Andean Region: Agrochemical Imports Climb with Fungicides as Major Business Unit

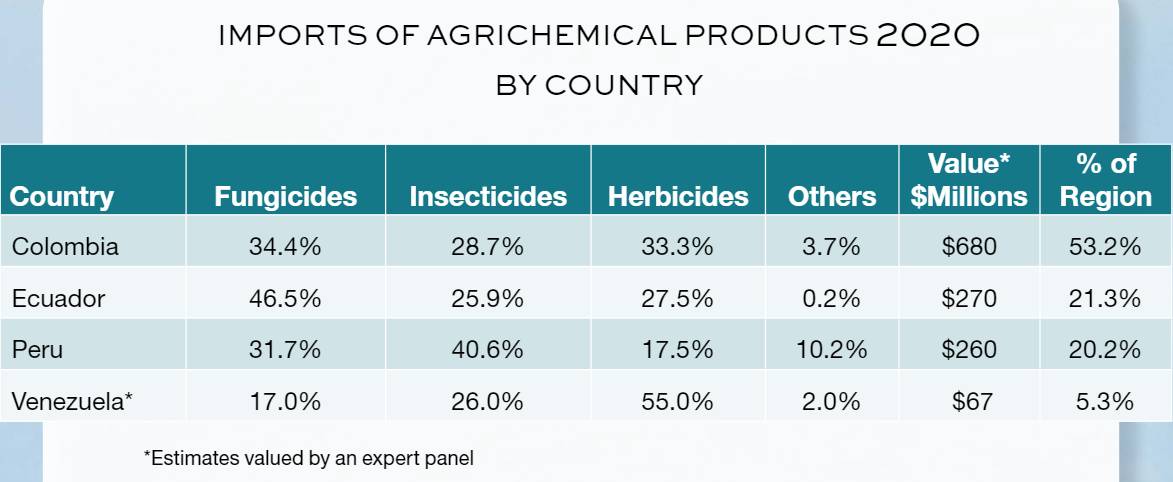

Agrochemical imports from the Andean region were worth around $1.3 billion dollars. In general, about 80% of imports come from China, the United States, Germany, and India. The remaining 20% come from various countries with a notable portion of them coming from Colombia.

The market is largely dependent on imports of both ready-to-use formulated products and active ingredients to be used to formulate, mainly in Colombia where the majority of formulating plants, factories and repackaging facilities are located. Multinational produce a large segment of these products not only for the Andean Region but also for Central America and the Caribbean, as well as Chile, Mexico, and other countries in Latin America.

Formulated products in the region were approximately 71% of the total imported, and the import of active ingredients was 29% last year.

Mixture products are those that contain two, three and up to four active ingredients and are having a great reception in different countries, especially due to the wide spectrum of control they offer and the good effectiveness that is achieved in the different crops of the region. In the Andean region, these premixtures can account for approximately 20% of total imports, and of those fungicides occupy the greatest share with about 45% followed by Insecticides with 30% and in lesser part the herbicides with about 17% of imported premixes.

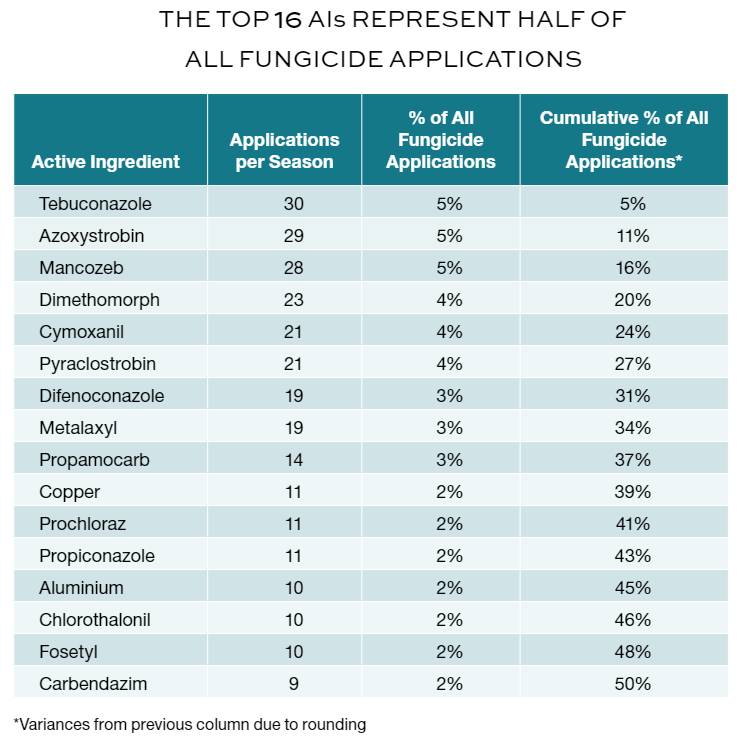

The Top-5 of the most used fungicides in mixtures are the active ingredients Tebuconazole, Azoxystrobin, Mancozeb, Dimethomorph, Cymoxanil, Pyraclostrobin, and Difenoconazole. Mixtures like cimoxanil+mancozeb, azoxistrobin+difenoconazol, fluopicolide+propineb, azoxistrobin+flutriafol, pyraclostrobin+boscalid, trifloxystrobin+tebuconazole, tebuconazole+azoxystrobin are the most imported in the region.

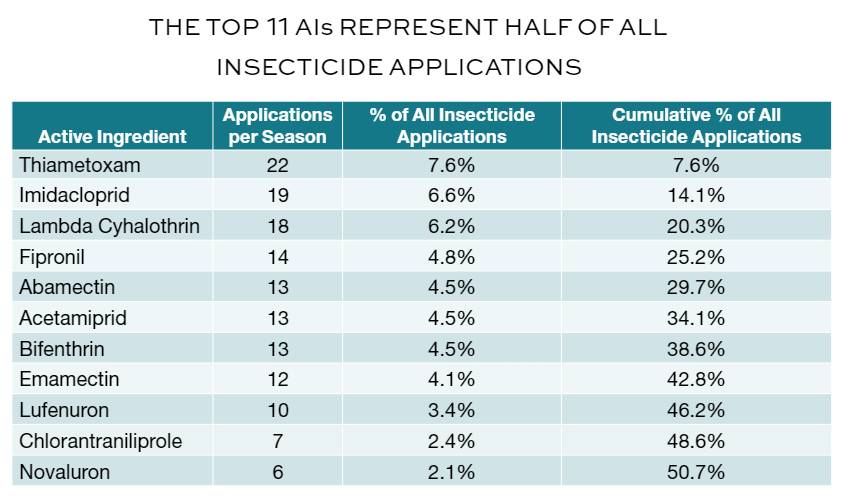

The Top-5 of the preferred insecticides for making mixtures are Thiamethoxam, Imidacloprid, Lambda-Cyhalothrin, Fipronil, and Abamectin. Mixtures like thiamethoxam+lambda-cyhalothrin, diflubenzuron+methomyl, lufenuron+emamectin benzoate, thiamethoxam+abamectin and chlorpyrifos+dimethoate, betaciflutrin+imidacloprid, lambda-cyhalothrin+thiamethoxam, cipermetrina+clorpirifos, chlorantraniliprole+thiamethoxam, cipermetrina+profenofos are the principal ones imported in the region.

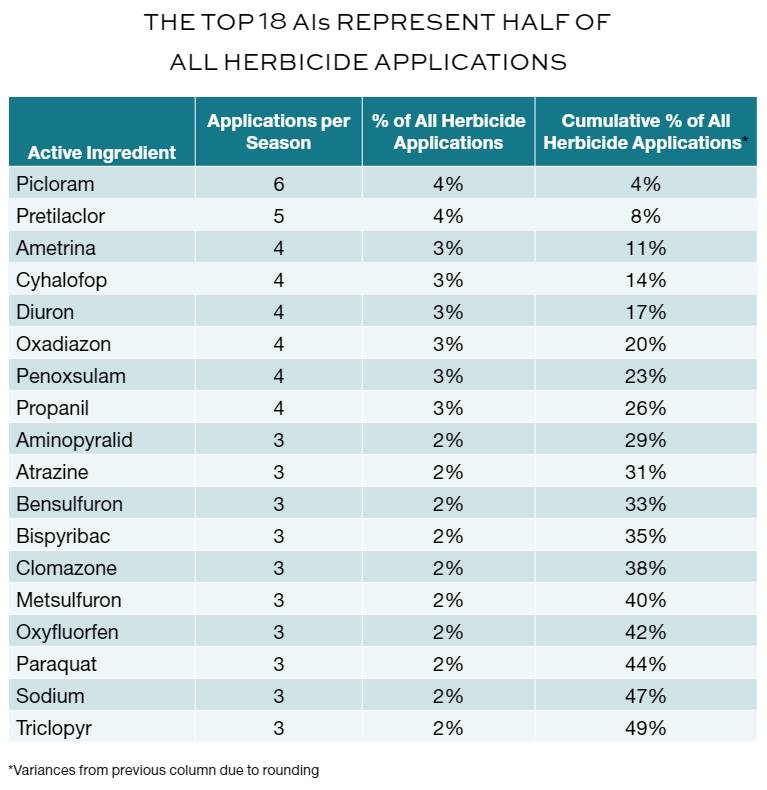

Regarding the herbicides, the Top-5 of the most used active ingredients in herbicide mixtures are Picloram, Pretilachlor, Amethrine, Cyhalofop, and Diuron. Mixtures like 2,4-d+picloram, 2,4-d+aminopyralid, clomazone+pendimetalina, propanil+triclopyr, imazamox+imazapyr, bispyribac-sodium+bensulfuron-methyl, atrazine+nicosulfuron, bentazone+mcpa and picloram+2,4-d are the most imported in the region.

The mixture segment has been a strong product extension for many companies, especially R&D-based multinationals, as new active ingredients or ones recently off patent can be combined with synergistic chemistries to create a novel product, which sometimes can qualify for a patent extension or a new patent. As this strategy matured, post-patent companies, because they have been able to establish their products and especially new products with different assets, have copied the model and now are able to deliver three types of innovations to farmers:

- Mixtures: with two, three, and up to four active ingredients to cover a wide spectrum of phytosanitary problems in the field.

- Formulations: safe and more effective formulations to exert a better application and greater effectiveness in control, effectively protecting crops against diseases and weeds that cause pathogens. For example, formulations that allow combining the benefits of an emulsifiable concentrate and a wettable granule formulation.

- Concentrations: Allow reductions in the number of containers and packages to take to the field, as for example in the case of products with formulations 150 SL to 800 WG of the same active ingredient.

For the importation of agrochemicals, in many cases the brand of the company or local distributor is particularly important for commercialization in the market, so, the model of importing bulk product and repackaging locally is a common practice in the region. For which there are specialized plants in this area that do this maquila work for importing companies, which corresponds to approximately 20% of total imports of formulated products.

There are several models to commercialize chemical products in the agricultural market, among which are:

- Selling to trading companies or distributors in each country, whether they register the products in their name with their own brand or import it in bulk or concentrate, repackage it locally, and distribute it in the country.

- Using the manufacturer’s brand by importing and distributing the product ready to be marketed, which may be exclusive. The companies that manufacture them can also register the products on their behalf and import them directly or they could assign the import right to different distributors.

- Another model that can be used is to sell to local importers for internal use, such as producers’ associations, cooperatives, and any production company that needs this type of model.

In general, the marketing of agrochemical products in the region is based on land tenure, so the marketing strategy is retail or retail sales. In the Andean region, there are approximately 30,000 stores to serve around 8.1 million farmers, who need to have these products on hand to be able to carry out an adequate control of biological problems in their plots.

Imports of both formulated products and active ingredients, most of which fall mainly on post-patent companies, which in the region import approximately 51% while R&D companies import approximately 49%.

In Colombia, imports of agrochemical products in 2020 increased by about 31% over the imported value in 2019. Imports in 2020 were proportionally distributed, mainly in fungicides with 34% of the total and that grew over the year 2019 35% to become the main business unit in the country. In second place were herbicides with 33% of the total and an increase over 2019 of 55%, especially driven by the increase in rice areas; and in third place insecticides with 28% of the total with an increment of 4% over the year 2019. In general, products in mixtures correspond to approximately 19% of total imports.

Within the imports of fungicides, the three main imported products are protectants such as mancozeb with 19.3% of the total imports of fungicides, propineb with 5%, and chlorothalonil with 4.5%. Among the systemic fungicides are difenoconazole with 4% and pirimethanil with 3.5% of all fungicides. Around 119 different mixtures were imported, which are 24.5% of the total imported. The mixtures of cymoxanil+mancozeb, azoxystrobin+difenoconazole stand out, each one with 3% of the imported total and fluopicolide+propineb and azoxystrobin+futriafol with 2% and 1% respectively of the imported total.

Among the herbicide imports are glyphosate with 14% of the total, paraquat with 8% and propanil with 8% also of the total herbicides. Mixtures occupy a prominent position with 46% of the important ones and around 170 different blends of 2, 3, and up to 4 different actives. About 39 mixtures were imported, corresponding to a total of 10.5% of the imported value in herbicides. The mixtures focused on rice and paddock crops.

The three most imported insecticides were imidacloprid with 17% of the total insecticides, Spinetoram with 6% and Fipronil with 5% of the total. The insecticide mixture products had a participation of 22.1% of the total imports and more than 60 different insecticide mixes are counted. The most prominent mixtures are betaciflutrin+imidacloprid with 5% of the total imports, followed by lambda-cyhalothrina+thiamethoxam with 4%, cypermethrin and chlorpyrifos with 2% and the mixture chlorantraniliprole +thiamethoxam with 2% of the total.

In Peru, imports of agrochemical products in 2020 increased by 16%, with formulated products being 95% and technical only 5% of the total imported. Insecticides are the first imported group with 36% of the total, followed by fungicides with 32%, which maintained the same percentage of participation as in 2019. Herbicides grew by 2% compared to 2019, being 18% of total imports.

The most imported insecticides were methomyl with 10% participation, followed by fipronil with 7% and chlorpyrifos with 6% followed by imidacloprid with 6%.

The most imported fungicides were metabisulfite with 7% participation, cymoxanil and mancozeb with 5% and azoxystrobin with 5% and tebuconazole with 4%.

The main imported herbicides are glyphosate 40% of the total imported, 2,4-D being 11% and paraquat with 10% of the total herbicides.

An especially important product within growth regulators such as hydrogenated cyanamide, which corresponds to 4% of the total, had an increase of 12% compared to last year.

Ecuador increased imports by 12.4% over those of 2019. Five multinational companies import 51% and have a wide portfolio of products and infrastructure, the other part it is done by national companies. Twenty of the importers registered the previous year handled 95% of the incoming agricultural inputs. As previously indicated by country of origin, most of the products come mainly from Colombia and China.

Fungicides are the most important group since around 47% of these products are imported mainly due to the fact that the banana cultivation in the country is the main consumer of these products. Herbicides followed with 27% and insecticides with 23%. By crop, bananas command the purchase of imported agrochemicals, followed by crops of flowers, rice, corn and potatoes.

In Venezuela, herbicides are the main imported product with 55% due to the sowing of corn, rice, sorghum, sugar cane, soybeans and the maintenance of pasture areas for livestock. They are followed by insecticides with 26% and fungicides with 17% to be able to comply with the crops of coffee, vegetables, and beans.

Today the great work that is being done in the countries of the region on the subject of agrochemicals is very important, complying with the norms that are established in each of them on local regulations, using the products that have authorization to be applied, in the case of exporters, reviewing the MRLs, working together with the certifiers who are aware of these issues and working for example on one of the key points such as re-entry periods, which is one of the most important aspects after the application of agrochemicals.

It is important to understand specific problems in the field, to do IPM, and when it comes to the chemical control package, offer a rotation strategy, thinking about the protection not only of the crop but of the active ingredients because they are no longer coming out new products to the market.