China Price Index: Chinese Crop Protection Companies Need to Restart the Road to Re-Globalization

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his China Price Index. Below he also explores why Chinese innovation, combined with large-scale, high-end flexible manufacturing, could be more attractive for global collaboration.

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his China Price Index. Below he also explores why Chinese innovation, combined with large-scale, high-end flexible manufacturing, could be more attractive for global collaboration.

In the fall of 1806, while still in Berlin after Napoleon’s conquest of the city, he issued a sweeping trade war decree designed to cripple the economy of his most implacable foe — Great Britain. This blockade, now known as the “Continental System,” became one of many beginnings that led to Napoleon’s downfall.

Britain, as the first country in the world to enter the industrial revolution in the early 19th century, brought great impact to the global society at that time. The main manifestation of the industrial revolution in Britain was the replacement of handicrafts by large-scale machine and the replacement of manual workshops by machine factories. It brought about major changes in the social structure and production relations in Britain, and the productivity increased rapidly.

Although Britain suffered from a short-term economic downturn, the British economy was resilient enough to cope with Napoleon’s “Continental System” through the Royal Navy and the active expansion of emerging markets, such as South America and Asia. In the end, Napoleon fought against Russia because of increased internal disagreements among his European allies, and this was the last straw in Napoleon’s ultimate defeat.

The current trade war between China and the United States is very similar to the confrontation between Britain and France two centuries ago. The United States is the world’s most important consumer market, while China is the global manufacturing center. This pattern may be difficult to change in the short term. While the Trump administration reached an agreement with China in the short term, the long-term weaponization of tariffs is more likely to continue.

Pressure from the outside may also be a good thing for Chinese companies. During the four decades of China’s reform and opening, a large portion of the country’s entrepreneurs were well rewarded for simply making the most of their drive. Now, that dividend period of launching new products and securing purchases from overseas markets for a long time is drawing to a close. A series of measures by the Trump administration is prompting Chinese entrepreneurs to rethink sustainable development for the next two decades.

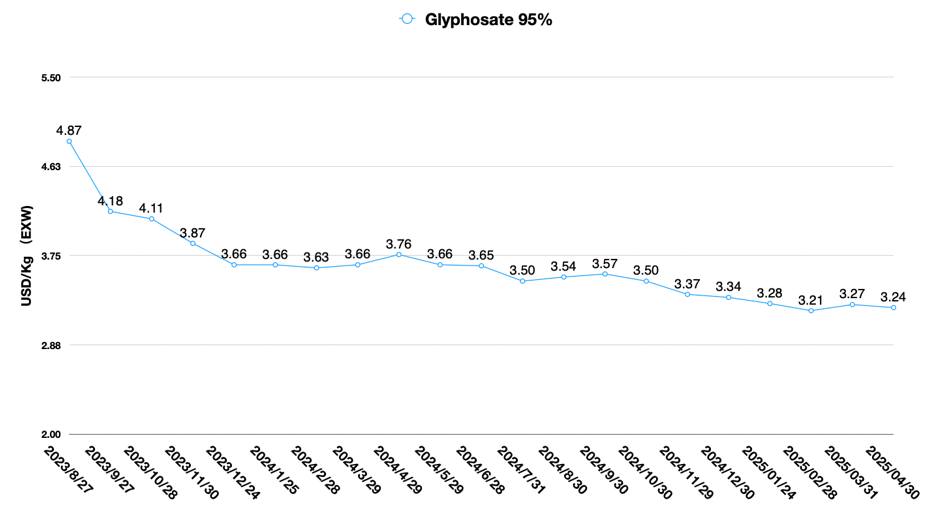

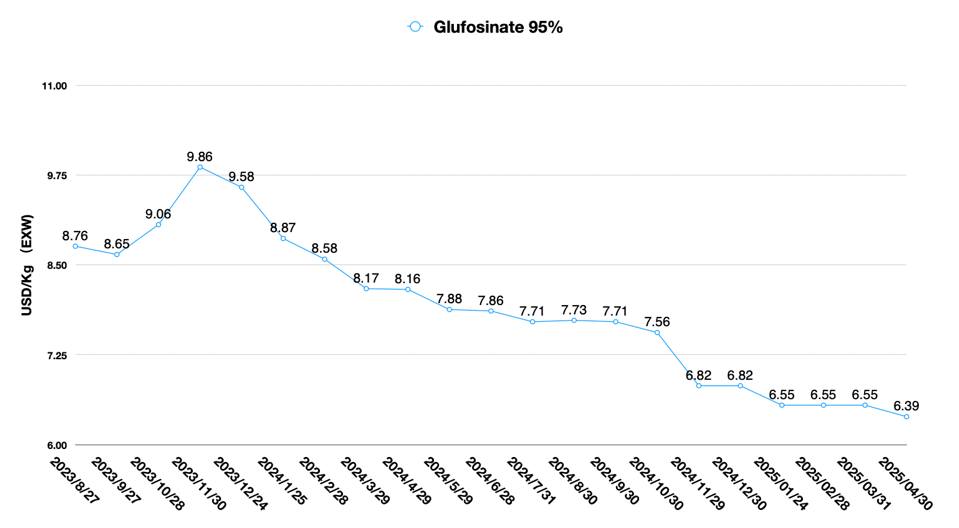

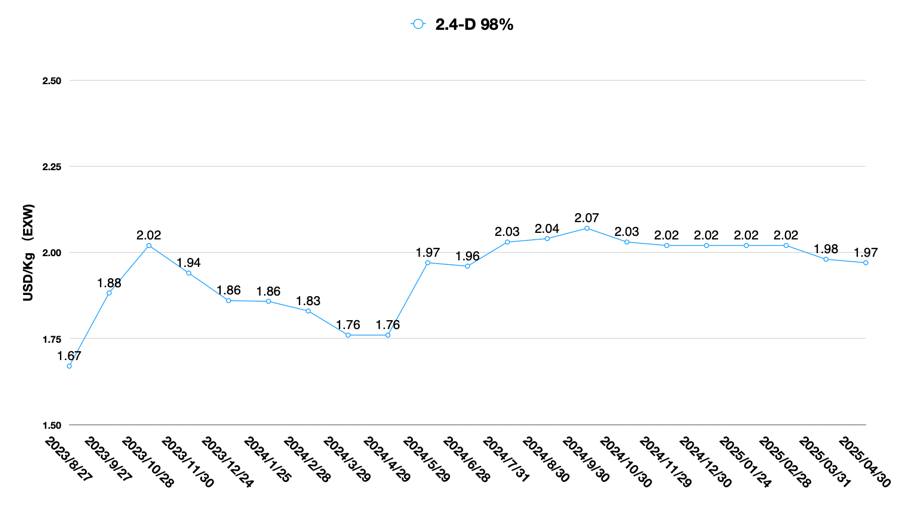

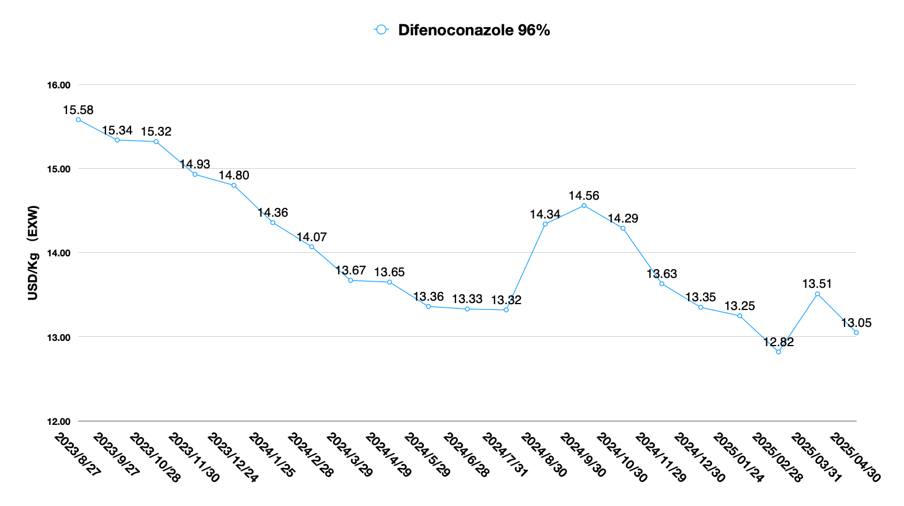

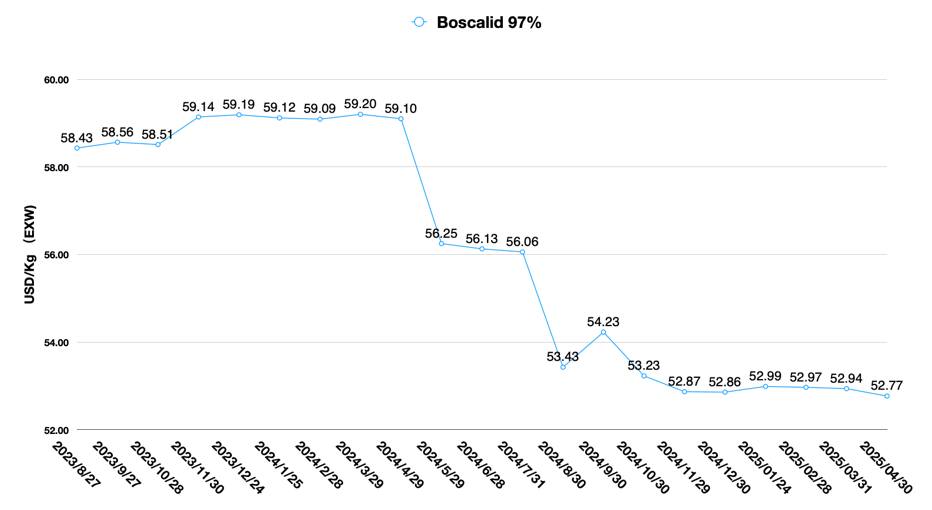

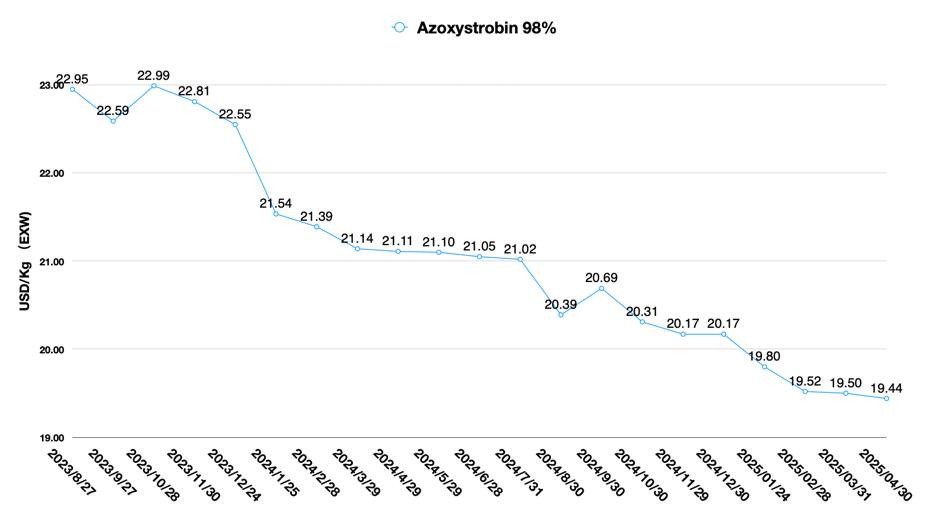

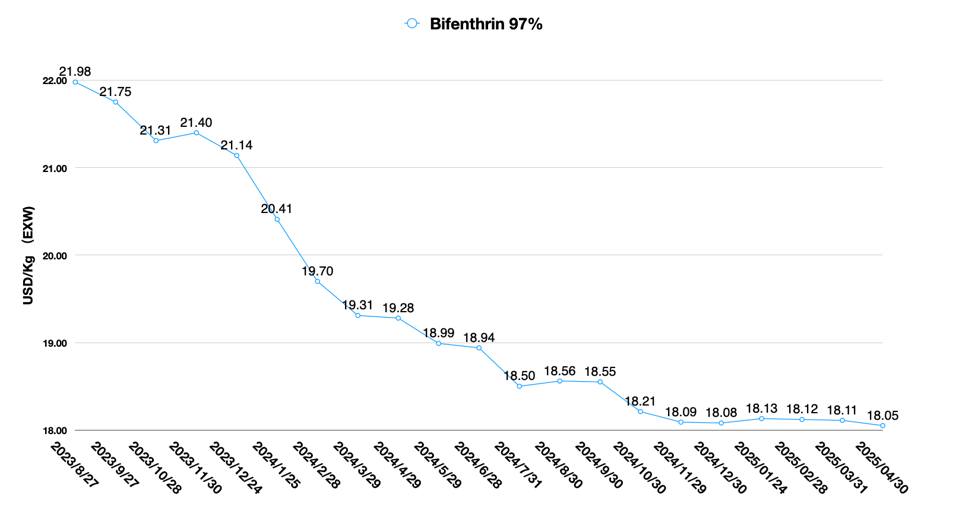

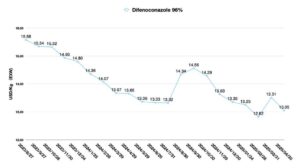

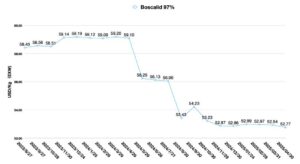

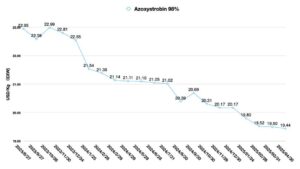

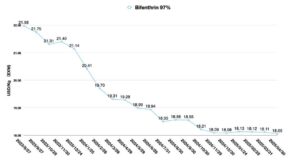

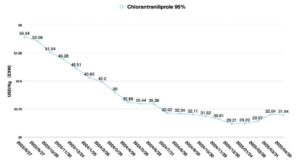

The global agrochemicals market is currently undergoing a difficult period of adjustment. According to AgbioInvestor forecasts, the global agrochemicals market value is likely to decline by 6.4% in 2024 as compared to 2023, approaching a market size of $70 billion. Undoubtedly, the downward spiral of raw material prices in China is one of the key factors contributing to the decline in the value of the global crop protection market.

But price is always a lagging indicator as I always mentioned. It was global crop protection companies adjusting safety stocks and aggressively pressurizing the channel during the COVID-19 pandemic that was the most important trigger. The supply chain whip effect forcing Chinese companies to misallocate resources is the essence of what led to overcapacity in China. The downward spiral in the value of the global crop protection market is forcing Chinese companies to find new breakthroughs.

Re-globalization is re-emerging as a future strategy for Chinese companies

The “China+1” strategy for supply chains was first adopted by multinationals during the Covid-19 period, mainly in response to the impact of supply chain disruptions in China. Nowadays, this strategy has become obsolete. It is difficult for a company with a single product line like FMC to compete with China’s scale of manufacturing by shifting capacity to India. In the Chinese market, FMC lost some market share in 2024 due to competition from China’s chlorantraniliprole formulations. In the U.S. market, Albaugh and Atticus are also active in the chlorantraniliprole portfolio construction. A “Monroe Doctrine” strategy that is closed to itself can hardly be supported by the synergy of the upstream industry chain, and therefore cannot maintain its substantial core competitive advantages in the long run.

At a time when geopolitics is becoming an influence on company operations, the China+N strategy will gradually surface in a critical window over the next two decades. While the China+1 strategy is for buyers, the China+N strategy is about Chinese companies going global.

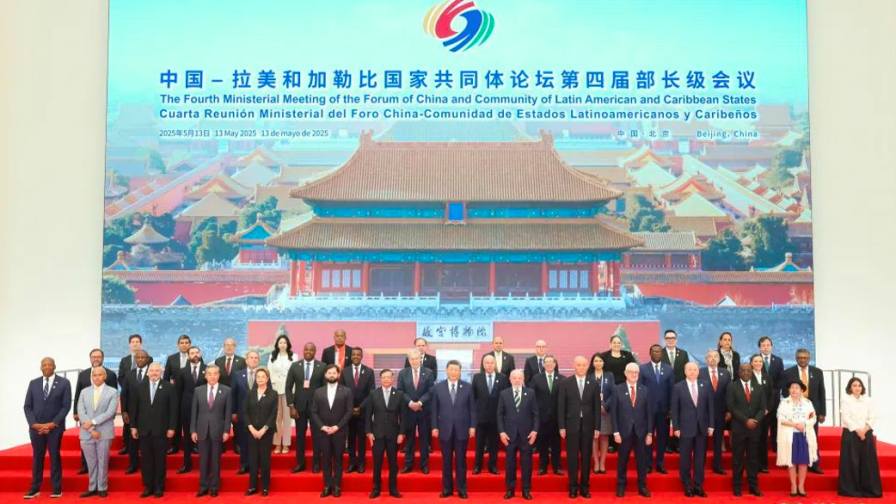

The opening ceremony of the Fourth Ministerial Meeting of the Forum of China and Community of Latin American and Caribbean States was held at the China National Convention Center in Beijing on the morning of May 13th, 2025. Photo: Xinhua News.

Like Britain’s strategy in the 19th century, China is aggressively developing emerging markets. The opening ceremony of the Fourth Ministerial Meeting of the Forum of China and Community of Latin American and Caribbean States was held at the China National Convention Center in Beijing on the morning of May 13th, 2025. Colombian President Petro, Brazilian President Lula, Chilean President Borich and other key leaders of Latin American countries attended.

In addition to promoting multilateral trade, China, as well as Chinese enterprises, will actively invest in Latin American countries, striving to realize common development between China and Latin American countries in the areas of fair trade, direct investment, infrastructure construction, agricultural reciprocity, scientific and technological innovation, new energy investment, and educational cooperation.

It is a clearly biased view to think that China’s emerging market strategy is simply about dumping commodities to relieve the pressure on overcapacity. While China’s supply chain advantages will persist, China is opening new opportunities for entrepreneurial start-ups around the world, as well as for local capital in Latin America.

For example, by capitalizing on China’s demand for agricultural products from Latin American countries, Latin American entrepreneurs can easily leverage Chinese supply chains to build their new businesses and reap the rewards of China’s huge market demand for soybeans, beef, and more agriculture commodities. Bringing prosperity to the world through fair trade should be China’s intention.

In the field of crop protection, Chinese pesticide companies such as Fuhua, Lier and other leaders are already very reliable in terms of the quality of their products. Although Chinese companies expect new entrepreneurs to bring them a larger number of contracts. Chinese companies are becoming more visionary in the phase of performance resistance. And the patience of the Chinese supply chain is increasing.

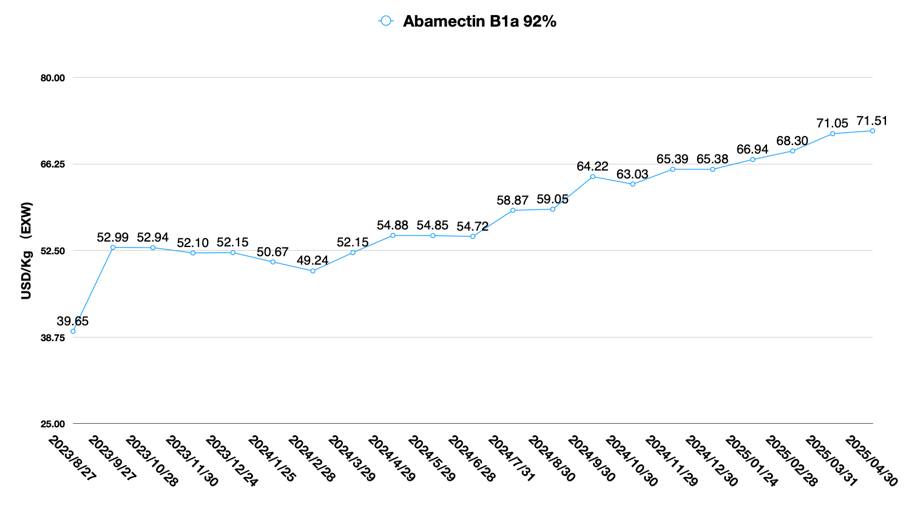

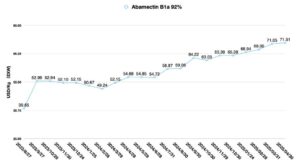

On the other hand, volatility in the Chinese pesticide market is decreasing. We have not seen significant volatility in the market, except for the price increase of clethodim due to limited supply of upstream raw materials and the price increase of abamectin and emamectin benzoate due to low-capacity start-ups. The stabilization of price volatility in Chinese supply is good news for global buyers. Price volatility is no longer a key factor preventing entrepreneurs from entering the high-growth and high-potential agricultural inputs business in Latin America.

Finally, as competition in the market intensifies, multinational companies are being forced to make strategic adjustments to reduce costs. In the process of lowering agricultural input prices, market competition has shifted from pure price competition to differentiated services as well as digitalization drives. This opens the possibility of reshuffling the local market for agricultural inputs in Latin America. Differentiated services and digital drive are the strengths and values of Latin American entrepreneurs.

Recently, Corteva CEO Chuck Magro mentioned in a recent interview that Corteva will make its technology available to any distribution or retail partner who wants to license the technology and brand it as their own. Innovative sales models that are closer to the market are becoming the new go-to-market strategy for multinationals. As a result, the market landscape will change. For China’s innovative products, out-licensing and helping regional partners build their own unique brands will also spur Chinese companies to cultivate local markets with overseas partners and achieve high growth.

Due to the strong demand for biologics in Latin America, China’s innovative biologics should be important for Latin American distributors to consider. For example, Newsun, a Chinese biologics company, has recently succeeded in obtaining EU registration for its plant-derived biostimulants astragalus polysaccharide and pollen polysaccharide. In 2022, Newsun signed a strategical agreement with BASF Demark to develop pollen polysaccharide’s distribution in the EU. The Brazilian market should be Newsun’s next focus. Chinese companies’ multiple sources of biologics raw materials and years of process accumulation are the core competencies of Chinese biologics. Moreover, China’s unique and innovative biologics and low costs are likely to bring a richer product line and higher margins to Latin American distributors.

Of course, direct investment in Latin America is also a direction that Chinese companies need to consider in the future. Meeting the needs of Latin American farmers more flexibly will be a topic of greater interest to Latin American entrepreneurs. Therefore, establishing a complete and efficient supply chain cluster in Latin America will be one of the options for Chinese companies’ re-globalization. Such supply chain clusters will not be exclusive to Chinese companies. Latin American investors and entrepreneurs should take the lead. Because in a global economic downturn, a greater respect for Latin American culture is key to the success of both parties. As we often say in the Chinese pesticide market, only the Chinese can solve China’s problems. Latin American entrepreneurs shall have more say in corporate governance.

Long-term U.S.-China game promotes industrial upgrading and China’s re-globalization

While China is actively exploring new markets, geopolitical risks are profoundly affecting its overall strategy. Competition between the two economies of China and the United States has become inevitable. Complementary economic structures make the competition between the two economies both complex and incompletely decoupled. In 2023, China accounted for 32% of the world’s total value of production, while the United States accounted for 15%. However, in global consumption, the United States accounts for 29% of the world, while China accounts for only 12%. Outside of China and the United States, the production and consumption are relatively flat in other countries and regions.

After the U.S.-China trade talks in Geneva, both sides have shown some degree of restraint in the trade war. U.S. companies have also quickly begun replenishing inventories during this brief 90-day cooling-off period. Market trends are telling the cold hard reality that in the short term, lower consumption in the U.S. and lower scale of production in China is almost impossible to achieve.

In addition to the trade between the U.S. and China, another key factor is multinational corporations. U.S. multinationals account for 27.8% of the 2024 Fortune 500 ranking. Since the U.S. represents the second industrial revolution. The large-scale complex manufacturing represented by the Ford automobile made the United States a world power of highly efficient manufacturing. And at the same time, numerous multinational corporations were born as a result led by active capital markets.

Under the historical trend of globalization led by multinational corporations, China has taken over the global manufacturing industry. But the price is that in the short term, China inevitably also walked through the old road of developed countries to pollute first and then govern, and this situation is especially obvious in China’s pesticide industry. China’s environmental storm from 2017 was an internal correction of this phenomenon.

Thus, unlike the last two industrial revolutions, China is moving from large-scale flexible manufacturing to large-scale high-end flexible manufacturing. One of the key points is that Chinese companies must deal with the dual challenges of cost reduction and pollution control at the same time. These two external pressures are forcing Chinese companies to upgrade their industries, and by 2025, the process transformation and upgrading of Chinese pesticide companies have been largely completed, with CAC Nantong’s upgrading of its 2,4-D production process being a classic case in point.

It is encouraging to note that in most of the new production capacity in China, innovative technologies such as micro-channel reaction and artificial intelligence-assisted manufacturing have been applied to actual production on a large scale. This also makes China’s pesticide companies have the enterprise moat which is lack in other countries. Green processes, environmental orientation and carbon neutrality have become a must for Chinese pesticide companies.

Compared to the characteristics of MNCs’ globalized operations and the diversity of their supply chains, the globalization strategies of Chinese firms are clearly lagging significantly behind. The high level of competition among Chinese firms has extended from within China to overseas. This is evidenced by the massive global registration of formulations by Chinese crop protection companies.

For a free market, competition is good for industry development. However, an important issue in front of Chinese companies is how to reposition their globalization strategy for the next twenty-year window. More Chinese bosses are still considering purely direct investment and continue to profit from other countries. However, in the global trend toward maintaining their own economic development, this simple relocation of production capacity is difficult to replicate the high growth achieved by Chinese companies in the forty years of China’s reform and opening.

Instead, bringing in global investors and utilizing China’s entire industrial chain to contribute to the employment and economic development of the countries where the investments are made may be a better option. But he shortcoming of Chinese companies is precisely that they do not have strategic teams with a global perspective. It is difficult for their corporate governance to break through the one-man decision-making mechanism of the founder. Therefore, the globalization of corporate governance is more urgent than the globalization of China entrepreneurs.

Re-globalization is almost a new course to Chinese. And multinational crop protection companies should not be excluded from the it. Multinationals such as Bayer, BASF, and Corteva should view the re-globalization of Chinese companies as a historical opportunity rather than as a zero-sum game. MNCs’ supply chain strategies may take a longer-term view, e.g., how can they maintain a dynamic edge in the world crop protection landscape 20 years from now?

From my point of view, the gap between cross-border scientific innovation in the Chinese market and overseas innovation is very small. We cannot easily ignore the impact of Chinese innovations on the global crop protection market, such as the application of supramolecular technology in agriculture, China’s multi-targeted and highly effective peptide biopesticides, and the new biologics developed by Newsun utilizing China’s unique crops that have made their debut. Since innovation in MNCs comes mainly from external sourcing. Mergers and acquisitions are common operations. Chinese innovations are likely to affect the future valuation of these overseas innovators. For example, peptide products are already commonplace in China. So, wouldn’t Chinese innovation combined with large-scale high-end flexible manufacturing be more attractive for collaboration?

The establishment of a dynamic capability system based on data for decision-making, with the ability to anticipate geopolitical risks, predict the impact of supply and demand balances on price fluctuations, and the involvement of the entire decision-making chain, will be the core element that will make future enterprises successful in the process of China’s and the world’s joint growth. Perhaps we can conclude that the more global uncertainty increases, the more we should probably focus on the stable and tirelessly innovative Chinese market.