Indonesia Market Approaches $500 Million

Agriculture is an important aspect of Indonesian economy; it contributes 15% of the country’s GDP, and it provides employment to 41% of the Indonesian workforce.

Indonesian farming comprises smallholder and large plantation farming. Smallholder farming focuses primarily on rice and cash crops (soybean, corn, fruit and vegies) while large plantation farming focuses on export crops like palm oil and rubber.

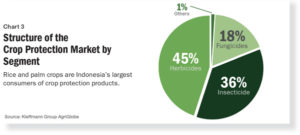

Rice and palm oil are key crops for Indonesia. And both crops are the biggest consumers of crop protection in the country.

Kleffmann Group estimates the Indonesian crop protection market at $480 million in 2014. By segment, herbicide and insecticides account for two-fifths (81%), and fungicides constitute 18%.

Multinational companies dominate the country’s crop protection market, including BASF, Bayer CropScience, Dow, Monsanto, and Syngenta. Considering rice alone, multina tional companies are responsible for more than 80% of the crop protection market value across all categories — herbicide, insecticide, and fungicide.

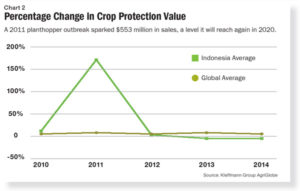

Between 2010 and 2014, the Indonesian crop protection market has increased 136%. What is extremely remarkable is that the sudden jump happened in just one year. In 2010, the crop protection market value was just $203 million. The following year, the value soared to $553 million — an astounding jump of 172%.

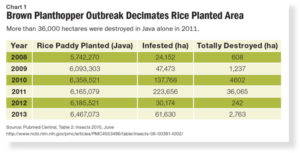

An article by Craig Thorburn (Center for Geography and Environmental Science), attributed the dramatic rise in crop protection usage to the outbreak of brown planthoppers (BPH) or Nilaparvata lugens in 2011.

Chart 1 shows that in Java alone, the BPH infestation spread more than five times the area planted from 2008 to 2010, and it increased a further 62% in 2011. During this year, the area of totally destroyed rice production was almost eight times as large as the previous year. The article blamed the outbreak to the BPH-susceptible hybrid varieties which the Indonesian government heavily promoted since 2004.

In 2012, the government temporarily abandoned its hybrid policy and instead distributed BPH-resistant inbred varieties Inpari 11 and 13. There was also a relatively low rainfall during the year. These managed to control the BPH issue effectively.

Through 2014, the market value of crop protection is still positive despite a downtrend in 2013 and 2014 as BPH began to be controlled.

Data is presented at ex-company level, represents harvest year and is calculated using average year exchange rates. Real term values are calculated using 2010 as the base year.

Experts estimates that the crop protection market in Indonesia will exceed $500 million by 2020, and this is likely. Nevertheless, we also expect a controlled growth as government policies will try to balance productivity and sustainability.

Indonesia’s march towards self-sufficiency requires agriculture policies such as facilitation of availability of production inputs such as seeds, fertilizer, and chemicals. Farmers will continue to use chemicals on their crops to ensure productivity and the agrochemical companies will continue to provide farmers technology options to grow their business.

We expect that the government will more seriously promote measures to mitigate the negative effects of agriculture in the environment. This is becoming inevitable considering the serious effect of global warming to agricultural production. The government may intensify promotion of integrated pest management, and there are indications that biological controls and biostimulants will be growing segments in agronomy in a few years. Promotion of Good Agricutural Practices via private and public-private efforts also aims at responsible use of crop protection — thus, avoiding excessive use of chemical crop protection.

It is expected that the global crop protection companies will continue to develop innovations and technology that will address the need for higher productivity and safer environment. But at the end of the day, farmer education is necessary to ensure that these technologies will be used properly and will not lead to environmental concern.

Noreen D. Acaylar is Managing Director of Southeast Asia for Kleffmann Group, a global research and data consultancy that offers monthly analysis to AgriBusiness Global based on its in-country surveys of farmers. Find out more about Kleffmann’s amis AgriGlobe, a global database of pesticide and seed use, at www.kleffmann.com.