Agrochemicals: The Politics of Channel Management

Editor’s note: This article was originally published on LinkedIn.

Many years ago, there used to be a notorious gang of clothing store thieves in the U.S. Their modus operandi was simple, but elegant. They used a long stick to remove large numbers of clothes from racks at once, thereby robbing the stores very quickly.

And one day, as the urban legend about this crime goes, the gang was caught when one store, at the suggestion of a cop, arranged its clothes with alternate hangers facing opposite directions (see the photograph below). This messed up the racking and the gang’s modus operandi and slowed down the thieves by forcing them to remove one hanger at a time.

Photo Credits: Venkatesh Rao, Breaking Smart Newsletter: Politics of Productivity.

I love this story because it helps me illustrate a point I’ve come to appreciate in the last 10 months I’ve immersed in the agri-input industry:

Channel Management is Politics

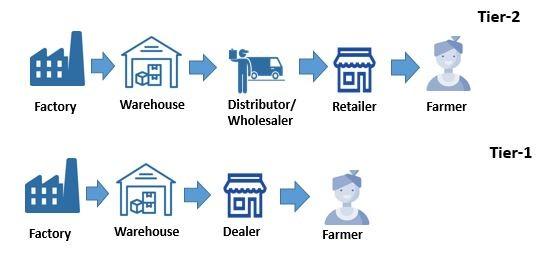

Channel, at the end of the day, is about stakeholders vying to control the distribution. The fundamental reason why you should study the channel and its structures of distribution (Tier-1, Tier-2) deeply is not to simply get “organized” or “efficient” upto the last mile for its own sake, but to gain political control over the channel. Otherwise, you risk someone else taking control.

Allow me to spell the obvious truth.

There is no such thing as a “disorganized” channel. Every state of “organization” of channel is a means of control for somebody. And If you don’t know who that is, it probably isn’t you. As we build platforms which manage the channel through machine intelligence, it becomes all the more critical to understand who benefits from a particular structure of distribution.

That’s why I want to talk today about the politics of Channel Management. Shall we dive in?

In my last post, when I asked the question, “What influences the buying behavior of Indian farmers, when it comes to agri-inputs? ” and analyzed the critical importance of the Trade Channel in agri-input marketing, I got an interesting comment from Aashish Argade, Assistant Professor at Institute of Rural Marketing, Anand.

Aashish wrote,

“I spent about four years in the agri-inputs industry, and felt that there was no innovation in most of the business practices and processes…I find that agri-inputs is largely a product and/or price driven industry — successful companies either have new products, or they are low-priced. No efforts made to understand either the consumer or channel member more closely.”

Even if you disagree with his comments about understanding channel members, it’s a fact that we still have a long way to go to deeply understand the needs of the channel and the customers.

Think about it.

Why is it that the fundamental problems in the channel distribution haven’t been solved yet? Taslima Khan, in her story in Economic Times about agri-startups,summed it up well

“They(Agri Startups) are trying to disrupt the traditional channels of distribution—local retail shops and co-operatives closely associated with the farmers for ages but which have inherent challenges such as non-timely availability of products, non-transparent pricing and fake products.”

“Inherent challenges?”. Absolutely.

If you have been working hard for a decade attempting to solve these problems for world’s leading agrochemical companies, like we at iConcept do, you would know that we are talking about three intractable, entangled, messy problems.

By the way, do you know the trendiest, or the sexiest way to solve, or at least, claim to the world that you are solving these problems in 2018?

With due apologies to the utopians of the technology world, I am talking about Blockchain. Many believe that all roads to solve Traceability and fake products in agri-inputs end at Blockchain, despite its significant barriers of performance, scalability, security and energy-sustainability.

If you ask us, with a decade of experience, we’ve figured so far that nothing is more perfectly suited to Indian market conditions (or even other emerging markets, as our experience in Phillipines, Kenya, Malaysia & Indonesia attests) than the humble bar-coding solution. Sure, it may not look as cool as Block chain. However, cost-wise. efficiency-wise. flexibility-wise. It is the best appropriate Indian solution.

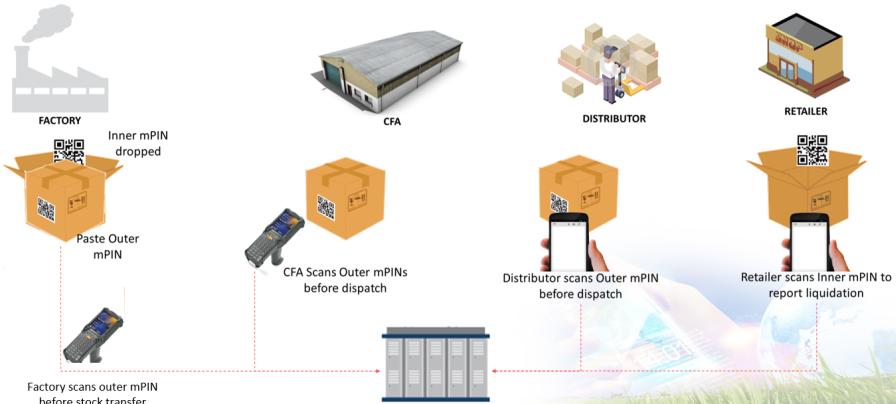

Here is the complete workflow of our m-PIN Bar-coding Solution approach, which has now become the industry norm in agrichemical industry.

This diagram is largely self-explanatory, and I don’t want to beat our own drums. But, I must tell you this.

In our experience so far, this dual approach of Inner mPIN and outer mPIN creates a positive feedback loop in addressing the challenges of Channel Inventory and Channel Loyalty together. It helps agrichemical and hybrid seeds companies address the mutually conflicting challenges of maximizing Product Availability and Working Capital Improvement.

Maximizing product availability is a no-brainer. But, what is working capital improvement? For most of you, this is everyday business. Allow me to spell the basics, for the uninitiated.

Working Capital Improvement:

When you are managing the channel, you strive to optimize the inventory data to determine the right safety stock levels. You set optimum inventory norms, lot sizes. You analyze slow-moving, obsolete inventory and balance stock across locations to ensure lower inventory carrying cost.

So far, so good.

Does this approach solve all the above three problems, once and forever?

You know the answer.

Perhaps, it helps to reflect on what Henry David Thoreau once said about technology.

“Technology is an improved means to an unimproved end”

What makes Channel management a political beast is exactly this realization.

These three problems are political by design. And to effectively work through these problems, you need a clarity of strategic vision, ability to experiment with structures of distribution (see the image below for an overview of structures) and implement them across your channel partners, and, last, but not the least, build effective business systems that can effectively control the channels in line with your strategic vision.

If you are reading through the lines, the moral of the opening hanger-thieves story is very clear.

The moment you try to enforce uniformity across your channel edges near the last mile, you are exposing yourself to be attacked by your competitors.In fact, the weaker your channel strength is, the more varied your distribution structure should be (based on geography constraints) to maximize availability and resist control in the volatile political equation between the agri-input manufacturers and channel partners.

How do you play the art of channel management? How do you run better channel engagement programs? Do you experiment with different structures of distribution depending on your scaling goals? How have you transitioned from one structure to another structure of distribution?

Do you agree with my points? Would you like to share your candid feedback? Read. Debate. Argue. In the comments section.

P.S.: This post was inspired by this amazing newsletter I read on the Politics of Productivity.