China Price Index: Volumes and Values Fall in August, Syngenta Group Continues to Grow

The crop protection industry is changing faster than ever especially amid COVID-19 and shifting global demand.

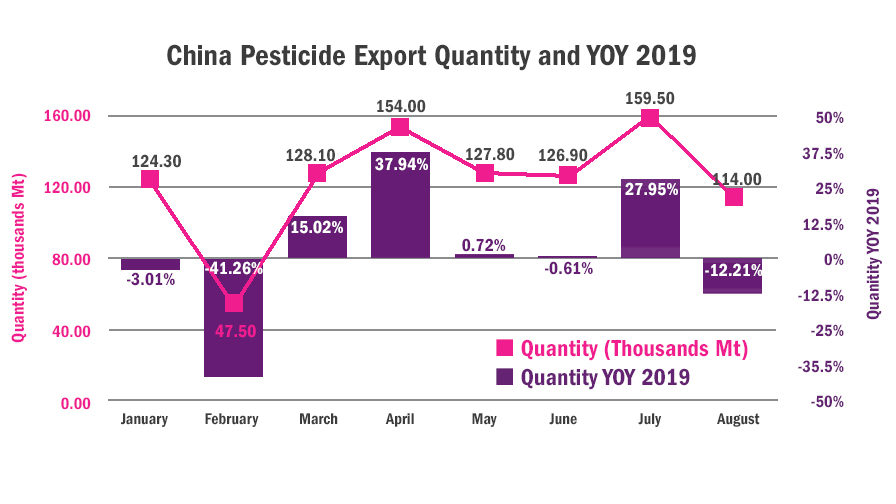

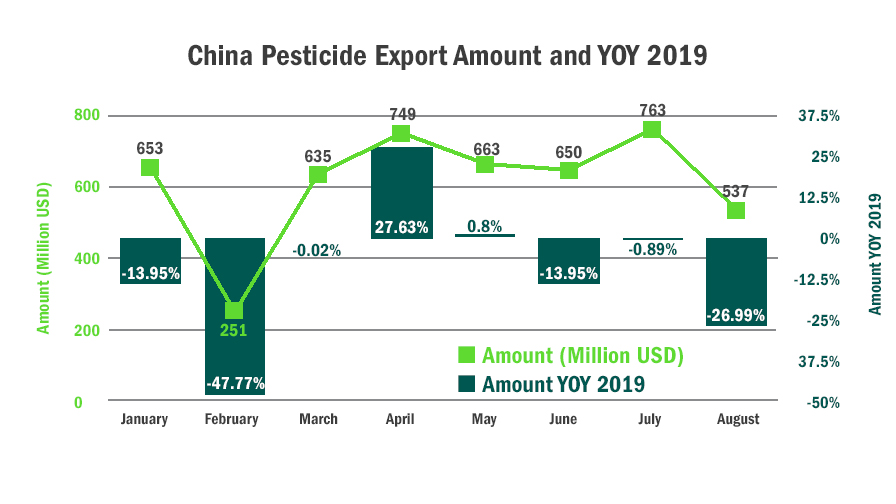

According to the official information from ICAMA, Ministry of Agriculture and Rural Affairs (MARA), China, export volumes and values of China agrochemicals fell in August. It was the first significant year-over-year drop in exports since February. Volumes fell more than 12% compared to August 2019, and values from the same time period fell almost 27%, illustrating soft prices in the current economic climate and the continued commoditization of high-volume chemistries and formulations. Some of it is by design as Chinese suppliers squeeze their margins to gain consistent purchase orders.

Parts of the demand picture are becoming clearer, too. For example, many distributors required heightened protections for their staff during the summer season, potentially limiting crop protection applications. Additionally, the early demand had stocked inventories and occupied the cash flow of overseas distributors, which put pressure on new product sales and distribution channel. The August slowdown in exporting is one signal of caution about global demand in 2021 season.

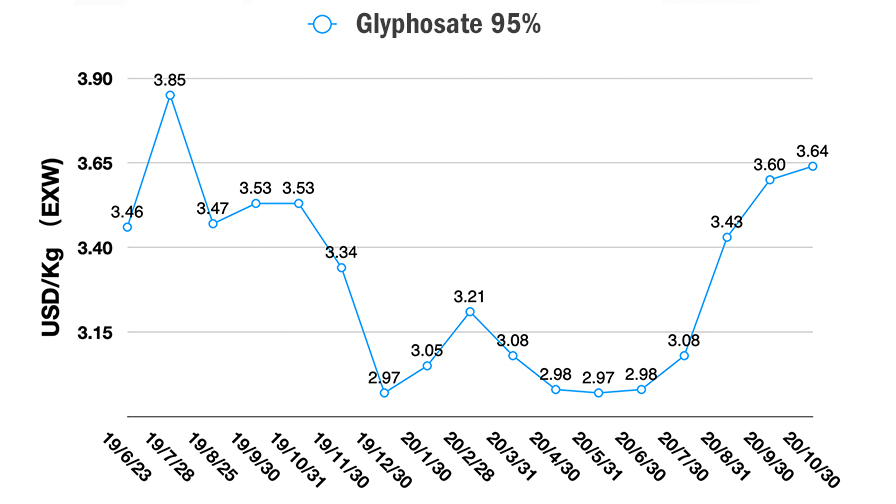

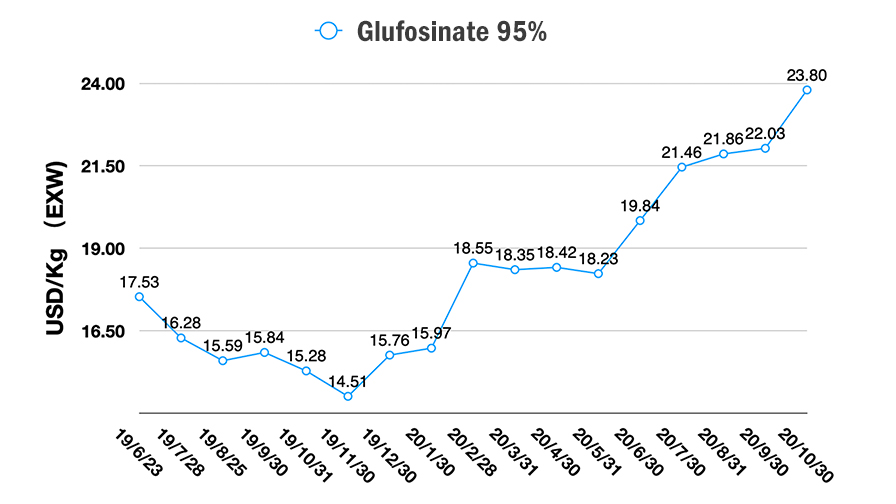

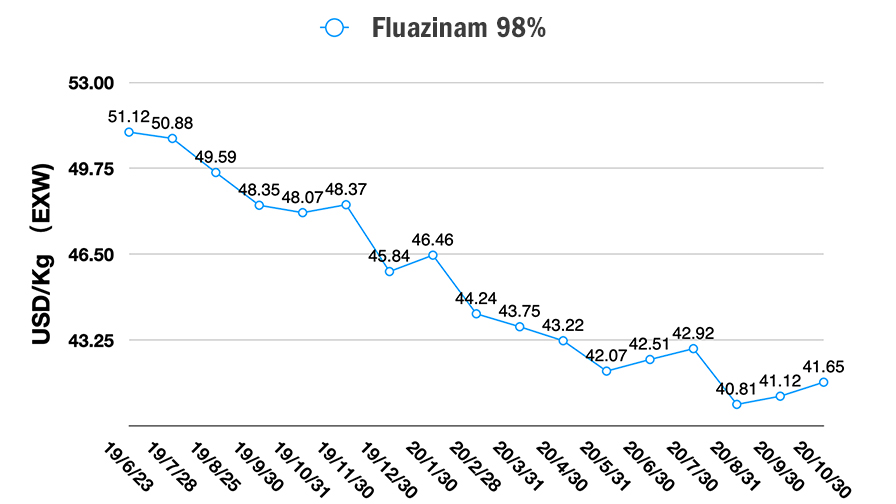

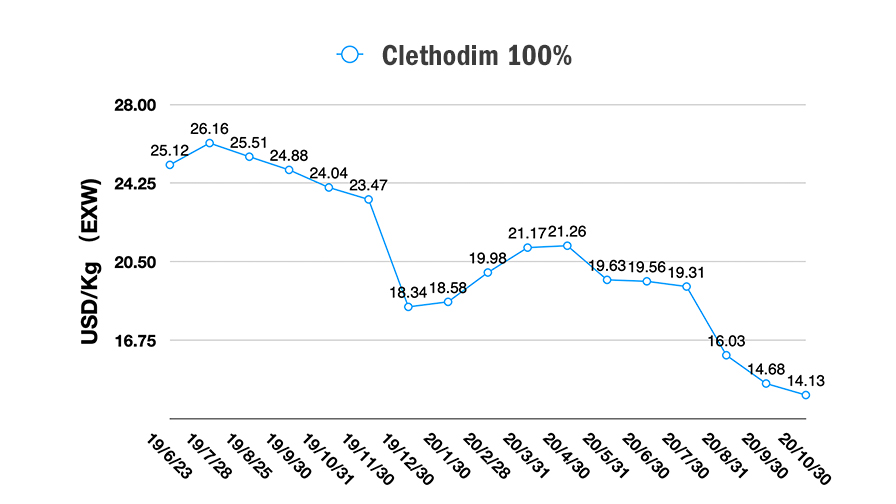

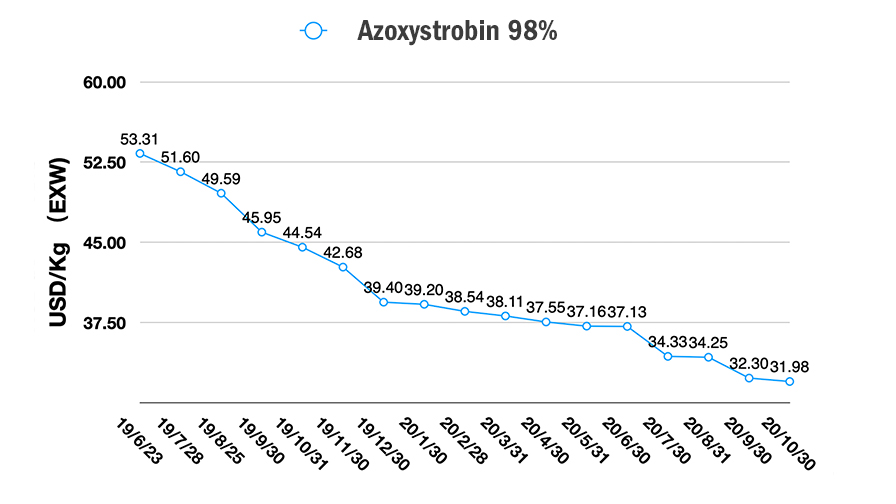

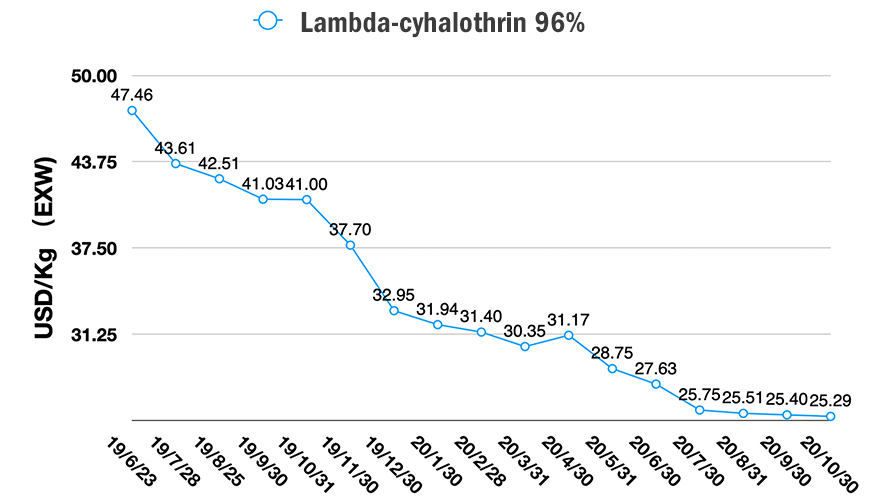

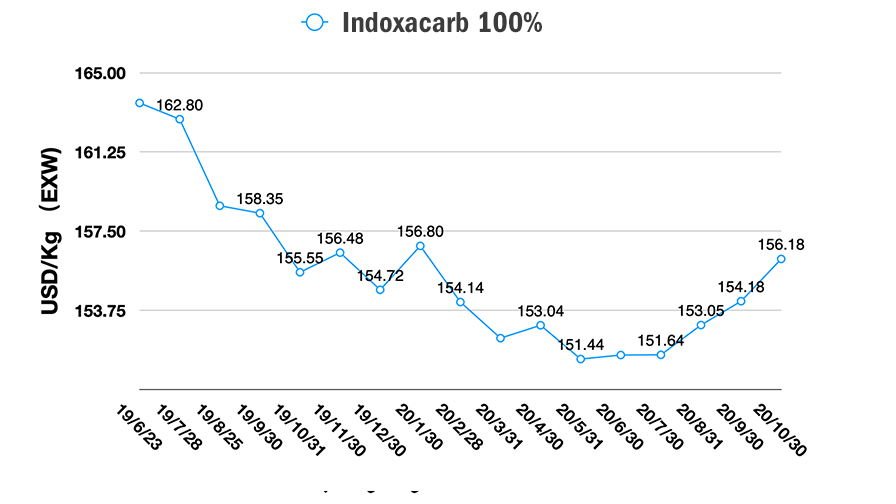

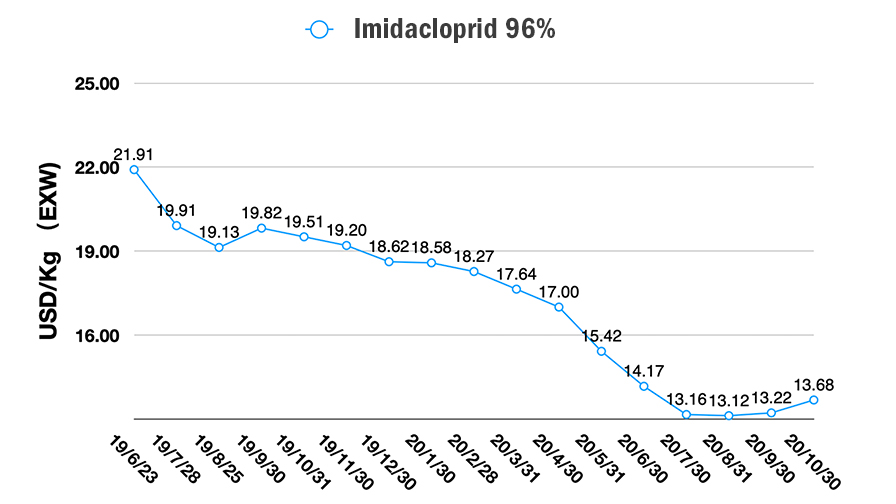

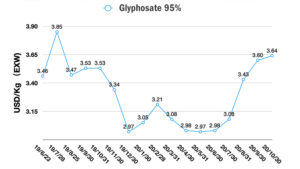

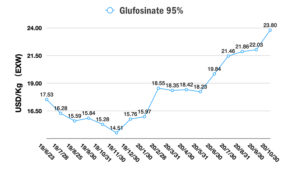

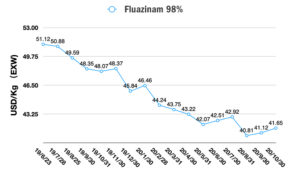

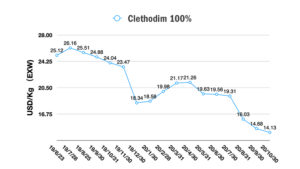

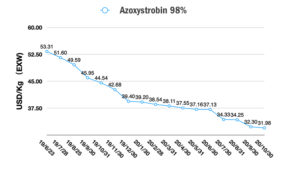

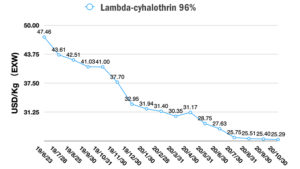

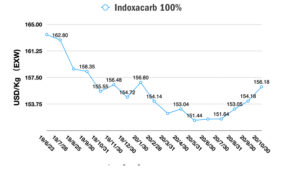

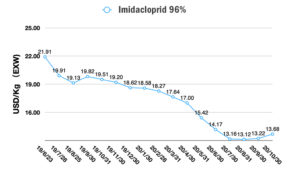

Fluctuations continued in October, partly due to the National Spring Holiday. The autumn season is the time for domestic formulation companies to place orders into AI producers. Glyphosate price is becoming stable, which could be maintained till the end of 2020. However, the raw material of glyphosate increased recently, so the glyphosate price in Spring 2021 could have a chance to increase. The clethodim price continues to decline, which appears to be engineered by some suppliers. The prices of glufosinate and 2,4-D have increased more than 6%. The nicotine pesticide prices increased during Oct 2020. And most price points of fungicides continue to be lower as a result of overcapacity.

In the China agrochemical industry, the huge integration on industry is happening which will lead to a new era of balance on supply and demand. The industry resources are consolidating into leading enterprises. The number of new producers is slowing as new capital pours into the agrochemical industry. M&A will be the key way to grow, optimize the portfolio and re-shape the industry structure.

ADAMA acquired majority stake in Huifeng’s Crop Protection synthesis and formulation facilities. The asset of Huifeng will contribute new capacity to ADAMA’s global supply chain on extensive portfolios. ADAMA can also help Huifeng to enhance management on environmental protection and waste treatment. The acquisition highlights Huifeng’s future growth based on its solid technology experience of agrochemical production. The anchor investor should generate a positive return on investment in stock market. Huifeng acquired by ADAMA, could have a chance to be another leading producer inside of Syngenta Group.

Huifeng was the leading manufacturer of prochloraz, epoxiconazole, bifenthrin, and glufosinate in China, along strong cooperation with multinational companies like BASF, FMC, and Bayer Crop Science. The biggest value of Huifeng is its position on global supply chain. When Huifeng faced investigation for environmental issues, the suspension of production affected the multinationals’ supply chain globally. The multinational sourcing team can’t move their supply chain out of Huifeng for other optional sources since the global registration of new sources requires time that could have forced companies to miss out on seasonal demand.

On Oct. 31, SinoChem International announced that assets of Yangnong Chemical will be separated, which will be put into Syngenta Group. Yangnong Chemical is the production leader in glyphosate, dicamba, and clethodim herbicides; pyrethroid pesticides and pymetrozine insecticides; and strobilurin fungicides. And their additional capacity is going to be released including propiconazole, difenoconazole, and fluazinam, among others. Syngenta Group could have more resources to meet the demand gap of the off-patent portfolio for global farmers.

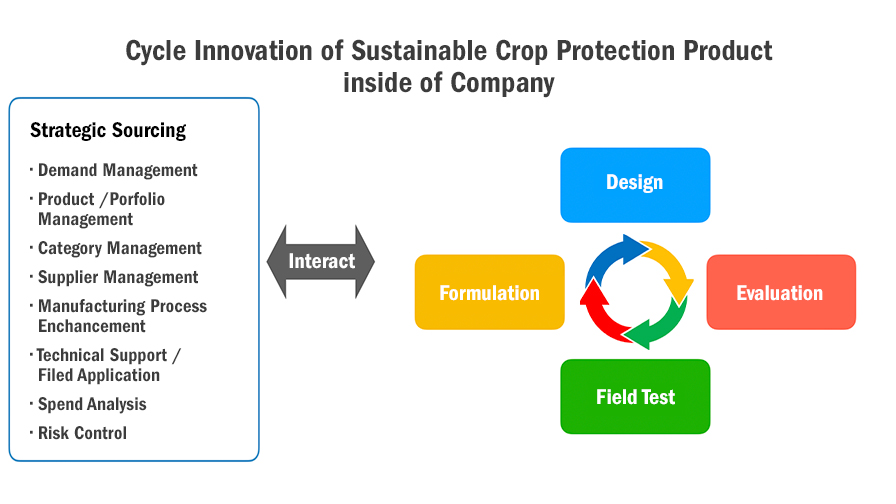

To deliver the sustainable crop protection product with reasonable profit is the key financial target for all activities of global crop protection companies.

The industry’s resources include raw material resource, experienced chemistry experts and workers as human resources, and capital resources. Even though the manufacturing centers are moving to northeast and west of China, the capacity is not the only critical point for sourcing consideration.

The huge capacity does not mean huge market demand. To the contrary, based on the simple economic theory, the demand decides the cost of production, which can be reduced by the production scale. Additional M&A activity can lower the cost of operations and optimize the resource allocation. Merger and acquisition targets will be introducing more resources into the cycle of innovation for sustainable crop protection product development, which is critical for sustainable growth of business.

A Chinese ancestral saying claims: Wisdom arises with adversity. The tough period during COVID-19 for the global crop protection industry will re-shape the future supply chain. The future sourcing strategy shall be the strategic sourcing interacted with sustainable product development supported by strong market insight. The novel ecosystem created by team internally or third-party alliance would be necessary during the new era of balance.