China Price Index: The Way Forward for Chinese Agrochemical Enterprises’ Internationalization

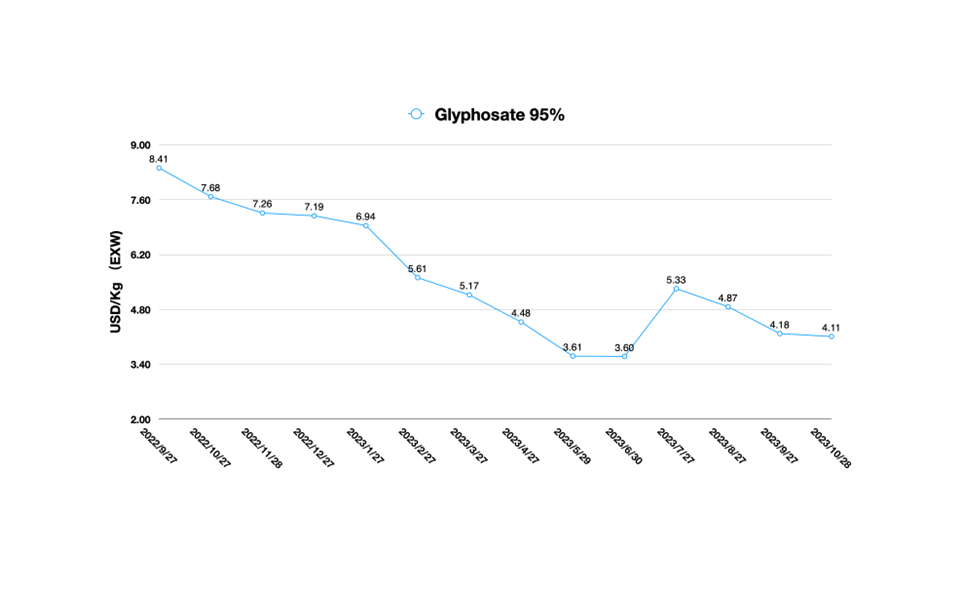

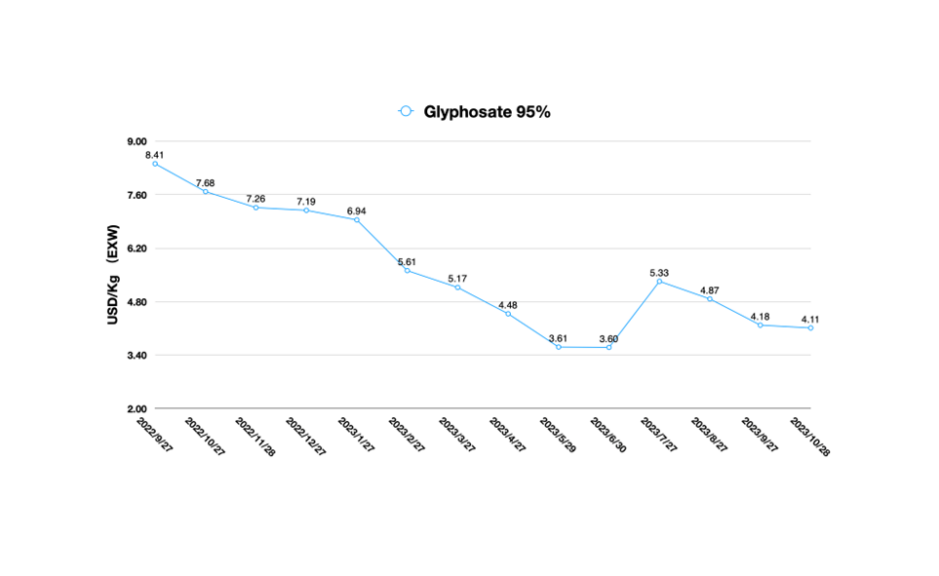

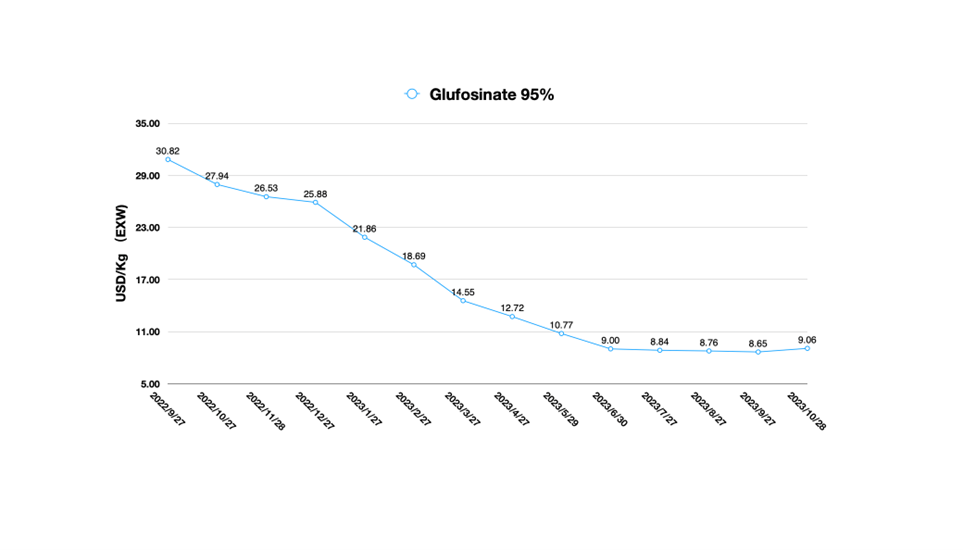

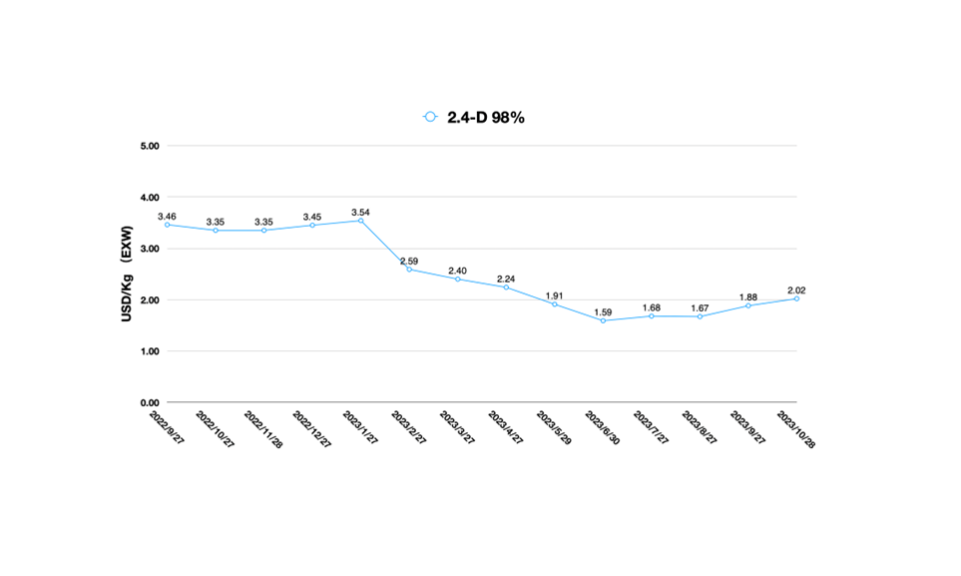

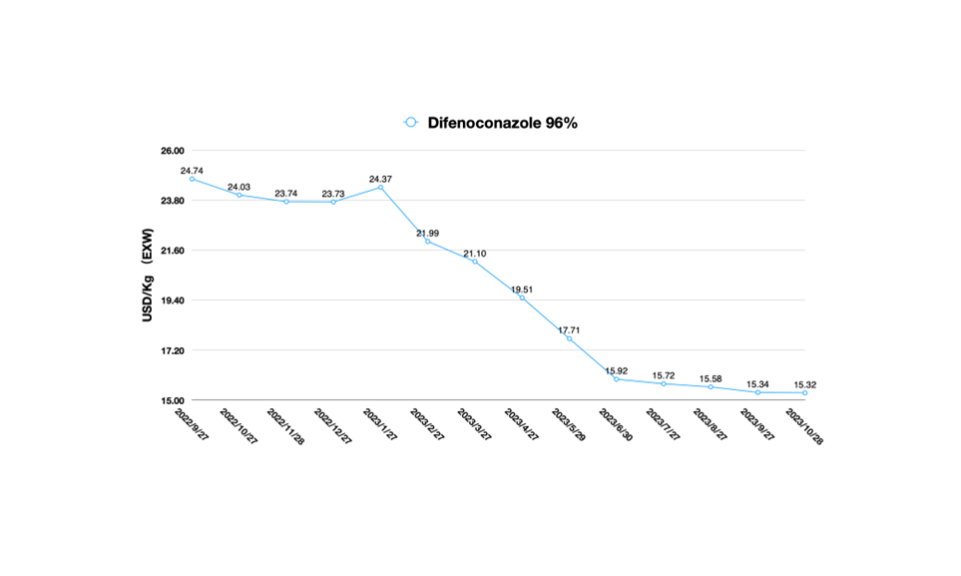

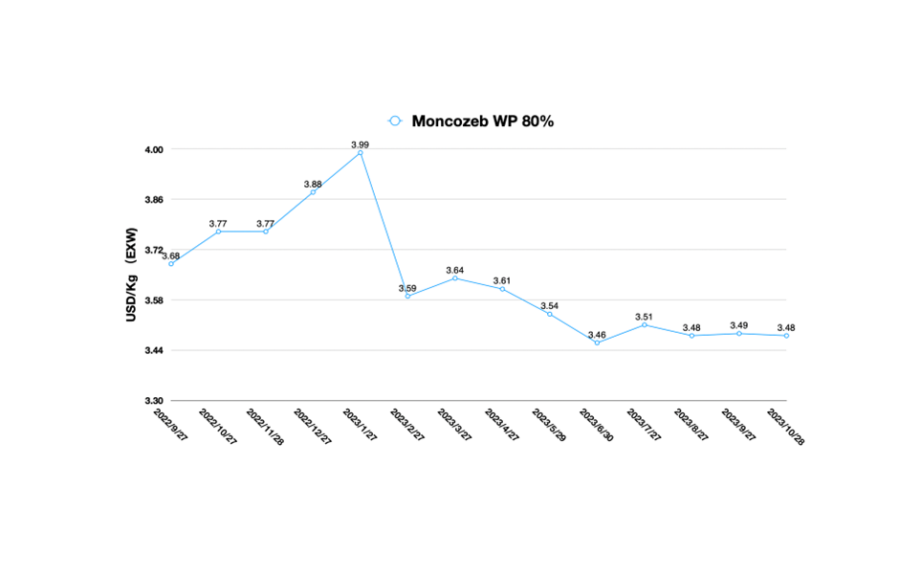

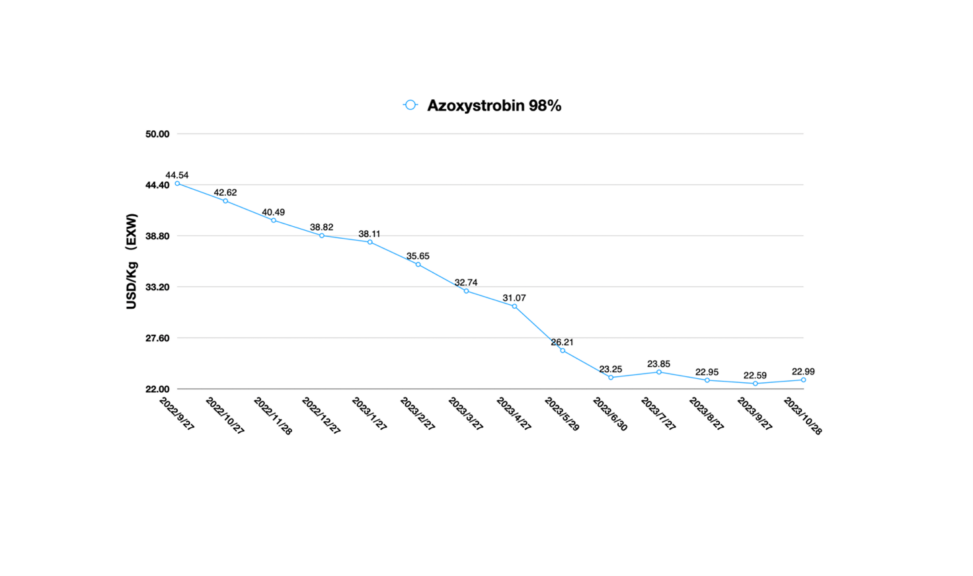

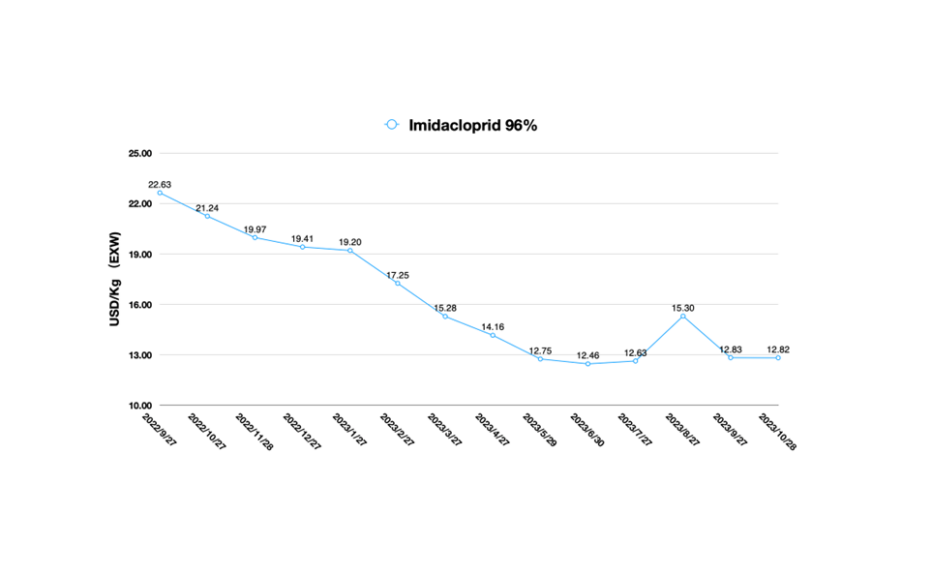

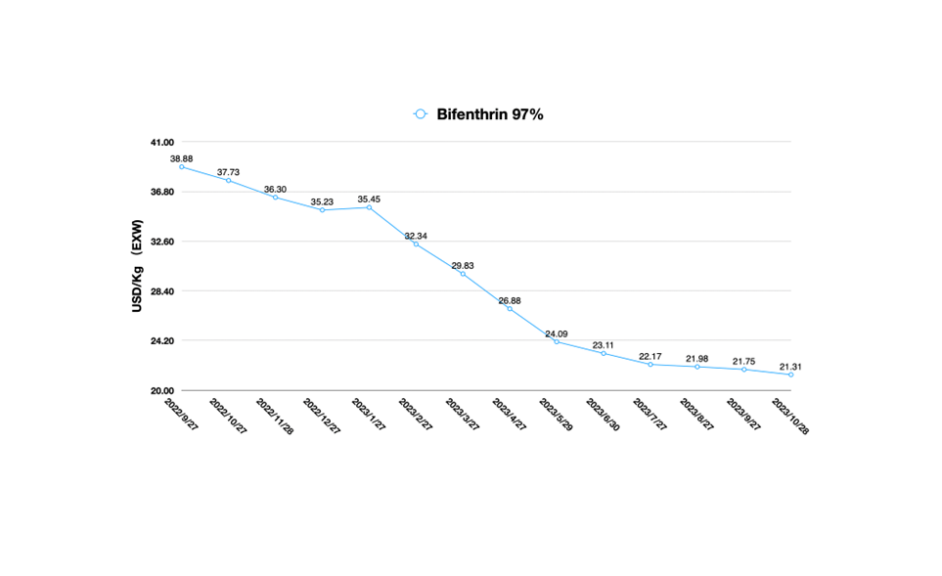

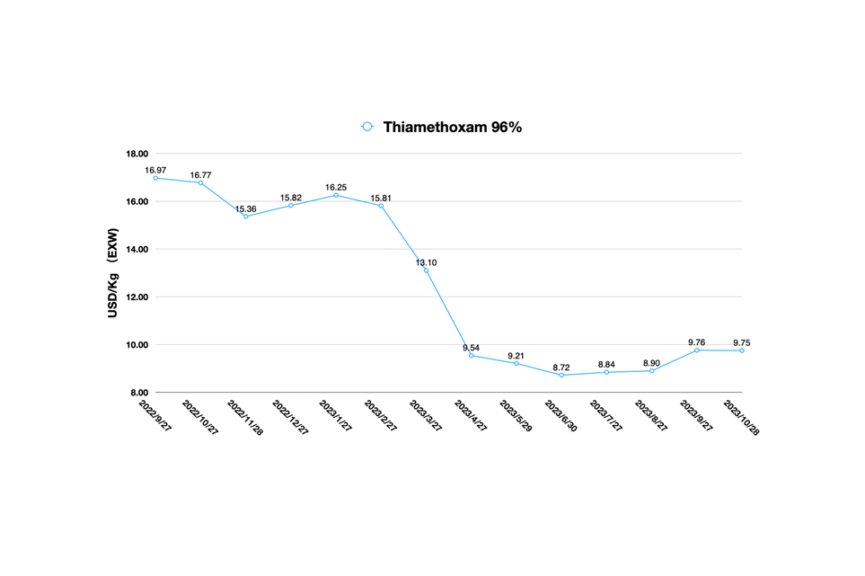

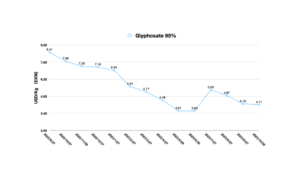

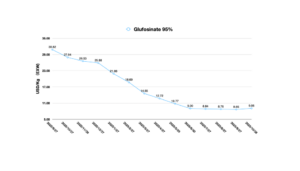

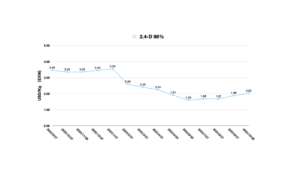

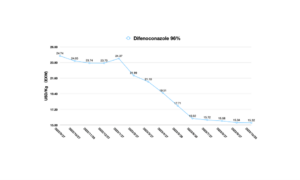

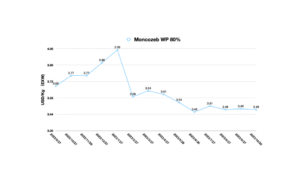

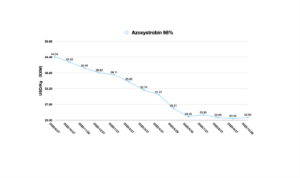

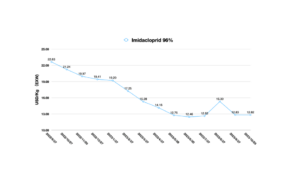

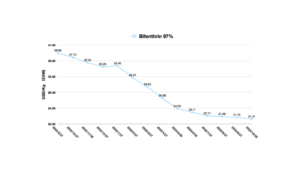

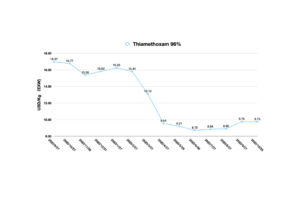

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also provides key insight into why supply chain management will become more difficult for global crop protection companies in the future, mainly because competition in the marketplace is changing faster than procurement teams can imagine.

As the price of active ingredients in China is going down, the shrinking demand is forcing Chinese enterprises to find a better way to link with the world. Over the past decade, the internationalization of Chinese agrochemical companies has been accomplished by cooperation with multinational corporations and national distributors. And the B2B business model has allowed Chinese agrochemical companies to take full advantage of entire chemical industry value creation to meet the global demand for crop protection products at lower product prices.

During this period, enterprises with certain technology can almost set up foreign trade teams at a very small cost, and then deliver products to global customers. This was the model used by almost all Chinese agrochemical producers in those years of supply category and capacity shortages. Today, however, we are faced with a complex international environment and the obstacle of excess capacity. Sales directors with customer resources are becoming less important in the top management inside of Chinese companies. The internationalization of Chinese companies needs to explore a new path, rather than waiting helplessly for the collapse of the industrial price system.

During the past five years, Rainbow’s performance has skyrocketed. In CCPIA’s China Pesticide Industry Sales Ranking, Rainbow was ranked in the top three with its 2022 sales of RMB 14.46 billion (about $2 billion USD). Rainbow’s rise has occurred against a backdrop of rapid acquisition of global product registrations. By consolidating demand for product lines from different countries, Rainbow can gain an advantageous position in supply negotiations with Chinese producers. The biggest sunk cost of this business model is the investment in overseas registrations and the need to holistically manage global demand. But for other Chinese producers, this business model cannot be replicated.

At the China Agrochemical Intelligent Manufacturing Summit Forum, which started on 12 November, Professor Wu Xuemin of the China Agricultural University suggested the intelligent production of pesticides in China should be deeply embedded in the supply chain of overseas customers through “intelligent interfaces.” In the context of global supply chain management shifting to an in-time delivery strategy, “flexible manufacturing” will be able to adapt to the demand of global customers for flexible supply. Combined with accurate demand forecasting, the flexibility and resilience to meet farmers’ needs for multiple product lines can help overseas agrochemical distributors save costs and improve customer satisfaction.

The whole continuous process, automated intelligent manufacturing upgrading, is a future direction for the development of China’s agrochemical enterprises. Intelligent systems such as artificial intelligence in the manufacturing process of accurate management can greatly reduce the human management of product quality fluctuations. Online monitoring system can provide timely feedback on the production of materials in the production process and timely feedback to the intelligent system. Based on the training of chemical scientists for intelligent systems or manufacturing artificial intelligence, process innovation using manufacturing data as infrastructure is possible.

Global registration cannot be evaluated as an asset in the eyes of Chinese investors. In contrast to registration, a virtual investment, the investment by Chinese companies in smart manufacturing overseas, could be a core entry point for the internationalization of Chinese agrochemical companies in the future.

Is the future internationalization of Chinese agrochemical enterprises just a unilateral success of Chinese enterprises? The answer is clearly, no.

The Chinese market is a microcosm. Overseas practitioners often think of China as a “backward” market. This is not the case at all. The Chinese crop protection market is a highly competitive market. In 2022, China’s agrochemical market entered white-hot competition. Patent portfolio positioning is rapidly sinking from a profit-oriented strategy to the mid-market segment. For example, Syngenta’s product line centered on its patented compound, Fluxapyroxad, is squeezing the mid-market for “high cost-effective” products.

In the beginning of November 2023, Syngenta Group announced financial results for the first nine months and third quarter of 2023 at beginning of November 2023. Group sales for the first nine months of 2023 were $24.3 billion, down 6% year-on-year and EBITDA was 22% lower when compared to an exceptionally strong 2022. Its crop protection offerings in China continued to see strong growth in the first nine months of 2023, with sales up 16% year-on-year, benefiting from launch of new technologies.

At the same time, local agrochemical companies in China are actively adapting to new application methods in the field through formulation innovation like drone crop protection. These two factors are forcing generic agrochemical companies, which have long dominated the mid-market, to suffer great pressure on their market share, as the market they once occupied through high quality and reasonable pricing is being eroded.

In addition, these kinds of generic companies often have a hard time making decisions about changes in the needs of the farmer segment. For example, they resist positively changing new application methods (drone crop protection) in the field. ADAMA’s performance in China, faces a different situation. According to the ADAMA’s announcement in China, the market is experiencing oversupply and pricing pressure is impacting both the branded formulation and non-ag sales.

Unlike these two companies, local Chinese formulation producers with advanced manufacturing systems, such as Huizhou Yinnong, China’s first fully automated “black-light factory,” are actively engaged in R&D of innovative formulations with multinational companies to embrace the drone crop protection. They are utilizing fully automated intelligent manufacturing to meet the demand of multinationals for innovative and resilient formulation products. Multinational companies are co-developing innovative formulations adapted to the Chinese market, such as in the field of unmanned aerial vehicle (UAV) crop protection by licensing patented active ingredients to Chinese formulation companies. Novel formulations like OD, DF, and biodegradable CS nano-pesticides have already been applied in the field of UAV crop protection in China’s cash crops, so that these innovative products ensure the profitability of the company. Products coming out of fully automated formulation companies in China can achieve formulation characteristics and field performance that exceed the performance of MNC branded products. This has allowed multinationals to compete in China with a wider and richer range of portfolios.

Here we can ask ourselves, can such an intelligent manufacturing company only exist in China? Or is it limited to the field of formulation products? If we must give an answer to this question, I think the future of Chinese smart manufacturing system should expand overseas. From the production of active ingredients to innovative formulations, the whole process of intelligent manufacturing will be in the form of a system to land in the global agrochemical market.

However, this is not a potential threat to overseas regional distributors, as the core business model of such a smart manufacturing system would be still be B2B. And overseas smart manufacturing systems can help more distributors and multinationals diversify their portfolios and flexibly meet the changing needs of regional customers. The upstream supply chain of agrochemical raw materials is managed through intelligent manufacturing system, while China R&D and production management teams are located overseas to work directly with customers’ supply chain and marketing teams. Focusing on high-quality and high-performance portfolios is the key advantage to achieve sustainable growth. Therefore, a win-win situation is not impossible if the global distributors also want to join the venture into it.