China Price Index: Supply Shortages Loom As Energy, Environmental Policies Collide

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. He also provides insight into how China’s double control policy, upcoming environmental audits, the Winter Olympic Games, and Spring Holiday are all conspiring to disrupt manufacturing capacity well into 2022.

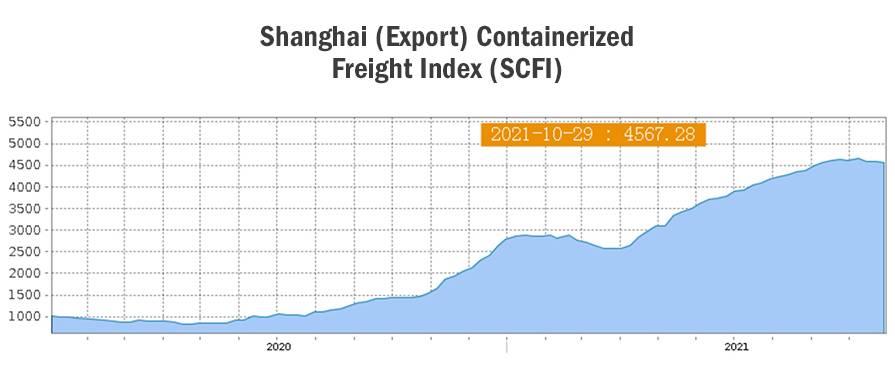

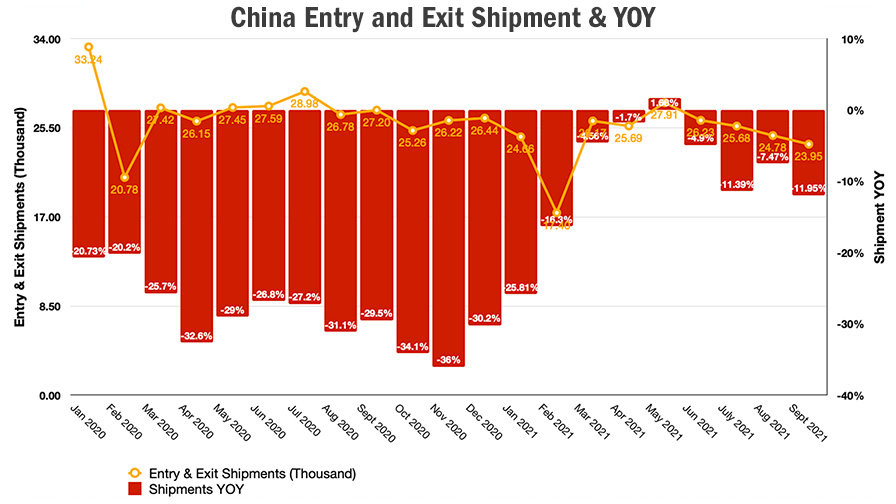

China’s Double Control policy on manufacturing plants for energy conservation continues to impact China’s agrochemical supply to the global market. According to the Shanghai (Export) Containerized Freight Index (SCFI), the freight cost index started to decrease in October, with shipping volumes lower possibly because of diminished production as a result of the Double Control policy. According to custom’s data, the China Entry and Exit Shipment dropped 11.95% YOY in September 2021. The low rate of entry and exit shipment in the autumn of 2021 could signal a sudden decrease in China’s supply due to suspension of production.

Moreover, yellow phosphorus prices dropped almost in half between Oct. 8, 2021 and Nov. 2, 2021 from a high of about 60 CNY/Kg. The drop in yellow phosphorus pricing was a clear signal that China’s production cannot be back to normal rapidly. It is unusual to have a price drop when China’s yellow phosphorus capacity was cut around 48% in total. The key reason for such scenario is because production suspension in different provinces due to Double Control. It seems clear the Double Control policy has already been affecting the downstream production of key agrochemicals, and raw materials could continue to fall if lower production rates persist.

According to many agrochemical manufacturers in China, the 50% capacity guarantee in Q4 2021 and Q1 2022 would be the best result for business maintenance. Like other fine chemical production, agrochemical manufacturing needs continuous production management. The suspension of production and shortage of electricity supply would bring higher risk on safety control and inventories in the coming six months. Moreover, there are other factors to block the production. The limited availability of key intermediates hampers capacity of operation. The impact is influencing the entire chemical industry both upstream and downstream. Employees’ workloads cannot be 100% due to the suspension of manufacturing. Operation costs would increase due to the lower capacity. The State-owned manufacturers and companies with advanced-tech processes could maintain the hiring rate. Private companies with only long-tail portfolios would be less competitive. Such impact would bring a new round of consolidation and phase-out much of the overcapacity that China has been working to eliminate, which would be realized in 2022 and last into 2023.

The turning point for Shanghai freight costs and yellow phosphorous reflect the decline in production in China. Without strong demand from the production side, the logistics costs and raw material prices would have soft landing or drop due to the disruptive nature of uncertainty around capacity utilization.

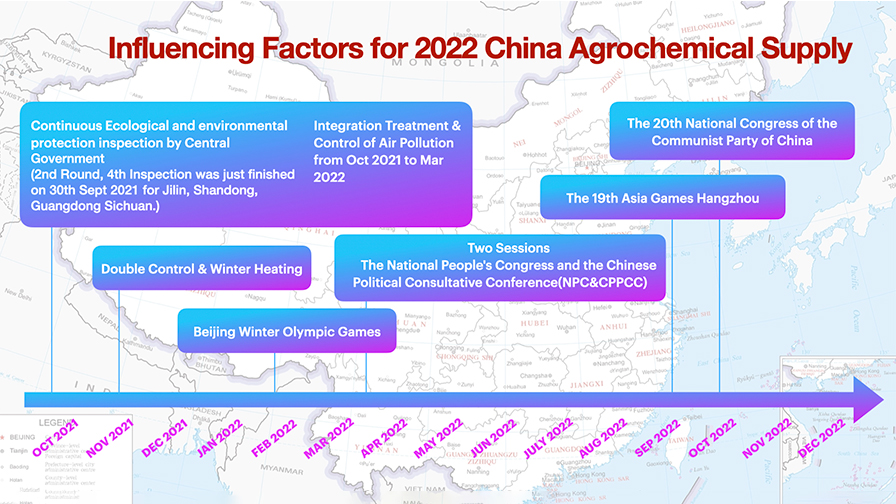

To summarize the future influencing factors for 2022 China agrochemical supply, the following timeline provides a good overview:

By the end of 2021, the Double Control policy will be exerting its influence at the same time as the integrated air pollution control policy, which runs from October 2021 to March 2022. The environment protection audit will last until the Beijing Winter Olympic Games since the Chinese Spring Holiday takes place at the same time. Winter heating in northern China started in November in some cities and provinces. According to caixin.com, policy makers in China introduced multiple measures to stabilize coal prices. Domestic thermal coal future prices halved within half a month. On Nov. 2, the main contract 2201 closed at 891.8 yuan/ton, down 5.51% from the previous trading day and 53.26% from Oct. 19, falling back to the level in early September.

In addition, the National Development and Reform Commission announced on Oct. 31 that the national unified power plant coal supply has been higher than coal consumption for 25 consecutive days since October 5. Coal storage levels reached 106 million tons recently, 28 million tons more than the end of September, available for 19 days. With the stable supply of coal, China’s government is trying to maintain the livelihood of people during this winter, which places a priority on the health and safety of the people versus industry production.

During the Spring Holiday, Beijing Winter Olympic Games will be the other influencer, especially for the production in Hebei, Shandong, Shanxi, Shaanxi areas, which are close to Beijing. Air pollution control will be the priority for audit. Since China’s agrochemical companies have been facing air pollution and waste emission control issues during the past three years. The basic upgrading of VOC control had already been done. The controlling for Beijing Winter Olympic Games would start from December 2021 and continue through March 2022. Recently, there are some cases of COVID-19 found in Beijing and Hebei Province. The restrictions on travel and people gathering will be another disruptive issue for production in the Jing-Jin-Ji area. The Two Sessions (Lianghui) follows the Beijing Winter Olympic Games, so restrictions could soften between March and April 2022, but they will be consistent with ongoing policy.

In September 2022, the 19th Asia Games in Hnagzhou could affect South China’s production. The hazardous goods will be controlled strictly the same as the control during the China International Import Expo in November 2021 in Shanghai. At the end of 2022, the 20th National Congress of Community Party of China will be important for the nation. The similar control like the Two Sessions would also be an impact on chemical production.

Moreover, it is not easy to predict the effects of China’s 2022 carbon neutrality policy and electricity supply. Provinces will be very careful regarding management of their energy consumption intensity. As mentioned before, chemical production needs continuous process management. The alternate power brownouts would not be a good solution. What could be happening in 2022 would be planning the production period in whole year. Agrochemical companies would calculate clearly about how much quantity they can provide in the new season.

An accident disturbed the agrochemical production in Inner Mongolia. According to Xinhua News, four people died and three people were injured in an flash explosion at a chemical plant in the Alashan high-tech industry development zone on Oct. 22. The Inner Mongolia government started to investigate the reason for the accident, which is impacting the herbicide supply. The reference glyphosate price touched 12.83 USD/Kg, a historical price since 2008. And there is no signal the situation will improve considering the confluence of factors already discussed, including Double Control, high price raw materials, and strong demand.

And as we’ve been discussing and anticipating for months in this column, glufosinate prices remained stable at 54 USD/Kg EXW. A primary manufacturer started operations recently. But the most important thing should be to feed the undelivered orders. The high glufosinate price will be stable in Q4 2021 and Q1 2022. The high pricing of key non-selective herbicide has driven up diquat prices as an alternate choice. The non-selective herbicide market will remain tight during the next six months. The low operation rate is affecting most triazole producers. The tebuconazole AI price rose around 90% above the number in the summer 2021. The high energy consumption on upstream production put more pressure on downstream production. Imidacloprid AI increased to more than 40 USD/Kg, which is around 74% higher than 2008.

In the price trend chart, all products’ pricing is increasing sharply. In the next six months, there is a high possibility for a supply shortage and extremely low production rates. And China is facing a new round of COVID-19. The controlling of the pandemic is a top priority for the success of coming events. A disruptive supply chain could make medium or small-scale distributors struggle during the next season. Due to the relatively high safe inventory in different markets, generic products from multinational companies could be an alternative choice to guarantee the planting of 2021/2022 season.