The Path Ahead for M&A

The Questions

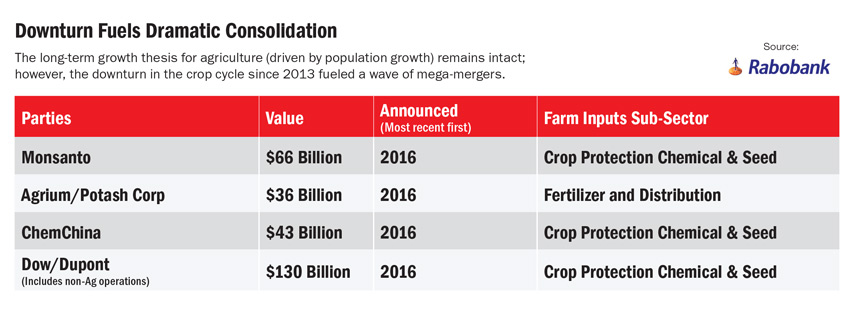

Bayer AG’s proposed $66 billion takeover of Monsanto would create, by far, the industry giant capturing more than a quarter of the world’s seed and agchem market.

“The reason for the mergers is not driven by any one company’s need to carry out their internal strategy as much as it is about shareholders demanding continued growth and improved earnings per share.” –Garrett Stoerger, Verdant Partners

Based on size alone, “it’s hard for people to be dismissive of it,” says Garrett Stoerger, Partner at M&A advisory and consulting firm Verdant Partners. If it does go through, and it appears chances are good as overlap of the two businesses is limited to a few select crops, there are other questions — such as how to unify two disparate company cultures.

Dr. Werner Antweiler, Associate Professor at the University of British Columbia’s Sauder School of Business, recalled one very famous mega-merger of American and German companies from back in 1998, and the culture-clashing chaos that ensued. “Will this deal realize its full potential, or will it go the way of Daimler-Chrysler and flounder?”

“It’s far from clear to me the two cultures will be able to merge into a new approach that satisfies both sides. Without strong leadership from Bayer, they are at risk of repeating the same mistakes,” Antweiler tells AgriBusiness Global.

“Moreover, the Monsanto brand is more liability than asset, while the rich Monsanto R&D pipeline and patents, and Monsanto’s expertise on the agritech-IT (‘smart farming’) side are the most promising gains for Bayer.”

Commenting on the broader agchem backdrop of late, “There is a lot of skepticism; so many things are going on at the same time,” Rob Dongoski, Partner, Global Agribusiness Leader with Ernst & Young, says.

He’s right: The year felt like one long merger announcement, one of the last (at least for 2016, but we could be wrong) being the Agrium-Potash tie-up.

And then the U.S. election further confounded things.

According to analysts we spoke with, it’s anyone’s guess whether a Trump presidency will prove friendlier to the mergers or move in the direction of slowing down foreign takeovers. While there is an element of uncertainty, it’s clear that the new administration’s focus will be on corporate tax and trade policy.

“We are waiting with baited breath to see how aggressive (Trump’s) policy initiatives will be as respects global trade and preservation of U.S. jobs,” says Kenneth S. Zuckerberg, Executive Director, Senior Research Analyst with Rabobank’s Food & Agribusiness Research and Advisory group.

Desirable Assets

It’s no secret that appeasing antitrust watchdogs will entail asset divestitures. All told, $12.8 billion worth of assets at minimum could hit the market because of consolidation, according to estimates by analyst Christian Faitz with Kepler Cheuvreux.

As Bayer CEO Liam Condon told the German daily Die Tageszeitung in late November, “In North America the combined market share in cotton is indeed quite high. We anticipate that parts of this business may have to be divested.” U.S. government data shows Monsanto and Bayer had about 70% of U.S. cottonseed sales last year.

He added, “Another strong market position in North America will emerge in canola.”

The genetics developed by Bayer and Monsanto command about 70% of the market for that crop in Canada, Stoerger says. Vegetable seeds, due to the high number of species and specialized markets, is a less obvious area that could need attention, he adds, as market share is substantial between Monsanto’s Seminis, the world’s largest vegetable seed company, and Bayer’s Nunhems.

The big question focuses on the agrichemicals piece of the pie. Will Bayer keep the Liberty/LibertyLink glufosinate business, or will Monsanto retain its original claim to fame, Roundup Ready?

Dongoski says it’s a toss-up on which scenario plays out, but the sheer expansiveness of the Roundup business — worth about $4.8 billion in annual sales — may give it the edge on staying put.

The omnipresent weedkiller clearly has its issues, including the risk it won’t be reauthorized in Europe when the AI’s 18-month extension there runs out at the end of 2017. On the flip side, Monsanto has finally secured EPA approval for its “replacement” Xtend dicamba-based technology for soy and cotton.

Yet, one could argue convincingly the upper hand lies with LibertyLink, a choice alternative for growers desperate for ways to control glyphosate-resistant weeds.

With more than 60 million acres of corn, cotton, soybeans, and canola now having the LibertyLink trait, Bayer expects acreage to double across multiple crops in the next few years. It also previously unveiled a $500 million investment to double worldwide production of Liberty, beginning in mid-2017.

The Other Deals

For DuPont, it has revealed it will sell a business making herbicides pending its merger with Dow AgroSciences, according to a Bloomberg report. It also said DuPont is considering disposing of insecticide and seeds units that might pose an obstacle to the deal.

“We can expect that DuPont will divest one of its older herbicide portfolios, rather than letting go of one of its newer herbicide brands like its newly announced FeXapan brand,” Laura Lee of research firm Lux Research wrote in a November report. Lee named Breakfree and Cinch herbicides as brands it may potentially divest, some formulations of which contain active ingredients atrazine, acetochlor, and S-metolachlor.

“The changing regulatory attitudes surrounding atrazine may push DuPont toward divesting this specific technology, especially while the company is under pressure to trim its herbicide business,” Lee noted.

However, less restrictive geographies are still prime regions to accept the technology, she said, noting that the Canadian Pest Management Regulatory Agency proposed for the continuation of atrazine and trifluralin registrations last December. In addition, Australia recently approved the registration of an atrazine-based herbicide.

Of the three deals, Syngenta-ChemChina should be the easiest to get past regulators, as the combination with the Chinese company’s Adama would still only result in 19% market share, according to a Bloomberg report citing a research note by Citigroup analyst Andrew Benson. Some disposals of fungicides and herbicides may be required, Benson said.

The most logical buyers of assets up for grabs resulting from the trio of mega-mergers, say analysts, will be other agchem players, but expect private equity firms, such as Paine & Partners and PPG, as well as second-tier seed companies and big U.S. ag retailers feeling the pinch of input suppliers to join the mix of (highly) interested parties.

“Do large fertilizer players combine with the new agchem giants to bring everything to farm? That’s a potential.” –Rob Dongoski, Ernst & Young

“Farm sizes are getting bigger, and there is a more direct relationship with suppliers. (Ag retailers) are feeling threatened by that,” Dongoski says.

BASF’s Markus Heldt commented in a press briefing that the company will “actively seek to exploit the opportunities arising from the ongoing mergers in order to strengthen our presence and expand our offer.” Syngenta CFO John Ramsay also told dealReporter in July that it is ready to buy assets divested in the Bayer-Monsanto merger, including cotton and vegetable seeds.

Unintended Effects

The knee-jerk reaction to consolidation is that product choice and innovation will suffer. There is a natural fear that a high concentration of market share will be a negative for farmers, Zuckerberg says.

“If you step back and look at what usually goes on (with M&A activity), new competitors, spin-offs, and innovators often come to the table.” He points out that entire new classes of inputs emerging on the market — microbials, biostimulants, and seed treatments — originated from smaller, niche companies, which were later picked up, developed, and brought to market by the multinationals.

While Zuckerberg believes marginal products will go away, he argues that combining R&D dollars “will probably result in positive product innovation after the mergers become integrated. From an innovation standpoint, it is possible there could actually be more product choices, rather than fewer.” It’s a counterintuitive view shared by many experts.

Aside from the chief goals of growing market share and spurring innovation, the mergers also have the potential to reshape relationships between end users and suppliers, as new technologies and digitization shake up traditional business models to shift toward more shared risk.

“How the combinations will manifest in on-farm value has the potential to go way beyond chemistry and seed. It has the potential to shift risk and create visibility across the entire value chain,” Dongoski says. “Changing that relationship could enable emerging markets and smallholders to leapfrog into areas they haven’t gotten into previously.”

In the shorter term, smaller-scale companies will also be poised to take advantage of their larger competitors who are distracted by the demanding integration process.

“The reason for the mergers,” Stoerger explains, “is not driven by any one company’s need to carry out their internal strategy as much as it is about shareholders demanding continued growth and improved earnings per share. An unintended consequence is that this is going to consume tremendous resources and time by all companies involved.”

All of this, and it could be that the M&A wave is just beginning.

“Do I think this is the end of transactions? Not even close,” Stoerger adds. “This will set off a secondary wave of carve-outs, spin-offs, and divestitures of assets deemed anti-competitive or no longer strategic to the newly combined businesses.”

According to Ernst & Young’s annual survey of U.S. executives, the Capital Confidence Barometer, three-quarters of ag respondents reported they will be actively pursuing acquisitions in the next 12 months. “I think it’s true to what is going to happen,” Dongoski says. “No doubt that based on the survey result and our conversations in the market, companies in ag are looking for growth.”

He also points out that growers’ largest expenditure has not been brought into the agchem circle yet: fertilizer. “Do large fertilizer players combine with the new agchem giants to bring everything to farm? That’s a potential.”