Agrochemical Trade Update: What to Expect Between the U.S. and Asia in the Coming Weeks

Editor’s Note: Fanwood Chemical Inc.’s Jim Delisi provides this update on world trade covering U.S. interactions with China, Japan, and India. He also offers insights on the industry in general.

Duty Suspension Update

The United States International Trade Commission opened the window to accept new requests as well as renewals of existing suspensions/reductions on Friday, October 11, for a period of 60 days. The window closed on Tuesday, December 10.

We will be compiling a list of all such requests that impact agrochemicals in the near-term future. Please let us know if you are interested in reviewing such a list.

General Observation

The agrochemical industry continues to be suffering a very significant downturn. In many instances, the drop off in market value for some active ingredients is in excess of 50%. It appears as if there are at least two main factors:

- Inventory levels in the field appear to be very high. If they are as high as some believe, then the industry will be in a tough slog for a prolonged period of time.

- China tariffs/plant interruptions. Both of these issues are having an impact on the price and availability of imports from China.

Please see additional details below.

Trade War with China

There were significant changes made last Friday in the “China tariffs”. The U.S. and China agreed to a phase one deal at that time. It contains many elements, including IP, currency, and a purchases commitment. It also changed the U.S. tariff structure. As of the date of this letter, the following U.S. tariffs against Chinese imports are in place:

- Tranche 3: 25%. This rate was scheduled to be increased on October 15, 2019 to 30%. That increase is on hold at this time. The time period for requesting exclusion has elapsed. USTR is currently reviewing all of the requests that were made. To date, no agrochemical requests have been accepted, though they have denied several more since last month. It is likely that these levies will be in place for at least the next 6 to 9 months at a minimum.

- Tranche 4a: On September 1, 2019, tariffs of 15% were imposed for products on this list. The exception requests window is open until January 31, 2020. The levies on list 4a have been cut in half to 7.5%, effective December 15, 2019.

- Tranche 4b: On December 15, 2019, tariffs of 15% were scheduled to kick in. These additional levies will not be imposed at this time.

If you don’t already have it, please ask for the list we prepared detailing our best efforts to sort out how this impacts individual agrochemicals.

It is expected that the agreement will be signed in mid-January. It is also expected that associated federal register notices will be published shortly to enshrine the new duty rates for list 4a and officially postpone the imposition of tariffs on list 4b.

Thankfully, it has been agreed that negotiations on phase 2 of the agreement will begin immediately, rather than the original proposition to wait until after our November election.

India

The U.S. and India continue to negotiate their differences. The results of these efforts are very difficult to predict at this time.

Japan: Stage 1 Free Trade Agreement

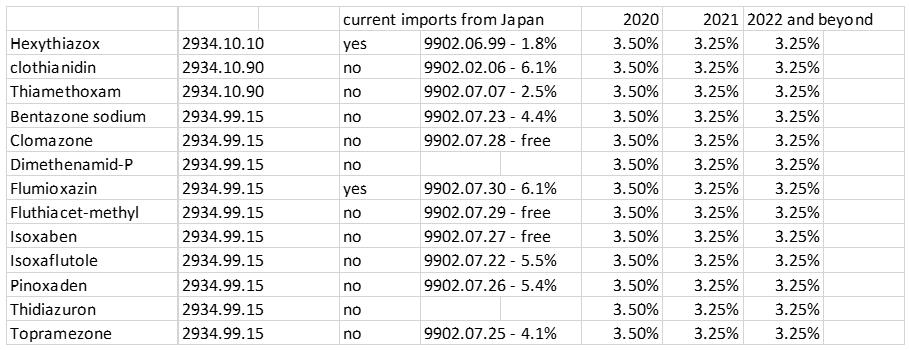

There are three tariff lines in the agreement where the U.S. will cut the tariffs on imports from Japan upon implementation of the agreement which is likely to occur on January 1, 2020: 2934.10.10, 2934.10.90, and 2934.99.15. There are several agrochemicals imported into the U.S. in these categories. Below, please find an illustrative list:

The Japanese Parliament ratified the deal a week or so ago. It is therefore highly likely that President Trump will sign an executive order putting this agreement into place on January 1, 2020.

Trade Stats – Formulated Agrochemicals

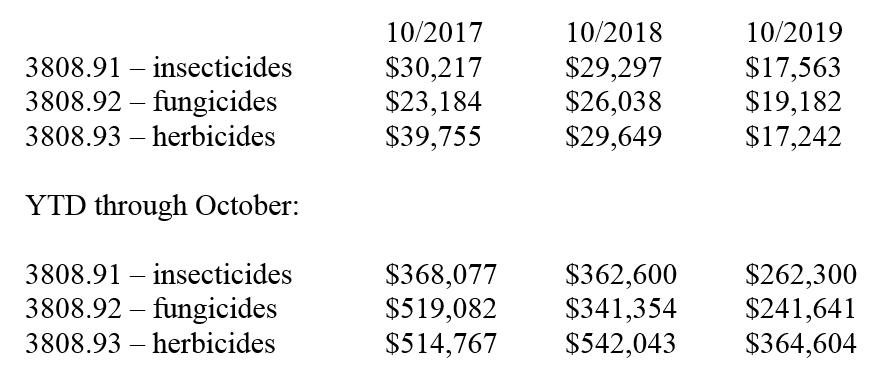

The update version of our “Index” which includes import details for all formulated agrochemical imports in 3808.91, 3808.92, and 3808.93 for September is below. It continues to show a sharp drop-off in imports of formulated products (000):