China Pricing Index: Agrochemical Prices Fall During Lower Demand

The world was operating in sync with the law of comparative advantage, which David Ricardo published in “On the Principles of Political Economy and Taxation” in 1817. In the aftermath of COVID-19, it might seem like the law is broken, But it isn’t. Instead the global community will establish a new balance and reallocate its resources accordingly.

According to the law of comparative advantage, under free trade, an agent will produce more of and consume less of a good for which they have a comparative advantage. The free trade minimizes the cost of the whole society and bring more value for people. U.S. farmers are good at GMO soybean farming, and China is good at agrochemical production. That is simple example of comparative advantage.

In March, China began to restart its factories following the control of COVID-19. All of China’s manufacturers needed to gather workers other provinces across vast distances. The federal government required local governors to test temperatures of all people in public spaces. Until now, some area in China still require travelers from potential infected areas to stay home for 14 days to double confirm if travelers are infected or not as a precaution to mute the second wave of spread.

Rural areas recovered faster than cities since the spring cultivation must be maintained. Through March 28, the operation rate is up to 98.6% according to Ministry of Industry and Information Technology. But it is not full capacity for industry manufactures until the whole country operates at a corresponding level.

Nufarm EU is facing big challenges on the truck transportation across the board in EU countries due to COVID-19. China was facing the same challenge. The different reason in China was that truck drivers had to stay at home for COVID-19 control since Chinese Spring Holiday. The rate of February transportation of cargo in east of China is around 70% to 80% comparing to the February 2019. The Southwest transportation rate is up to 80% to 90%. The big cities like Beijing and Shanghai are lower than local areas. In March, the transportation of cargo showed significant recovery.

Based on the previous two factors, the operation rate and transportation, the supply of agrochemicals in March was very tight due to the low inventory of active ingredients. The uncertainty made purchasing managers anxious about China supply, and prices increased on some active ingredients. And the infections in the EU and U.S. further complicated matters.

The global lockdown means that international retailers cannot move on to arrange their supply chain. When Indian also start lockdown nationally, some of global distributors are waiting for the China raw materials from Shanghai Port. Utilizing and relying on the local plant capacity is the top priority for multinational companies.

Under such case, the key prices of active ingredients are decreasing since the sudden “zero” demand from overseas. There are some cases about cancellation of exporting orders. The big capacity of herbicides and insecticide are in lowing way of price. Due to the always low inventory of fungicides, the price of fungicide is still on high level like triazole fungicides.

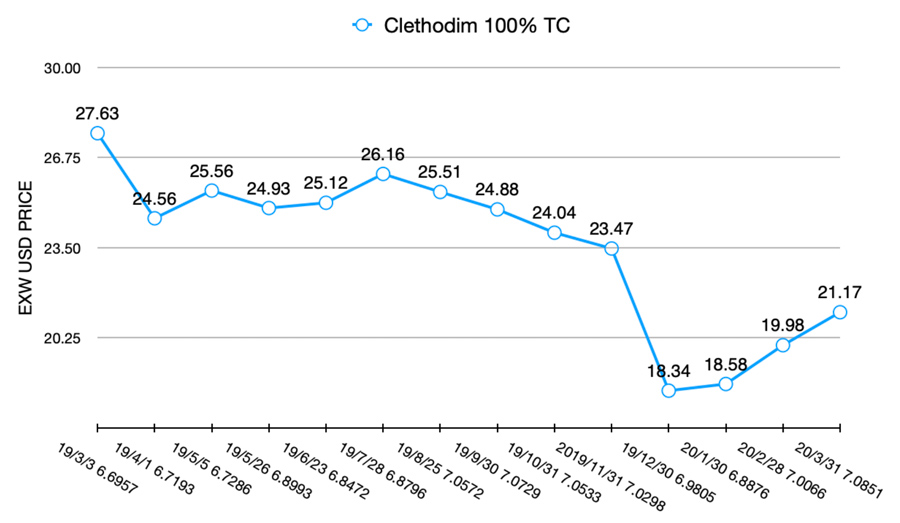

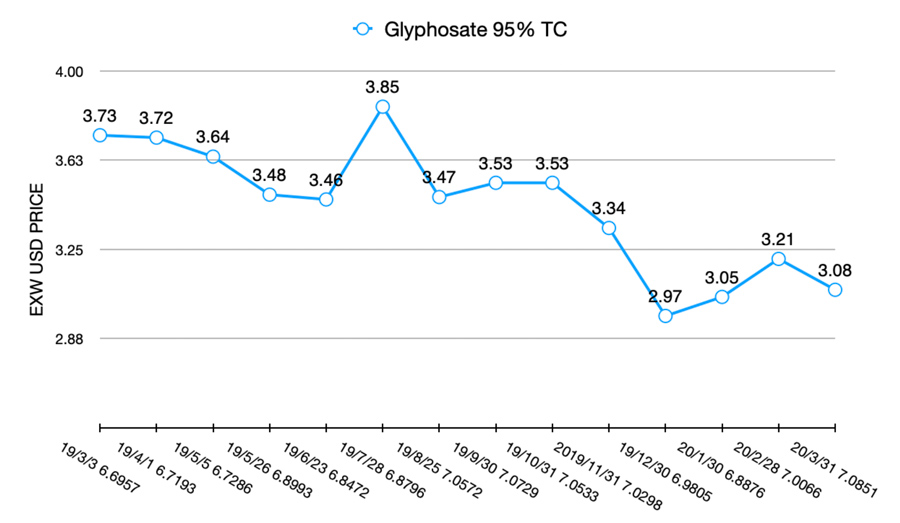

Herbicides

The clethodim AI price rose 11% in March since the low operation rate and shortage of raw material supply. So sourcing teams want to have more inventory in case the shortage of supply. However, the operation rate of glyphosate is recovered. Meanwhile the transportation rate of cargo in Sichuan is back to 90% according to the number of Ministry of Transport where the Fuhua is the leading glyphosate producer in China. All the factors are leading to a decreasing price of glyphosate due to weak demand from overseas.

U.S. corn area will be increasing 8% according to USDA Perspective Planting Report 2020. The 2020 soybean planting area in U.S. will be up 10% compared to 2019. Considering the tariff war between China and U.S., it could be the positive U.S. farmers’ perception on China purchasing soybean from U.S. more than Latin America. Corresponding, Brazil and Argentina will also try to find solutions to increase the competitiveness on soybean price in 2020 to capitalize on China’s remaining orders. With strong demand from China on agriculture products, the global herbicide market could have chance to stay more stable in 2020 than 2019. COVID-19 is also to push farmers to choose the labor-saving way to use sterilant herbicide together with GMO seed program.

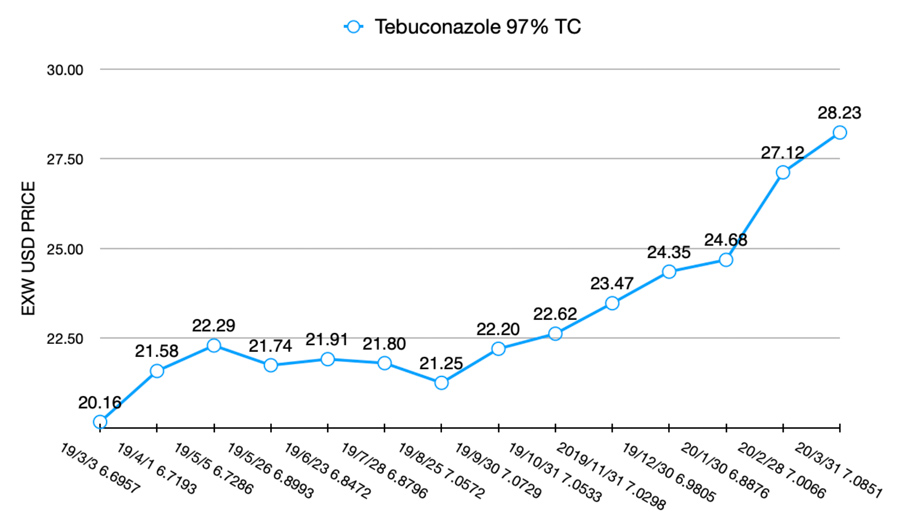

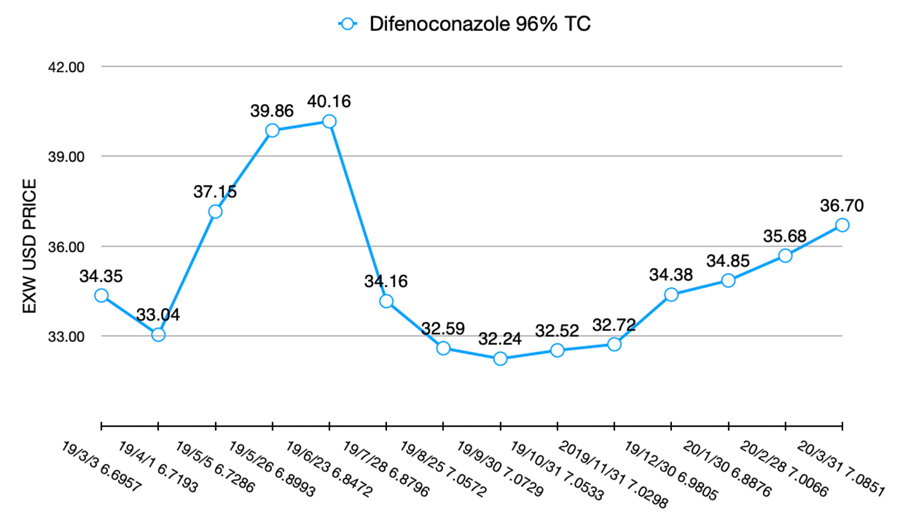

Fungicides

Regarding fungicides, the triazole fungicides are still in short supply. Along with the limitation of operation, there is strong demand on difenoconazole and tebuconazole, which were widely made co-formulation with strobilurin fungicides like azoxystrobin, trifloxystrobin and pyraclostrobin, etc. And some are key products in the portfolios of multinational companies as mixtures and single formulations of triazole like Nativo of Bayer CropSicence, MIRAVIS from Syngenta and Bumper from ADAMA. Multinational companies’ supply cannot fully meet demand for the global production and distribution of these products.

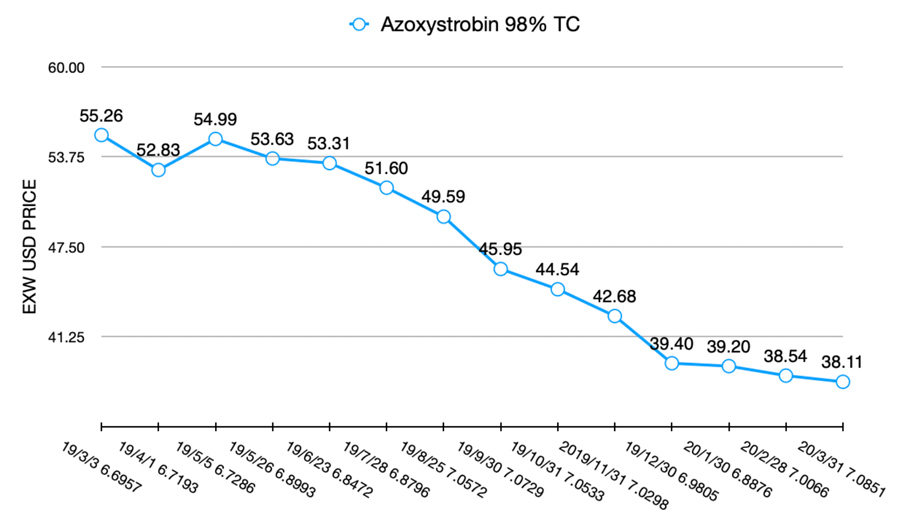

The azoxystrobin price is controlled stably by the key intermediate supply capacity. But due to the fluctuation of USD exchange rate, the EXW price is slowly decreasing for overseas prices.

Insecticides

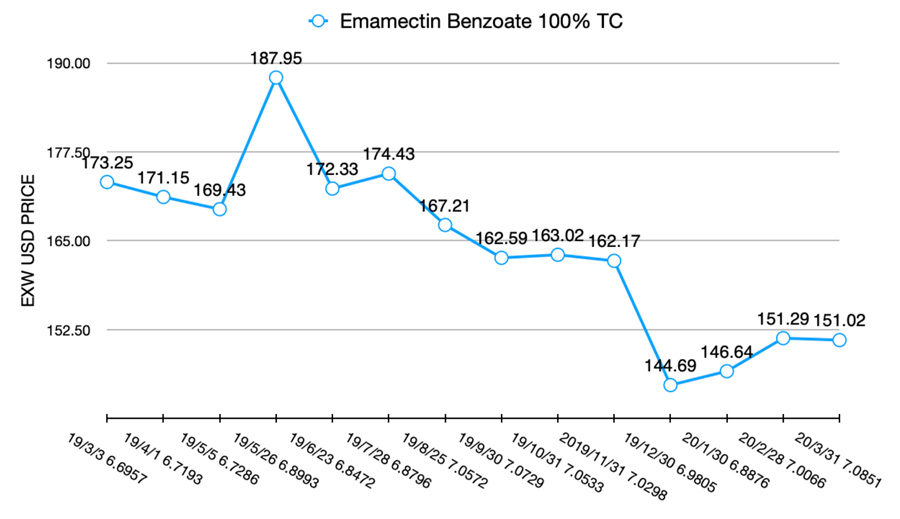

The potential risk of fall army worm (Spodoptera frugiperda) is increasing in Asia. Asian countries have a strong need to control the pest, so a lot orders of emamectin benzoate are being pushed into the value chain, and the emamectin benzoate price is increasing in China. But the fluctuation of the exchange rate will dilute the price increase.

Thiamethoxam is affected by the intermediate supply from Hubei province, which was the epicenter of COVID-19. After Prime Minister Narendra Modi announced the world’s largest lockdown on March 24, 1.3 billion Indians had to stay home for 21 days to slow the spread of COVID-19. It will be the additional impact on global agrochemical supply since the world’s key manufacturing centers were hit by COVID-19 one after another. Supply in India has been stable thus far, and as a result the pyrethroid insecticide price has been stable globally but could start increasing in China.

China recently change the VAT refund for key agrochemicals to promote the global trading. It will give an additional reason for global distributors to purchase. But considering the logistic risk, the cargo arriving could be pending due to the control spreading COVID-19 on arriving port. After the tariff war, Brazil is the top one importer of China agrochemical in 2019. If Latin America can recover from the controlling of COVID-19, the distributors in LATAM will benefit from such policy soon.

The COVID-19 is a serious crisis for global agriculture and food security. Crop protection is more important for farmers than ever. Up to now, the global market like US and Brazil shall have sufficient inventory in the channel for farmers. But a bigger concern will be the transportation of the cargo and maintaining the harvest when we are facing labor shortages.

Multinational companies with global manufacturing facilities will be able to strategically relocate production to mitigate labor issues as COVID-19 continues to linger. Global sourcing teams will need to rely on China and India capacity but also consider the balance of the risk of global crisis for global farmers.

COVID-19 is pushing us to improve innovation. We do not need to wait for 2050, the world will face the challenge together right now. We can anticipate that the UAV crop protection in China will have good potential to bring precision agriculture to the field. Labor shortages and maintaining efficient agriculture production systems will be the 2020 key topic for every country in the world. Bless the world in our unified plight.