China Price Index: As Agrochemical Companies Centralize, Where is China’s Blue Ocean Strategy?

The best way to understand the China agrochemical industry is to understand and analyze the policy of China Agrochemical Industry Development. From 2018, Institute Control of Agrochemicals, Ministry of Agriculture (ICAMA) launched new Pesticide Regulations. The new regulation increased entrance standard of pesticide registration and optimize the control of pesticide production and operation for China.

New regulations enhanced the requirements for agrochemical industry entrance. Legal pesticides need to have official registration, including the requirement on production permit for quality control of pesticide product; traceability of China pesticide products by QR code; strict control on pesticide distribution channel; and official permission of agrochemical business in China.

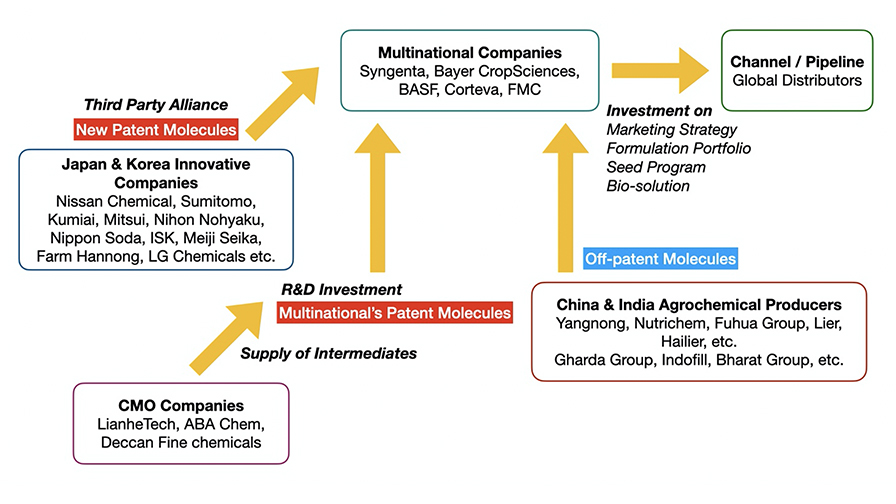

The high standard of entrance directs resources of the China agrochemical industry to the leading producers dominated by post-patent producers, but that is changing as the industry is more deeply influenced by multinational companies as they merge with and acquire Chinese capacity.

The new strategy adjustment by Syngenta, Bayer Crop Science, Corteva, BASF, and FMC have resulted in new alliances and cooperation on supply chain management. Cost savings and risk control of consistent raw material are two critical aspects which need to be considered by their sourcing teams.

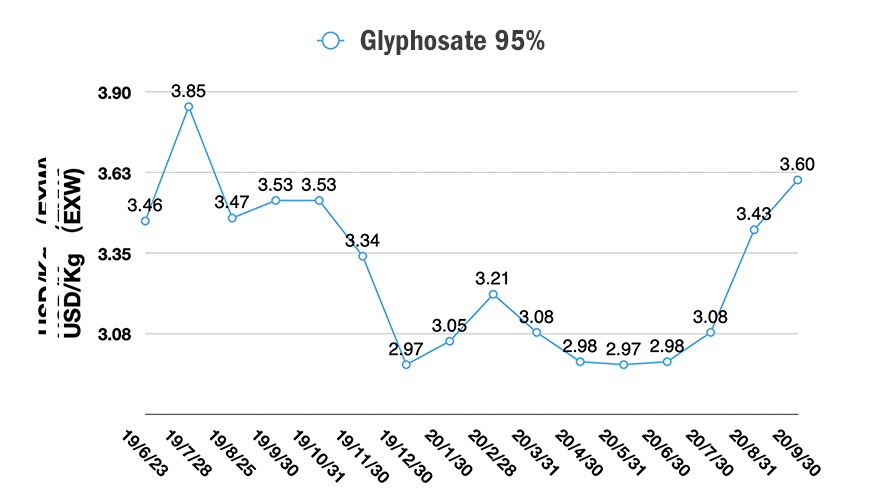

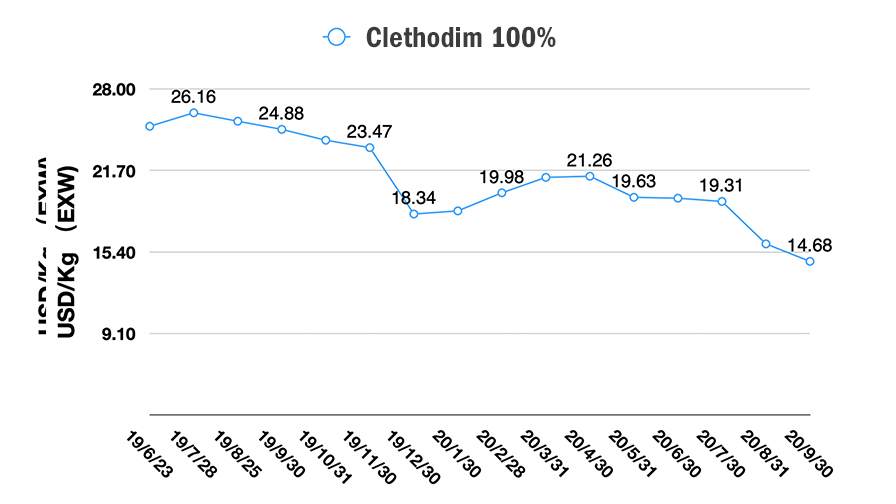

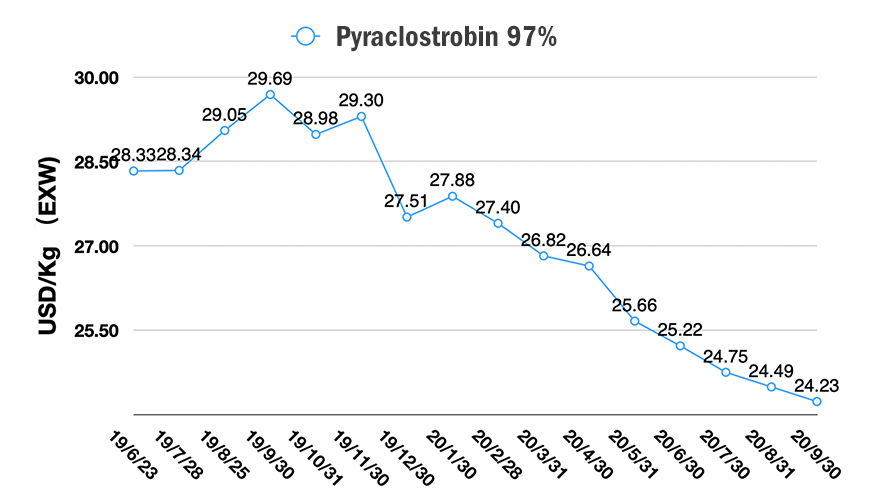

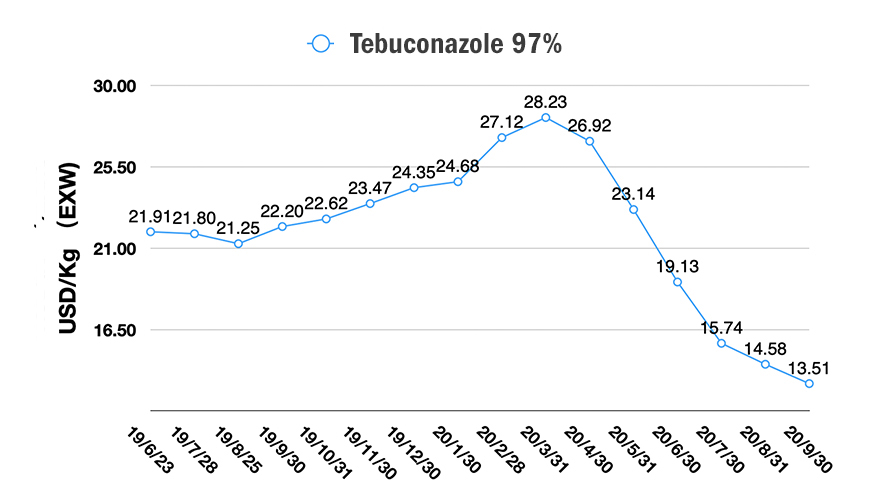

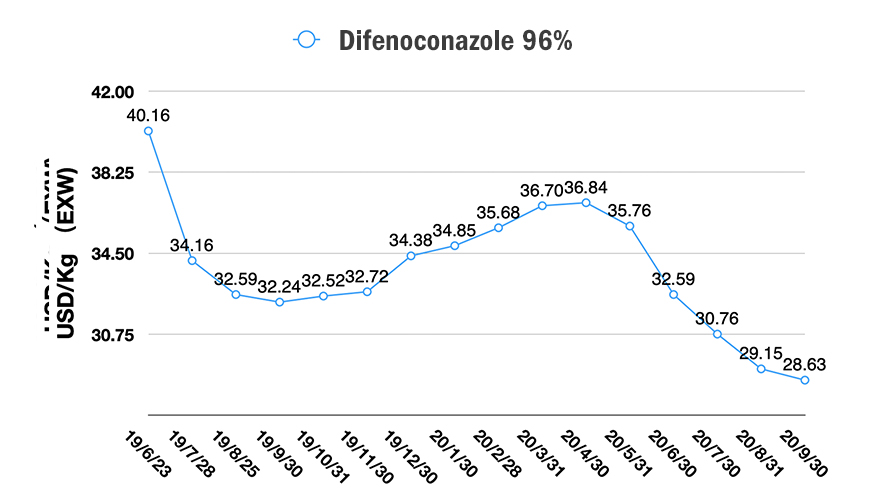

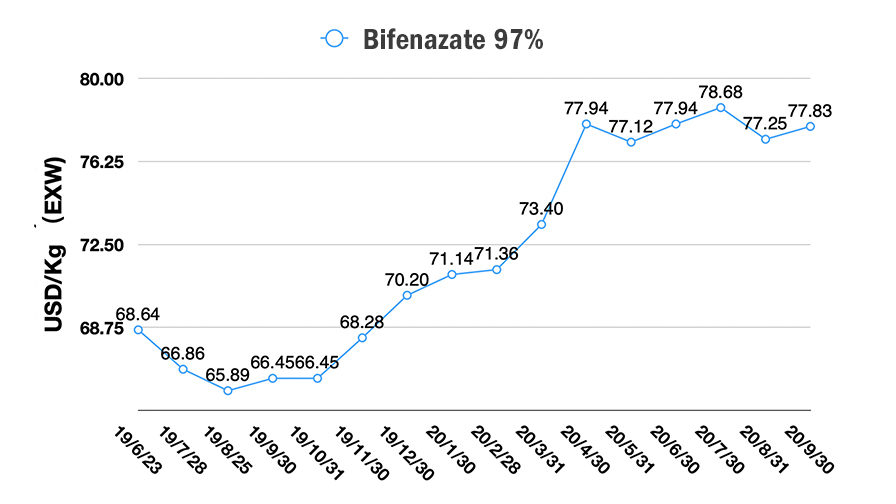

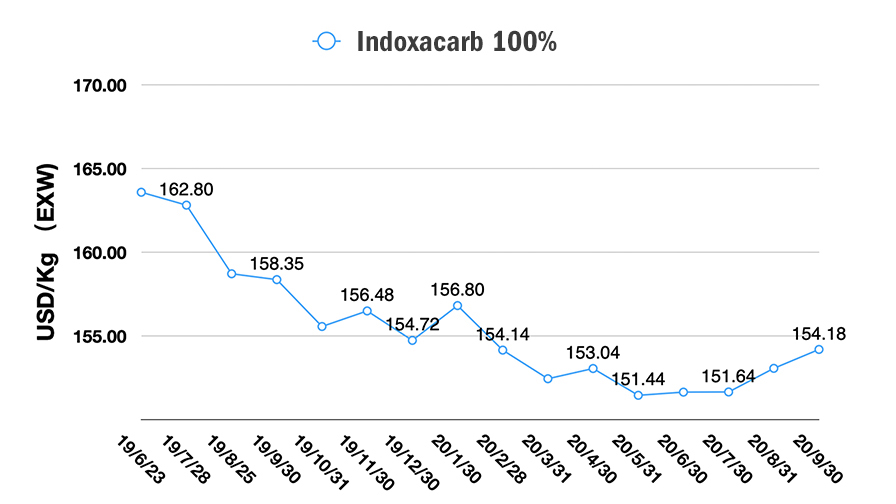

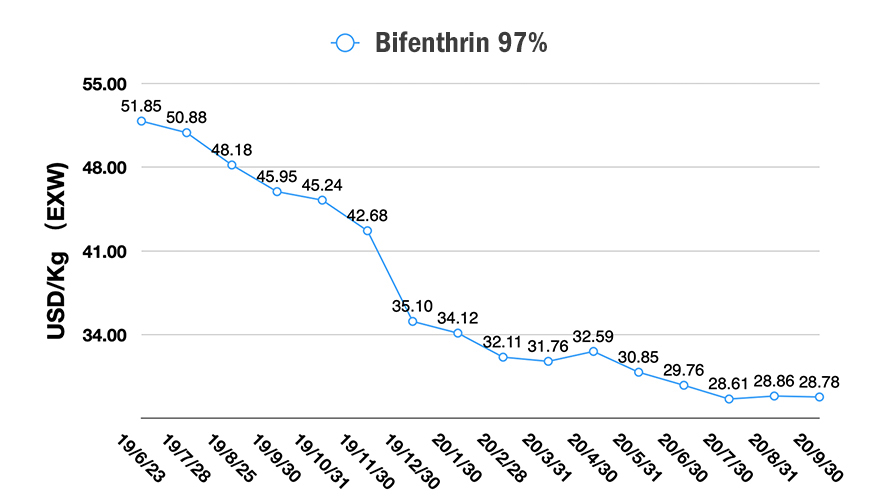

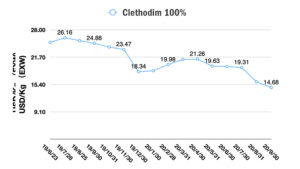

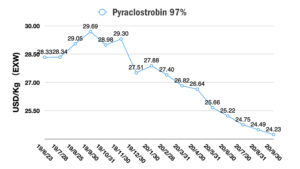

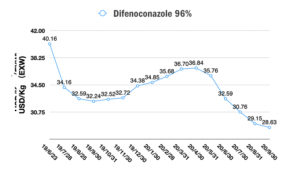

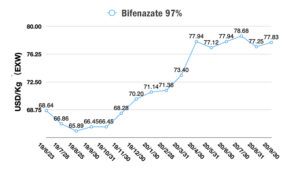

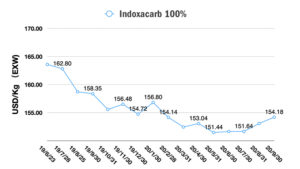

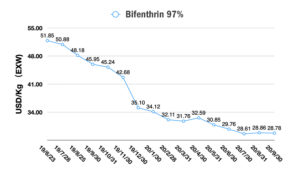

The China Agrochemical Price Index was affected by the Olympic Games in 2008, and environmental protection since 2017. The latest environmental protection enhances China’s capability of waste treatment and complete environmental law and regulations in the agrochemical industry. On the other hand, it also drives key manufacturers to relocate into national industry parks, heading into the northeast and west of China. So new capacity on most of agrochemical products began in 2018, and much of that new capacity is delivering product into the value chain now, possibly adding to the deflated prices we’re experiencing.

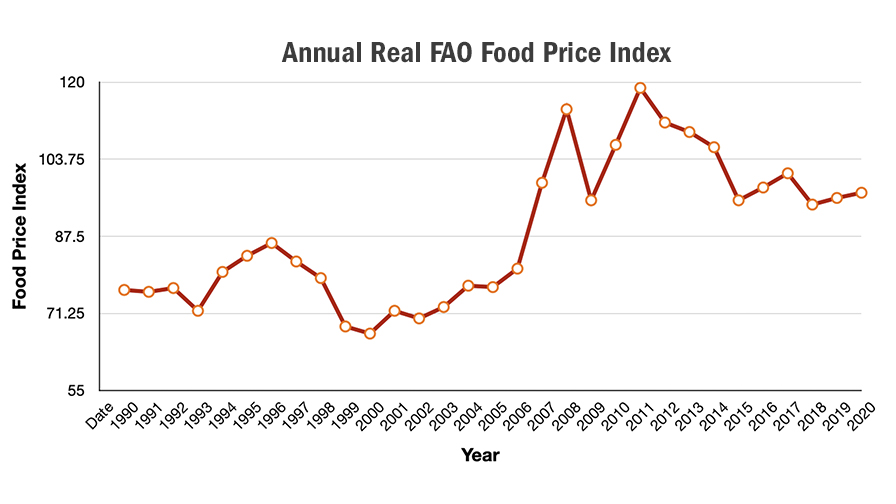

But the market will return to prices determined by the supply and demand of crop protection portfolios. According to FAO data, the Annual Real Food Price Index shows a slight increase of global food prices in 2020. Even facing the global pandemic of COVID-19, the global food supply is still stable, which will result in slowly increasing demand on global crop protection in the 2021 season due to the lower level of food prices, comparing 2011 to 2012.

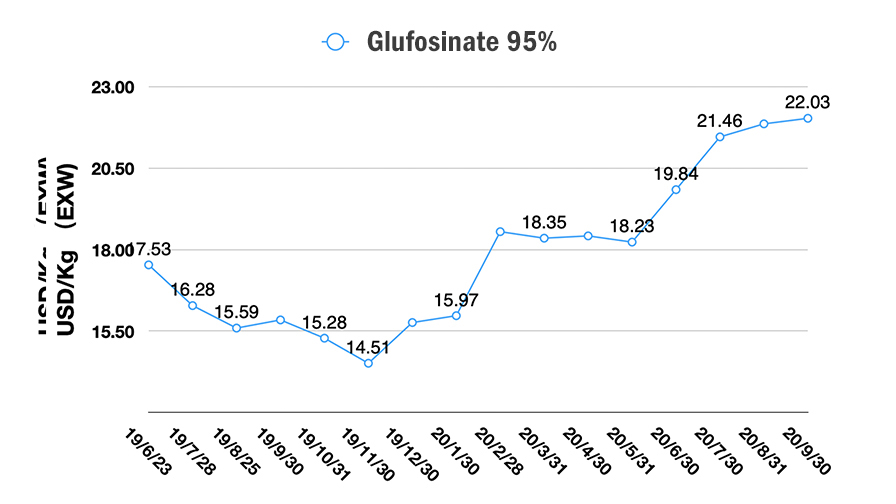

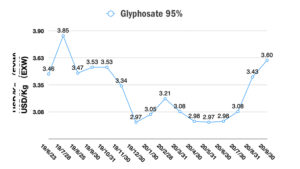

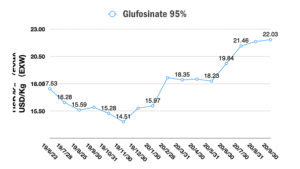

The stable demand on global crop protection will offset the high perception of high potential profit on new capacities in the coming three to five years. Moreover, we also need to consider the impact on off-patent layoff like chloripyrifos, re-eveluation of glyphosate, and dicamba’s drift issue. The uncertainty of global regulation will restructure global crop protection portfolios. Liberty with glufosinate and Corteva’s Kyber are good indication for global off-patent producers. The “traditional GMO seed program plus pesticide” is facing challenge on resistance on super weeds. The reduction of pesticide input and zero growth policy of China agrochemical inputs are the other key factors to be evaluated. Biological products could be a good choice for the market. China government also encourages to apply bio-portfolios into China arable land for sustainable growth on China agriculture industry.

The change of global agriculture industry drives the upstream to have disruptive strategy for better position in the market. Referring to the chart above illustrating the position of the China agrochemical industry in the world crop protection value chain, could off-patent producers figure out where will be their blue ocean of sustainable growth?

The leading producers have sufficient resources and support by regulators. But they still face the challenge on marketing strategy and manpower construction for the future growth together with global farmers.

China Agrochemical Supply (See slideshow for Product Prices)

After the National Holiday, the China agrochemical industry starts inventory preparation for domestic market. Its mainly for distribution of agrochemical formulation products into the pipeline in 2021 sales season from February.

The purchasers from local formulation and trading companies are participating in ACE, AgroChemEx by CCPIA, to discuss Q4 sourcing. It will give active ingredient producers a chance to monitor buyers’ concerns.

The AgriBusiness Global Trade Summit brought enthusiastic Chinese suppliers into e-marketing and online communication with a global sourcing team. More innovative companies are trying to reach customers in innovative ways. We call 2020 as the “first year of the online era” for the Chinese agrochemical industry. The digital marking will influence the whole value chain from molecule production to impact on global farmers deeply.

With the strong resilience of quantity exporting from July, Chinese agrochemical suppliers are trying to maintain transactions with customers by offering lower prices. Even though lower profit, it is the only way to decrease the production cost by full capacity operation. If we do not consider the occasional case like the Sichuan flood, the production and supply of China agrochemicals are stable. But the payment from overseas are still facing problems since the obstacles of social distancing from COVID-19. The customers are requesting longer credit line to get through this tough period.