Coronavirus Update: China Provides Production Incentives, Governments Ease Logistics

Governments around the world have designated agriculture as an essential industry, allowing farm operations and crop input suppliers and distributors to continue unimpeded operations to supply the world’s food, feed, fiber, and fuel.

The mostly good news:

- Disruptions in the food supply and production have been minimal. Farms are experiencing heightened demand from consumers who are stocking up on produce amid stay-at-home orders around the world. The closure of restaurants and schools has hurt some producers, notably dairy, with some oversupply, but the glut of perishable foods are helping retailers keep up with surging consumer demand thus far.

- Governments around the world have designated agriculture as an essential business. This means that logistical lockdowns shouldn’t affect the movement of farm workers, produce, crop input products, or workers in the factories that produce them.

- Agriculture economics remain strong, and food processors are the rare strong sector in an otherwise flailing global economic system driven down by energy, travel/hospitality, and service sectors.

- The European Commission clarified that the production and transport of agricultural inputs such as plant reproductive material is included in the list of essential goods and services to which the so-called “green lane” procedures at borders shall be applied.

- U.S.: The US Department of Homeland Security designated both agriculture and chemical sectors as critical infrastructure and includes transportation systems to move products around the country and to ports. The food and agriculture sectors accounts for about 20% of all economic activity in the U.S.

- India: Farm work, pesticide manufacturing, fertilizers, seed, and related agriculture industries have been exempted from India’s 21-day lockdown. To clarify, the Pesticides Manufacturers & Formulators Association of India (PMFAI) made appeals to the Central and State governments including the Prime Minister of India, to allow manufacturing, sale, distribution, and transportation of pesticides/agrochemicals under the Essential Commodities Act, along with other agri inputs like fertilizer and seed.

- China: All eyes continue on China as it has become a barometer for how quickly a major economy can restart its factories and workforce amid a lingering contagion. The China Crop Protection Industry Association (CCPIA) says pesticide production is about 70% of normal as workers trickle back into factories from various quarantines and physical distancing guidelines. China has also designated agriculture and supporting industries as essential, and therefore pesticide transportation and logistics are cleared through their “green channel.” Essentially, interstate highways are generally cleared for travel, but some restrictions still remain in areas where community spread persists. CCPIA estimates that 78% of local roads are clear for travel, based on data from 1,500 agricultural counties in 25 provinces. Additionally, 92% of the 362 key seed enterprises have returned to work and their production capacity has reached 62%. The resumed operations rate of chemical fertilizer and urea enterprises reached 69%, diammonium enterprises reached 61%, potash fertilizer enterprises reached 88%, compound fertilizers reached 51%, and more than 1,400 pesticide enterprises reached 70%.

- Incentives for Chinese manufacturers: Rebates are back to 13% on exported chemistries: On March 20, the tax rebate rate for some export goods will be increased, which involves more than 370 pesticide varieties under HS Code Chapters 29 and 38. For pesticide technical-grade products, the export tax rebate rate will be adjusted to 13% if tax is paid at 13%; for all pesticide formulations, export tax rebate rate will be adjusted to 13% if tax is paid at 13%, where export tax rebate rate will be adjusted to 9% if tax is paid at 9%.

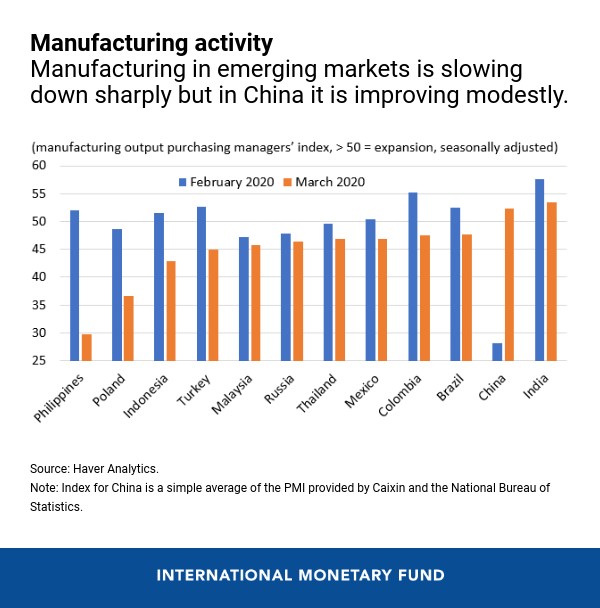

- Manufacturing activity in developing markets is slowing as non-essential manufacturing halts and labor becomes less available as a result of illness or transportation restrictions (see IMF chart Manufacturing activity or view full IMF blog post An Early View of the Economic Impact of the Pandemic in 5 Charts)

And, the other news:

While farms and factories continue to produce goods, the logistics and distribution side of the agriculture economy has been hampered by sporadic infrastructure closures and labor shortages as a result of sick workers and mandatory quarantines. And oversupply in some sectors, notably dairy and beef, could be a financial drag on producers if demand doesn’t pick up soon.

Cobank published its quarterly analysis on commodity production in April:

- Beef: Since mid-January, April live cattle futures have fallen about 25% and have not yet shown signs of a bottom. We continue to expect beef production to grow 2% in 2020 which will test domestic consumers’ willingness to pay the premium prices of 2018 and 2019.

- Dairy: The seasonal increase in milk supplies in the U.S. with the spring flush was met with economic weakness in China and other countries. School closings in March also impacted fluid milk consumption as elementary schools consume a significant portion. Home stockpiling has provided some price support, but not enough to offset the losses related to food service.

- Chicken production is up 7.7% through the first two months of 2020. This implies a slower rate of margin growth for the rest of the year due to the weak chicken prices and producer profitability. Worker illness and limited capacity of cold storage facilities could put additional strain on producers.

- Corn, wheat, and soybean: Since 2020 began, grain prices have fallen meaningfully. Prices have declined for corn by 12% and soybeans by 7%. Wheat prices are flat.

- Biofuels: Aggressive competition between the U.S. and Brazil along with a cratering crude oil industry will result in a drop in ethanol production and profitability.

- Cotton: Cotton prices plummeted in March as futures followed estimates for a collapse in global GDP and the shutdown of clothing manufacturing in China in efforts to contain the spread of COVID-19.

- Rice: Futures prices surged to a 5 1/2-year high in March before falling back to more moderate levels at the end of the quarter. Fears that drought will cut rice production in Thailand have supported global rice prices, with Thai rice prices touching 6-year highs. Concerns that rice shipments from top-exporter India could be impaired by the Indian government’s recently imposed lockdown have added to the fears of shortages.

- Sugar: Strong consumer demand for sugar amid crop shortages has created a stable to strong pricing environment.

See the full Cobank report that includes more analysis on these commodities and additional analysis on specialty crops, water, power, energy, communications, and the overall agriculture economic outlook.