Should Agri-Input Manufacturers Outsource E-Commerce to Startups?

Editor’s note: This article was originally published on LinkedIn.

Now, when we work with this question, depending on where the stress is placed, it contains many questions — all of which are real questions — asked again and again when you think deeply about bringing digital transformation to agriculture. Here are few possible versions:

1) Should agri-input manufacturers outsource e-commerce to startups?

2) Should agri-input manufacturers outsource e-commerce to startups?

3) Should agri-input manufacturers outsource e-commerce to startups?

The answers and the assumptions they hold beneath about the future of agribusiness are just as various.

Let us perhaps, focus on the most critical one.

Those who respond positively to the first question often spell out their critical assumption loud and clear: Making quality products for farmers is our only core business. It has so far led us on an organic growth trajectory. Why divert attention from that? Everything else, including technology which facilitates traceability and builds relationships with channel partners are, at best, non-core activities, and can be outsourced to dime a dozen work-for-hire vendors.

But, there is a problem.

What happens when today’s non-core activities become value-added activities tomorrow? What happens when mastering them becomes a question of strategic vision and therefore, needs to be kept inside, or at least with trusted partners?

Take the case of IBM and their decision to outsource the microprocessor for its PC business to Intel, and its operating systems to Microsoft. When IBM executives made these decisions, they were wise choices, based on what they did best (or in business speak, “core competencies”), and often lauded by the business press of the 80’s.

However, today, in hindsight, we narrate a different story. How could IBM be so naive to not see through this ridiculously expensive decision worth billions, handing over the cake to two companies, which captured not just profit, but also stole the thunder from IBM forever?

How do we drive through this fog of uncertainty between core and peripheral activities? Is there a way to think through this in context of agri-input e-commerce?

Let’s dive in.

Allow me to introduce Harvard Professor Clayton Christensten’s “Law of Conservation of Attractive Profits“. Instead of explicitly spelling it out loud, I am going to explain it visually through Lego blocks.

Broadly speaking, every industry value chain has two types of value chain lego blocks. Integrated blocks and Modular blocks. Integrated blocks operate in a tight interdependent fashion and every nut and bolt of it — from design to manufacturing to distribution — is fully owned inside.

Modular blocks, on the other hand, operate in tight-knit coordination with partners outside. They are relatively independent blocks, and are governed by mutually agreed quality standards.

Let us understand this better with an example outside agribusiness. How about the restaurant Industry?

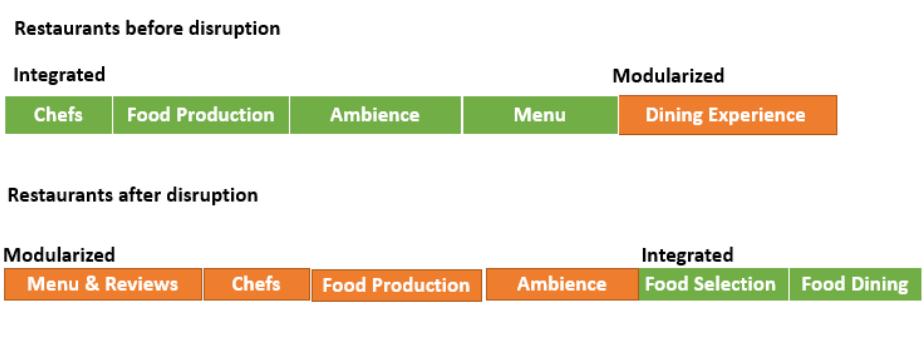

If I am a large and popular restaurant chain, my value chain would look like the image given below. When I franchise my restaurant outlets, I provide the modularized dining experience to my customers. And in order to facilitate that, I will own the core blocks. I will have the final word in it. From Chefs to the right kind of ambience to the menu items that would continuously evolve as per customer tastes.

Now, when digital disruption happens, commoditization kicks in, and the value chain blocks which were once integrated become modular. In response to this shift, a new set of integrated blocks take over to capture the declining profit in the previous arrangement. Net net, profits have been conserved. They have only evolved from one business model to the other.

If you are with me so far, the net impact of digital disruption in the restaurant industry can be summed up this way:

What started off with Yelps of the world digitizing menu and user reviews, has now come a long way. Today, with an app, I can have my unique dining experience (using Uber-like services to rent culinary kitchens), along with my preferred food selections. Every other component in the value chain, from Chefs to Food Production has now been commoditized and modularized.

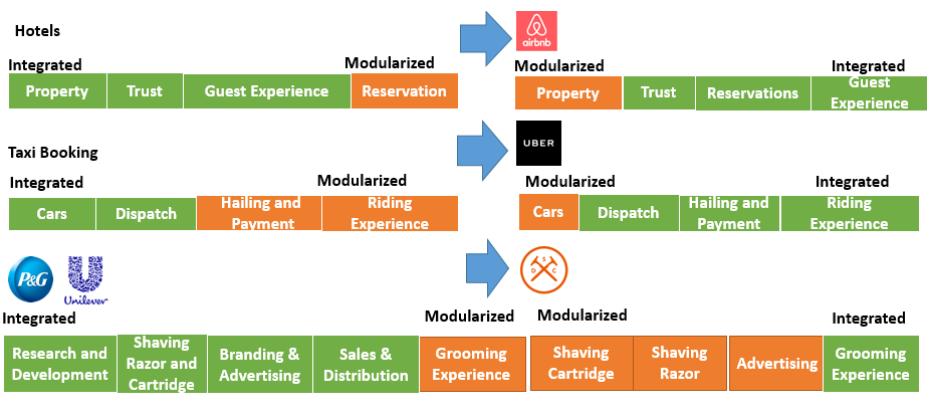

Using this framework, I can map digital disruption happening in many other industries as well. Here’s a quick glance of the disruptive shift happening across hotels, taxis, and men’s grooming industries (with the advent of subscription service like Dollar Shaving Club). I am not going into too much specifics here. If you have any comments, or if you have a different perspective about disruption in these industries, I am all ears. The Hotels and Taxi Booking examples have been adapted from the popular Stratechery blog.

So far so good.

Can we now use this framework to understand how digital disruption could play out in the case of e-commerce in agri-inputs?

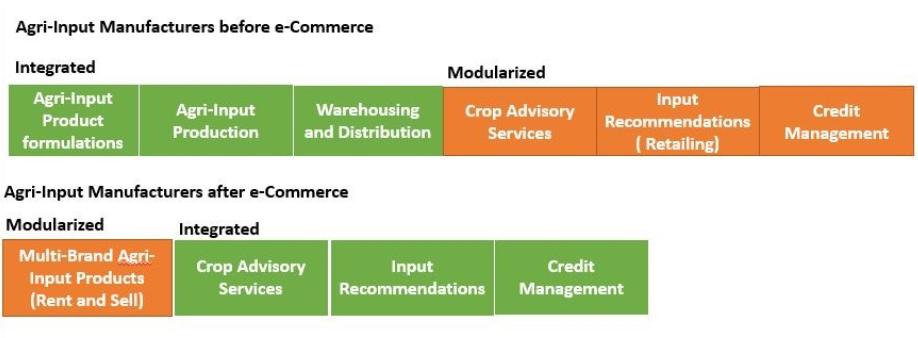

Let us unpack this diagram in more detail.

Law of Conservation of Attractive Profits predicts that incumbents who once integrated backwards, competing through exclusive supplier relationships, will now be taken over by aggregators who aggregate modularized suppliers to integrate forward with customers at scale.

If you look at the game play of e-commerce startups like AgroStar, NaPanta, Destaglobal, this is more or less what is happening. The green blocks in the diagram above cover a snapshot of the integrated services they are currently experimenting with. Take a look at the interface screen which welcomed me when I was experimenting with NaPanta, a tech solution vendor focused on Andhra and Telangana regions.

Tad too ambitious perhaps? It’s mind boggling to think of the scale of on-ground operations required to facilitate such diverse integrated services to customers. Would these services scale, given the on-ground complexities in the Indian market?

Honestly, I don’t have an answer to this question.

However, if and when these e-commerce players scale up their operations (and that’s a big if, mind you) what value-added activities are likely to become critical? I can take a shot at this question, though.

When integrated, single-brand focused, agri-input products distribution (at warehousing and distribution stages) evolves towards modular, multi-brand agri-input products, traceability system of these products’ supply chain which ensures product safety and quality would become extremely critical.

In an article written for China Daily, Zhang Qingfeng, Director of the environment, natural resources and agriculture division of the East Asia department of the Asian Development Bank, goes on to include “traceability systems” as one of the key elements essential to connect the entire agricultural value chain from production to marketing through Internet-mediated networks.

What are the other interesting facets of this diagram? Did you notice “Credit Management”?

I included this after learning about Destaglobal’s “cash-only” e-commerce transactions that have been happening in Maharashtra regions. I don’t have the numbers and the full picture here. But, it seems that, in a market used to procuring agrichemicals (among other agri-inputs) on credit, there is an alternative cash-and-carry market emerging for those who prefer the convenience of a variety of multi-brand agri-input products under a single roof.

How do you see this game play? Do you think this multi-brand organic inputs model would scale? Do you see any particular challenges that I have missed in my analysis?