Mitigating Risk in a Post COVID-19 World in Agribusiness

Supply chains, by their very nature, have risks. The pandemic that has complicated decision making for supply chain managers in 2020, and could continue to do so into 2021 as well.

As part of the AgriBusiness Global Trade Summit™, Stephen Pearce, Founder and Director, AWP Associates & Bancella Ltd., addressed some of the issues supply chain managers are dealing with and offered insights into how to overcome them.

“We really had a mix of considerable headwinds related to how we buy, how we plan, and how we manage demand signals throughout the value chain,” Pearce says listing a number of issues the industry faced pre-COVID 19 dividing them into three categories:

1. Supply Chain Disruptions

- Stricter environmental standards in China

- Rigorous enforcement

- Accidents

- Factory relocations

- Integration & consolidation

- Factory & park closures (temporary & permanent)

2. Supply Demand Imbalance

- Trade tension between the U.S. & China

- Punitive tariff impositions

- Weather issues

3. Strategy

- Geographical de-risking (India)

- General trend toward softening demand and prices (with exceptions)

Changing Dynamics

Whether they’re facing any or all these issues, it’s easy to understand why supply chain managers might be looking for strategies to work through these issues.

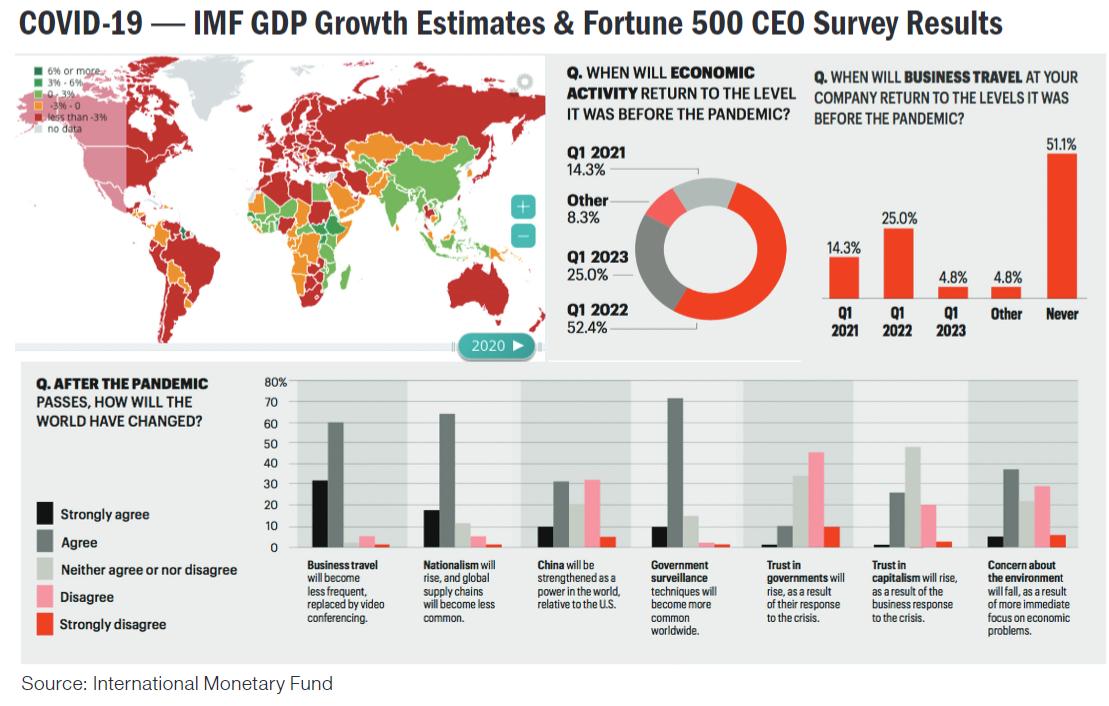

“What’s interesting to me when I look at this particular picture is it used to be — ‘when the U.S. sneezed, the world caught a cold economically,’” Pearce says. “But it seems to be the reverse in this situation. When you look at where we buy primarily as an industry, India and China seem to be coping fairly well related to the levels of GDP that they’re able to sustain, as compared to most of the destination markets.”

It’s also worth noting, Pearce says, how China is investing in other countries.

“If you look at a lot of the African countries that are (showing a healthy GDP), they have a lot of money being pumped into their economies by China,” Pearce says.

China and India have both worked to take advantage of the current situation.

“From a more tactical perspective, we have the whole: ‘It’s India’s time’ type of platform with regard to how companies and what companies were going to do with regard to delisting strategies to other parts of the world with a primary focus on India,” Pearce says. “There was a general trend at that time toward softening demand and prices. There are clearly exceptions to that as it related to certain manufacturing constraints. Generally, the picture was softening.”

Nationalism

Pearce shared results of a survey of Fortune 500 CEOs discussing post pandemic concerns.

“A lot of CEOs believe nationalism will rise, and global supply chains will become less common, which is interesting in so far as our industry relies predominantly on the Far East for supply,” Pearce says. “One thing that we might expect after all of this is the world needs to globalize in order to recover quickly. If the sentiment is more nationalist in terms of supply chains and the way we operate, that in some sense could potentially hamper recovery in some sectors.”

On a related note, China has been a critical supplier for a very long time for the ag input industry. The disruptions created by COVID-19 and the desire of many companies to diversify their supply chains, raises an interesting question.

“Will China be strengthened as a power in the world relative to the U.S.,” Pearce asks. According to those who responded to the survey, “The general consensus was that wasn’t going to be the case. There wouldn’t be any critical shift in power in terms of China’s influence on the world as a result of the pandemic.”