Three Keys to R&D

What do you consider research and development? R&D often connotes big-budget molecule discovery, but increasingly, it includes heightened investment into intellectual property rights, formulations, and the data necessary for registrations.

What do you consider research and development? R&D often connotes big-budget molecule discovery, but increasingly, it includes heightened investment into intellectual property rights, formulations, and the data necessary for registrations.

Progressive companies are spending more money on R&D than ever before, especially post-patent companies, which are forced to create better products to grow their brands in the marketplace. Discovery companies traditionally invested a greater percentage of revenue back into research, but that’s not the case anymore. In terms of percentage of revenue, the top-five spenders on R&D are post-patent companies. Many companies are spending the 4% to 7% of revenue that multinationals sink into research. This is true for manufacturers around the world. Although, it is important to note that not all companies organize the same business functions under R&D.

UPL is one of the biggest spenders on R&D, investing more than 11% on average. It is increasingly true for formulating companies that began as national distributors, too. Many have grown into regional distributors, formulation experts, and toll manufacturers on a foundation of research. Turkey’s Safa Tarim, for example, reinvests an average of 10% of its annual turnover to feed its R&D. There are dozens of others around the world.

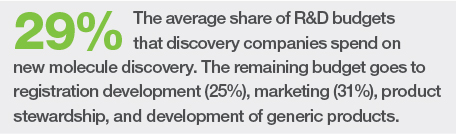

So where is all this research money going? With few exceptions, companies aren’t throwing dollars at the discovery of new molecules like they once did. Notably, Monsanto and DuPont spend twice as much on seed and trait development than traditional chemical discovery. Seed research investment continues to monopolize a greater share of R&D expenditures at Syngenta, Dow, Bayer, and BASF, too, in the wake of fewer new AIs coming to market. Global market share of off-patent products is close to 80%, growing steadily each year for the past 20. Although many pipelines look strong, there are some signs that trend will stabilize in the next few years and perhaps reverse, despite the quarter-billion price tag that comes with discovering a new molecule and bringing it to market.

By and large, research budgets now fund formulation development, intellectual property rights, and collective data needed to support dossiers for registration.

Formulation innovation is today’s competitive battleground.

Product optimization and delivery systems have never been more important as farmers demand for efficacy, efficiency, and specific agronomic solutions to pest challenges. Wettable powders are losing share to wettable granules. Capsule suspensions and microemulsions are becoming more common, and more companies are developing oil-dispersed products.

New delivery systems continue to emerge in an attempt to differentiate products in a crowded market and offer better value for farmers. Brand building is expensive on the back end, but the best brands that deliver value can carry the higher price points necessary in an increasingly commoditized marketplace. The products that seem to be delivering the most value and best prices are mixture products.

Mixture products continue to be a lucrative way to package multiple AIs with the right mix of adjuvants and surfactants to provide agronomic solutions, oftentimes to challenges faced in specific markets for certain crops. The combinations are endless, and so is the ability to create essentially new products for specific uses, which brings us to possibly the fastest growing part of R&D budgets around the world: intellectual property.

Intellectual property rights are the new global currency.

Licensing for proprietary technologies has never been more prolific. As companies compete to offer the best products for consumers, they are increasingly pushed to license best-in-class technologies from competitors to incorporate them into optimal agronomic systems. This is seen most prominently in the seed and trait segment and in mixture products that include patented AIs. It can also be seen when companies buy brands from the original patent holder and continue to work together to optimize the technology, create new products and distribute it.

While patents can pay off, they are expensive, too. Post-patent companies are discovering this more intensely as they invest into the protection of their own proprietary generic products, especially mixtures and patented processes. All manufacturing companies are investing into greater patent protection for processes, both synthesis and formulation technology. Companies then must invest in protecting patents, and generic companies invest in their right to operate when processes are challenged, as well as in protection of their proprietary processes.

The cycle has made IP instrumental in evaluating both product development and market development. It requires 20-year development timelines that begin with evaluating the nature of patents that include discovery, synthesis process, formulation, special protections in certain countries and possible extensions that might arise. And of course, there protections on the data needed for registrations.

The cycle has made IP instrumental in evaluating both product development and market development. It requires 20-year development timelines that begin with evaluating the nature of patents that include discovery, synthesis process, formulation, special protections in certain countries and possible extensions that might arise. And of course, there protections on the data needed for registrations.

Registrations are the lynchpin in deal-making.

Data translates into investments for registrations. Generic companies are making regular investments into GLP data to support their products. GLP laboratories in India are now recognized under OECD, and some large Chinese companies are building their own infrastructure, even some of the larger trading companies are doing so. Some are going the extra step and filing for their own registrations in key markets, or more commonly, partnering with distributor companies to share the cost of registering products.

The grab for registrations is fueling the need for more long-term partnerships between suppliers and distributors. Power in the value chain has shifted to the distributors that hold registrations because they have the market access. Products, generally, are oversupplied and inexpensive. But the data compensation to the original patent holder can add significant cost without data support from manufacturers and additional investments into toxicity studies and field trials. Suppliers and distributors willing to invest equally into the process are positioning themselves as serious partners capable of sustainable market-share growth and continued investment into R&D.

In no small way, the push for registrations, patents and formulation expertise address the broader challenges that companies face in the market, including increased competition, downward price pressure on commodity AIs, the high cost of registrations, and the demand from growers for agronomic solutions.

R&D has become either a limiting factor for growth or a vehicle for expansion. It continues to push reinvestment of profits at higher percentages, but it also establishes companies as viable and desirable partners at all ends of the value chain.