Report: Farmers Face Another Season of Tight Margins As Operating Costs Rise and Commodity Prices Fall

According to a recent RaboResearch report, rising operating costs and falling agricultural commodity prices are once again squeezing field crop farm margins, with financial pressures likely to persist across major crop regions through mid-2027.

Global crop margins to remain under pressure

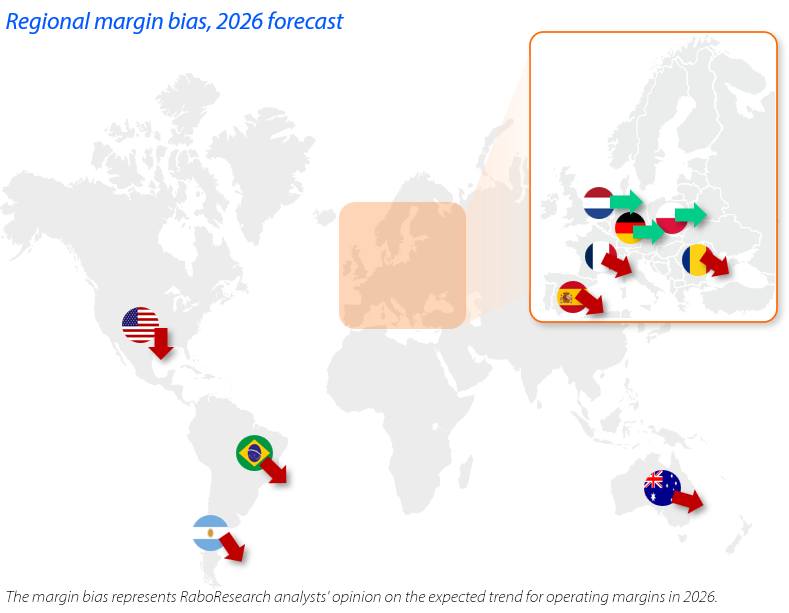

Recent RaboResearch analysis points to another challenging year for field crop farmers across major agricultural regions. Producers continue to face declining commodity prices and persistent input cost pressures. The landscape in 2025 is even more complex than last year, with geopolitical tensions and new tariffs adding to uncertainty. While some relief is expected in crop protection costs, overall operating expenses are trending upward, posing substantial challenges for producers of soybeans, corn, and other crops.

Despite tighter margins, production trends suggest that farmers remain committed to investing in their fields to sustain or expand output. Projections indicate another record crop for corn and soybeans, with top-producing regions driving growth. “These record production levels are exerting downward pressure on commodity prices, despite declining stock levels” explains Bruno Fonseca, Senior Analyst – Farm Inputs for RaboResearch.

Higher operating costs are leading to a more expensive 2026 crop

Operating costs for soybean and corn farms show an upward trend for the 2026 season, primarily driven by rising fertilizer expenses. Due to a tighter supply-demand balance, fertilizer prices continue to climb, prompting farmers to seek alternatives. However, increased demand for substitutes is also pushing their prices upward. High fertilizer prices are negatively impacting affordability in Brazil, the US, Australia, and key production countries in Europe. In fact, the affordability index for phosphate has reached its lowest level since 2010 and currently sits at -0.68, according to RaboResearch estimates. “If affordability does not improve, we expect a significant reduction in demand for the next planting cycle,” notes Fonseca.

Although prices for major active ingredients sourced from China are showing signs of decline compared to the previous year, per-hectare costs, particularly for specific product categories, are increasing in Brazil and the US due to reduced supplies. “Overall, the 2026 season is projected to be more expensive across all regions covered in the analysis, presenting considerable headwinds resulting from escalating input costs.”

The world is awash in agricultural commodities

Corn, wheat, and oilseed farmers are all producing robust output in 2025. The big three corn producers in the world – Brazil, China, and the US – are all projected to deliver record-high crops, while global oilseed and wheat crops are expected to set records for a sixth consecutive year. Altogether, the world is looking at record production and supplies, creating the bear market commodities are currently in.

This is occurring at a time when bullish fundamentals are in place as well, particularly for corn and wheat. Global corn stocks have been in a downtrend since reaching their peak in 2016/17. Likewise, global wheat stocks have been trending down since 2019/20. In addition, the corn and wheat stocks-to-use ratios are at their lowest levels since 2012/13 and 2014/15, respectively. Plus, domestic consumption of corn, wheat, and soybeans is at record-high levels. In the long term, a strong foundation of demand is in place to support prices. “However, record output in major production areas like Brazil and the US is overwhelming the market with supply, which will keep prices depressed in the short to medium term. And with stubborn and near-historic input prices, profitability in the grain and oilseed sector will remain challenging,” warns Fonseca.