Weed Resistance Creates Challenges, Opportunities

By Santiago Zuberbuhler

Kleffmann Group

Argentinean farmers are constantly pushing the boundaries of arable land. The overall treatments applied to protect their crops represent a growing market valued today at some $2.5 billion in agrochemicals alone. Almost 65% of that value is targeted at weed control.

In 2014, 33 million hectares were cultivated with extensive crops, and roughly 60% of that area was represented by soybean.

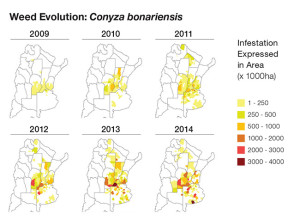

The maps show the super-developed hectares treated against Conyza bonariensis between 2009 and 2014. In 2009, fewer than 250K hectares were treated. Over time, the intensity of treatments has increased to the point that in 2014 there were over 4 million hectares of developed area treated. Source: Kleffmann Group AMIS panel data and Resarch

The Evolution of Key Arable Weeds

Encouraged by the fall in glyphosate prices, no-till farming was a game changing technique in Argentina’s agriculture landscape of the late 1990s. Argentinean farmers became early adopters of Roundup Ready (RR) biotechnology, and rapidly RR soybean crops colonized the greatest portion of Argentina’s arable land.

RR soybean combined with glyphosate succeeded as a simple and cost-effective solution for weed management throughout the ’90s. No weed species presented itself a challenge against this approach. For almost 20 years, a generalized and continued use of the same strategy, now also possible in cotton and corn RR crops, produced a high selection pressure on weed populations, giving rise to nature’s own glyphosate-resistant weed species.

Conyza bonariensis was the first tolerant weed to emerge from the intensive use of glyphosate. Conyza is not actually resistant to glyphosate, but once it reaches a certain size, it is unaffected by its chemical action. This weed started in the south of the provinces Cordoba and Santa Fe, and in the north of Buenos Aires. This colonization process followed the retreat of winter crops, which were being abandoned by growers due to the implementation of export quotas for wheat. Then, Conyza quickly expanded to the rest of the country, emerging in fewer than five years, as the most targeted weed in Argentina.

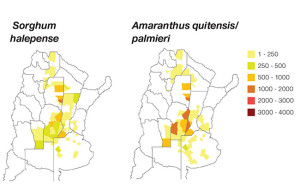

Sorghum halepense is another interesting example. RR biotechnology became the solution for controlling this progressive weed in the ’90s. After 15 years of successful control, the first glyphosate-resistant individuals appeared, which required a new approach to weed management.

Amaranthus has emerged as one of the most recent glyphosate-resistant weeds, and it’s a great example of the rapid rate of territory colonization weeds achieve, once they become resistant.

The above maps show the super-developed area being managed for resistance in sorghum and amaranthus species in 2014. The spread of area treated has been increasing rapidly since 2009.

The Path Ahead

In the last decade, Argentinean farmers have almost tripled their economic effort in weed management in soybean crops, from a base of $20 per hectare in crop year 2005, to $60 per hectare in crop year 2014. This increase in costs is explained by four main drivers: product prices, dose adjustments, number of treatments per hectare and variations in the overall quality of the herbicides palette. Of the four, only prices are external to the farmer. The remaining three are changes in the way farmers manage their weed problems, and they represent 70% of the increment in costs. Already, this early and generalized use of the technology is costing farmers an average of $28 per hectare per year, which totals more than half a billion dollars per year. This means that to preserve this technology for the future, farmers should take an active role by considering carefully its use and not leave it to the industry to handle alone.

In the next couple of years, the R&D pipeline will deliver new technologies, and a new generation of young, more highly educated farmers will be in place to use them. This combination of technology and young educated farmers provide significant opportunities to create new products and agronomic platforms that help production systems evolve based on sustainability for both technological and ecological resources.

Santiago Zuberbuhler is key account manager at Kleffmann Argentina. He can be reached at [email protected]. Kleffmann Group, a global research and data consultancy, offers monthly analysis to FCI based on its in-country surveys of farmers. Visit our website for archives of Kleffmann’s market reports.