China Price Index: Exploring Pricing and Geopolitical Concerns for China’s Agchem Market in 2023

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he provides answers to questions that were asked during a recent AgriBusiness Global Live webinar.

The world has battled through numerous challenges during the past couple of years. While some of those challenges have eased (or companies have learned to maneuver through them), a number of roadblocks still exist. To get insight on expectations for 2023, David Li presented the webinar “Beyond the Reality: New Dynamics of China’s Agrochemical Industry.” You can view the webinar here, under past sessions. Here are some of the audience’s questions and Li’s answers.

ABG: Can you provide a forecast for 2023 on the availability and prices for key AIs like tebuconazole, prothioconazole, and S-metolachlor?

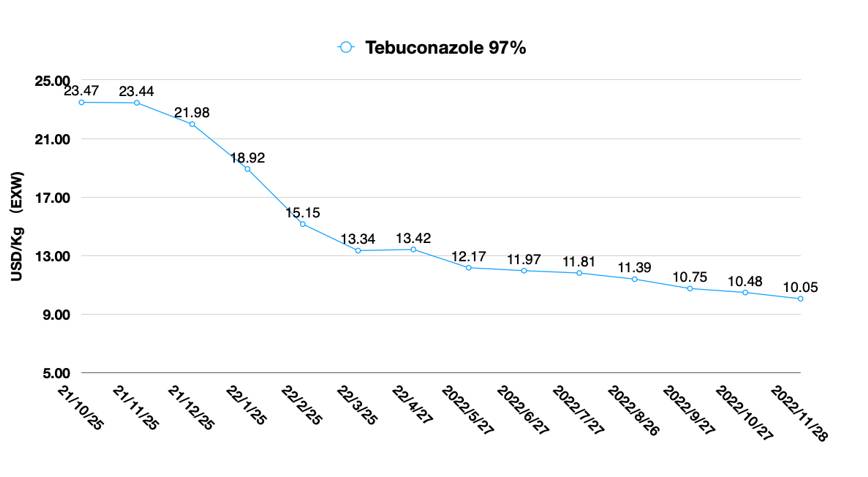

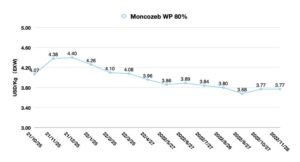

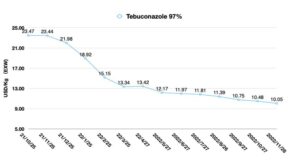

DL: The tebuconazole market is at a stable low-pricing level. Since the weak demand and ordinary supply, the price is expected to be flat without big fluctuation. In 2023, the demand will be in a consumption-oriented position. The inventory level of tebuconazole does not need to be improved.

The prothioconazole supply is smooth in China market. Over capacity affects the pricing of it. The price is heading down. In 2023, the prothioconazole will be in a downward trend. The early marketing margin is diminishing. There will still be room for price reduction based on the contract volume.

S-metolachlor supply is very tight due to the strong demand of Syngenta. We assume it is because the EU energy issue to push Syngenta to capture the supply of China as much as they can. And it is for meeting farmer demand in the 2023 season. The suppliers are focusing on Syngenta’s demand without additional cargo being released to the market. Even with the difficult supply situation, the price of S-metolachlor experiences less fluctuation. We see the suppliers consider the supply guarantee to Syngenta as the top priority, not the profit margin. In 2023, S-metolachlor will still be in a mature position in the global crop protection market. The capacity will not be easy to release soon. So, in 2023, the tight supply will not easily change. Stable higher prices will be possible.

ABG: What will be the geopolitics impact on exporting to the United States in the future?

DL: The current geopolitical situation in China is beyond what can be covered by brief analysis. In 2022, the exporting of Chinese agrochemicals to the U.S. was strong. If further tensions happen, the gap of China supply might not be bridged in the short term. A shortage of supply and incredibly high prices could return when sanctions or tariffs on Chinese commodities come.

In the long term, the era of China’s low-cost, bulk commodity manufacturing that has continued to supply developed country markets for the past few decades is going to be over. China is undergoing a radical economic transformation from a real estate and finance driven economy to a technologically innovative and sustainable one. China’s future exports to the U.S. and world market will be completely different from what they are today in terms of category, value-added products, and volume. In the crop protection sector, we can predict an increase in the share of nano-pesticide products, biologicals, innovative formulations, and novel AIs, etc.