often hear about us early in their journeys,” Melnick notes. “At ABIM, they come to us seeking guidance on strategy, product development, and acquisitions. The conversations we begin there very often define the projects that shape biological crop protection over the following years.”

As consolidation quickens and sustainability becomes non-negotiable, the convergence of capital discipline, scientific innovation, and strategic partnerships is remaking Brazil’s bioinputs industry into a model of resilience and growth. The role of M&A is no longer just financial—it is transformative, enabling breakthroughs to reach farmers faster and at meaningful scale.

With deep market intelligence and global reach, DunhamTrimmer positions itself as both a catalyst and a trusted advisor at the heart of this process. And at ABIM 2025, the company will once again have the world stage to reinforce its message: that in the future of bioagriculture, knowledge, trust, and strategic alignment will prove as valuable as the technologies themselves.