How Will the Shift from NAFTA to USMCA Impact the Mexican Agrochemicals Market?

In terms of agricultural practices, Mexico is more in alignment with South America than it is with North America. The same is not true for political or trade alignments. Mexico is more closely aligned with the North, where the original North American Free Trade Agreement (NAFTA) essentially eliminated barriers to trade and investment between Mexico and the U.S. NAFTA’s implementation in 1994 removed tariffs on more than one-half of Mexico’s exports to the U.S., including agricultural products.

In 2018 exports of agricultural products from Mexico into the U.S. amounted to U.S. $26 billion. Fresh vegetables ($5.9 billion), fresh fruit ($5.8 billion), and processed fruit and vegetables ($1.7 billion) accounted for more than 50% of these exports. Compared to 1993 (pre-NAFTA), overall trade exports from Mexico into the U.S. have increased by some 800%. This has been one of the key drivers for growth in the Mexican domestic agricultural market since 1993. Trade flows, however, work both ways, and imports into Mexico from the U.S. totaled $20 billion in 2018. Leading import categories include maize ($3.1 billion) and soybeans ($1.7 billion).

In 2018 exports of agricultural products from Mexico into the U.S. amounted to U.S. $26 billion. Fresh vegetables ($5.9 billion), fresh fruit ($5.8 billion), and processed fruit and vegetables ($1.7 billion) accounted for more than 50% of these exports. Compared to 1993 (pre-NAFTA), overall trade exports from Mexico into the U.S. have increased by some 800%. This has been one of the key drivers for growth in the Mexican domestic agricultural market since 1993. Trade flows, however, work both ways, and imports into Mexico from the U.S. totaled $20 billion in 2018. Leading import categories include maize ($3.1 billion) and soybeans ($1.7 billion).

Although the trade deficit in agricultural produce is only $6 billion, the overall trade deficit between Mexico and the U.S. amounts to some $80 billion to $100 billion on an annual basis. This trade deficit was one of President Trump’s campaign pledges for the “scrapping” or renegotiating of NAFTA, and at the end of 2016 the U.S., Canada, and Mexico signed an agreement to replace the older agreement. In June of last year Mexico became the first country to ratify that agreement known as the United States-Mexico-Canada Agreement (USMCA). The USMCA can be considered as NAFTA 2.0; however, there are some significant changes that will impact on agricultural trade going forward and, in turn, on the domestic Mexican pesticide market. At press time, USMCA had been signed by all three countries but only ratified by Mexico, although the U.S. Congress had indicated that it was willing to pass the agreement.

Largely, then, as a result of the trade alignment under NAFTA, the Mexican domestic market has grown faster than many other Latin American markets such that it now occupies the third position within the overall Latin American market.

Mexico: Growth Market

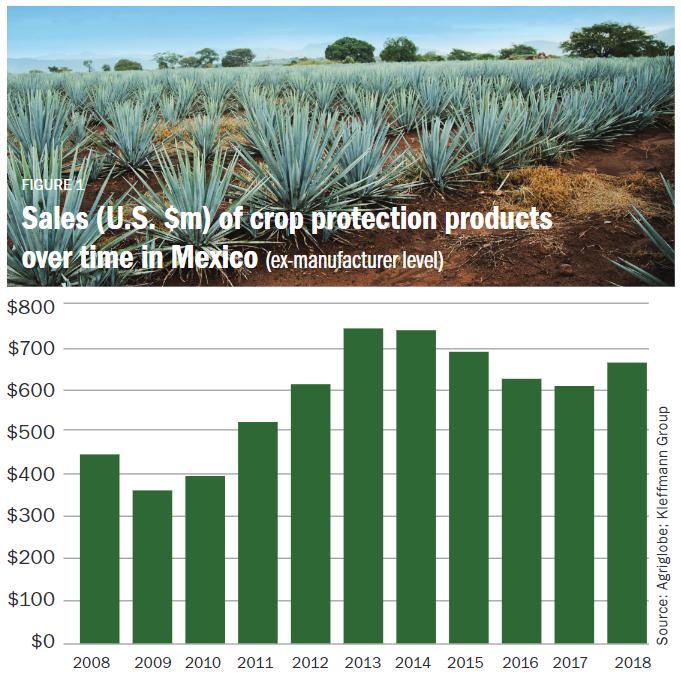

As published last June, the global crop protection market in 2018 increased at a rate of 2% in nominal terms over that of 2017. As a comparative figure, the Mexican market grew by more than 8% in 2018 compared to 2017. Mexico has also considerably outperformed the global market growth, with a compound annual growth rate (CAGR) of 4.3% per annum over the time period 2008 to 2018 compared to a more modest CAGR of 2.3% per annum for the global market over the same time period.

Mexico, like most markets, suffered a decline in 2009 (as a result of the financial crisis) and then once again in 2014, when, among other factors, a marked decline in commodity prices took place. Mexico suffered more than most markets and did not post a recovery until 2018, in part due to the uncertainty regarding NAFTA and USMCA.

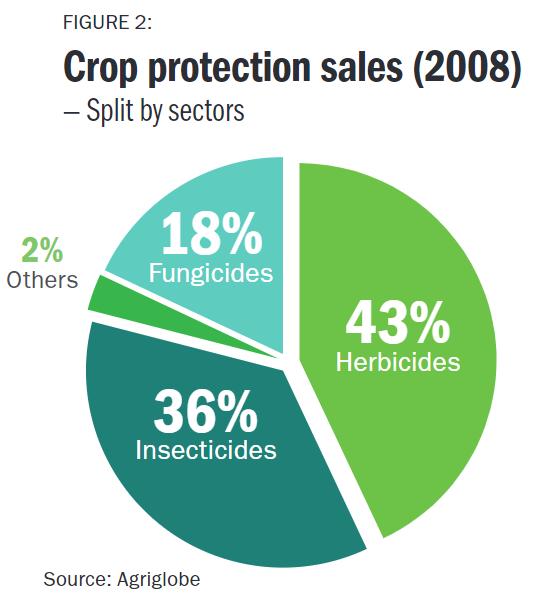

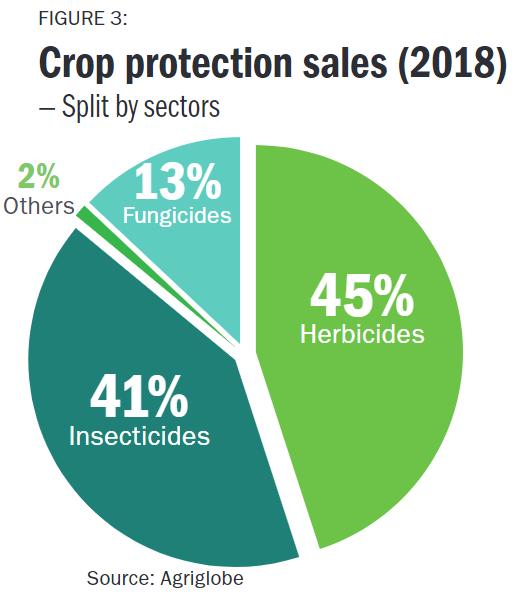

Value increases aside, the market is also changing somewhat and becoming more insecticide- and herbicide-focused when comparing 2008 sector splits with those from 2018 (Figures 2 and 3).

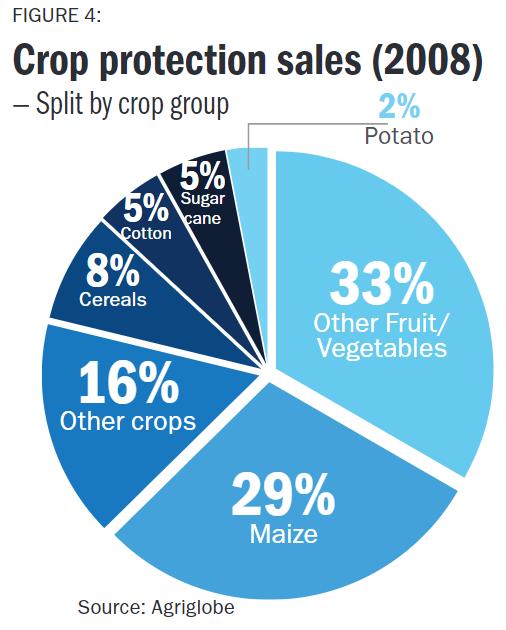

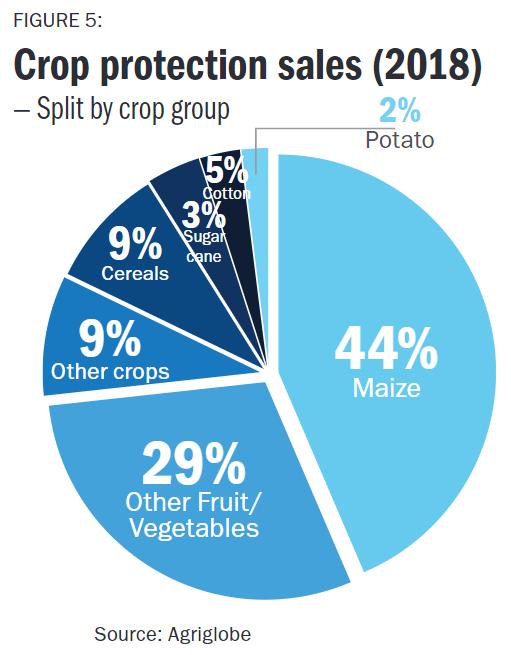

The same is true if we compare the relative significance of the different crop groups in terms of pesticide spend (Figures 4 and 5).

The most striking development of the domestic market over the 2008 period to 2018 is the growth in the maize market driven by an increase in crop area, a general increase in intensity of product use (particularly insecticides), and more recently the growing concerns of a failure of USMCA discussions. The growing importance of maize and the decline in other fruit and vegetables also goes some way to explain the shift in sector sales toward herbicides and insecticides and away from fungicides (Figures 2 and 3).

As with pesticide usage, production of maize has also grown. Between 2008 and 2018 production has increased at a CAGR of approximately 1.6%, with white corn growing around 1.2% and yellow corn around 7%. Behind these growth rates are rising yields, in part the result of increased mechanization and improved seed varieties. Between 2012 and 2017, mechanized maize area grew at a CAGR of 3.5% and by 7.8% in irrigated production areas. Over that same period, the area cultivated with improved maize seed increased at a CAGR of 4.4%, again by a higher 8.2% in irrigated production areas. Apart from the gains achieved through higher yields, rising prices have also increased the value of maize production in Mexico by over 100% since 2005, a trend anticipated to continue.

Outlook for 2020

The importance of a favorable USMCA outcome should not be underestimated in the development of the Mexican market for pesticides. The U.S. has a presidential election looming, which could derail the deal altogether. Concerns (at the time of writing) on labor rights within Mexico also have the potential to derail the process.

However, as with other international trade disputes, including the China/U.S. trade war and “Brexit,” USMCA, if signed, may be one of a trio of agreements with significant impact on global pesticide markets in 2020.