It’s India’s Time: Reforms to Shake Up the Sector

Broad and ambitious, the “Make in India” campaign of Prime Minister Narendra Modi’s government is poised to bring potentially huge changes in the dynamics of the agrichemical industry. It won’t happen overnight, but the gears are in motion.

Eyeing stronger global competitiveness of the Indian manufacturing sector, the new National Manufacturing Policy is the most comprehensive and significant policy initiative of its kind undertaken by the Indian government. Far-reaching in scope, the reforms span regulation, infrastructure, skill development, technology, availability of finance, exit mechanism and other pertinent factors related to growth of the sector. The vision is to boost manufacturing sector growth to 12% to 14% per year over the medium term, and create 100 million additional manufacturing jobs by 2022.

“People are going to have to go through the process and think very carefully about how this affects them, directly and indirectly — both as customers, formulators, manufacturers. (Make in India) has some potentially interesting and opportune downstream effects.” — Stephen Pearce, Arysta LifeScience

What it means for agrichemical companies is that they will no longer be issued new import registrations for products that have a manufacturing registration in India.

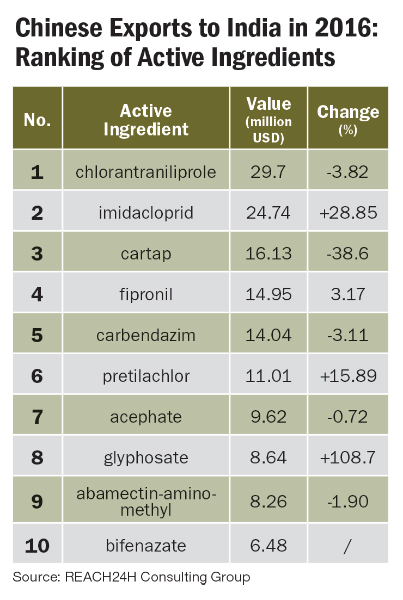

If it is implemented as stated, Make in India effectively spells the end of the rising tide of Chinese exports to the country, which make up 55% of the $925 million India imports worth of technical, intermediates, and finished products each year, according to a Rabobank report. What’s more, the proportion of finished products had been steadily rising and growth was expected to continue given the cost advantages of Chinese producers.

“People are going to have to go through the process and think very carefully about how this affects them, directly and indirectly — both as customers, formulators, manufacturers. (Make in India) has some potentially interesting and opportune downstream effects. It also poses issues around ensuring that supply chains are de-risked and that the appropriate diligence goes into the downside risk assessment,” Stephen Pearce, Global Head of Procurement and Strategic Sourcing for Arysta LifeScience, says. “The whole scenario where India has typically been the place to shop for insecticides and some fungicides, and China being the primary place for herbicides, might also change,” Pearce says, adding: “As companies look to de-risk their supply chains, other regions may also start to look attractive.”

The growth rate for Chinese exports to India will likely plummet by 80% as a result of the new regulation, according to the Rabobank report by Vaishali Chopra. This implies exports will increase at a rate of around 1.2% annually to 2022, while a large proportion of imports will shift from formulated products to raw materials.

“It is a very important move which could enhance manufacturing in India to a great extent,” Chopra tells AgriBusiness Global. Capacity utilization of India’s agrichemical manufacturers could rise from the current 55% to almost 100%, supported by this initiative. “We need to wait and watch on what will be final dictate of the Central Insecticides Board and Registration Committee (CIBRC) on this,” Chopra says.

In short, the changes mean there will be a lot for companies to think about, in India and beyond.

Pearce sums it up this way: “There’ll certainly be winners and sadly some losers, but one thing is for sure: Now is the time for many companies to take a good hard look at their supply and value chain footprint and use this as an opportunity to both fine-tune and reassess the areas of assurance of quality supply, supplier selection in terms of geographical footprint, and regulatory strategy based on new, emerging manufacturing trends that may evolve.”

Priority Treatment

Manufacturers, on the whole, argue that any short-term drawbacks of “Make in India” are outweighed by the prospect of long-lasting positive effects on the country’s agchem industry.

Elizabeth Shrivastava, Managing Director, AIMCO Pesticides

“Indian generic pesticides manufacturing was stifled over the last last 10 years due to CIBRC’s policy of allowing the import of ready-made pesticide formulations without registering its technical. This allowed the importer to get unlimited monopoly protection and stop any ‘me-too’ registrations of Indian generic manufacturers,” Elizabeth Shrivastava, Managing Director of Mumbai-based AIMCO Pesticides, says.

After Pesticides Manufacturers and Formulators Association of India (PMFAI) went to Gujarat High Court against the unfavorable conditions for Indian generic manufacturers, and won the case in court — underpinned by the Make in India reforms — CIBRC crafted the new regulation.

In addition to the new rule, CIBRC is reviewing the registrations of the existing players by putting a condition for reviewing and renewing all current registrations every five years.

“The new policy will encourage Indian generic pesticide manufacturing and provide protection from undue dumping from imports. We firmly believe that by formulating this regulation, the government of India has signaled that products made in India will have priority treatment, and this will encourage foreigners to invest in Indian manufacturing facilities,” Shrivastava says.

In the longer term, Dr. Bipul Saha, Senior Vice President of R&D with Hyderabad-based manufacturer Nagarjuna Agrichem Limited, believes Indian manufacturing will also benefit from a lack of availability of Chinese raw materials and intermediates eliminated due to environmental crackdowns there. “Agrichemical companies from all over the world will approach Indian companies to meet their needs,” he says. “We have already seen this happening in India.”

Vaishali Chopra, Rabobank

But even if India’s producers have ample capacity, most of those interviewed said that they are not ready to immediately handle the demand for technical products previously imported heavily from China. “They may still need depend on imports to an extent, as the export component is increasing at double the rate of domestic growth. So, imports from China will continue but the growth rate will be slowed down because of this move,” Rabobank’s Chopra says.

Saha, as well as others we interviewed, expect the Indian government may listen to the demands of industry associations and relax regulations, at least for a short period.

“The cost is likely to go up in the short term,” Saha says, but prices should stabilize after the country’s capacities rise in the next two to four years.

Given how reliant India has been and continues to be on China for base chemistries, one source, who asked to remain anonymous, says he is certain the reforms may drive additional competitive dynamics based on a potential shift of basic power of seller versus buyer, “especially if certain downstream markets are not available to them to sell into.”

In addition, the source expects that Chinese will use the opportunity to leapfrog India by selling direct into other markets the Indians rely on for exports using China-originated material.

Companies relying on registration access from China into India “may also need to quickly re-think and restructure,” he says.

Are They Ready?

Somnath Nandi, Business Development Manager for International Trade with Saraswati Agrochemicals India Pvt. Ltd., based in Delhi, expects it to take at least five years for Indian technical manufacturers to satisfy domestic needs, if everything moves well.

While Indian technical manufacturers have adequate capacity for pyrethroid manufacturing, other products need import support, he says, adding: “I wonder that if I even accept that Indian manufacturers now have enough capacity for technical manufacturing, why Indian formulators are so dependent on imported technical, which the new policy doesn’t support. It should be either because Indian products are not cost-effective while synthesizing technical, or due to the fact that the quantity does not satisfy the requirement.”

Because Saraswati Agrochemicals just started its export business a few months prior to the rule implementation, it hasn’t felt an impact, Nandi explains. “But, as we are sharing our prices with some trading partners based on the rising technical prices in the Indian market, our customers are hardly accepting them,” he says.

Because Saraswati Agrochemicals just started its export business a few months prior to the rule implementation, it hasn’t felt an impact, Nandi explains. “But, as we are sharing our prices with some trading partners based on the rising technical prices in the Indian market, our customers are hardly accepting them,” he says.

While backward-integrated companies will benefit, the companies that will take the biggest hits due to the new policy are clearly the Indian trading firms that rely heavily on Chinese imports. “They will have to change their strategy and start procuring from India. Some multinational companies, including Chinese companies, may form joint ventures with Indian companies to manufacture products they need,” he adds.

Another aspect of the reforms is that companies possessing a manufacturing certificate for indigenous manufacturing of a given pesticide will not be permitted to import.

“The great loss will be to those companies that import technical heavily and manufacture, but have low capacity. Because they have to surrender their import certificate at the cost of their manufacturing certificate, other small importers who have only import licenses can continue to use the same,” Nandi explains.

A Vested Interest

In a very competitive market that is already awash with Chinese companies selling formulated products, India bringing its own actives and formulations into the space will no doubt heighten the competition between its own and Chinese suppliers, but how far and how long it will take for the changes rattle down the chain remains to be seen. Sources said India must sustain its investment long enough to show the world the prices can stay competitive, and even then, it will not be an easy task to seduce companies to start registrations with India as the source.

Pearce points out: “We all have a vested interest in serving our end user. Being able to work together on these scenarios, and make sure we’re going hand-in-hand on de-risking supply chains, capitalizing opportunities, and doing it with a degree of transparency and diligence is good for everybody. It reduces the possibility of too much disruption. It means there will be fewer losers (and winners), but it takes out the flux and uncertainty of everything.”