China Price Index: China’s Crop Protection Market Evolves Post-Covid Lockdowns

The world’s crop input industry supply chain is deeply interconnected with an enormous number of tentacles tracing their way back to China. So, when Chinese manufacturers coughed, the world’s crop input industry caught a cold. Add environmental and regulatory changes to the country’s manufacturing and the past few years have been particularly challenging for procurement experts.

-

-

1 of 9

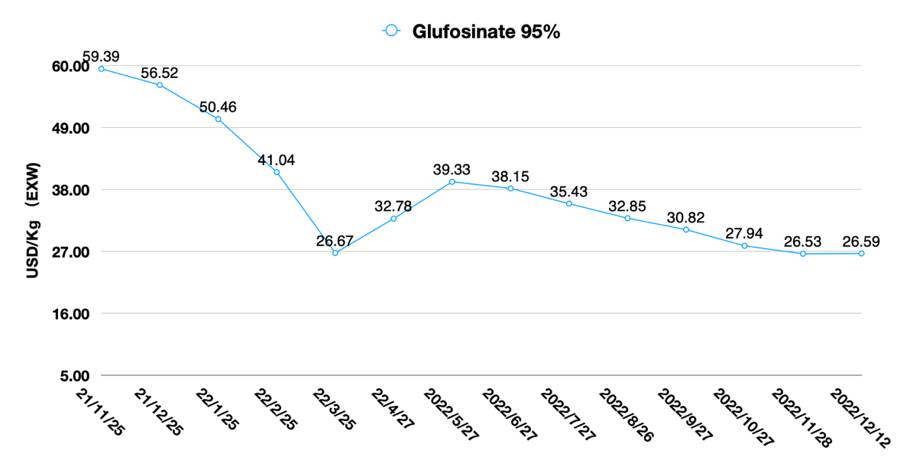

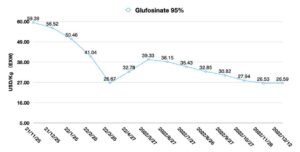

Herbicides

Glufosinate 95%

-

2 of 9

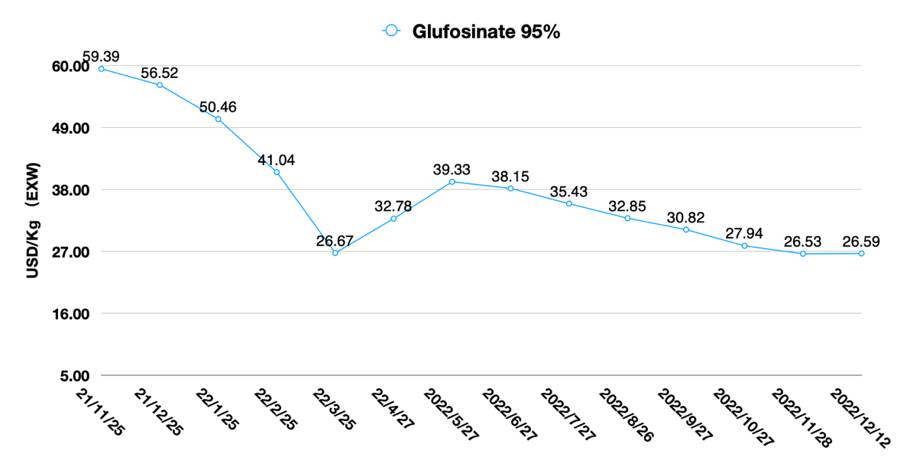

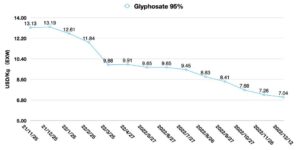

Herbicides

Glyphosate 95%

-

3 of 9

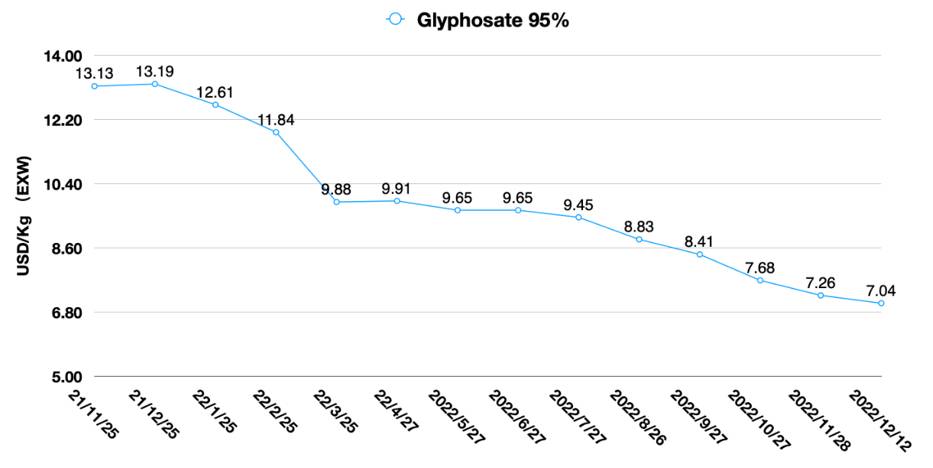

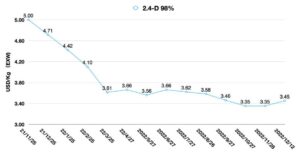

Herbicides

2,4-D 98%

-

4 of 9

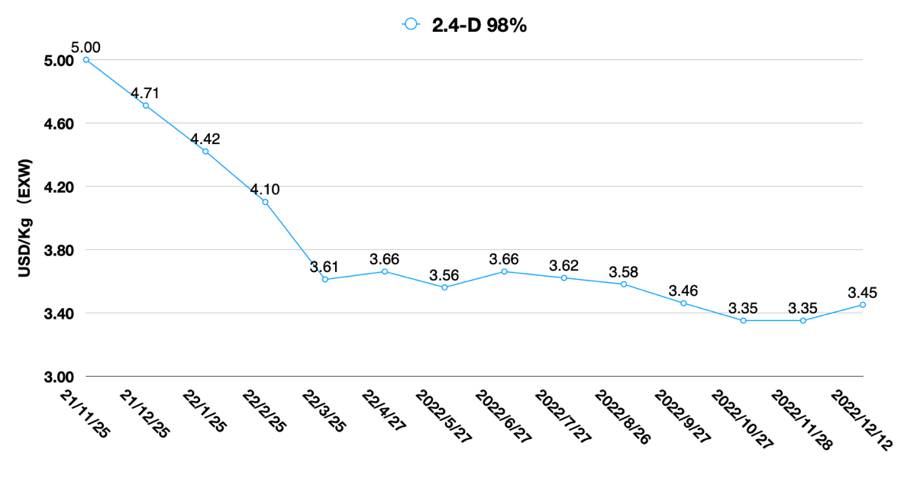

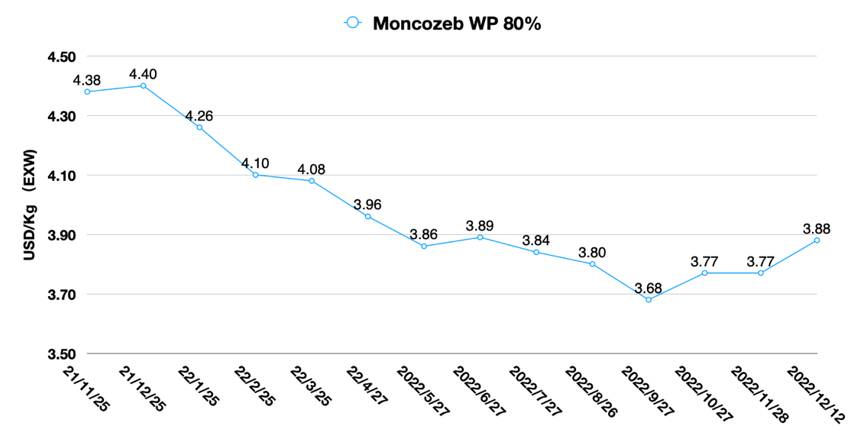

Fungicides

Moncozeb WP 80%

-

5 of 9

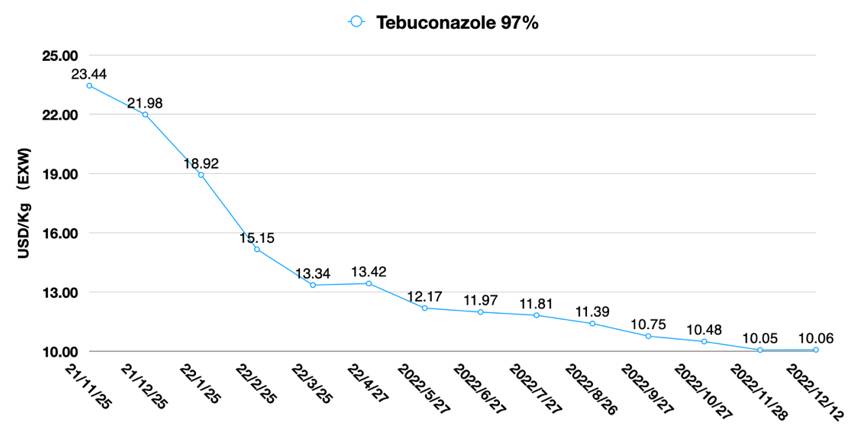

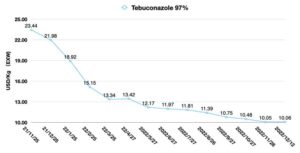

Fungicides

Tebuconazole 97%

-

6 of 9

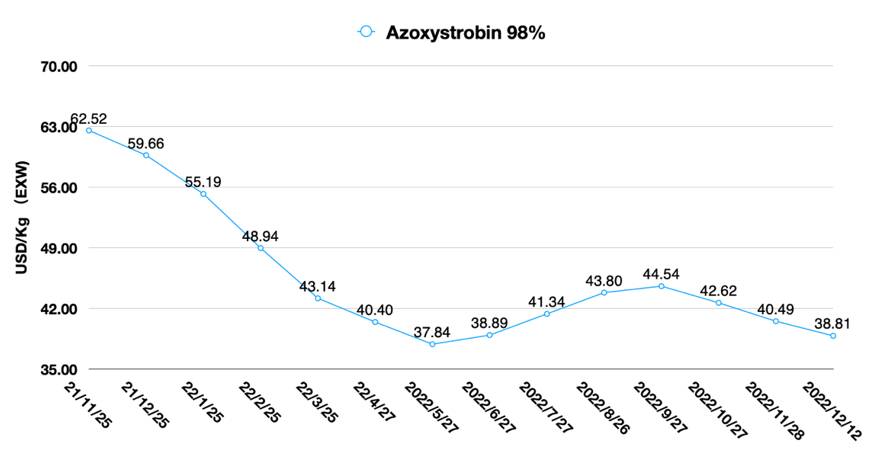

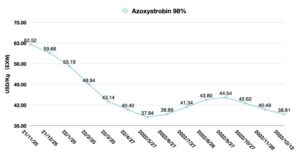

Fungicides

Azoxystrobin 98%

-

7 of 9

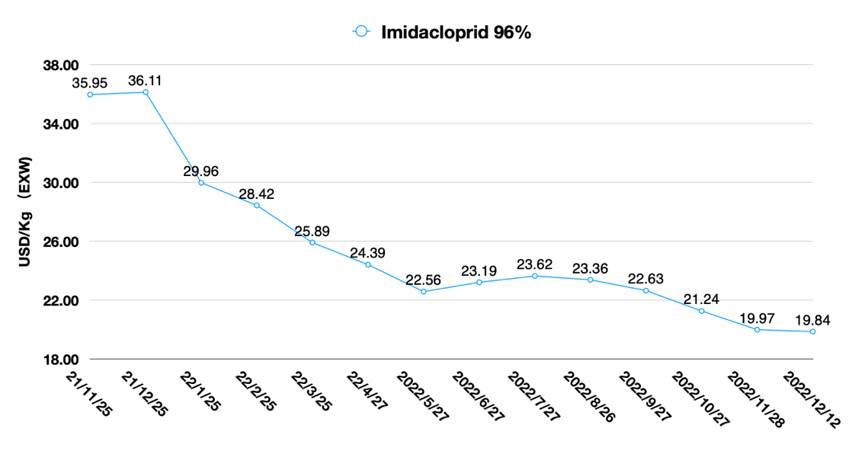

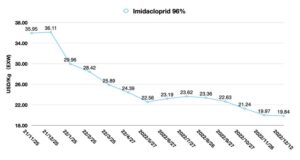

Insecticides

Imidacloprid 96%

-

8 of 9

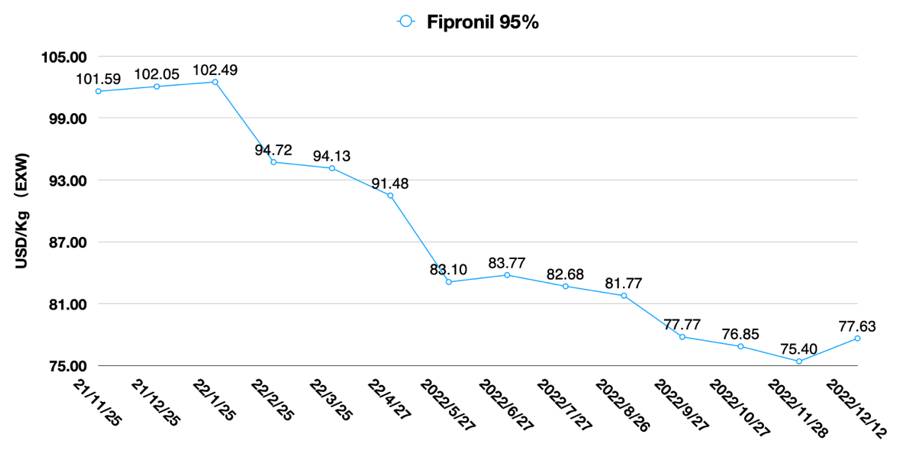

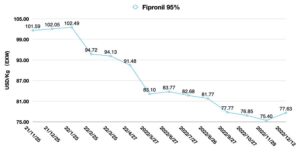

Insecticides

Fipronil 95%

-

9 of 9

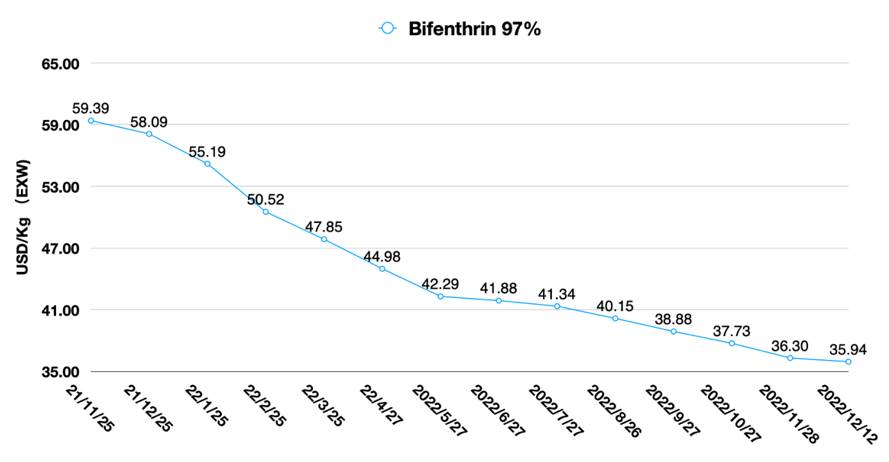

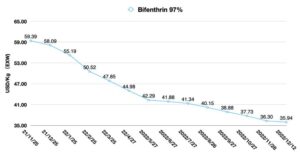

Insecticides

Bifenthrin 97%

View all

Herbicides

Herbicides

Herbicides

Fungicides

Fungicides

Fungicides

Insecticides

Insecticides

Insecticides

David Li, Marketing Director for SPM Biosciences, and the author of the China Price Index, offers insights on what the industry might be able to expect as the country reopens. Read full story.

Get The Newsletter Today!

Update

AgriBusiness Global connects the crop input value chain from raw material manufacturers down to distributors and trading partners around the world. Our content empowers smarter sourcing and business decisions by providing key insights to buyers and sellers of crop inputs including crop protection (both traditional agrochemical and biocontrol) and plant health products (including fertilizers, biostimulants, macro and micronutrients). See all author stories here.