COVID-19 Shifts China Trade; Pushes Agrochemical Prices Down

China trade was booming during days leading up to the challenges created by COVID-19. According to General Administration of Customs Peoples Republic of China, the Association of Southeast Asian Nations (ASEAN) replaced the European Union as China’s largest trading partner during the first five months 2020. China’s foreign trade with ASEAN members reached 1,700 billion yuan (US $242.9 billion) during the past five months, up 4.2% on a year-over-year basis, and accounting for 14.7% of China’s total global trade volume during the period.

The ASEAN countries have a history of trade with China that traces back two thousand years. The Maritime Silk Road connected China, Southeast Asia, India, the Arabian peninsula, Egypt, and even Europe, and flourished between the 2nd century BC and the 15th century AD. Today, the East battles COVID-19 together, which could contribute to Asia’s quick return from the pandemic.

With complementary economies and lower shipping costs, ASEAN countries like Thailand, Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, and Vietnam, have huge potential to benefit from future agriculture relationships with China and India. The potential China food and fruit market should open a new path for ASEAN economies to be bounce back from the impacts of social distancing and international lockdowns.

During Precision Application Asia (hosted by Meister Media Worldwide) in Thailand November 2019, the Thailand Board of Investment (BOI) highlighted the backgrounds of Thailand’s agricultural businesses to global precision agriculture partners. Agriculture is one of Thailand’s key economic contributors, accounting for 10.4% of total GDP. Rice, rubber, and tapioca are key agriculture products exported from the country. Looking at the country’s agricultural future, Thailand is driving into Agriculture 4.0 characterized by innovation-driven economy, sustainable agriculture, and precision farming.

There majority of small farmers in Southeast Asia work on less than 1 ha of land. This is similar to farms in the south of China. Unmanned Aircraft Vehicle System (UAS) crop protection is developing very quickly due to the labor savings and the ability to spray during the rainy season. In Thailand, S.A.T.I. Platform Co., Ltd. is training Thai farmers on drone control and drone crop protection. As an option for precision farming, the UAS crop protection is becoming a popular way of precision farming in Southeast Asia. In the foreseeable future, UAS crop protection is not only a new way to spray, but also a “new channel” flying on the sky.

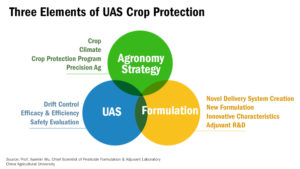

Due to the new demand from famers, multinational portfolios are also changing for UAS crop protection. Prof. Xuemin Wu, the Chief Scientist of Formulation & Adjuvant Laboratory in China Agricultural University made a speech at the Precision Application Asia show. He mentioned there were “Three Elements of UAS crop protection” for global precision agricultural professionals of Southeast Asia. Combined by agronomic strategy, farmers can utilize innovative technology like UAS, precision agtech, integrated pest management (IPM), and digital farming to minimize agriculture input and work toward increasing yield.

China has a strategy in place with the goal to minimize the growth of agrochemical inputs in 2020, called Zero Growth. In Southeast Asia, new regulations are coming out to re-shape the agrochemical supply as well. Thailand officially banned the use of paraquat and chlorpyrifos beginning June 1, 2020. Local farmers have 90 days from that date to return any remaining products that include those two active ingredients. Alternative agrochemical options will be critical for farmers. Meanwhile, India also issued its Banning of Insecticides Order 2020 on May 14, 2020. The manufacturing of mancozeb, 2,4-D, acephate, chlorpyrifos, and monocrotophos will be forbidden in India, and the country’s global supply strategy will be affected by it.

New off-patent molecules will become a more interesting investment. As such, there will be new competition on synthesis process enhancement and cost savings of recent off-patent active ingredient production over the next five years. Moreover, the new formulations with novel characteristic for precision farming can enrich the portfolios for generic companies to compete in the off-patent active ingredients market.

Manufacturers were affected by the supply chain block of raw materials and intermediates due to the COVID-19. The cost of logistics increased quickly during the past five months. With the impact of COVID-19, many currencies depreciated sharply. Routine investments into new capacity were still being carried out. All these factors are shrinking the net profits of China’s agrochemical manufacturers.

Multinational crop protection companies were executing a sell-in strategy into the Chinese market. Before May 2020, multinational companies pushed local distributors to purchase cargos as their inventory. They are all aiming to have as much as possible cash flow from key distributors. It also can put more pressure on competitors. In 2020, China has had more rainfall than in the past few years. Local agronomists are seeing heavier insect and fungus infestations, which will increase consumption in the China market. From June to September, the China local sales strategy would be sell-out to famers. All companies are paying to the distribution with high pressure of revenue in COVID-19 impact.

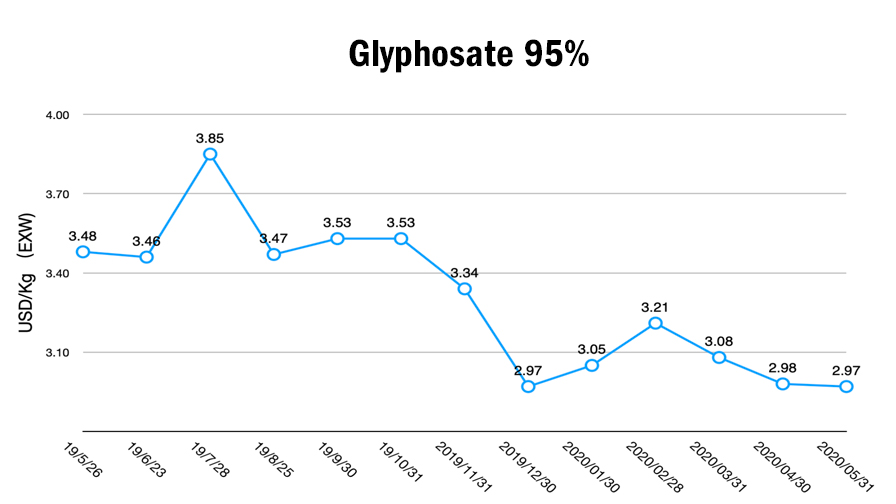

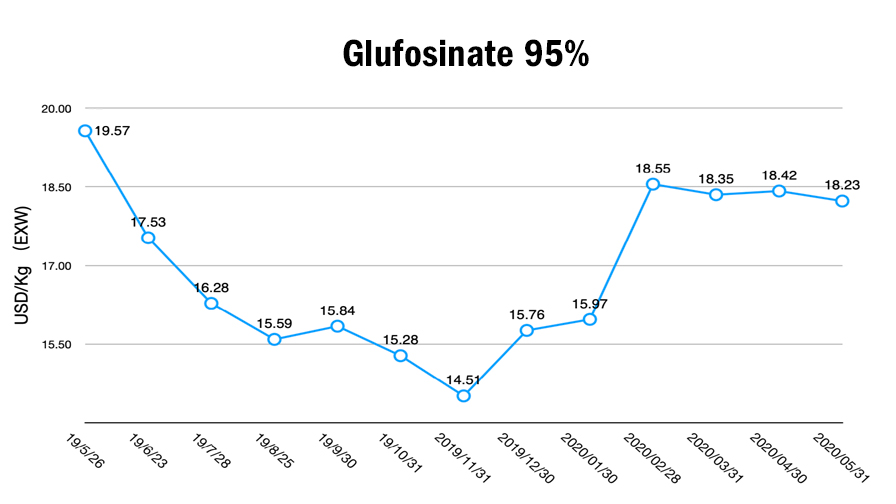

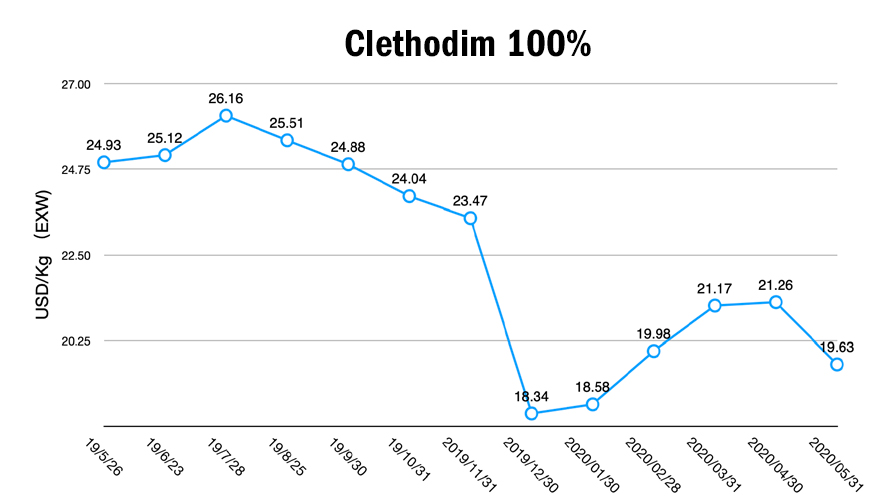

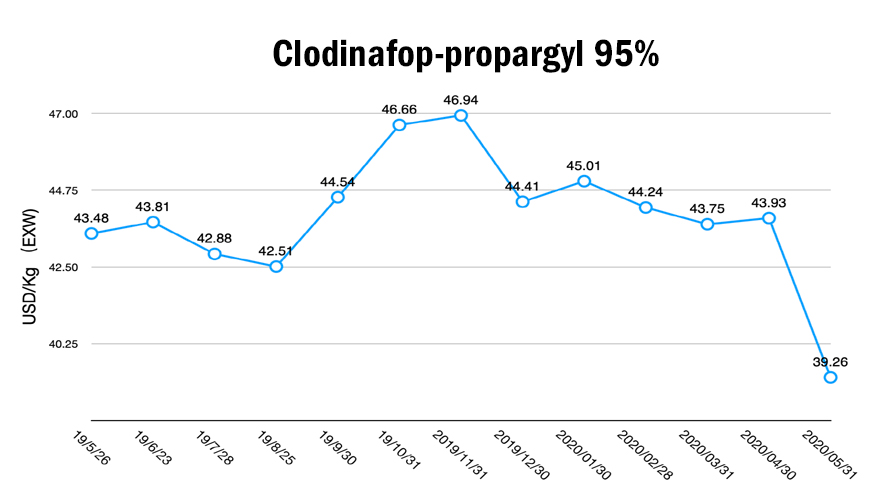

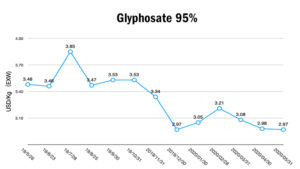

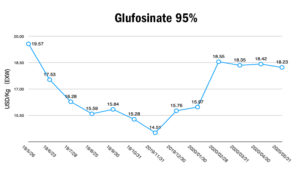

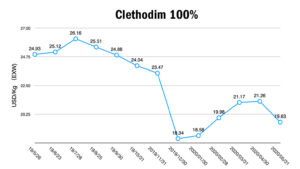

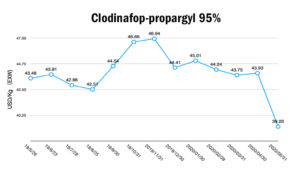

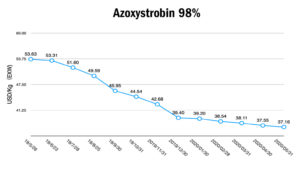

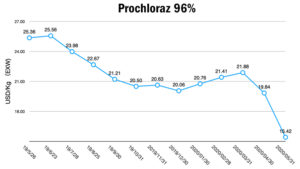

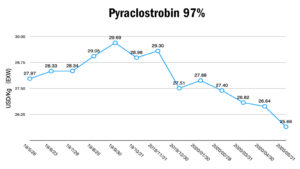

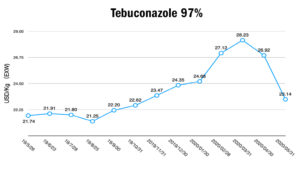

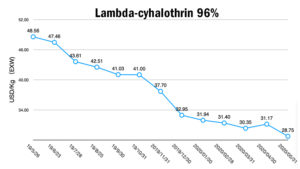

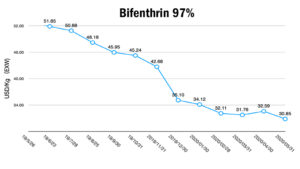

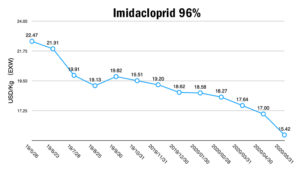

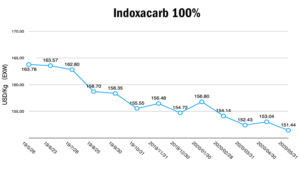

Below is a look at the current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market. Click on the product name to view its price chart, or view the slideshow above.

Herbicides

Glyphosate production was stable in May. As glyphosate inventories increased, the result was a newly balanced (lower) price. Glufosinate demand was stronger than in April; as such, the Ex Works (EXW) price of glufosinate is expected to head up in the coming few months following a fluctuation in currency that dropped the USD EXW price of glufosinate. Clodinafop-propargyl prices are dropping sharply because the supply of raw material has slowly returned to normal. An increase of clethodim availability decreased the price of the herbicide by 8%.

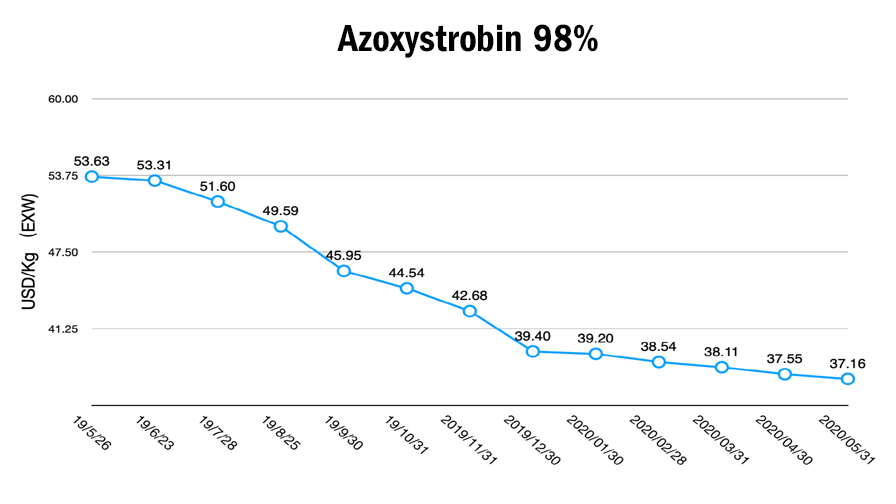

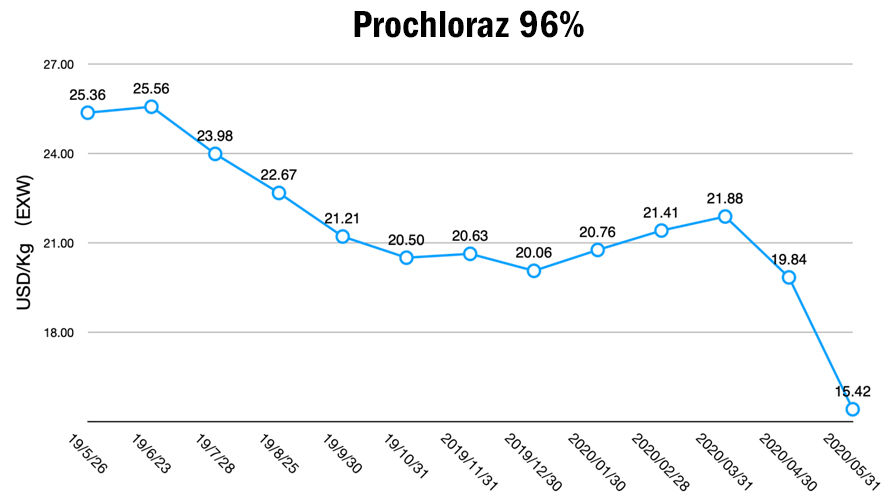

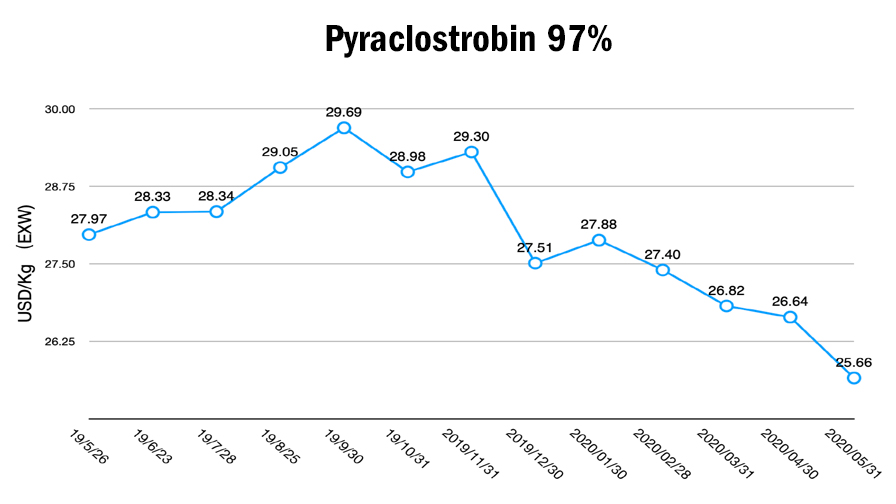

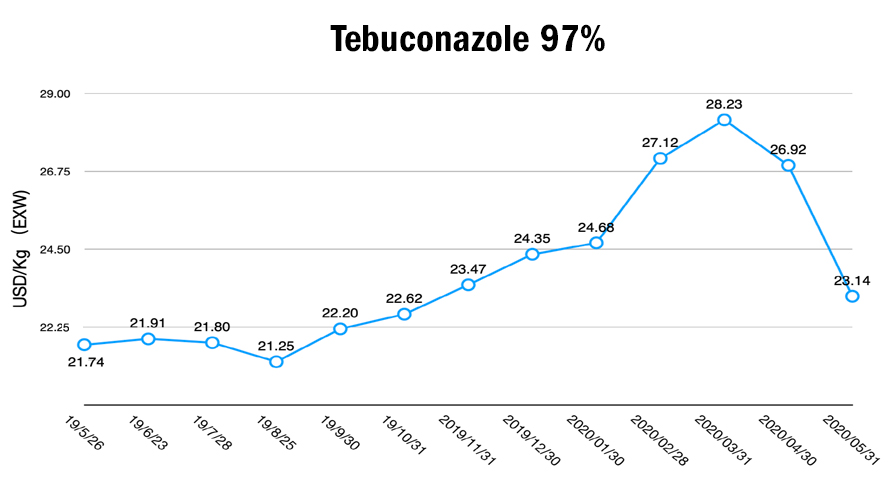

Fungicides

Most fungicide prices decreased in May. The price of prochloraz went down because of increased capacity timed to control wheat scab in China’s wheat market passed. Local demand for prochloraz is weak. Tebuconazole capacity increased quickly resulting in a price drop for the fungicide of 14%. Azoxystrobin price remained stable since the demand from overseas increased. The competition for pyraclostrobin is going to become tougher with additional capacity recently released.

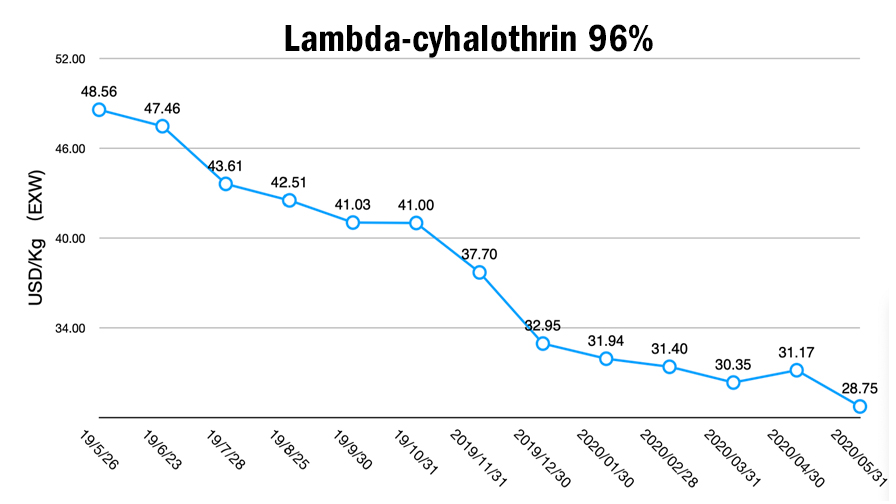

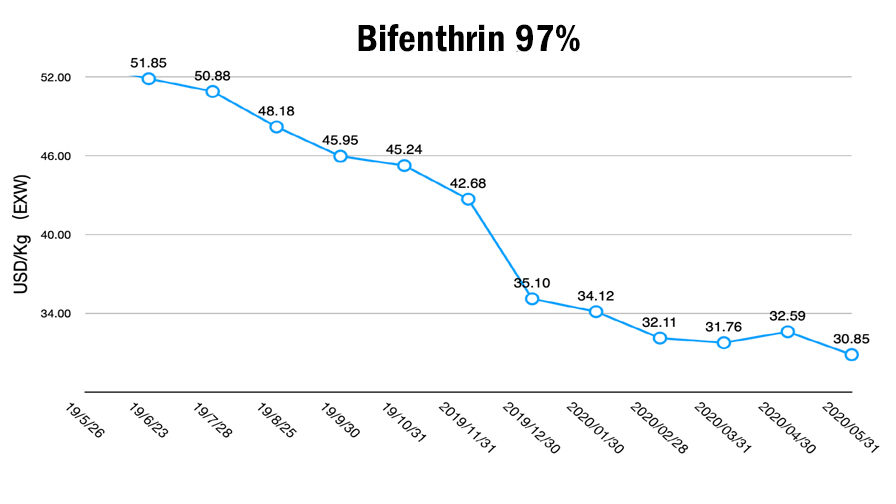

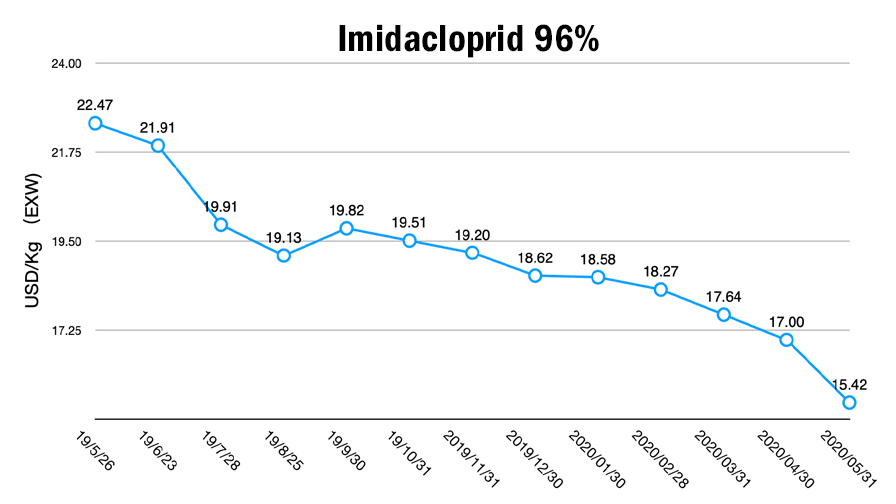

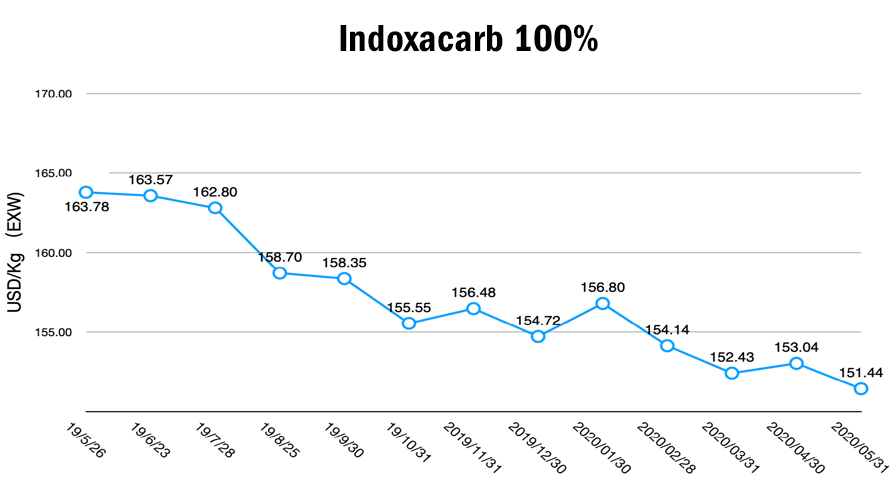

Insecticides

Prices for imidacloprid and acetamiprid went down 8% due to high inventory and low overseas demand. The China market demand of Lambda-cyhalothrin was also weak, which lead to the slowly decreasing price of the insecticide. As the bifenthrin manufacturing rate increased, the price of this insecticide also decreased gently. With the use of indoxacarb to control fall armyworm, the price of indoxacarb is stable (not considering fluctuating exchange rates).