Biostimulants Continue Their Meteoric Rise

In the world of crop inputs, biostimulants seem to be the popular and cool new kid that everyone wants to be friends with. The excitement that surrounds the nascent biostimulant market also comes with confusion and some serious competition.

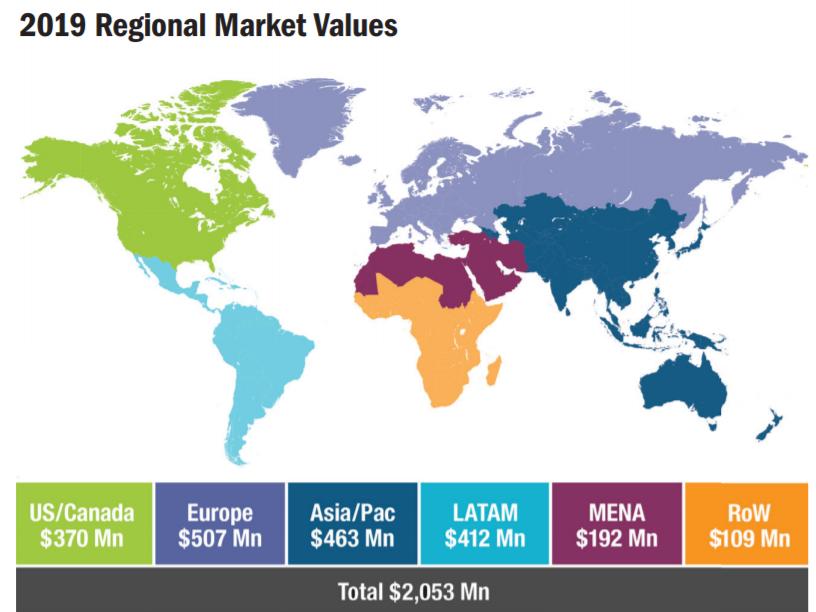

In 2019 the biostimulant market edged past the $2-billion mark, according to study from DunhamTrimmer, a leading market research firm in the biologicals space. Nearly a quarter of the market is based in Europe, which accounted for $507 million of the total. The Asia/Pacific region ranked second at $463 million followed by Latin America at $412 million, the U.S./Canada at $370 million, and the Middle East/North African region at $192 million with the rest of the world accounting for the remaining $109 million.

Source: DunhamTrimmer LLC

And with double-digit growth expected for the next decade, it’s little wonder companies around the world have taken the opportunity to join the biostimulant party.

“The biostimulant market is enjoying a more-healthy moment,” says Manel Cervera, Managing Partner with DunhamTrimmer. “The market is growing in double digit numbers and at an accelerating pace and will for years to come.”

There are still challenges accompanying biostimulants — a lack of a universally accepted definition, regulatory challenges, lack of understanding about how the products work — to name a few. Despite the challenges, plenty of companies continue to invest in these plant and soil health products.

“It’s an exciting place to be at the moment,” says Arne Pingel, Syngenta’s Global Marketing Lead for biostimulants. “Biostimulants are growing strongly. They’re moving more and more out of the snake oil corner into being reputable products.”

Syngenta sold its first biostimulant product, ISABION, some two decades ago in Spain and Russia. The product, which is still the company’s best-selling biostimulant, is especially rich in amino acids and peptides and helps specialty and vegetable crops overcome abiotic stresses like transplant shock and cold.

There are a number of factors contributing to the segment’s growth. Traditional crop inputs have faced unrelenting pressure from regulatory agencies and consumers concerned about where their food comes from and how it’s grown. Research that has deepened the understanding of modes of action and field trials that prove efficacy have pushed biostimulants from the realm of anecdotal hyperbole and worked to put it on equal footing with traditional crop inputs.

Science

Though much of the research supports claims made by manufacturers, there remains some reluctance among some growers.

“Every farmer that I’ve ever run across, no matter where it is in the world, everyone comes from Missouri (the Show Me state) — ‘I want to see how it performs,’” says Dan Custis, CEO at Advanced Biological Marketing, a develop, manufacturer, and distributor of agricultural biologicals.

Corey Huck, Head of Biologicals at Syngenta, agrees the science is important, but suggests more can be done.

“Good science is the way to the market,” Huck says. “Unfortunately, in biologicals, that’s not always the case. There’s opportunity to bring better science here.”

John Wolf, Senior Director of Innovation at Agricen, agrees that while strong science supports biostimulants’ value, there is still more to learn.

“When we’re looking at an herbicide, there is a very specific mode of action,” Wolf says. “However, many biostimulants can affect multiple plant processes, so while we can narrow down the mode of action and the ultimate benefit, we need to continue to discover how biostimulants interact with each other and other tank mix partners.”

Investments

With sound science and double-digit growth expectations, it’s no wonder biostimulants are seeing a surge in resources.

Cervera says the investment is still in the early stages. “We haven’t seen the big movement like we’ve seen in the biocontrol industry.” Biostimulants bring the potential for “high profitability” along the whole value chain, he says, which is why many biostimulant companies are more receptive to those investments even if means giving up some control of the company.

“If they want to survive, to keep growing, they need to invest more in research and development,” Cervera says. “They need to invest more on getting to market. Invest more into R&D. To date, that has been a challenge. They need to gain more financial muscle.”

Biostimulants are growing on the backs of some pretty fundamental market drivers, Huck says. Those include consumers looking to understand more about the products that are used to raise their food and “some really good science is starting to come to biologicals.”

Right now, the biostimulant market is about $2 billion globally.

“We see that growing at a compound annual growth rate of around 9% to 10% for the next 10 years at least,” Huck says. “It’s a market that’s providing a lot of growth and opportunity for us to expand our portfolio.”

Markets

The market for traditional crop inputs has gone through a series of consolidations leaving the industry with a few big players along with many small- to medium-sized companies. In contrast, biostimulants comprise a fairly fragmented market.

“It’s pretty fragmented with a lot of small players that are trying to get their widget, for lack of a better term, into the marketplace,” Wolf says. A lot of small companies have developed technology, but they’re not sure how to get their products to the grower. It’s a little crowded because there’s a lot of ways to approach this market today.

“We’re starting to see some players develop more integrated solutions that source across a broader spectrum of product technologies, and I think this is a really positive development for the grower.”

To date, biostimulants have found the most favor among growers of specialty crops. According the DunhamTrimmer’s recently released Global Biostimulant Market Report report row crops and cereals growers are starting to show more of an interest.

“Row Crops & Cereals will be the fastest growing Crop Group segment globally as well as in each individual Region,” the report says. “The main factor favoring this growth is that this segment accounts for the majority of the world’s agricultural area and, until recently, was slow to adopt biostimulants. In-field development carried out by many biostimulant companies has generated more data and knowledge about the benefits of these products in extensive crops. Concurrently, row crop and cereal growers and their technicians are trying to adapt biostimulant products and technologies to conventional management practices and seeking greater replicability of the results and a favorable ROI.”

That ROI is being seen around the world. Both governments and growers are starting to realize the value biostimulants bring to the supply chain.

“In India there are discussions about how to reposition biostimulants so that the grower is protected, the consumer is protected by having only high-quality products coming to the market (and is safe and effective),” Pingel says. “The discussion has started. It’s an avalanche.

“Climate change is a topic here that’s driving all these discussions,” Pingel continues. “Adverse growing conditions, growing population — we need to feed more people with the same or less area. Science, governments (legislation) as well as the industry — growers and consumers are realizing this is making agriculture more sustainable than it is already.”

South America is another hot spot for biostimulants.

“Brazil has been open to a lot of these products for a long time,” Custis says. “But as a biopesticide the regulatory system there is probably a lot harder than what we face in the U.S.”

ABM is working with companies to have its products distributed in Brazil, Peru, and Argentina.

Regulatory

While no globally accepted definition exists, every country or region, or in the case of the U.S., every state must decide what constitutes a biostimulant. That lack of definition has, in the past, made it easier for unsavory actors to sell products that don’t work and can cause problems for genuine players.

Countries that define and regulate biostimulants, require testing and proof of efficacy, have added legitimacy to the field.

“They’re making it easier for products that have quality to bring added value for the grower,” Pingel says. “In the past, everybody could come in and register and sell. Now you need to prove that you are safe, and that you bring added value to the grower.

“This is led by changes in legislation in Europe. The EU commission is bringing out legislation that will change the market — separate the wheat from the chaff. The good things will stay and those overpromising and under delivering will be leaving. In the U.S. we see similar legislation changes.”