Defining R&D Strategies in the Global Crop Protection Industry (Part 1)

Editor’s note: This is the first article of a series on Strategic R&D management in agchem and bioscience to be published on AgribusinessGlobal.com.

In scientific or technological organizations, the primary function of Research and Development (R&D) is to develop new products by driving future product development.

“It’s really hard to design products by focus groups. A lot of times, people don’t know what they want until you show it to them.” — Steve Jobs

In industrial scientific R&D, “Research” may be defined as a process addressing the questions “what is the challenge, and what is its solution?” while “Development” may be defined as a process addressing the question “how do we utilize the solution to the challenge in a commercially viable manner?”.

For the crop protection industry, “Research” may include processes addressing the challenges of pesticide resistance as well as the commercial need for the introduction of new products, through the discovery of pesticidal active ingredients with new or improved modes of action.

“Development” may be described as the processes addressing the optimization of active ingredient efficacy, safety, and commercial viability.

R&D Portfolios

The market position of a company (incumbent or new) determines — to a large extent — the extent of their R&D and Innovation strategies.

For mature corporations and traditional businesses with a near monopoly, existing products and strategies may limit development, and these companies tend to focus on Defensive Core Portfolios.

Figure 1: Strategic R&D portfolios.

A concern for these companies is that focus on an aggressive growth portfolio and neglect of the core portfolio may lead to the competition using the opportunity to attack their core business.

New companies and start-ups which do not have a core business to defend do not have the same limits and tend to pursue Aggressive Growth Portfolios.

R&D in the Crop Protection Industry

While the post-war era of discovery and commercialization was a period of continuous innovation since the 1980s, crop protection corporations have increasingly counted on growth through global expansion and reliance on revenues from existing products.

With the financial crisis of 2008, globalization stagnated, crop protection products became commodities, and corporations focused on “growth” through acquisitions, collaborations, and licensing agreements.

Many of these acquisitions and consolidations were driven by the need to spread the high fixed costs of pesticide R&D (specifically the cost of discovery and development of new active ingredients), production, marketing, and distribution over a greater sales volume in more markets (economy of scale).

Within the global crop protection industry, for many companies R&D resources have become too diluted to implement true product innovation and strategic vision, and larger companies have leveraged consolidation to access the research and development initiatives of smaller, more innovative companies.

Recently, however, R&D restructuring and investment by leaders in the crop protection industry has shown an increase, driven by technological developments such as the introduction of novel active ingredients, the adoption of genetically modified crops, new application techniques, formulation developments, and the introduction of unique biopesticidal product ranges.

In this context, industrial R&D utilizes future-oriented long-term strategies common to scientific research, while retaining focus on commercial yield.

R&D is crucial for the development and introduction of new products, or for the incremental improvement of existing product ranges.

In contrast to most other corporate activities, R&D does not aim to yield immediate profit and is associated with considerable risk and an uncertain return on investment.

Measures of R&D reflect the state of the industry, such as the level of competition or the degree of technological progress.

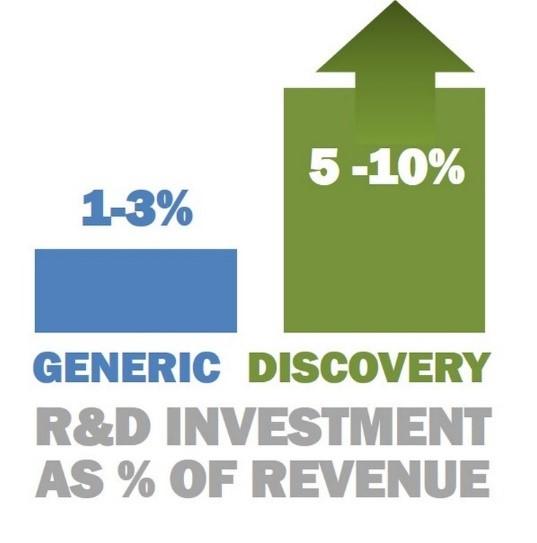

Figure 2: R&D spending ratios as a percent of revenues for crop protection product development.

For the pesticide industry, R&D spending ranges from the low single figures for generic plant protection companies to more than 10% of total sales turnover (revenues) for discovery-based companies.

R&D spending ratios of more than 10%-15% of revenues are unusual, representing a level more generally seen in high-technology engineering companies.

R&D Processes in Crop Protection Product Development

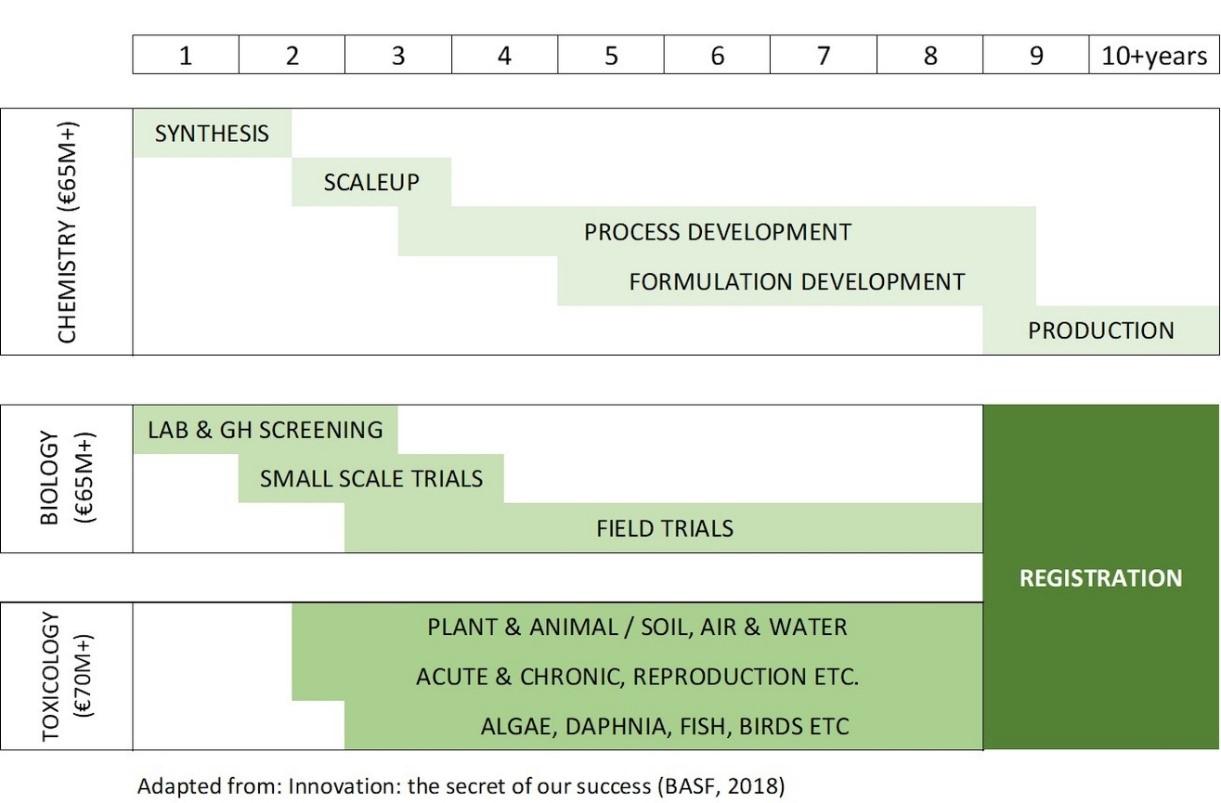

For crop protection R&D, the process of identifying a novel active ingredient and converting it into a product that farmers can use can take more than 10 years, and requires an investment of more than €200 million (Figure 3).

Figure 3: The research and development process for crop protection products.

The process encompasses Chemistry R&D: including active ingredient research and formulation development, Biology R&D: including mode of action research and application development, and Toxicology: the determination of health and environmental risks.

For the crop protection industry, R&D identifies and addresses the challenge of how to enable proactive responses to technology change, competition, and changing customer needs.

In the rapidly changing global crop protection landscape, organizations survive by continually improving their range of products.

R&D Strategies in the Crop Protection Industry

For the crop protection industry, R&D strategies have typically included new product discovery (new active ingredients and technologies), as well as product development — including the development of off-patent products (generic products) and the development of new or improved products based on existing active ingredient portfolios (proprietary products).

New product discovery and development focuses on identifying and developing active ingredients with novel modes of action that can be combined with existing active ingredients in resistance strategies, that may provide increased effectiveness in specific crop species, that may offer a lower cost of production, and which may be patented.

Intellectual property protection, such as patents, give these companies the chance to recover the costs of discovery R&D, by providing competitive advantages such as posing a legal deterrent to imitators while offering first-mover advantages such as higher prices and profit margins.

New product development requires considerable R&D investment, with discovery companies typically spending 10% or more of their revenue on R&D. In contrast, companies focusing on generic development typically spend 1%-3% of their revenue on R&D.

Following the recent rounds of acquisitions, collaborations, and licensing agreements, increased focus is being placed on R&D investment in the integration of biological and chemical technologies for crop protection.

The rise of “integrated” crop protection companies is a major development that has led to consolidation among agricultural seed and chemical companies, and the introduction of genetically modified seed varieties (GM crops) with complementary chemical crop protection products.

Examples include crops engineered to be resistant to the herbicides glyphosate and glufosinate, and the development of “plant-incorporated protectants” — a form of biological insecticide in which foreign DNA such as the BT-toxin gene is inserted into crop genetic material.

R&D Trends in Crop Protection

Due to the technical challenges and high costs related to the successful discovery and development of active ingredients with novel modes of action, R&D investment by crop protection companies is shifting away from research (discovery) back to development.

Renewed focus is being placed on increasing the effectiveness and safety of existing active ingredients and formulations, by optimizing pesticide application and uptake, by decreasing the persistence of chemicals in the environment and by reducing toxicity to humans and other non-target species.

While increasing R&D and regulatory investments are driving the development of crop protection products with fewer health and environmental risks, there is a tendency for the industry to focus on products based on their commercial potential — at the expense of products for smaller markets.

A separate development trend in the crop protection industry is the increasing investment in biopesticide products and strategies.

Biopesticides are naturally occurring biological agents, substances or mixtures of substances used to prevent, destroy or control pests (including weeds) and diseases, and are currently exhibiting strong growth in the global pesticide market.

R&D investments in biopesticide product and strategy development focus on improving techniques for the development and application of biopesticides to enhance their commercial feasibility.

Thanks for reading. Please feel free to read and share my other articles.

If you found this article interesting, you will find more useful information in STRATEGIC R&D MANAGEMENT: AGCHEM & BIOSCIENCE by Harry Teicher. Aimed at managers, researchers, and others wishing to understand basic strategic aspects of Crop Protection, this book is an easily accessible introduction to essential principles of Strategic R&D Management.

For more information, visit BIOSCIENCE SOLUTIONS – contributing to the development of sustainable Crop Protection solutions by providing independent Strategic R&D Management and Scientific support to AgChem and BioSolutions Businesses developing science-based products.