China Price Index: How Leading Chinese Agrochemical Companies Are Investing in R&D, Manufacturing Clusters

The 70th Anniversary Ceremony and Development Forum of Pesticide Science in China Agricultural University (CAU) was held 27-29 October in Beijing, China.

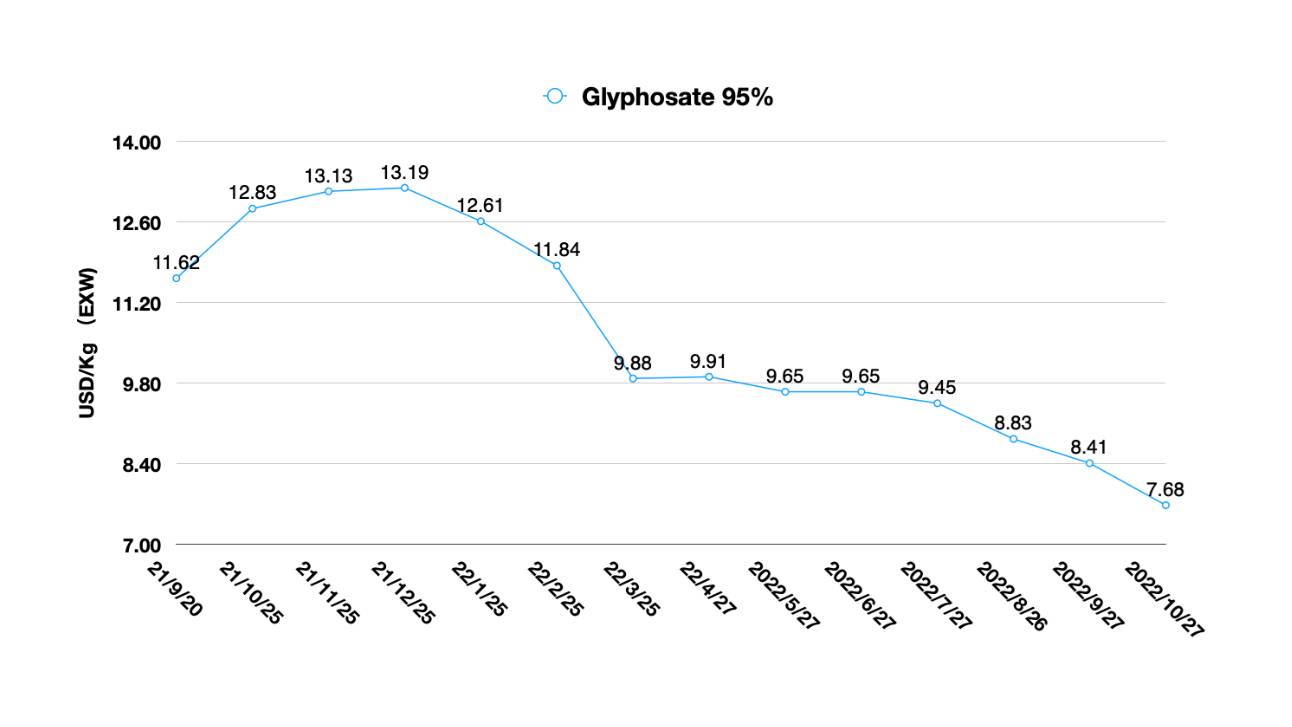

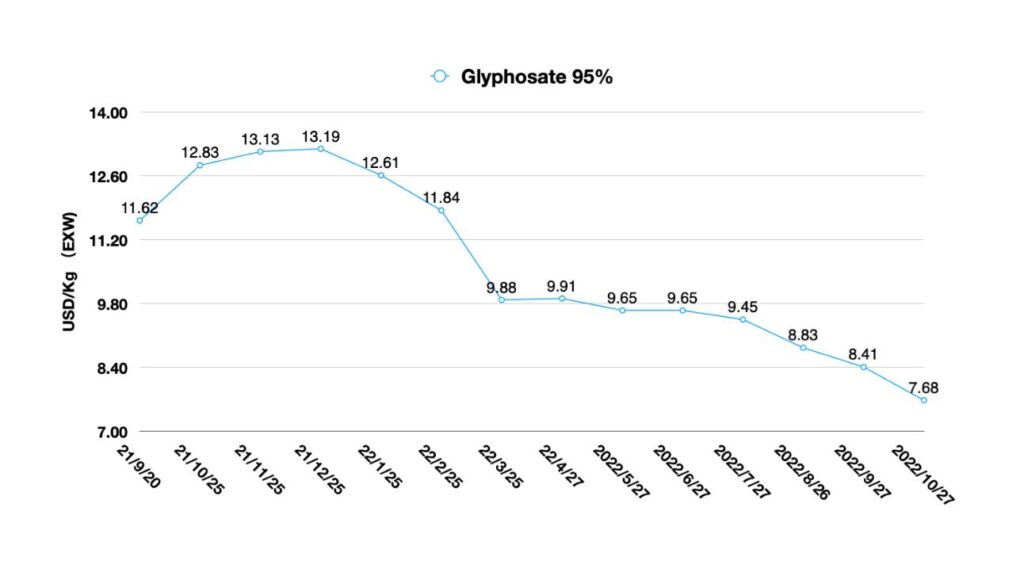

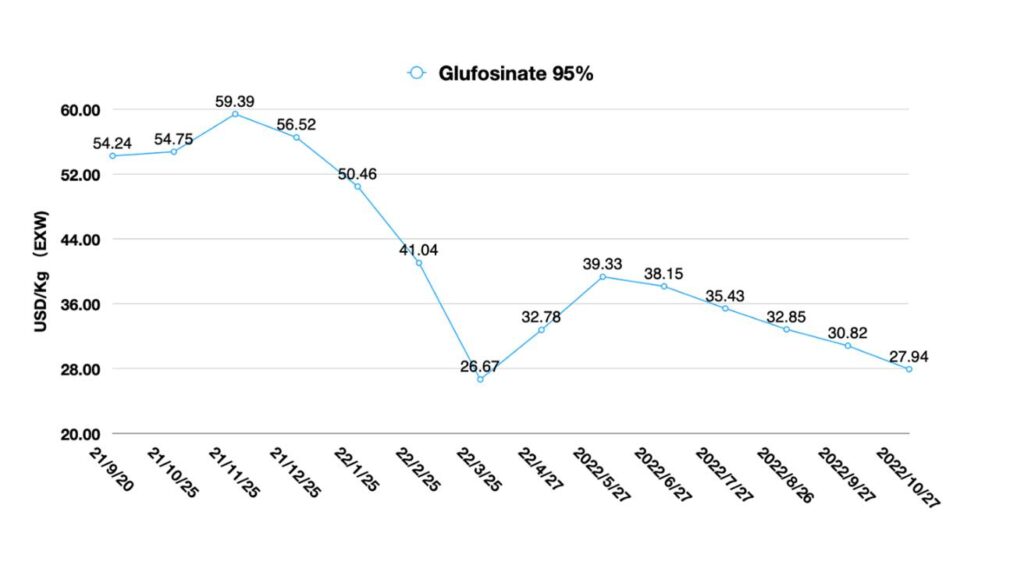

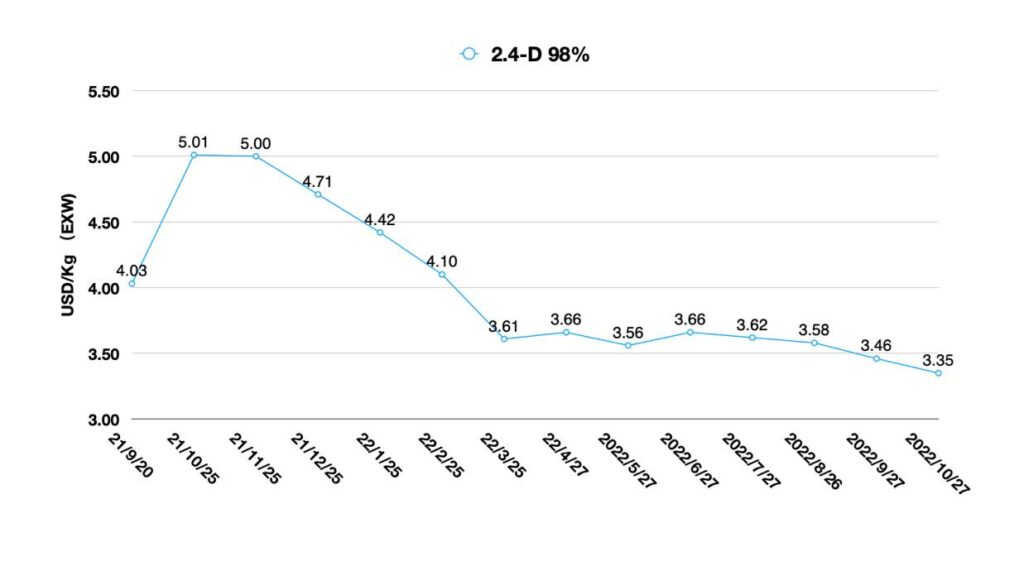

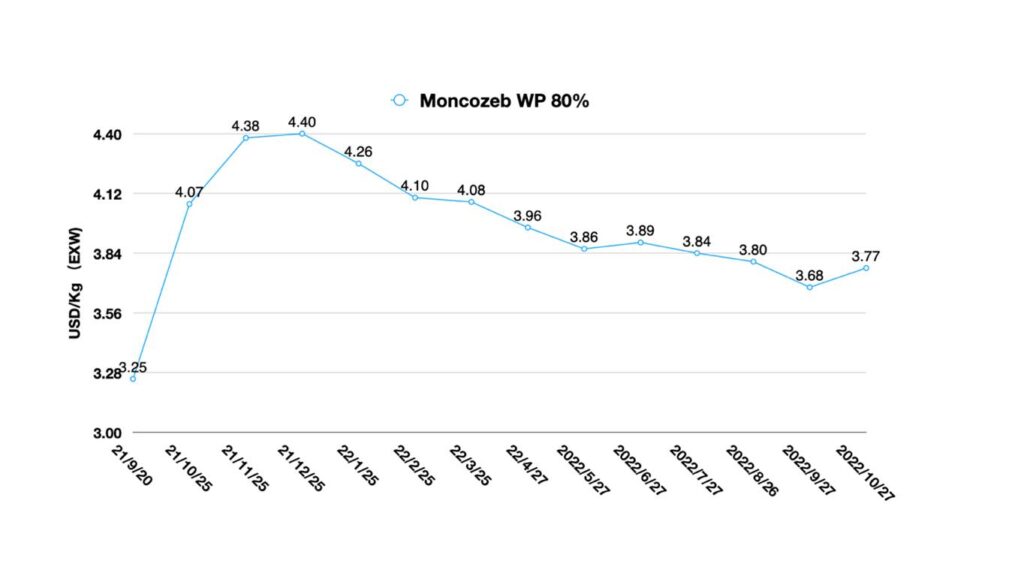

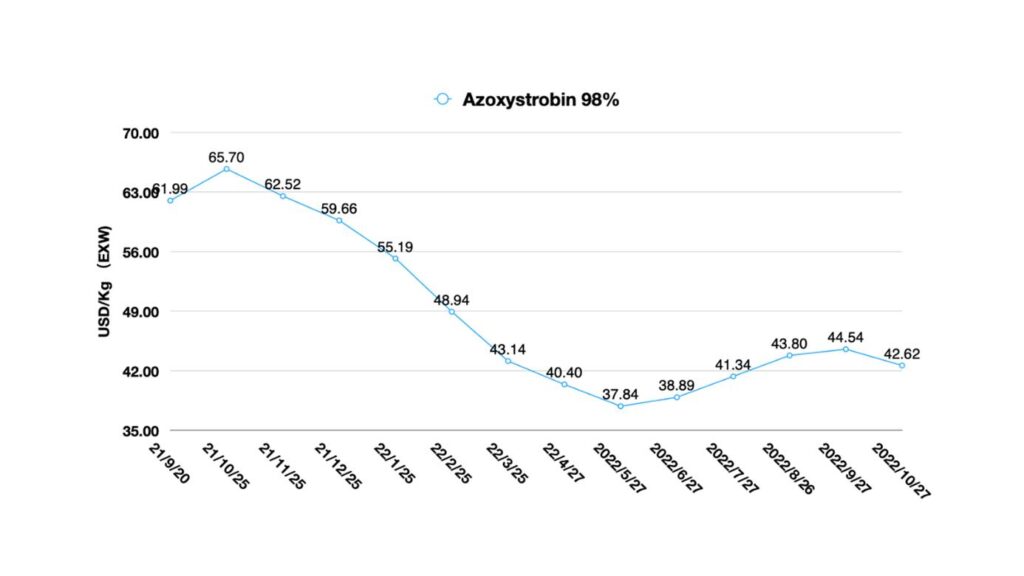

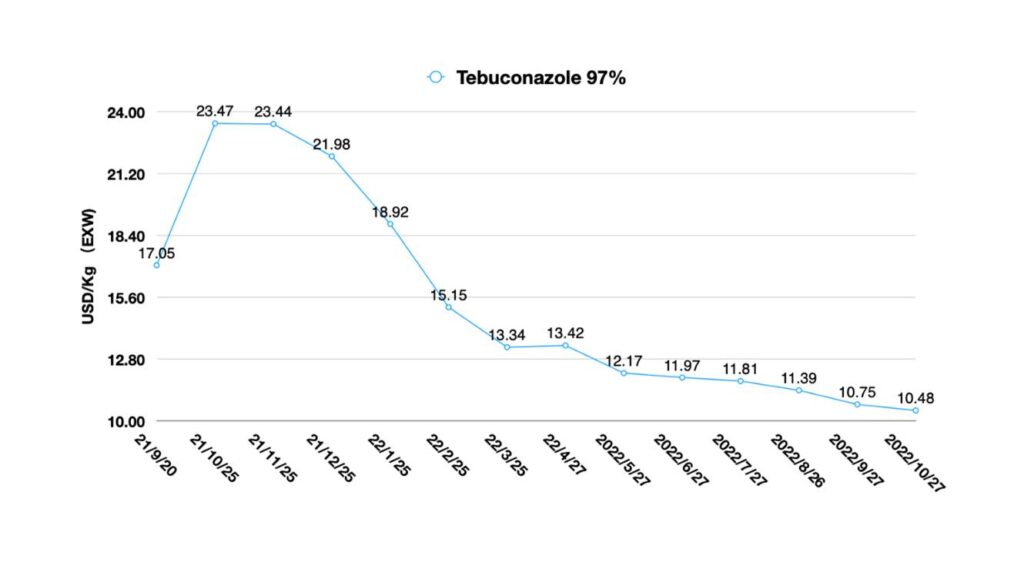

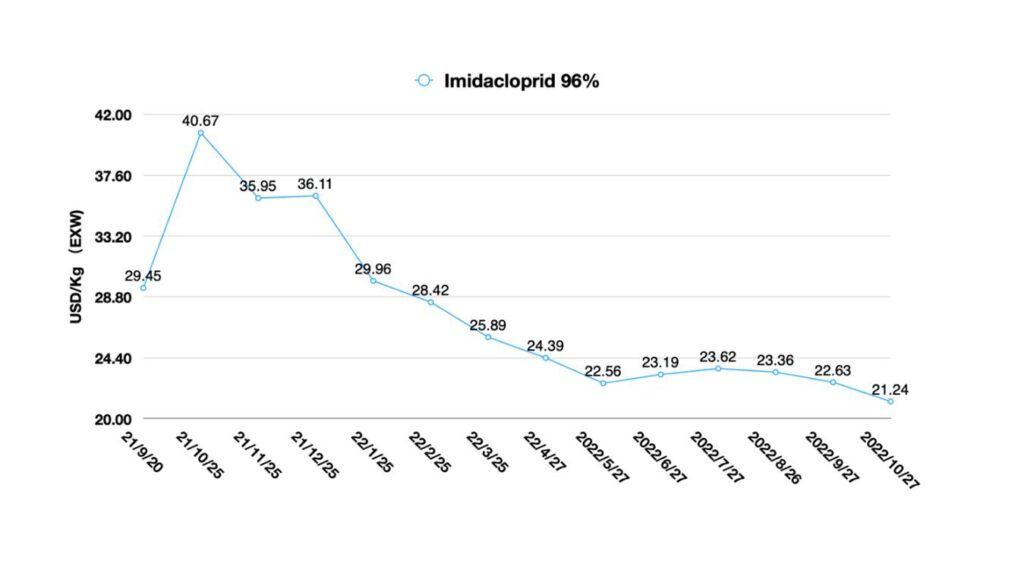

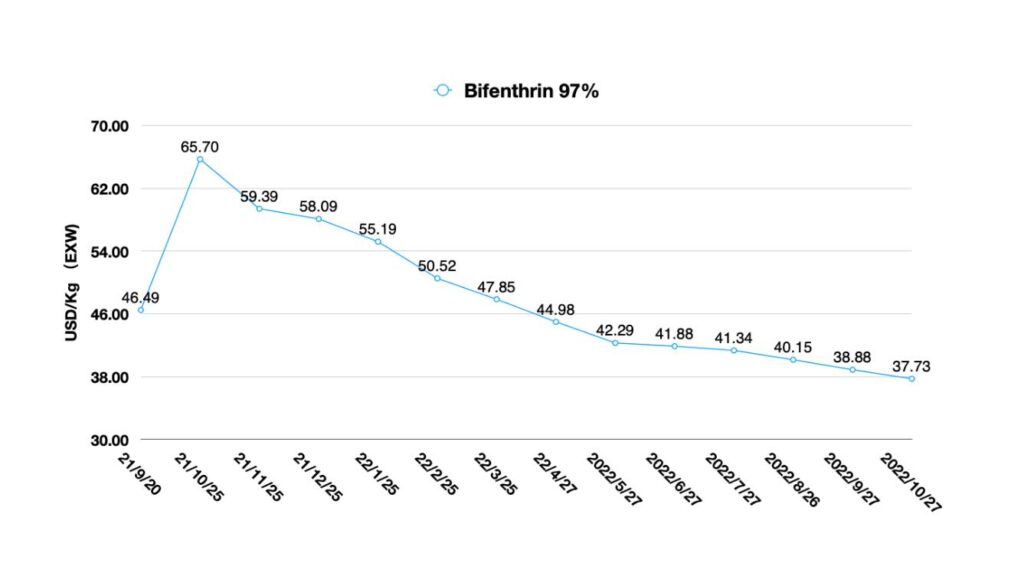

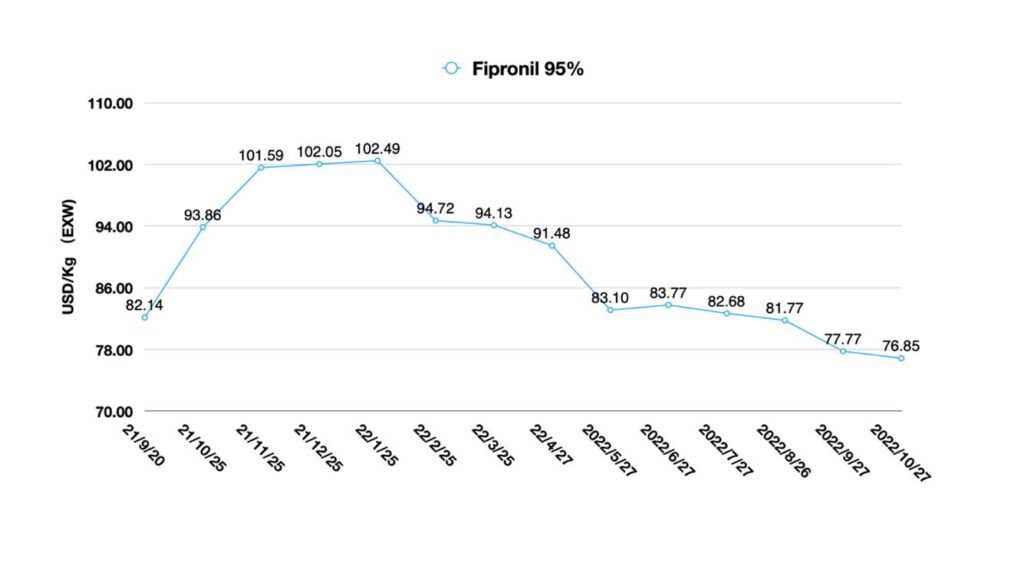

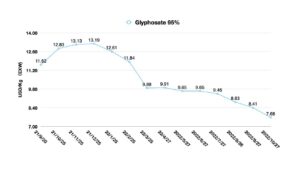

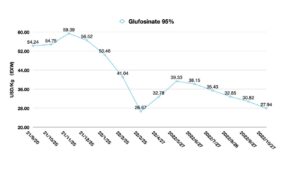

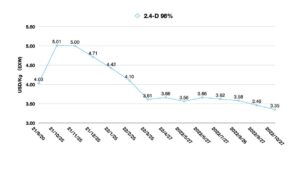

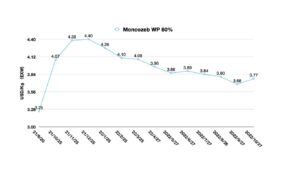

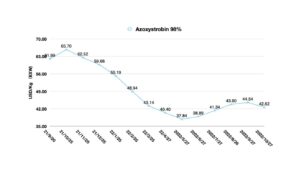

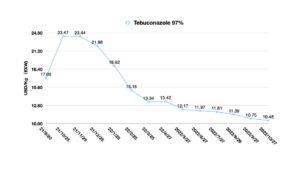

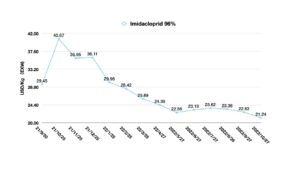

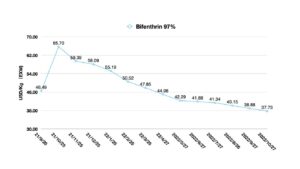

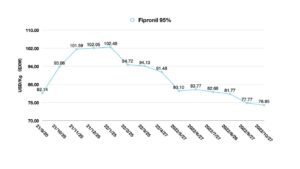

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he provides insight on how leading agrochemical companies are investing in both R&D and manufacturing clusters to develop long-term sustainable growth.

The 70th Anniversary Ceremony and Development Forum of Pesticide Science at China Agricultural University (CAU) was held on 28 October. Pesticide research and development in China was the main focus of the forum. CAU professors discussed how China’s pesticide industry has evolved and how the country has become a vital pesticide production base in the world.

Fuheng Chen and Wanyi Chen, as representatives of the older generation of scientists at CAU, offered positive expectations for the development of China’s pesticide industry and for young scientists who aspire to pursue pesticide research.

During the ceremony, CAU and leading companies including CAC Nantong Chemical, Nutrichem, and the China Crop Protection Industry Association (CCPIA), among others, jointly established the China Agricultural University Pesticide Subject Development Fund to promote the development of undergraduate pesticide education at China Agricultural University.

Professor Xuemin Wu of CAU expressed his gratit

ude on behalf of the pesticide department and expressed his high hopes for the joint development of cutting-edge talents with the companies. Xiuzhu Huang, Director of ICAMA, also reviewed the past decade of pesticide regulation in China and shared a vision of the future for the country’s pesticide industry. Shubao Sun, President of CCPIA, also offered congratulations during the ceremony.

Looking back at the history of China’s pesticide development, it is not difficult to draw a conclusion — talent and R&D have always been the cornerstones. In the early years of People’s Republic of China, Chinese manufacturers started gradually producing organophosphorus pesticides. Around 2000, the Chinese pesticide industry entered a mature phase. Nutrichem, a company founded by alumni of China Agricultural University, transformed the Chinese pesticide manufacturing model from “product-centric” to “customer demand-centric.” It was the illustration of the Chinese agrochemical industry’s capability to upgrade, which was mainly caused by innovation and hard work in the labs with huge contributions from young scientists trained at CAU. Nutrichem focused its investment on R&D by optimizing chemical synthesis routes in the laboratory, improving processes, and increasing the efficiency of production at scale. Its advanced customer service concept is still being studied by many Chinese agrochemical companies.

Overall, the Chinese pesticide industry is characterized by being large but not strong. Over the past 20 years, globalization of the supply chain driven by multinational companies shifted the production of mature and long-tail pesticide products, which the Chinese chemical industry supported. China become a world manufacturing base for pesticides during these two decades.

However, corporate investment in R&D over the past decades has been at a rudimentary level, and the industry is still under-invested in life sciences and basic chemistry. For historical reasons, Chinese pesticide companies have relied more on third-party universities or research institutions for R&D. Although this kind of R&D has had a relatively long tradition, its path to commercialization was too long to control the risk of future market sales. As a result, many innovative products miss the best timing to enter the market.

Chinese pesticide companies also rarely launch intellectual property portfolios on the international market. After replacing East Asian manufacturing hubs such as Japan and Korea as the main pesticide producers, companies with super capacity have gradually taken a favorable position in the upstream chain of multinational companies. On the other side of coin, the scale of production capacity soon became the only competitive advantage in the Chinese market. It can be argued that the lack of investment in R&D has led to Chinese pesticide companies being unable to make excessive profits in the blue ocean market and investing in huge capacity in the short term to build up their moats, which is one of the reasons for the overcapacity in China.

Currently, China’s pesticide industry needs an integrated innovation ecology. Innovation in China’s pesticide industry is still concentrated in two areas.

One is in R&D institutions, and the other is in enterprises. The R&D institutions have a solid innovation base, but they are distant from the market and operational mechanisms of go-to-market are not efficient, which makes it difficult to create patent AIs or innovative formulation products that are highly compatible with market demand. On the other hand, enterprises’ own R&D is mostly aimed at process optimization, improving atomic utilization, and reducing waste emission and energy consumption through process route research and impurity research for future projects. In general, cost reduction and maintaining efficient operation of large-scale production are the key objectives of enterprise R&D.

To compare the innovation ecology of the agricultural and food sectors in the U.S., capital support, talent platform, and collaboration of listed companies are the three elements necessary for a successful project. Retired executives from multinational companies who have worked in R&D, marketing, and supply chain provide advisory services to start-ups. Before start-ups are created, the founders should try to match with the R&D gap of listed agricultural or multinational companies. This approach allows for a rational allocation of resources in the agriculture and food sectors and for the use of an innovative ecosystem to jointly support the development of start-ups. Multinational companies can share first-hand market demand with start-ups; start-up teams also have access to support from the innovation incubator.

In addition, investment in start-ups has a clear exit pathway — M&A or going public. This virtuous systemic cycle provides a steady flow of innovation to multinational companies, which complements their product lines and competes globally. Investments in the global agriculture and food sectors are being matched to multinationals like Lego blocks and are growing in performance.

Chinese pesticide companies face an important crossroads in 2022. Against the backdrop of high stock levels for global agrochemicals, where are the future growth points for companies? For resource-based companies, like glyphosate producers, a continuous and stable supply based on mineral resources will be their top priority. For companies with process enhancement and new molecule innovation as growth points, the market competition will be more complex for such China manufacturers.

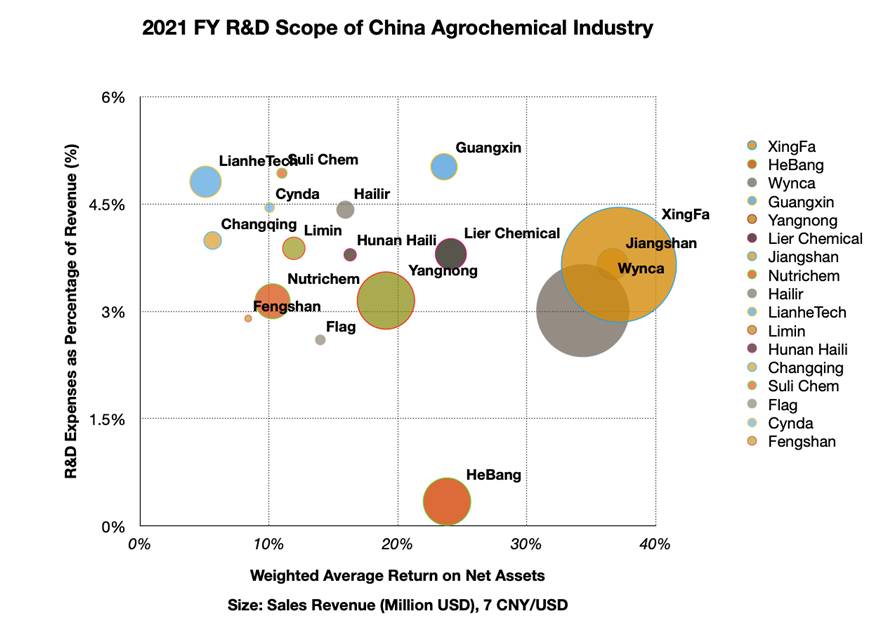

The more focused a Chinese pesticide company is on a niche market, the more it invests in R&D. After more than 50 years’ development, China’s agrochemical industry annually invests on average 3.62% of revenue on R&D. Among stock-listed agrochemical manufacturers shown below, manufacturers’ total 2021 R&D expense amounted to US $619.84 million. The strong investment in R&D resulted in the green process enhancement on new capacities, near off-patent AI R&D, and patent AI development.

One notable trend in the direction of investment by Chinese agrochemical companies is the increase in investment in regional circular clusters. The advantages of integrated manufacturing clusters will far exceed those of chemical parks. With leading enterprises as the driving force, integrated manufacturing clusters combine upstream raw material resources with downstream fine chemical production to form a complete industrial value chain.

According to BASF, the company is currently building a new Verbund site in Zhanjiang, Guangdong province. Announced in July 2018 and officially commenced in November 2019, the project would be BASF’s largest investment with up to €10 billion by 2030. The site would ultimately be the third-largest BASF site worldwide, following Ludwigshafen, Germany, and Antwerp, Belgium. Zhanjiang City supports and develops the construction of new capacity for BASF upstream and downstream. Their aim is to create a global level manufacturing cluster with access to China’s world-leading consumption market.

Leading Chinese agrochemical companies are learning from trends. CAC Nantong is willing to build an industry cluster in the industrial park where the company is currently located. In October 2022, Jiangshan signed an Agreement of Intention to invest and cooperate with the government of Wongan County, Guizhou Province, and WongFu (Group) Co. Jiangshan will invest and build a phosphorus chemical recycling integrated industrial project in the Fine Chemical Park of the Wongan Economic Development Zone, to create its third domestic production base. At the end of 2020, CoreChem started cooperating with new strategic investment partners, Zhejiang Longsheng Group and Safe & Rich Venture Capital, and established in-depth cooperation in technological innovation with Shaoxing Research Institute of Tianjin University. CoreChem joined the chemical pr

oduction cluster offering strategic cooperation with a stock listed chemical company in Zhejiang.

Even though different companies have different ways to maintain an advantage in the industry value chain, there is a more important factor for Chinese agrochemical companies. That is to figure out the sustainable position of global crop protection for the Chinese agrochemical industry.

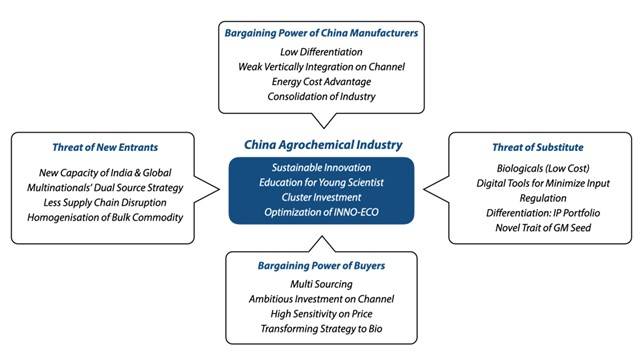

Porter’s Five Force analysis of China Agrochemical Industry.

The Porter’s Five Force analysis of China Agrochemical Industry could provide a quick glance at the operating environment of the competition of crop protection market. For the long-term sustainable growth of Chinese agrochemical companies, the R&D investment should be strengthening. Sustainable innovation needs to be formed by optimizing a robust innovation-ecosystem. It could be different from the U.S.’s innovation-based ecosystem. “Starting from the end” might be a good place for Chinese companies to start. The manufacturing marketing team should lead the innovation by tightly monitoring market trends. It would be fundamental to face new competitive rivalries around world. In 2023, biological products will have a greater market share. Multinational companies could focus more on managing their patent products. New seed traits will address more of the risks in the field. Digital technology and changes in laws and regulations will lead to an accelerated reduction of compounds in the field. Many challenges will increase the pressure on the future performance of China agrochemical companies.

Chinese scientists attending the 70th Anniversary Ceremony of Pesticide Science in China Agricultural University (CAU) provided author David Li with confidence on the future of Chinese supply.

The “China plus One” strategy for procurement teams is not really a crisis. It will reinforce the need for further cooperation of China’s agrochemical players. Chinese suppliers, CCPIA, and governors overseeing China’s pesticide industry would take more time to guide companies towards more accurate and efficient organizational strategic changes in response to the changing environment.

In 2022, China’s economy has been heavily influenced by COVID-19. China’s GDP growth reached 3.9% year-on-year in the third quarter of the year. The whole Chinese economy recovered to a weaker extent due to the recurring impact of the domestic pandemic. De-propertyisation and the creation of a sustainable economy built through innovation are happening in China. The rebound in infrastructure, especially within the chemical industry, empowers the country’s development.

As a young person in the crop protection industry, Chinese scientists attending the 70th Anniversary Ceremony of Pesticide Science in China Agricultural University (CAU) provided me confidence on the future of Chinese supply. Like Chinese ancestors always said, when the new Spring Festival comes, there will be always some new seedlings emerging from the soil.