Trends and Drivers in the Global Crop Protection Industry

Global human population growth is around 75 million annually, and estimates place our total population at over 9 billion by mid-2050.

The logistical challenge is not only the projected 9 billion people, but also the estimated hundred billion head of livestock we will need to feed to maintain our current consumption standards.

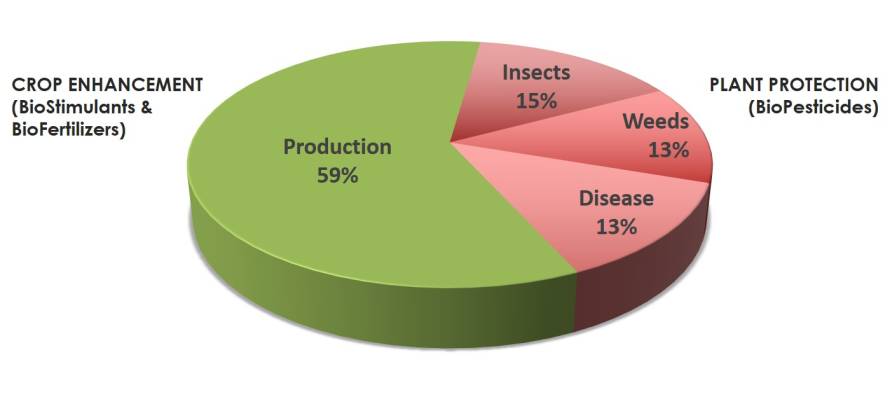

Without crop protection strategies, we risk losing almost half of our overall crop production to insects, weeds, and disease. Plant Protection agents — including biopesticides — reduce these losses, while Crop Enhancement agents (including biostimulants and biofertilizers) contribute to increasing overall crop production.

Figure 1: Agricultural Biologicals in Crop Protection.

To provide sufficient crop resources, new and innovative crop protection strategies are constantly being developed and implemented.

These include formulation and application innovations for conventional pesticides (herbicides, insecticides and fungicides), as well as the development and application of economically viable biopesticides.

Crop Protection Trends

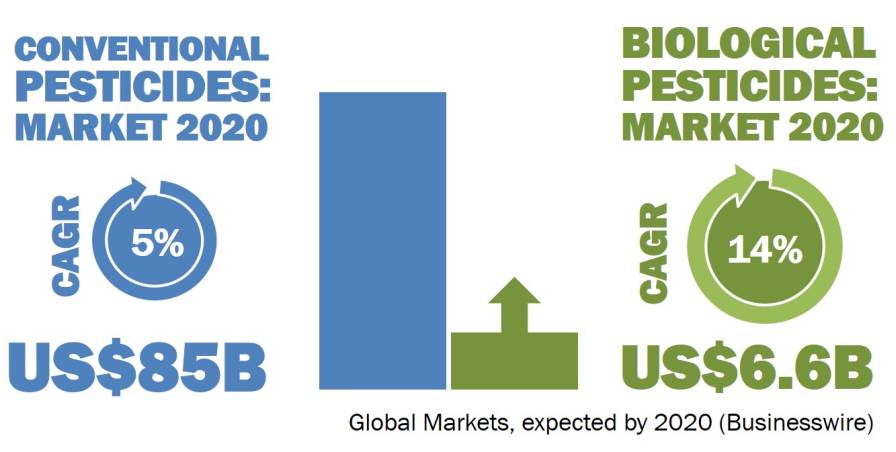

Estimates of global market sizes for crop protection products (conventional pesticides as well as biopesticides) vary, but the consensus is that biopesticides are expected to increase from about 2% of the global pesticide market in 2003 to about 8% of the global pesticide market (estimated to exceed 82 billion USD) in 2020.

Current opinion is that the compound annual growth rate (CAGR) for biopesticides during this period is expected to exceed 12%, compared to an expected overall pesticide CAGR of about 7%.

Figure 2: Estimates of global market sizes for crop protection products.

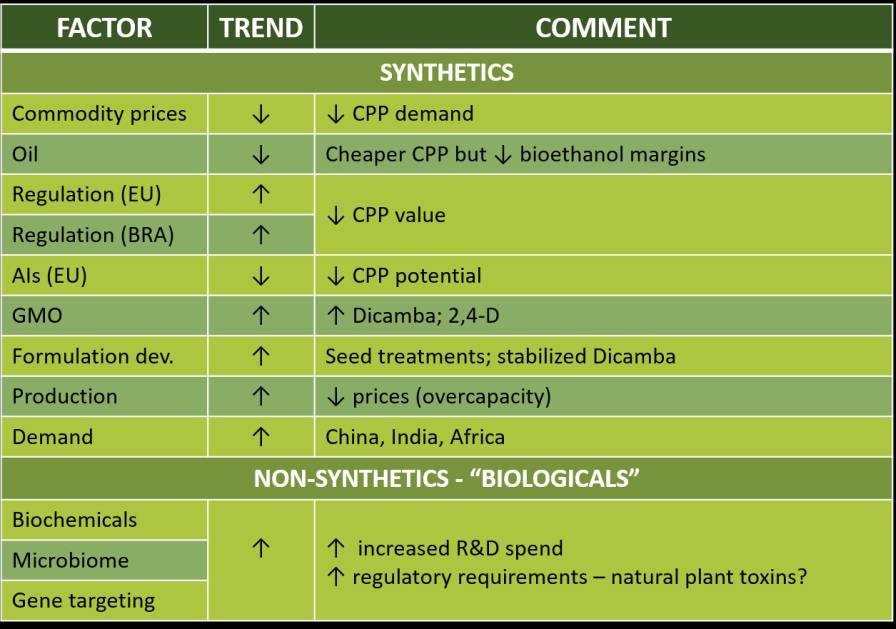

Falling commodity prices reduce the value of crops for farmers, and thus demand for crop protection products. While lower oil prices permit cheaper production, associated declines in bioethanol margins restrict grower willingness to invest in these products.

Conventional Pesticide Trends & Drivers

Pesticide production is increasing to meet demand in rapidly expanding regions such as Latin America, Asia-Pacific, and Africa — a potential overcapacity may, however, lead to a decline in prices.

A few active ingredients, such as dicamba and 2,4-D are experiencing increased interest, due to trends in GMO technologies (trait stacking) and advances in formulation development (seed treatments).

Stricter pesticide regulatory requirements in the EU and Brazil restrict access and increase registration costs, while an associated decline in the number of registered active substances in the EU is reducing the potential of crop protection resistance strategies.

Figure 3: Global industry trends and R&D drivers.

Biopesticide Trends & Drivers

Within the EU, stricter pesticide regulatory requirements, consumer awareness regarding hazards caused by chemical pesticides, and the phasing out of toxic conventional pesticides are factors driving the growth of the biopesticide market.

The leading agchem companies are expanding their biopesticide R&D and portfolios, with focus on biochemicals, such as naturally occurring metabolites with entomopathogenic or antifungal activities, microbiome (beneficial microbes which improve nutrient uptake and disease resistance in crops), and molecular biological techniques (gene targeting) such as CRISPR and RNAi.

Efficacy trials demonstrate conclusively that biology-based crop protection strategies can attain an efficiency at least on par with conventional crop protection strategies, when applied with due regard for factors such as plant-response kinetics and disease pressure development.

On the other hand, reports of inconsistent efficacy in the field lead to either over-optimism or skepticism by corporate decision makers and farmers alike. From a grower / end-user point of view, an important strategic strength of biopesticides lies in their application at specific timings, such as pre-harvest application.

Short pre-harvest intervals allow the application of biopesticides (especially biofungicides) immediately before harvest, where few (if any) conventional pesticides are available.

Potential restraining factors include the current low adoption rates of biopesticides, as well as the expectation of stricter future regulatory requirements for biologicals. Of importance with respect to toxicology, the formation of plant-produced toxins induced by biopesticides requires immediate attention.