Agrochemicals in the Crossfire: Trump, China, and the Future of Trade

Since “Liberation Day” on April 2, 2025, an enormous amount of activity has impacted agrochemical trade in the U.S. Uncertainty among importers has caused significant concerns.

Fentanyl tariffs on China remain at a flat rate of 20% and are not eligible for duty drawback on exports. There are also Fentanyl tariffs on Canada and Mexico of 25% for imports that do not meet the USMCA rules of origin.

Reciprocal tariffs on China are currently set at a rate of 10%, with many exceptions. While the exceptions list has been stable, the rate has been as high as 125%.

The Office of the United States Trade Representative (USTR) has been working with numerous countries to try to negotiate deals. The lever that is being used is the idea of tariff reciprocity, which is designed in theory to offset the tariffs and non-tariff barriers to U.S. exports in each country.

A list of these rates is available here. The current rate is 10% for all countries, except for China, Canada, and Mexico (for products that meet USMCA rules of origin). In theory, while there may be some exceptions for countries that are making a good faith effort, any country that does not make a deal deemed to be satisfactory to President Trump by July 8, will again be subject to these levies.

Court Actions

Three different courts have ruled that the President’s actions are not permitted by the statute he referenced. It is likely that the only one of these actions that matter is the Court of International Trade (CIT). Located in New York City, this court was designated by Congress to handle disputes involving international trade. They ruled against this entire program, which would include the fentanyl tariffs (Canada, Mexico, China) as well as the reciprocity tariffs.

The Administration promptly appealed and as of the date of this article, the CIT decision has been held open until the Appeals Court rules. This will likely not happen until arguments are heard, perhaps as soon as July 31.

The other two cases, one in Washington D.C., and the other in California, will likely eventually be folded into this case.

Whomever wins in the Appellate Division will surely appeal to the U.S. Supreme Court, and it is highly likely that a stay will be granted until they rule. It will therefore be close to the end of 2025 before there is a final decree on the legality of President Trump’s actions. If this schedule holds, the Administration will have plenty of running room to accomplish their objectives.

If the Supreme Court rules against the Administration, while any of the deals that have been made will still be in place, it will be fascinating to see how these actions are unwound for any countries that have not come to an agreement with the U.S.

There is also a class action suit demanding that all previously paid tariffs be refunded. This action will be moot if the court rules in favor of the administration.

If the court rules against the Administration, there are other ways to accomplish their objectives. However, they are much more limited in scope and require notice and comment periods.

One process would allow for 15% across the board tariffs for a limited time period – likely 150 days.

The President could also expand on the 301 process that he used in his first administration and is still in effect against China. Since China is already a target, they may be able to continue an aggressive approach to China in a similar manner. However, the other targeted countries would require a notice and comment period which would likely stretch out for at least six months. It would be unprecedented to take this action against multiple countries simultaneously.

There has been no indication that the 201 process, which needs to be related to Defense is being considered in these instances.

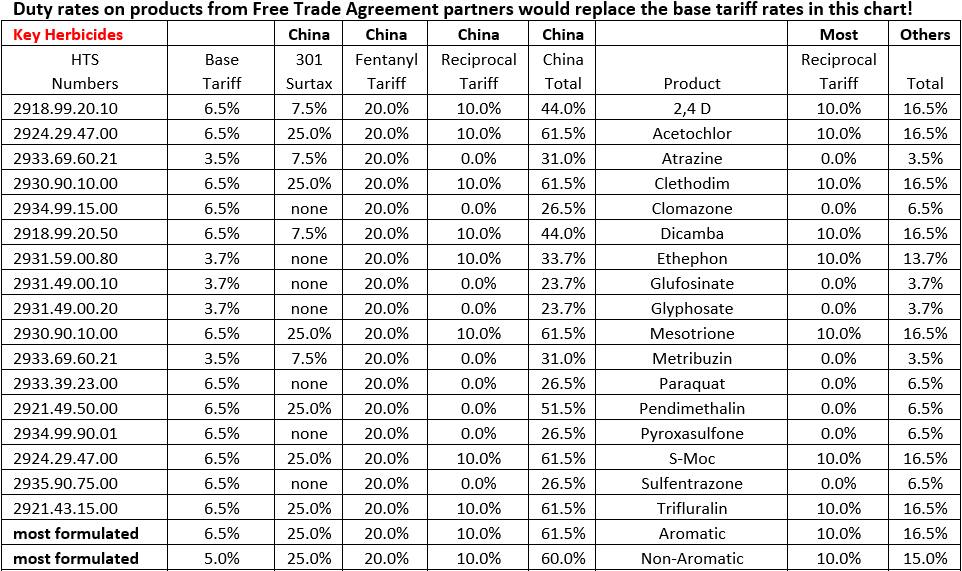

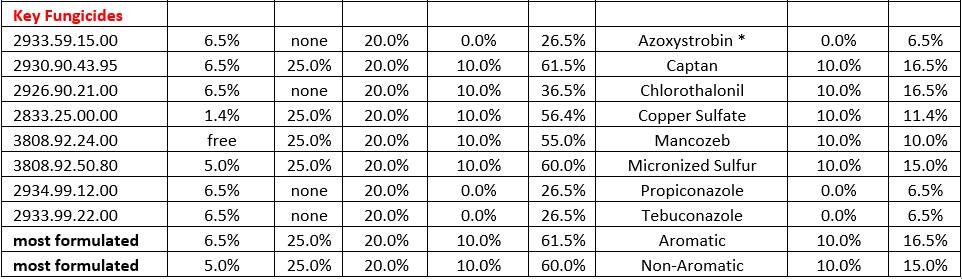

The following chart, as modified on May 12, 2025, represents the current state of affairs for a variety of important agrochemicals. It is current as of June 13, 2025.

Please review all of these details with your tariff experts before taking any actions based on this chart.

For those that wish to duplicate this chart for their own imports, it is important that all of the columns be used, since the rates in each column are subject to change, independently from the other columns. The beauty of this approach is that if after July 8 the reciprocal rates change for certain countries, columns can be added to reflect such changes.

We need to take this opportunity to remind all importers that the formulation of an agrochemical is not a substantial transformation under U.S. Customs definitions. Therefore, if you import a product into the U.S. from a third country that contains a Chinese active ingredient, for labeling purposes that material is likely properly classified as to where it was formulated, but for tariff purposes, that product is likely still Chinese and therefore subject to whatever the current tariff situation may be at the time of importation. When in doubt, you are urged to seek a binding customs ruling.

You are also reminded that the individual U.S. citizen that signs the import declaration is solely responsible for making sure that all of the declarations in that document are accurate and correct.

It also needs to be noted, except in instances where there are dumping margins, in countries where the U.S. has an existing free trade agreement, that agreement defines what is a substantial transformation.

Lastly, USTR and Customs are determined to aggressively prosecute evaders. In fact, it is highly likely that a chapter on this issue will be included in the commitments that countries will need to make to satisfy President Trump that specifically requires them to assist the U.S. in tracking down evaders.

Other Agreements

The only announced agreement as the date of this letter is with the UK. The UK has agreed to purchase significant quantities of ethanol and agricultural commodities, which should be a big positive for U.S. farmers and ranchers. It is important to note that the 10% reciprocal tariff remains in place, except where specifically referenced in the agreement. There is no impact on the chemical industry.

There is a lot of chatter suggesting that several other agreements are close at hand. The countries usually referenced that matter to industry include India, Israel, Japan, Taiwan, South Korea, Switzerland and Malaysia. It is very difficult to believe at this late date that more than one or two of these countries will successfully negotiate an agreement with the U.S. This is especially true in the case of India, Japan and Korea, all important sources for agrochemicals and intermediates.

If past is prologue, if materials are loaded on their last mode of transport by July 8, and clear U.S. customs within six weeks, it may be that they will not be subject to additional snap-back duty rates. It is hard to comment further until it is announced that such agreements have been finalized and we actually see the fine print.

For China, while it was agreed to reduce the reciprocity tariffs to 10% for 90 days, all other levies remain in place. This pause ends on August 12, 2025. U.S. and Chinese officials met in London on June 9, for two days of discussions. They mainly revolved around rare earth minerals. While the talks were said to be fruitful, nothing impacting chemicals was announced as a result of this gathering. The U.S./China joint statement of May 12 is available on the ABG website.

For the EU, it appears that the EU is still trying to determine how best to respond. It is difficult for the individual member states since trade policy is handled by the EU Commission from Brussels.

Interestingly, since the China pause expires on August 12, there could be a 5-week period when importing from China would be a bargain compared to much of the rest of the world.

U.S. Import Quantities

We maintain records that seek to quantify the gross volume of imports of biologically active agrochemicals into the U.S. Our chart would appear to confirm suspicions that imports of such products since the election of President Trump have surged. We find the following:

- December 2024 through April 2025: 288,000 MT

- December 2023 through April 2024: 205,000 MT

- December 2022 through April 2023: 223,000 MT

- December 2021 through April 2022: 256,000 MT

- December 2020 through April 2021: 225,000 MT

This is another clear indication that there is likely enough inventory to close out this season already in the U.S.

2,4-D Dumping Case

Corteva has now definitely prevailed in this action. The final dumping margins posted by Commerce are detailed below:

Totals (deposit rates):

- China

- CAC 153.08%

- Rainbow 296.21%

- All others 153.08%

- India

- Atul 25.91%

- Meghmani 9.5%

- All others 17.78%

It is also important to acknowledge that this order covers imports of 2,4 D derivatives that contain Chinese or India 2,4 D acid, esters, or salts, produced in any third country, including lands that have Free Trade Agreements with the U.S. that have rules of origin that would imply that the such materials were made in that country and otherwise enter the U.S. duty free.

By law, U.S. dumping orders sunset in five years. However, it is relatively easy to renew such orders so it is likely that it will remain in place for many years. There are provisions for annual reviews on the rates, which are not very burdensome to the U.S. proponent, but can be costly for objectors. However, in this case, since the stakes are so high, it is likely that the annual review cycle will be vigorously contested.

It will be interesting to see if other U.S. AI producers follow this approach.

The Department of Commerce published a Federal Register Notice on May 27 (available here), officially announcing the outcome and directing U.S. Customs to finally liquidate any open import entries. In addition, this notice invites companies that wish to be notified of upcoming annual reviews to register such interest. It must be noted that this notice only covers the dumping margins. The countervailing duty margins that were previously announced are in addition to these rates.

USMCA

It appears that USTR is preparing to open these discussions in October or November of this year.

It remains that case that USTR is still not fully staffed, and all existing staff is fully engaged in the reciprocity discussions. The deadline for the renewal of USMCA remains July 1, 2026.

There are indications that the Trump Administration may allow this agreement to lapse. At the very minimum they will be looking for modification, most especially to tighten up the rules of origin to be sure that China cannot use this agreement as a springboard into the U.S.