U.S. Retail Crop Protection Sales Hit $9.3 Billion in 2014

According to the 2014 CropLife 100 survey, the crop protection products category followed up on its 8% gain (in terms of retailer revenue) in 2013 with another 9% boost during 2014. Sales volume for the category now sits at $9.3 billion. Furthermore, crop protection products now account for 31% of all crop inputs/services revenues for the top ag retailers in the United States — the category’s highest market share in eight years.

According to the 2014 CropLife 100 survey, the crop protection products category followed up on its 8% gain (in terms of retailer revenue) in 2013 with another 9% boost during 2014. Sales volume for the category now sits at $9.3 billion. Furthermore, crop protection products now account for 31% of all crop inputs/services revenues for the top ag retailers in the United States — the category’s highest market share in eight years.

“Demand for crop protection products has definitely grown the past two seasons,” says Amy Asmus, co-owner of Asmus Farm Supply, Rake, IA, which derives more than 80% of its annual income from the category. “As growers have been forced to combat harder-to-control weeds, they are increasingly turning to different products to help accomplish this. That has provided a tremendous boost in overall crop protection product sales.”

Weed Worries

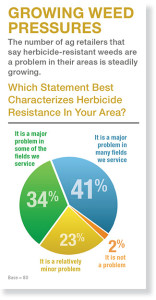

Based upon the latest available data, more than 20 states have at least one form of herbicide-resistant weed in their crop fields. This has forced growers to increasingly find new ways to manage them than what they’ve did in the past.

With herbicide-resistant weeds on the march across the U.S., CropLife 100 ag retailers saw a decided uptick in their overall herbicide sales during 2014. According to the survey, 75% of respondents recorded a 1% to more than 5% increase in their herbicide revenues during the year. Another 13% had flat sales. Only 12% reported a decline in their herbicide sales in 2014.

For herbicide prospects for the future, things look even brighter. As new cropping systems tied to dicamba and 2,4-D come into the market during 2015, ag retailers expect the segment’s sales to remain strong for some time to come.

Not As Much Fungicides

Not As Much Fungicides

As herbicides were enjoying renewed interest during 2014, another crop protection category segment, fungicides, were not. For the past several years, fungicide use as a preventive has increased among grower-customers looking to boost their crop yields in the era of $7 per bushel corn. But now that corn prices have dropped back into the $4.25 per bushel range, this trend has slowed down significantly.

In fact, according to statistics gathered in the 2014 CropLife 100 survey, the nation’s ag retailers saw a big pullback in fungicide use during the year. In 2013, 82% of respondents said 6% to more than 75% of their grower-customers were using fungicide application as a preventive measure in their crop fields. For 2014, however, this percentage has dropped to 76%.

For insecticides, 2014 was also a rough year. During 2013, this segment had 1% to more than 5% sales increases for 72% of CropLife 100 ag retailers. But in 2014, this percentage dropped to only 45%. Instead, 31% of respondents said their insecticide sales for the year were down 1% to more than 5%.

Editor’s Note: This article was adapted from FCI’s sister publication CropLife®