Agricultural R&D: 10 Challenges to Market Entry and How to Overcome Them

Innovators around the globe are bringing new science and creative concepts into production agriculture with potential to generate value for growers. However, even brilliant new concepts many times do not translate into viable commercial products to gain traction in the marketplace.

Moving novel products to producers and driving adoption requires rigorous product development — and that is as much about science as it is about process. Very early in that process, the plan must include regulatory and marketing strategy in parallel with field development that, at the end, should translate into a robust technology adoption platform. The absence of these components wastes resources, adds financial risks, greatly slows commercial adoption and lowers potential rewards for the innovative companies and their investors.

The movement from research into early development phase starts with proving the product concept. The first steps should validate useful benefits and define the scope. Conducting trials in well controlled environments, often in a greenhouse or growth chamber, narrows key variables. This critical step just begins to generate the necessary information and knowledge that will drive success in the next development phases. Simultaneously the business case, intellectual property position, and regulatory pathway should be clearly established to ensure the freedom to operate as well as set the commercialization timeframe, usually defined by the registration timelines.

Early development small-plot trials deliver performance facts to aid in determining best variants, formulations, rates, and timing of application for biologicals or new chemistry. Here we are still talking about few locations and several treatments. Ultimately, the goal is to make sure the product concept and delivery method are robust enough to face the challenge of environmental variability. This stage also finalized the registration requirements and safety plan as production options and markets are prioritized.

With clarity on how to deliver the new product, the product can move into late development. That is translated into small-plot trials conducted in several locations over multiple years. The robustness of that data will directly correlate with the number of replications and environments tested. During this phase, it is important to have reliable partners who can generate accurate and credible data. The performance and use data must continually build solid information about how, when, and where to apply the new technology for the greatest benefit. Ultimately, the goal of late development is to show the technology has value under different conditions.

Having a clear understanding on how to use the new technology is not enough to make it successful in the marketplace. Thorough and credible data sets need expansion and confirmation through large-scale, on-farm trials to demonstrate benefits locally. Growers listen to other growers. So, conclusive data from large-scale field trials in their area and on their crops grown by their peers are crucial to move new products from awareness to trial use and on toward adoption. And growers also are influenced by their local suppliers, dealers, and agronomists. The pathway to successful commercialization includes a go-to-market and technology transfer plan with a clear, concise, and credible story backed by scientific facts.

Aggregating knowledge and information during the development years helps translate facts and stats into meaningful messaging that the sales channel and their growers can trust. Knowing the key opinion leaders in farming communities and gaining their support is as important in the launch phase as defining the value and calculating the return on investment.

All the research conducted won’t be effective unless you identify your customer, understand their needs, and recognize how to market to them.

Optimization of the development process from discovery through development and launch encompasses many variables to manage. Much like farming, the complexity is enhanced by unknown and uncontrollable environmental factors, especially weather. The challenges require flexibility and resiliency, but the rewards can overcome the risks with proper discipline and focus.

A Prescriptive Response Development process allows innovators to discover and leverage their internal expertise with the consistent, disciplined data generated from well-trained and experienced product development experts.

Here are 10 challenges for innovations entering new markets:

1. ROI is your goal, your investors’ goal, and every growers’ goal — delivering to all levels leads to successful commercialization. Underestimating the cost of goods sold or the value to the grower can cut profits at both ends.

2. Managing and allocating limited resources — money and time. Even the largest multinational companies face resource allocation challenges. Resisting the urge to cut corners is paramount to avoid missteps or quality reductions. Identifying and maximizing internal strengths while accessing external expertise can accomplish timely results. This is not an exercise of “Good, Fast, and Cheap, choose two.” These three manageable elements of time, money, and quality must also consider the scope, impact on stakeholders, and user satisfaction for long-term success.

3. Focus and discipline to stay the course — avoiding opportunistic diversions of more uses, more markets, or more targets can help companies stay on track within allocated resources. The first course of action is to generate revenue with a successful launch. The first market may not be the biggest opportunity, but the fastest or easiest to enter.

4. Proven results from reliable and consistent data over many seasons and many locations. Structured protocols and disciplined analysis lay the foundation for best use practices on the farm.

5. Differentiated benefits by application, crop, or geography. Meeting the needs may go beyond cost-effective or proven solutions; the needs may include ease of application or convenience, as well as quality and yield. The value proposition may vary by market segment. Defining the value should not be cost of goods plus margin, nor should the basis be replacement of current practices. Instead, price optimization is based on perceived value when benefits are clearly known and proven. Back to ROI!

6. Defined product positioning and fit into the on-farm cropping system. Will the new technology require changing common practices or misinformed perceptions? Analyzing markets and segmenting best uses will help focus on early adopters. Defining the true customer will help realize the fact that 20% of customers deliver 80% of profits.

7. Engaging and convincing Key Opinion Leaders who can “unsell” the growers. Never underestimate the power of tradition and legacy. Change may seem good, but it is always difficult.

8. Define efficient regulatory pathway with required testing for safety and label registration plus variable rules by state or country.

9. Flexibility to consider options, alternative routes and timelines. Recognizing fluctuations in costs, competitive environments, and customer preferences will set the stage for timely adaptations to the plans. Reliance on internal staff for market intelligence often delivers insufficient or biased information. Precise, quantifiable, and reliable information is crucial at every step of development and launch.

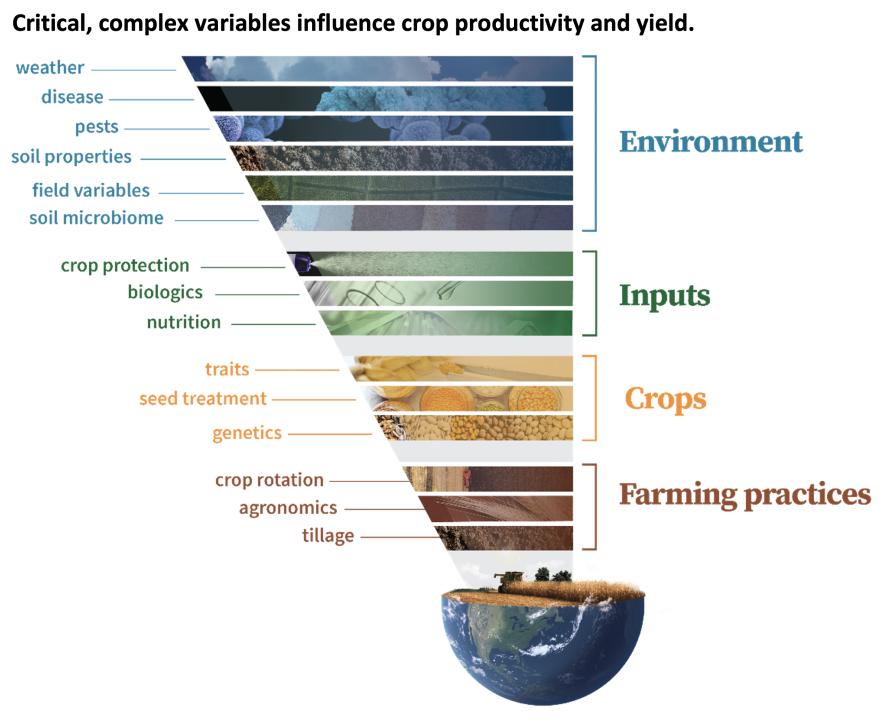

10. Complexity of production agriculture — unknown environmental factors along with evolving competition and barriers to entry. The critical, complex variables that influence crop productivity and yield include local farming practices, the cropping system, inputs, and the ever-elusive environment.