Middle East and North Africa: Embracing Modern Solutions to Ensure Better Food Security

The Russian invasion of Ukraine is having negative impacts on a global scale. For the Middle East and North Africa (MENA) region, the war is worsening an already bad situation of food insecurity.

In Egypt, where bread is one of the staple foods, the country imports 80% of wheat from Russia and Ukraine. In 2020, Egypt imported 8.2 million tonnes of grain from Russia alone. With the invasion, which has triggered a surge in controls on food export across the globe, the country faces skyrocketing prices for grain, making it unaffordable for Egyptian consumers.

This situation is not unique to Egypt. Across MENA, the largest food importing region in the world, the perennial challenge of food insecurity is deepening. Notably, on average more than 50% of the food consumed in the region is imported. In some countries, like the United Arab Emirates, 90% of food needs are met by other countries.

World Bank data showed that in 2020, MENA’s share of the world’s acutely food insecure people was 20%, which was disproportionately high compared to its 6% share of the population. In retrospect, more than 55 million of its population of 456.7 million was undernourished. The situation is dire in countries grappling with conflict like Yemen and Syria.

“We are extremely concerned about the millions of people in this region who are already struggling to access enough food because of a toxic combination of conflict, climate change, and the economic aftermath of COVID-19,” says Corinne Fleischer, World Food Program Regional Director for the Middle East and North Africa.

She adds that the knock-on effect of the Ukraine crisis is adding further strain to the import-dependent region with the prices of wheat flour and vegetable oil — two key staples in the diet of most families — rising across the region. Cooking oil is up 36% in Yemen and 39% in Syria. Wheat flour, on the other hand, is up 47% in Lebanon, and 15% in Libya.

“The MENA region continues to face an ongoing food crisis that has translated into increases in food prices and at times civil unrest. This has led to the urgent need to improve food security,” says Dr. Samira Amellal, Director General, CropLife Africa Middle East.

She adds that with high rates of population growth combined with severely constrained water and land resources, dependence on imports will continue to increase unless governments put in place measures to address food security and ensure reliable and consistent national food supplies.

EMBRACING MODERN SOLUTIONS

For the region, it is becoming increasingly critical to adopt modern plant science solutions and embrace the use of innovation and technology for a more sustainable model of agriculture to improve the incomes and livelihoods of farmers and contribute decisively to food security.

This is critical for the region where the agricultural land base constitutes less than one-quarter of its total land area, a majority of which is arid and semi-arid. Moreover, while agriculture is largely rainfed, the region is rain deficient, a situation that has been worsened by climate change.

Researchers reckon that as global warming becomes more severe, the MENA region will become drier with reduced and more unpredictable annual rainfall. Besides more extreme weather events becoming more frequent, huge masses of the region’s agricultural land areas will no longer be suitable for crop cultivation.

“The increasingly dry climate forces small farmers in the region to rely more on irrigation, fertilizers, and chemicals to maintain strong yields,” notes Mohammed Tazrouti, Campaigner at Greenpeace Middle East and North Africa.

To meet its food needs, the crop protection industry is increasingly becoming critical to the agricultural sector in MENA. The contribution of the agricultural sector to the overall economies varies significantly among countries in the region.

In Morocco, for example, agriculture accounts for a 12% share of gross domestic product (GDP) and for 33% of employment, whereas in Egypt it represents 11% and 21% respectively.

On average, the sector’s contribution to the total GDP of the region is around 13% and provides a means of livelihood for about a quarter of the population.

Market intelligence data shows the value of the agrochemicals market in MENA stood at $18.4 billion in 2021 and is projected to expand at a compounded annual growth rate of 2.8% to reach $21 billion over the next five years.

The level of agrochemicals consumption varies across countries and is mainly driven by the level of agricultural activities in each country. In North Africa, Egypt is the biggest market followed by Morocco, Algeria, and Tunisia. In the Middle East, Israel, Jordan, Iran, and Bahrain are some of the top markets.

Across the region, smallholder farmers are at the heart of food production. While they produce the bulk of domestic supply of staples, they are among the most vulnerable due to the impact of climate change, pests, and diseases. Challenges of low productivity and declining yields due to lack of access to affordable inputs are also rampant.

“Pests can contribute up to 40% crop losses if not managed while climate change can result in 100% of losses, if we don’t bring innovations that withstand the impacts of climate change like drought and pest tolerant varieties,” says Amellal.

Climate change and desertification make pests and crop diseases a more severe menace to farmers. Across the region, foot rot and fusarium diseases, leaf blight, and Septoria are main concerns for cereal farmers. For fruits and vegetables farmers, the various diseases that are of concern include powdery mildew, downy mildew, early and late blight amongst others. Similarly, various insects infest all crops with the most common being caterpillars, aphids, white fly, and thrips, among others.

To offer solutions, the MENA region has become a critical market for agrochemical manufacturers, distributors, and retailers. The region has attracted leading global and homegrown manufacturers of pesticides, seeds, and biotechnology products that are committed to offer farmers sustainable, innovative, and science-based crop protection solutions not only to keep crops healthy but also contribute in providing safe, affordable, healthy, and sustainable food supply.

This is evident by the farming practices in MENA. Given that the region is largely arid, farmers’ need to use minimum tillage farming systems. This means they require spray equipment to apply broad spectrum herbicides before planting to conserve soil moisture.

Governments have not managed to expand irrigation substantially, so farmers are forced to depend on seed technologies that are tolerant to water stress. Moreover, weed control is very important especially in the early stages of crop development to avoid competition from the weeds. In effect, quality herbicides are required, and farmers must avoid herbicide resistance by using reduced application rates. This is especially important in cereals and potatoes.

For companies offering solutions in the region like BASF, Bayer, Corteva Agriscience, FMC, Sumitomo Chemical, Syngenta, and Nufarm, among others, the onus is ensuring farmers have access to quality and affordable products. This is critical because many smallholder farmers in the region do not have sufficient finances to apply anywhere near the optimum level of fertilizer that is essential for better yields.

DISTRIBUTION, REGULATORY CHALLENGES

Despite having a retinue of multinationals and homegrown agrochemicals companies, the MENA region is largely a net importer of crop protection products. Most countries import ready formulated products from countries like China, India, Germany, Italy, Spain, France, and Belgium while a few advanced countries like Morocco, Egypt, and Israel import the technical ingredients to formulate products locally.

Data shows that Egypt, one the biggest crop protection markets in MENA, for instance, imported 9,000 tonnes of agrochemicals in 2018. Some 23 companies, among them Chema Industries, StarChem Industrial Chemicals, and CAM Agrochemicals formulate and repackage pesticides in the country.

“Access to innovative products will help turn around the impact of climate change while the close proximity to Europe provides an inviting market for products,” says Amellal.

For this to actualize, however, the region must improve the distribution networks to ensure products reach farmers. In addition, manufacturers need to ensure that they play a key role in the stewardship of products with special focus on smallholder farmers. This calls for investing in sustainable stewardship programs.

On investing in innovative and proper distribution channels, manufacturers and distributors have no options. Notably, one of the key challenges that the industry is currently facing is the impact of foreign policies, specifically the European Union (EU) Green Deal that puts a big emphasis on sustainable food production and systems.

Morocco, for instance, is a major exporter of fruits and vegetables to the EU market. In 2020, the country exported 1.4 million tonnes of fruits and vegetables to the bloc raking in $2 billion. “Widespread use of agrochemicals limits the ability of some MENA countries to export particularly to the EU,” says Tazrouti.

Apart from foreign policies, contagious civil unrests have not only impacted access to inputs for farmers by disrupting distribution channels but have also led to cost increases. The ripple effects have been the blossoming of illicit and counterfeit trade, compromise on quality of products, and decline in yields.

Part of the reason for a thriving illicit trade is a weak regulatory environment. “The pesticide sector in the MENA region remains among the least controlled areas, which is due to the lack of coordination between the concerned authorities, import companies, and distributors,” says Tazrouti.

Lack of coordination is not the only problem. In some countries, agrochemicals registration schemes lack clear registration requirements, and are therefore rendering them not functional. This has prompted stakeholders to push for the establishment of regulatory frameworks based on functional and best international practices.

Tragically, authorities do not see the urgency of it. This has been compounded by inadequate capacities within most regulatory authorities and lack of prerequisite competencies required for effective regulation and policing such as risk assessment and infrastructural facilities such as laboratories.

Still, although most MENA nations share near-similar climatic conditions and grapple with largely similar crop pests and diseases, the process of harmonization of agrochemical regulations has been frustratingly slow. In effect, the fragmented regulatory regime has largely impeded cross-border trade of products. “Based on the short history of regulation of pesticides, the regulation frameworks are still evolving,” says Amellal.

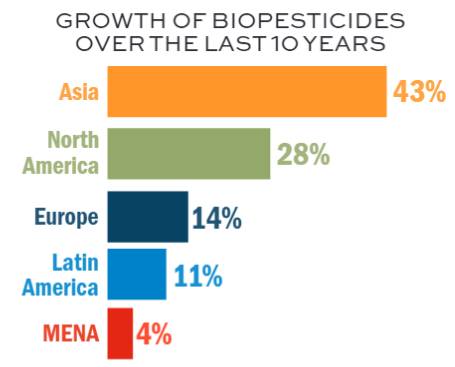

Part of the evolution of the agrochemicals market in MENA has been the entry of biopesticides, albeit at a slow pace. Globally, biologicals have made a footing over the past decade. Croplife Africa Middle East statistics show that sales have increased by 542% over the last 10 years compared to 57% increase in the synthetic crop protection market. Asia leads in growth of biopesticides at 43% followed by North America at 28%, Europe at 14%, Latin America at 11%, while MENA lags behind at 4%.

Despite the slow uptake in MENA, the region understands the need to produce crops on a limited area of land while tolerating increasingly variable environmental conditions and overcoming attacks from insect pests, diseases, and competition from weeds. While biologicals, as conventional chemical crop protection, are not automatically safe for the environment, they offer an alternative route to sustainability specifically in the area of integrated pest management.

“The region should prioritize biologicals and invest more in new technologies, and science-based research on ecological farming and adaptive agriculture,” observes Tazrouti. He adds that countries in MENA should adopt a progressive alternative economic pathway that ensures a long-term resilience and food sovereignty of local communities, specifically supporting a shift away from industrialized commodity food production and toward the re-localization of food systems and ecological food production.