Identifying Uncontested Market Spaces in the Global Crop Protection Industry (Part 3)

Editor’s note: This is the third of seven articles in a series on Strategic R&D Management in AgChem and BioScience to be published on AgriBusinessGlobal.com. For a full list of the articles, click here.

Since the 1980s, crop protection corporations have sought to grow through global expansion and incremental, “good-enough” product development, relying on revenues from successful chemicals that are decades old.

Today, organizations not prioritizing strategic vision and change risk being supplanted by those that are able to create market-shaping innovations.

Successfully executing strategic vision will depend on our ability to not only integrate synergistic conventional, biological and technological solutions but also on our ability to facilitate and integrate intelligent communication with crops.

The Need for Strategically Balanced Portfolios

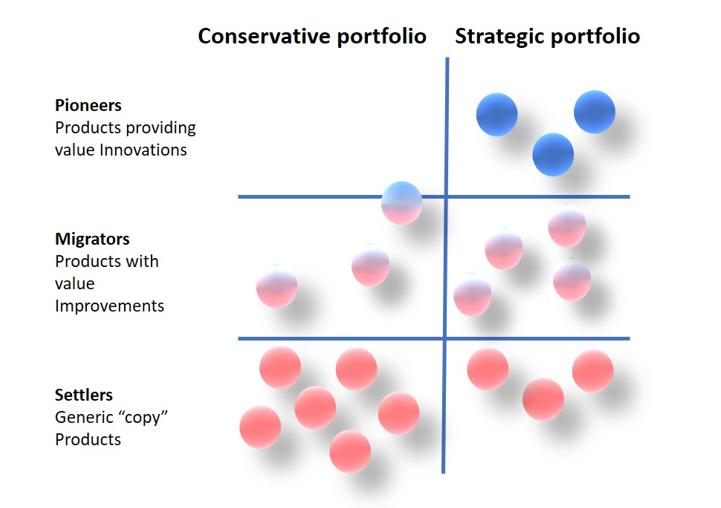

In the globally competitive world of crop protection, long-term survival is increasingly dependent on a shift from conservative product portfolios (“Settler” and “Migrators”) to strategically balanced portfolios which include “Pioneer” products.

- “Settler” products comprise the mainstay of generic portfolios, and the term is used to describe generic or copied products, for which the main competitive driver is cost domination.

- “Migrators” are products with value improvements, typically in the form of formulation developments, for which the main competitive driver is improved efficiency.

- “Pioneers” are products providing value innovations, such as the integration of technical advancements or novel technologies.

Figure 1: Pioneer-migrator-settler map for the prediction of future growth and profit (adapted from Kim & Mauborgne, authors/creators of Blue Ocean Strategy).

Driving Value Innovation

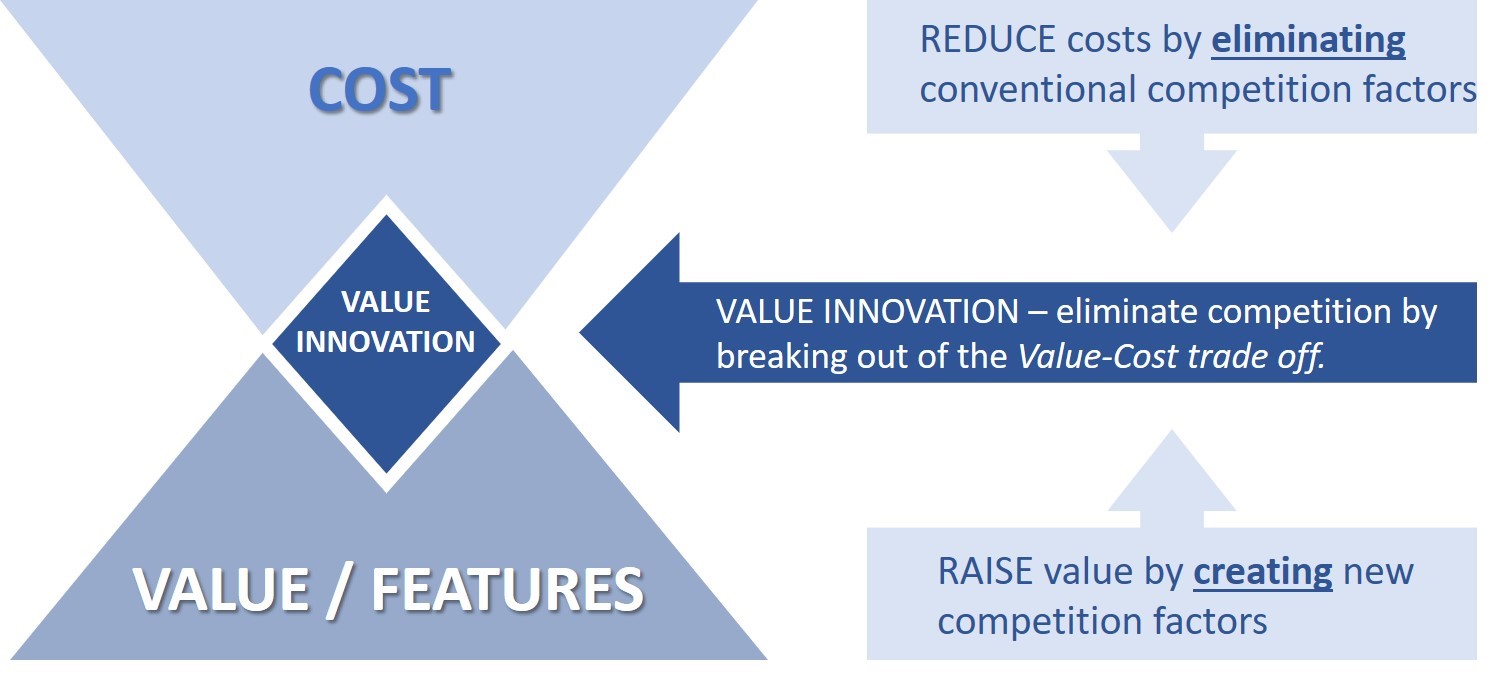

Crop protection corporations do not need to choose between a generic strategy of cost domination or differentiation but may simultaneously pursue differentiation and low cost (Value Innovation).

Figure 2: Value innovation through the elimination of conventional – and the creation of new – competition factors (adapted from Kim & Mauborgne, authors/creators of Blue Ocean Strategy).

Value innovation may be defined as the simultaneous creation of new utilities (values) at a lower cost. Cost is reduced by eliminating conventional competition factors while value is raised by creating new competition factors.

In value innovation, uncontested market spaces may be created by breaking out of the value/cost trade-off.

Identifying Uncontested Market Spaces (Blue Oceans)

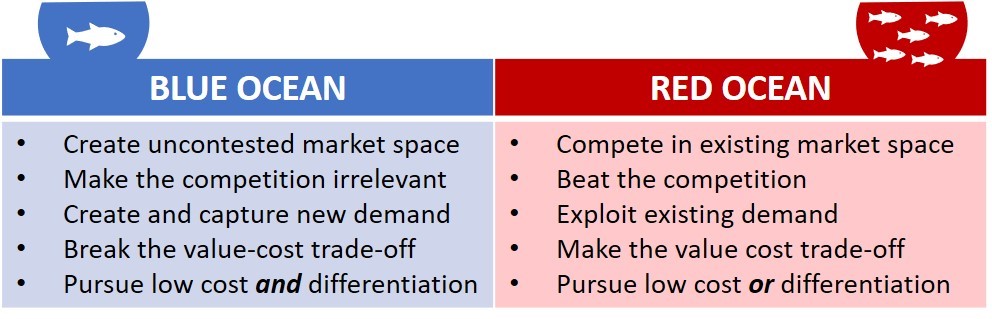

Through value innovation, competition is rendered irrelevant by opening new and uncontested market spaces (Blue Oceans).

Blue Ocean Strategy is a theory of market creation developed by W. C. Kim and R. Mauborgne, Professors of Strategy at INSEAD, one of the world’s top business schools, and co-directors of the INSEAD Blue Ocean Strategy Institute in Fontainebleau, France.

Blue Ocean Strategy proposes that companies can eliminate competition by creating “blue oceans” of uncontested market space, primarily based on value innovation and in which competition is essentially eliminated, as opposed to “red oceans” – characterized by primarily incremental innovation and limited growth prospects.

Figure 3: “Blue Oceans” offer uncontested market space, while “Red Oceans” provide limited growth prospects (adapted from Kim & Mauborgne, authors/creators of Blue Ocean Strategy).

To identify value innovations for the crop protection industry, Blue Ocean Strategy recommends that organizations create value innovation utility spaces by focusing on buyer (grower) product experience and pain points.

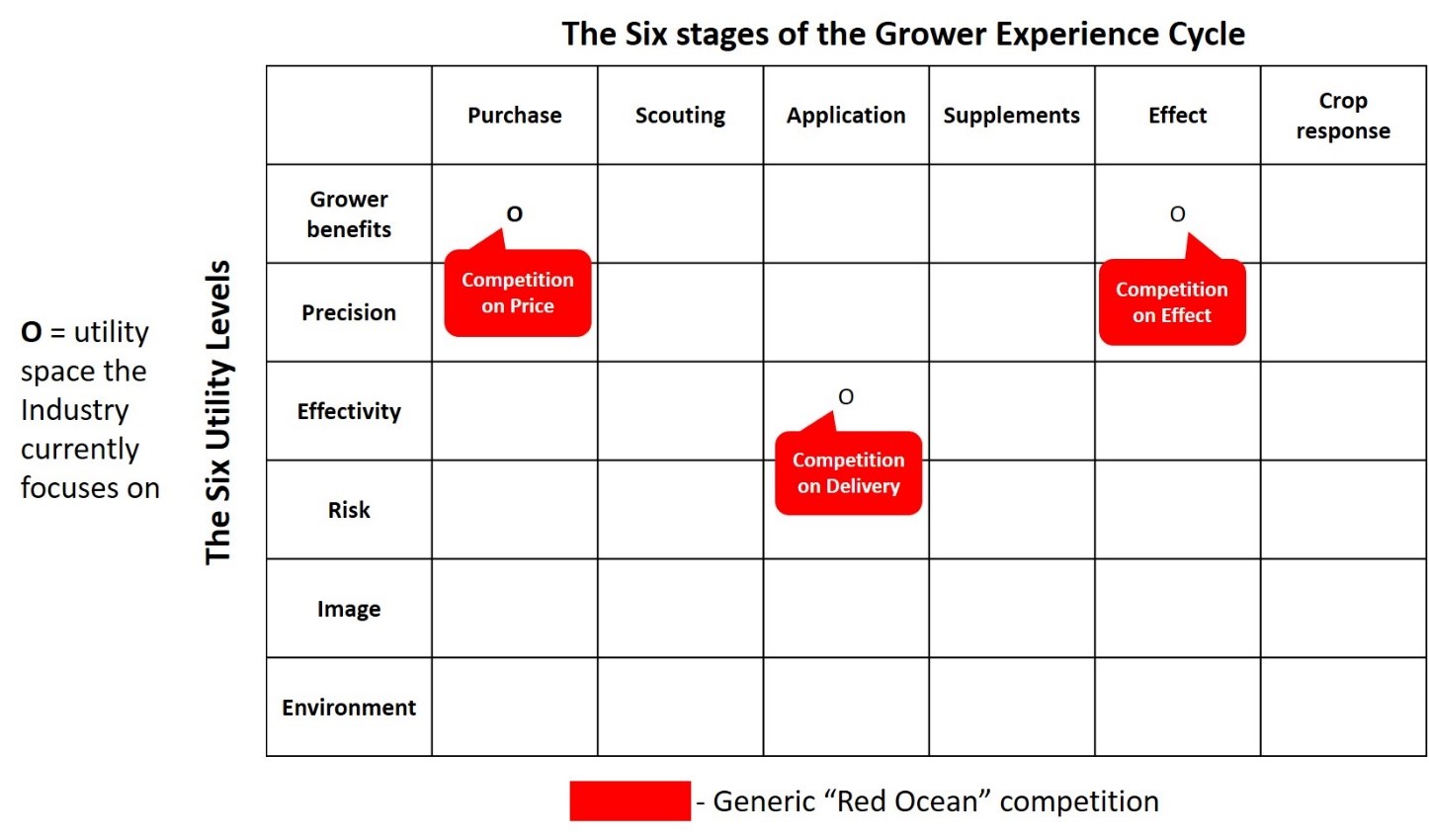

A Buyer (Grower) Utility Map can facilitate the identification of utility spaces that a product or service can fill, thereby contributing to new value propositions distinct from existing competition parameters.

Grower Utility Map

To create a Grower Utility map for the crop protection industry, grower experiences can be listed as sequential Grower Experience stages, for example:

- purchase of the crop protection product or utility

- scouting (identifying pest or pathogen levels and optimum application timing)

- application (delivery of the product to its target site)

- supplements (identifying and using the optimal adjuvant or co-product)

- effect (evaluation of sufficient effect to combat yield loss and reduce the risk of resistance development)

- crop response (elimination of crop phytotoxicity and induction of crop defense responses).

These stages may be broken down into Grower Utility levels, through which companies can provide utility for their customers. The most commonly exploited level is that of Grower Benefits, in which innovation can increase growers’ productivity by improving their efficiency.

By evaluating the 36 spaces of the Grower Utility map, it is possible to identify utility propositions that are different from existing products.

Within the crop protection industry, most generic crop protection companies focus on one or two stages of the grower experience sequence (e.g., purchase and application effectivity), overlooking the opportunities offered by the remaining stages.

Figure 4: Grower Utility Map. The generic crop protection industry currently competes in a “Red Ocean” of “Settler” products (adapted from Kim & Mauborgne, authors/creators of Blue Ocean Strategy).

Focus has traditionally been placed on delivering more of the same utility at the same stage of the grower’s experience, with innovation incrementally achieved through improvements in current utility propositions (“Settler” and “Migrator” products, see Figure 1).

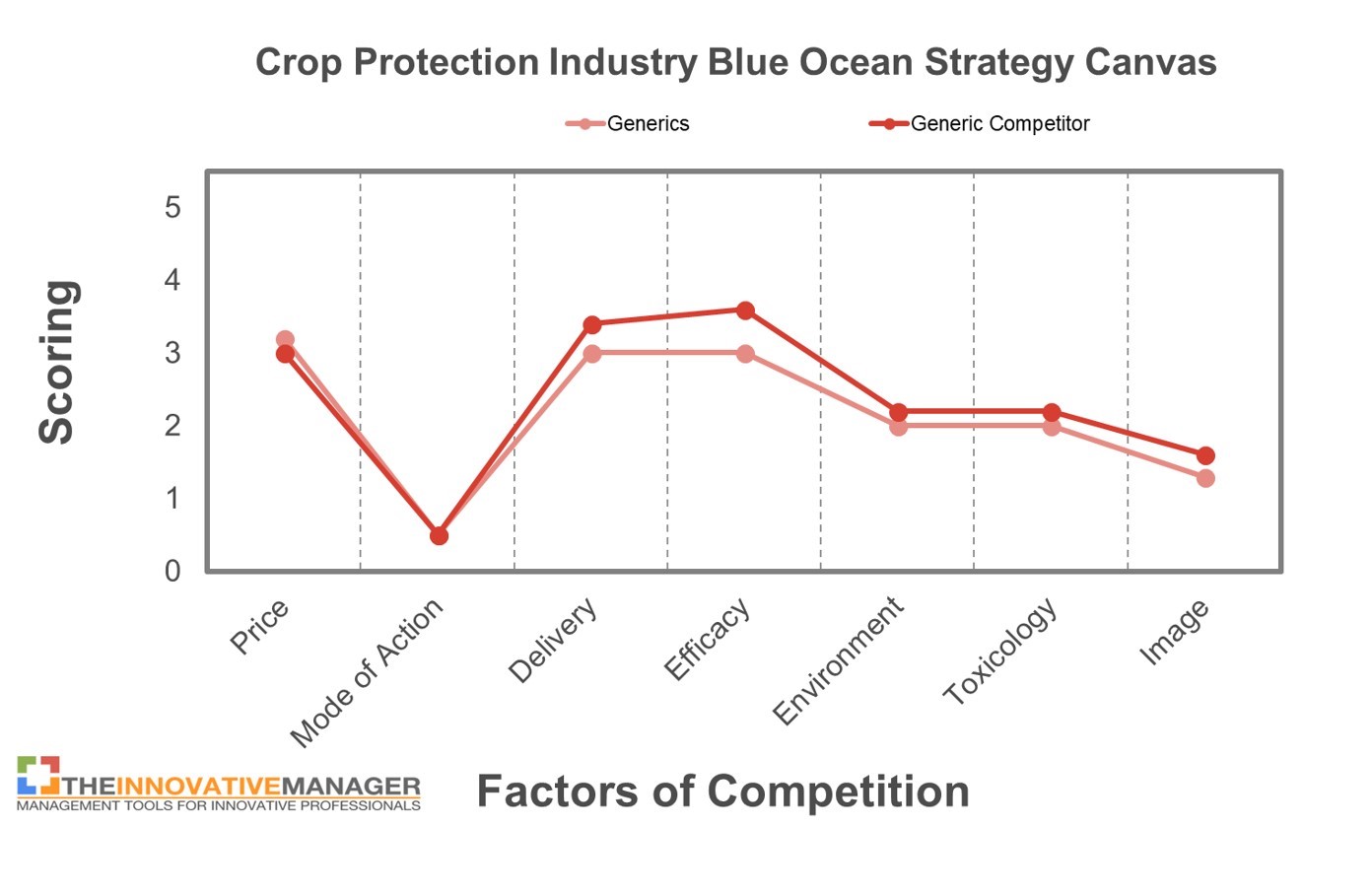

The current “state of play” of the competition’s product strategy can be visualized and compared to one’s own product strategy through a Strategy Canvas.

Strategy Canvas

The Strategy Canvas is a useful visual tool to compare a company’s strategic profile with that of the competition. In the following example, the current strategic profile of a traditional generic crop protection company is compared to that of the generic crop protection industry.

In this canvas, the factors that the industry competes on are listed on the x-axis, and the priority across these factors is scored on the y-axis. The strategic profile of both the company and the generic industry can be seen to be almost identical.

Figure 5: Strategy Canvas, generic crop protection competitor, compared to the generic crop protection industry (adapted from Kim & Mauborgne, authors/creators of Blue Ocean Strategy).

The traditional approach to generic crop protection product development has been to compete on prices and incrementally improve formulation and delivery technologies. This strategic profile is unlikely to create market-shaping innovations.

Advances in Biological Crop Protection Provide Value Innovation Opportunities and Strategic Adaptations

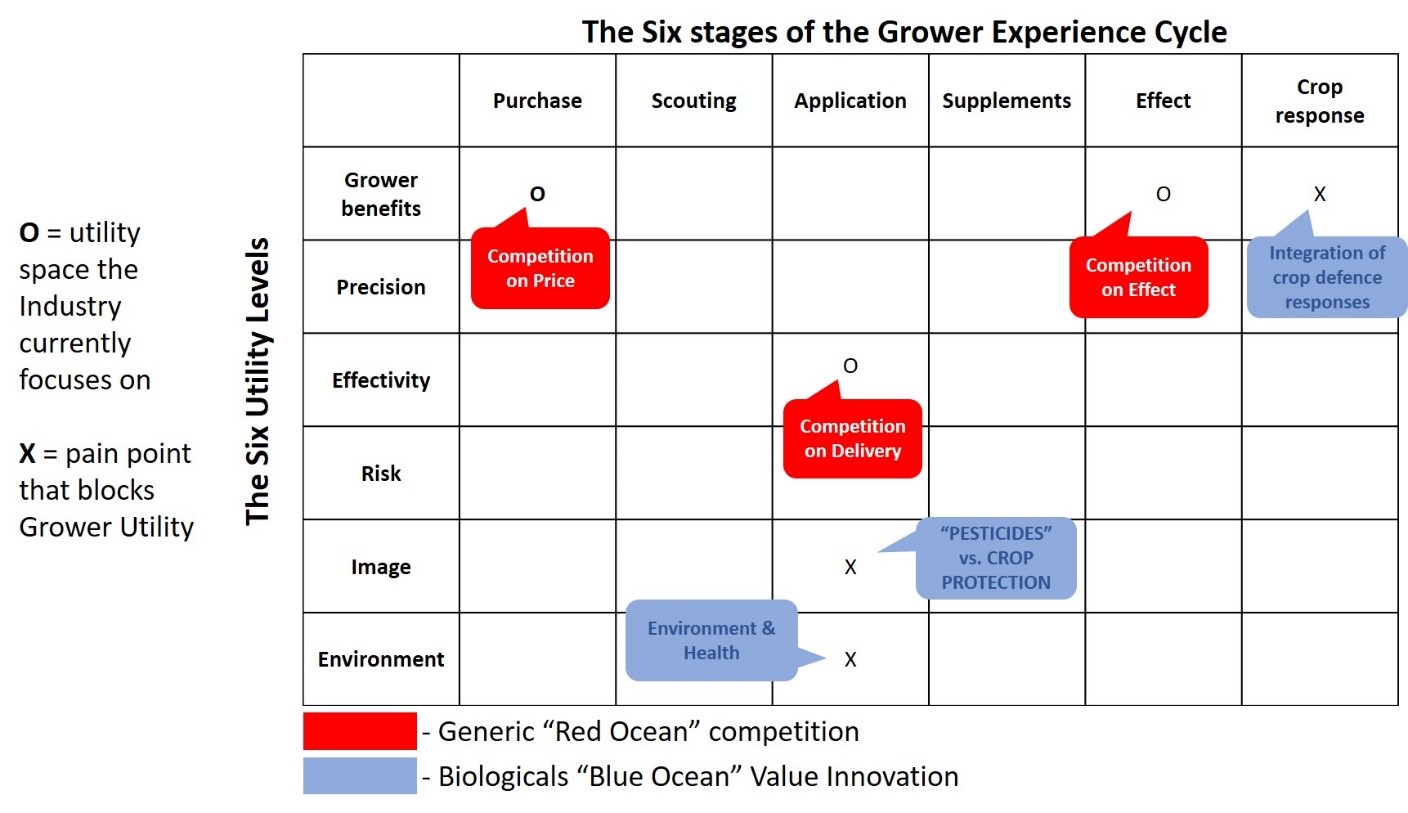

In contrast, the nascent biopesticide industry staked out new utility propositions on the Grower Utility map, to generate a unique strategic profile.

Figure 6: Grower Utility Map. The Biopesticide industry has created a “Blue Ocean” of “Pioneer“ products and strategies, through advances in Biological Crop Protection which provide value innovation opportunities and strategic adaptations (adapted from Kim & Mauborgne, authors/creators of Blue Ocean Strategy).

Over the last two decades, significant increases in our understanding of inducible plant defense responses (strongly driven by biopesticide R&D) provide us with new and powerful utility propositions to increase product efficacy, through the introduction of new modes of activity, and the integration of plant defense responses into overall crop protection strategies — an alliance between farmer and crop.

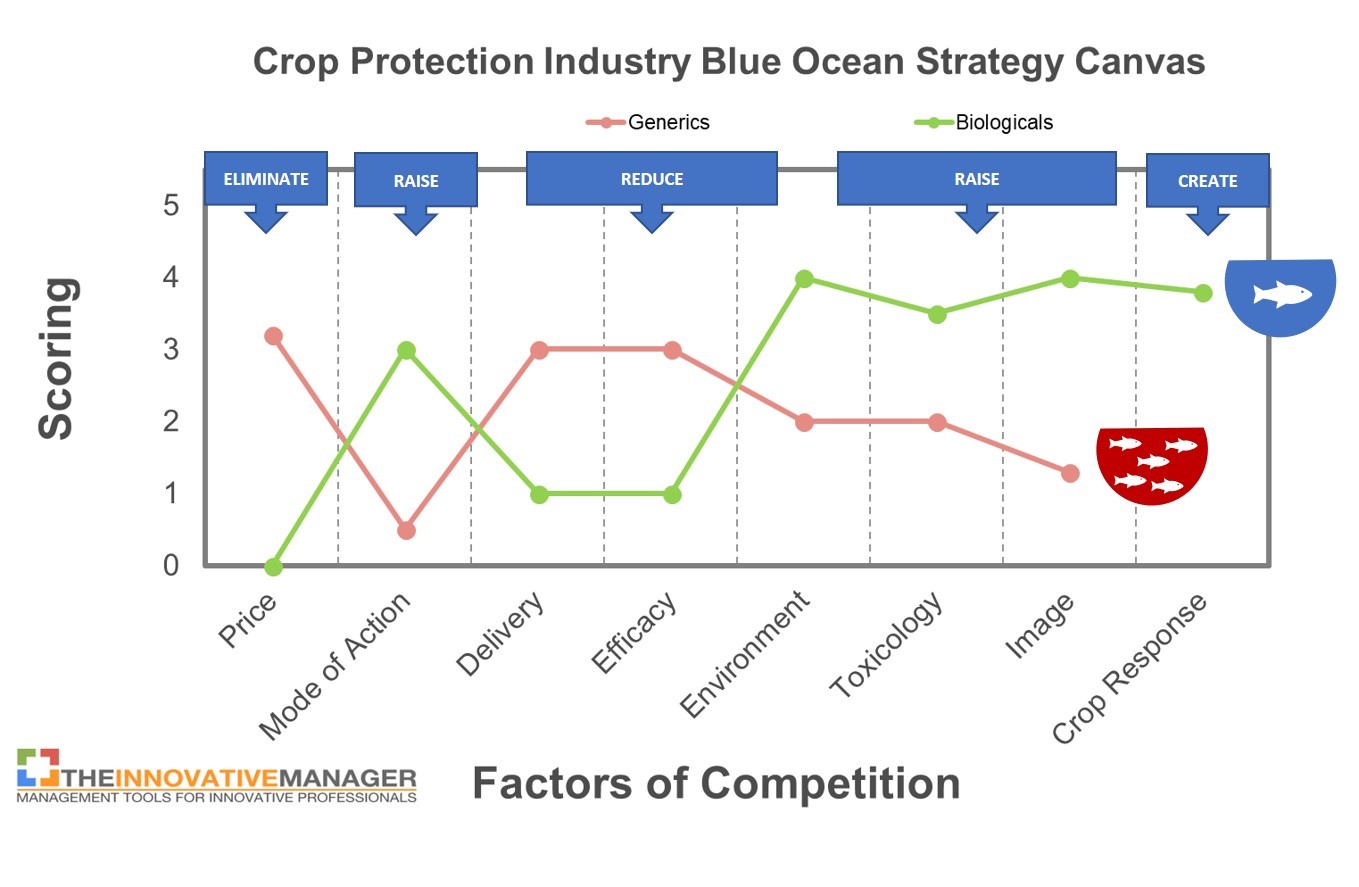

Figure 7: Strategy Canvas, biopesticide industry compared to the generic crop protection industry. “Blue Ocean” Value Innovation opportunities and strategic adaptations facilitate the identification and development of “Pioneer” products (adapted from Kim & Mauborgne, authors/creators of Blue Ocean Strategy).

To generate their unique strategic profile, the biopesticide industry altered their scoring on competitive factors through:

- Elimination of competition on price (growers accept the increased cost of Biopesticides)

- Reduction of competition on delivery (application of Biopesticides is more demanding than for conventional, chemical products) and efficacy (there is a perception of variable efficacy for Biopesticides)

- Elevation above industry standards of competition on new modes of action, environmental and toxicological advantages as well as positive branding (image)

… and generated “Blue Ocean” value innovation in an uncontested market space through:

- Creation of a new factor that the incumbent generic industry did not offer: the integration of plant defense responses into overall crop protection strategies.

The biopesticide industry has subsequently demonstrated that significant strategic synergies can be achieved by integrating biological and conventional crop protection — not only between products but also between the knowledge bases for these strategies.

In this next article of this series, we continue with Part II of how the Biopesticide & SMART-TECH Industries create a “Blue Ocean” of uncontested crop protection market space.

Thanks for reading. Please feel free to read and share my other articles.

If you found this article interesting, you will find more useful information in STRATEGIC R&D MANAGEMENT: AGCHEM & BIOSCIENCE by Harry Teicher. Aimed at managers, researchers, and others wishing to understand basic strategic aspects of Crop Protection, this book is an easily accessible introduction to essential principles of Strategic R&D Management.

For more information, visit BIOSCIENCE SOLUTIONS – contributing to the development of sustainable Crop Protection solutions by providing independent Strategic R&D Management and Scientific support to AgChem and BioSolutions Businesses developing science-based products.