China Price Index: Glyphosate Rises Amid Sichuan Flooding, Exports Taper Off

Editor’s note: Contributing writer David Li offers a snapshot at current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in the slideshow above. Below he provides insight into how factors such as weather, the pandemic, the fall armyworm, and more are impacting agrochemical manufacturers today and into 2021.

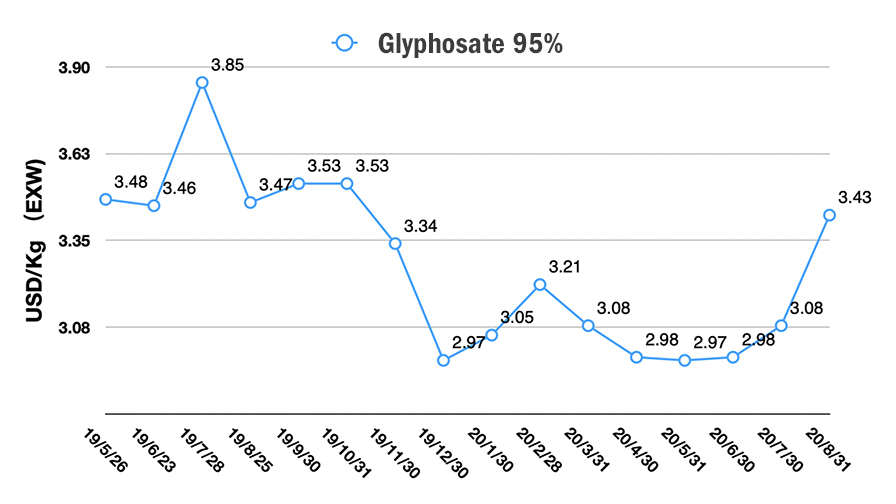

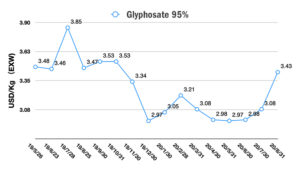

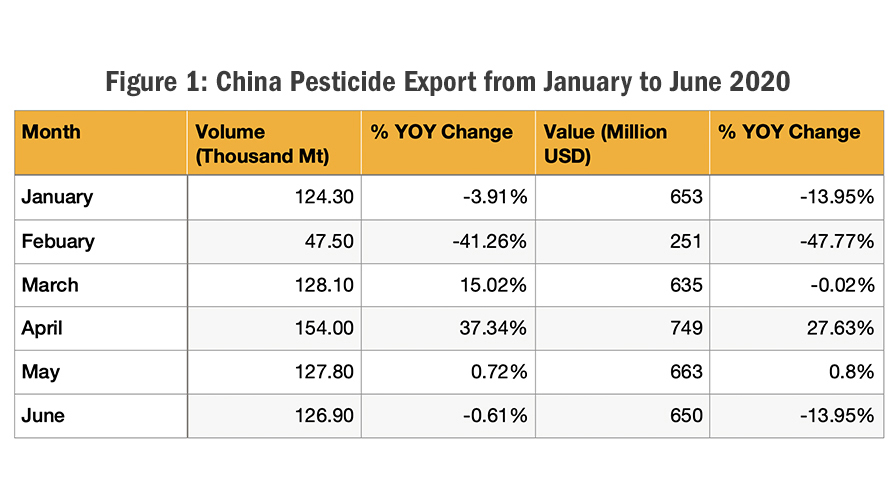

Year-over-year agrochemical export volumes from China in the first half of the year appear to be stabilizing. However, YOY prices continue to remain low (Figure 1) with the exception of April, indicating a lower-price trend for the first six months of 2020 compared to 2019. In Q3 2020, the flooding Sichuan Province caused an uptick in the price of glyphosate in August as a result of diminished capacity, but only one product can’t stimulate sales of an entire industry.

The overcapacity in China combined with lower demand around the world continues to impact prices well into this year.

Global inventories remain high for a combination of reasons. When China shuttered production in January and February, the uncertainty drove buyers to Indian companies, who ramped up production to meet demand. Then China reopened its manufacturing capacity in phases beginning in March. CCPIA inspected and led key agrochemical suppliers and worked closely with ICAMA, MOA of China, and local governments to declare agriculture input as essential material for food security. The re-operations of the China agrochemical industry proceeded to maintain the sufficient supply of agrochemicals as a key agriculture input. This action also helped global buyers to transfer their focus back on China supply.

In April, the quantity of China agrochemical export increased 37%. The multinational companies and global distributors captured the chance to source commodity chemistries from China to bolster their inventories. Those reinforced inventories diminished demand beginning in June, and the global demand of agrochemical material remains weak without much clarity of future demand.

The LATAM market is the key agrochemical exporting market for Chinese manufacturers. Like the Bayer CropScience half-year report mentioned, there were lower product returns in Brazil this year, indicating more consumption as products sell out. The inventory level in Brazil is back to normal recently. Brazil and Argentina’s pest pressures were high, driving insecticide sales increases. And soybean rust is still a key factor driving the fungicide market. Soybeans will always be a valuable crop there since the global demand on plant-based proteins will always be strong, especially from China.

COVID-19 brought more challenge on global animal protein business, which is a significant consumer of soybeans and corn. Worker protection and supply chain resilience are critical for future recovery and growth in the COVID-19 era. But the sales growth was offset by the impact of currency devaluation, particularly the Brazilian real.

According to the world bank article “Food Security and COVID-19,” global agricultural markets continue to remain stable. The overall production levels for the three most widely consumed staples (rice, wheat, and maize) are at or near all-time highs. But high levels of unemployment, loss of income, and rising food costs are also making access to food difficult for many people in different countries, according to the FAO report, “The Impact of COVID-19 on Food Security and Nutrition, June 2020”.

High-value crops might be affected more than broad-acre crops. Bayer CropScience mentioned their sales of vegetable seeds declined in 2Q 2020, especially in the North America region, where shifts in traditional demand cycles shifted into subsequent quarters. Processing industries and restaurants were hit by COVID-19 lockdown. Uncertainty of fresh-produce consumption make the farmers hesitate to invest on growing.

Global market demand is still uncertain and will have an effect on global trade. A good thing has been the Asian market’s quick recovery. In China, the difficulty of global transportation drives more local fruits and vegetable consumption. However, there was more rainfall in the season in China. It also drives consumption of fungicides in the China distribution channel. Farmers are facing challenges of integrated pest management since the resistant fall armyworm spreading from Yunnan province. UAS (Unmanned Aircraft Systems) is becoming the most popular way of agrochemical application in the China market. The formulation with capability for drone complex would have advantage for farmers purchasing.

The China local crop protection is under tough competition as one of world’s growing market. FMC and Corteva plan to utilize technologies of digital farming and precision farming to penetrate the China market. But the most successful team shall be the Bayer CropScience. Bayer is utilizing the most popular app, WeChat, to build a compact community online to capture farmers’ time on screen. Influence on farmers and its proactive approach online is its critical competitive advantage of digital marketing strategy during the pandemic. Despite physical distancing, we all have an innovative way to create value.

For global agribusiness leaders, the complicated society and economic environment increased huge uncertainty. FAO reported deep global economic shocks caused by COVID-19 will impact the cash flow and financial liquidity of producers, and small and medium agribusinesses to financial institutions, due to inhibited production capacity, limited market access, loss of remittances, lack of employment, and unexpected medical costs.

The consequence of the global impact by COVID-19 will affect China agrochemical suppliers in 2021. China producers within supply chain of multinational companies will have stable contract of purchasing. The game between squeezing of margin and stable business relationship is the new normal in the market. For off-patent producers, it will be critical to be sensitive and quickly respond to global regulation challenges. Innovation on near-patent expiry of active ingredients shall be significant for longer competitive advantages.

Below is a look at the current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market. Click on the product name to view its price chart, or view the slideshow above.

Herbicides

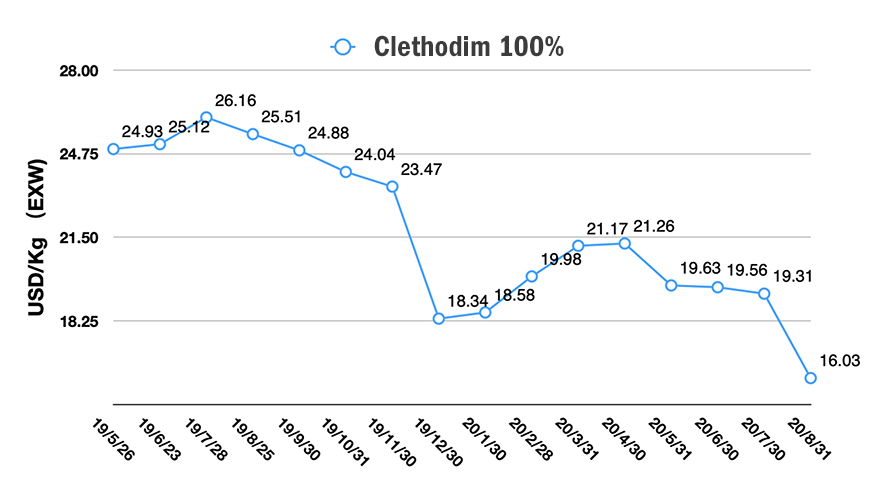

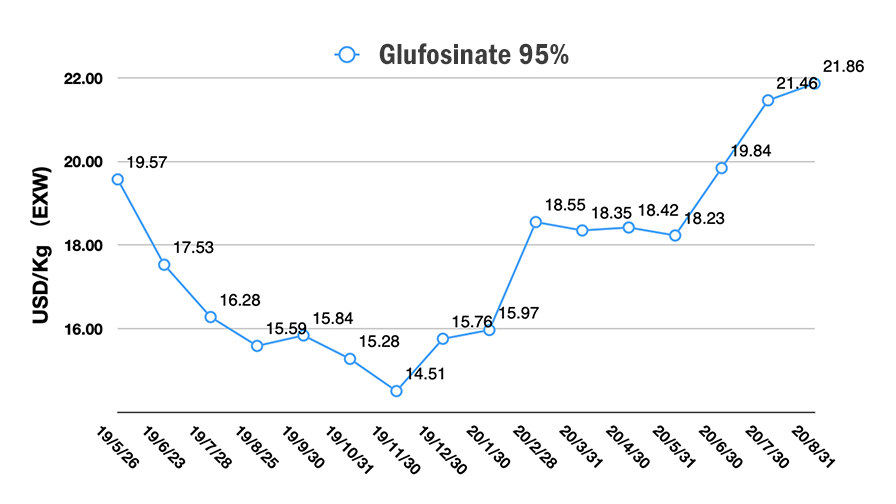

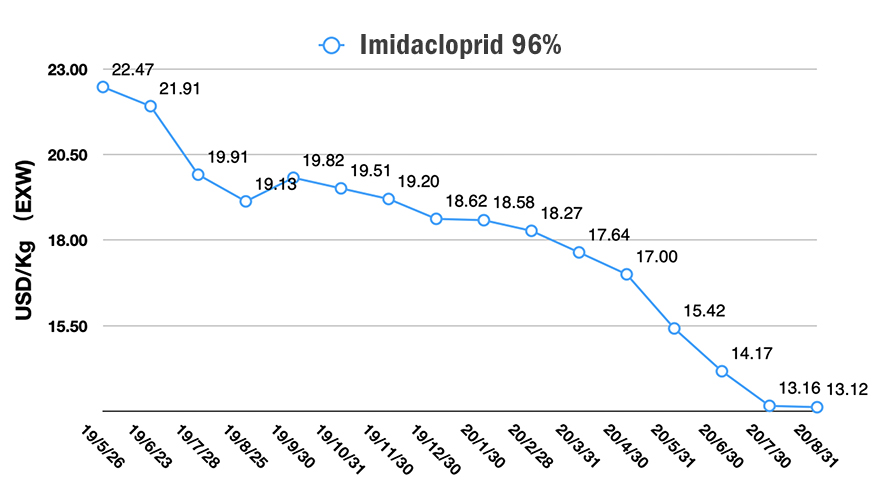

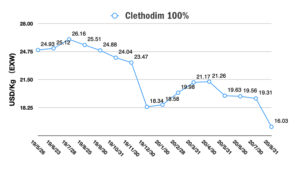

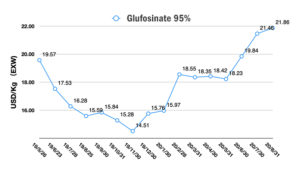

The glyphosate AI price went up due to Sichuan’s flood in August. The clethodim AI price decreased 18%. The glufosinate AI is still under shortage supply with high level price.

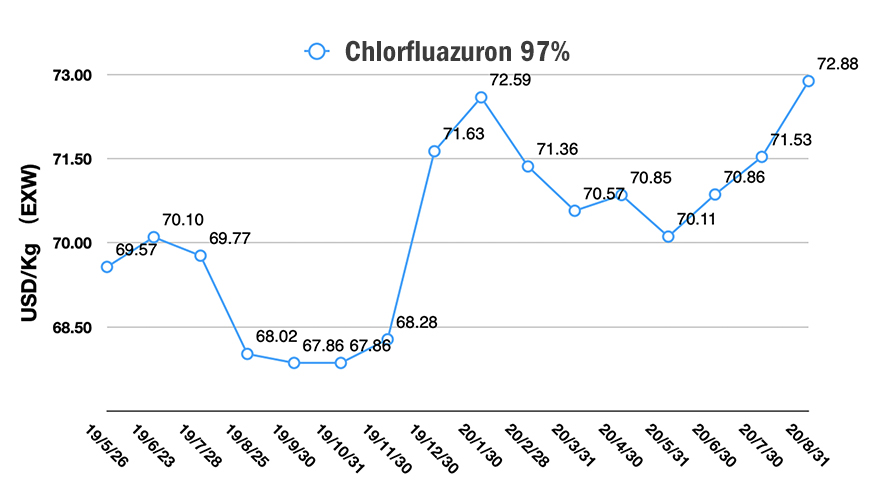

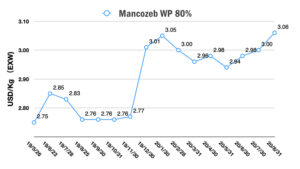

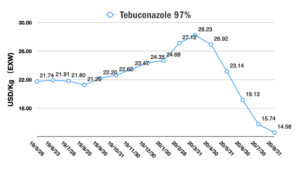

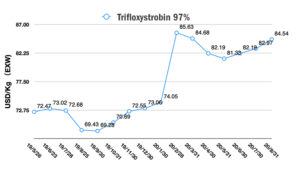

Fungicides

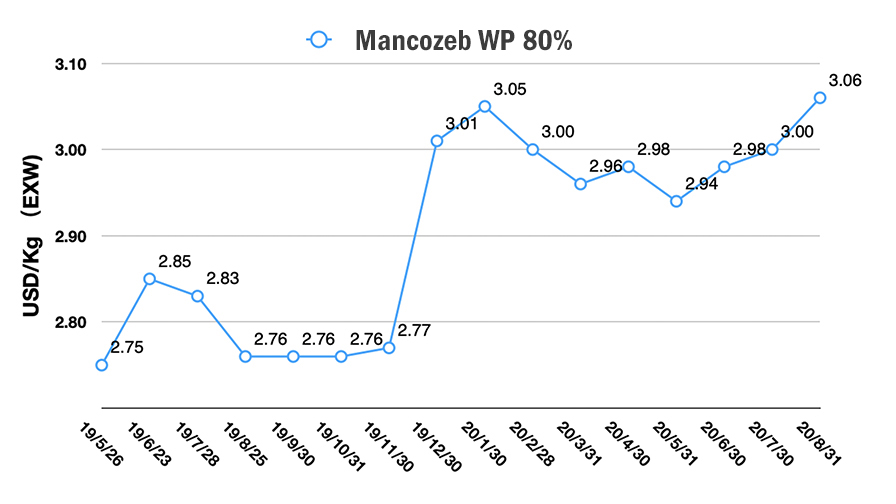

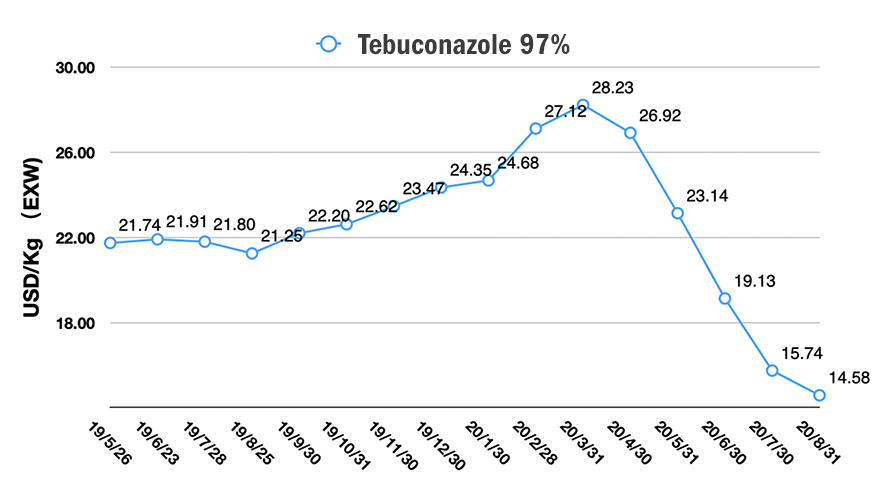

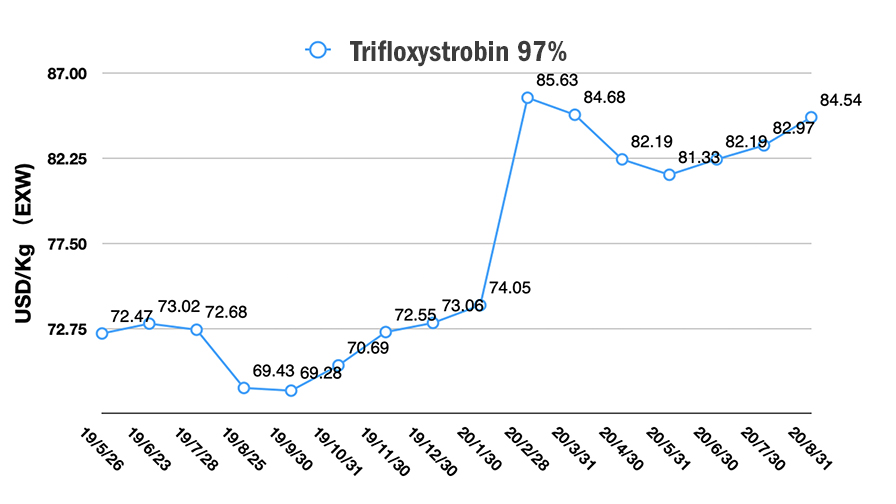

Mancozeb 80% WP price keeps going up. Trifloxystrobin price went up. Almost all prices of Triazole active ingredients like tebuconazole were weak in August.

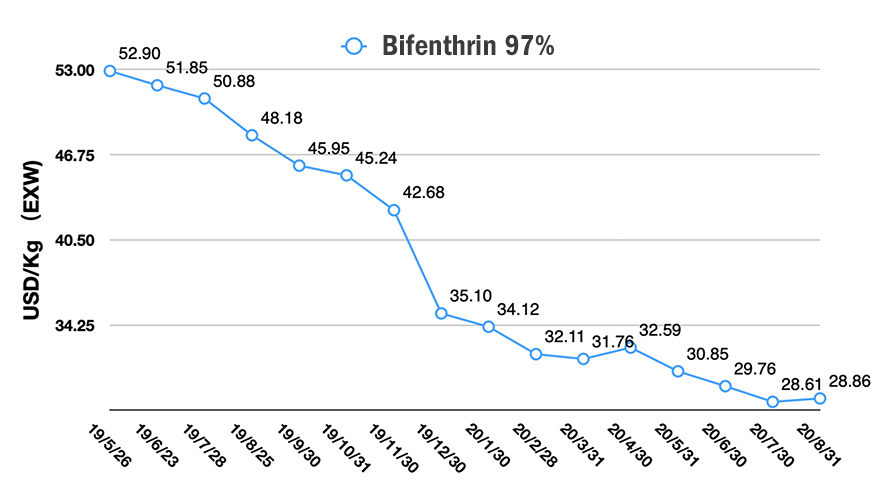

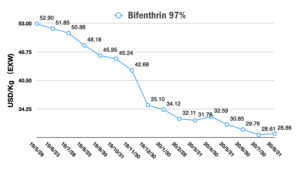

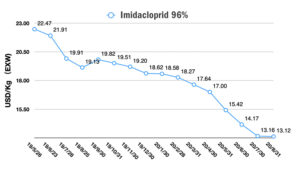

Insecticides

Since CCMP (2-Chloro-5-chloromethylpyridine) price was decreasing. And exporting of imidacloprid was not strong. The price of imidacloprid kept decreasing in August. It is a good time to prepare some neonicotinoid pesticides as inventory.