How the 14th Five-Year Plan Will Reshape the Chinese Agrochemical Industry

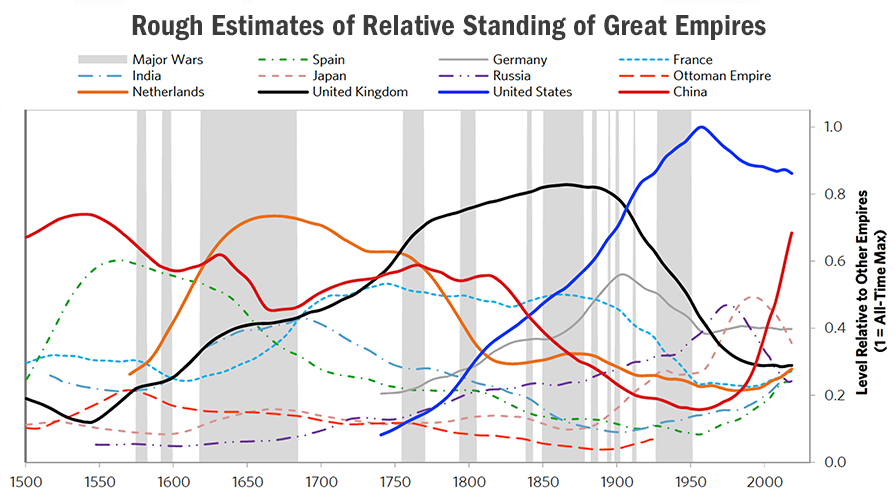

China is a unique civilization that has existed for around 5,000 years. The interesting thing is that China has continued to thrive during the existence of several prosperous empires throughout its long history. In “The Changing World Order” by Ray Dalio, Co-Chief Investment Officer & Co-Chairman of Bridgewater Associates, China’s growth history is detailed from a Western view. Dalio writes: Chinese leaders don’t just plan and try to implement their plans; they set clear metrics to judge their performance, and they achieve most of their goals.

In Chinese culture, we build an infrastructure of partnerships for many decades to execute the strategy with persevering patience. To protect the prosperity for the long term with benefits to the most people, Chinese ancestors create a system of self-examination that is hidden in Chinese philosophy and language. So the Chinese focus more on inner thinking than confrontation and circumstance.

In the beginning of 2021, China is investigating the 14th Five-Year Plan (FYP) for the agrochemical industry. The policy will guide the whole industry to move on from 2021 to 2025. The key goals of 14th FYP will be achieved till the end of 2025. So the basic principles of 14th FYP for agrochemicals can be a guideline for the future cooperation with Chinese suppliers.

Mergers and Acquisitions

The number of companies in the Chinese agrochemical industry will continue to decrease in the 14th FYP. New M&As will happen most probably among top 50 leading agrochemical companies in China. The big manufacturers will use their capital to launch the latest processes for molecule synthesis. The growing capacity of big manufacturers will bring more pressure on medium and small-scale producers with expectations they will not be able to compete. Scaling up can minimize the cost of production, and maximize the net margin of profit. By controlling natural resources and upstream supply, the Chinese agrochemical industry will be reshaped and oriented to innovation. Medium manufacturers can survive only by differentiation of their portfolios.

On March 31, 2021, China’s Assets Supervision and Administration Commission of State Council (SASAC) officially announced the merger and reorganization of SinoChem and ChemChina. It is the first M&A case for the Chinese chemical industry, in which agrochemical is only one part of their business. It will impact the China agrochemicals industry profoundly since the industry resource allocation will be reshaped. The upstream resources allocation will push the downstream manufacturers to re-arrange the investment on portfolio development. The merger will also have slow and indirect influence on the supply chains of the leading multinational companies.

Innovation

In the 14th FYP, China is aiming to control the rising capacity and focus on innovation. The key manufacturers will not only develop the production efficiency but also to control the impurity with cost savings for generic active ingredients. On the other hand, China manufacturers will also become more competitive on active ingredients with recent patent expirations. New capital entering this space has been focused on new patent expiries for many years. Additionally, the industry is focused on developing their own patented active ingredients, which is achievable by benchmarking the Japan and Korea agrochemical companies. It will provide more room for China manufacturers to have third-party alliances with multinational companies to supplement gaps in multinationals’ portfolios. The CDMO (Contract Development and Manufacturing Organization) and the development of new, patented AIs will progress in coming five years.

Carbon Neutralization & Sustainability

Since the heightened environment protection mandates that began in 2017, China’s agrochemical capacity continues to move into the northwest and middle of China. There is around 93,000 Mt AI capacity increasing in Nei Meng Gu, 132,000 Mt capacity arising in NingXia, and 27,000 Mt capacity growth in Hubei Province. The China agrochemical industry is facing a big challenge to balance between low-cost production and environmental regulations.

By innovating synthesis processes, Chinese companies will be able to expand the net margin of generic AIs, enhance the yield of synthesis, and control key impurities.

This will favor the larger companies, as China is expected to reach peak carbon emissions by 2030 with a goal of carbon-neutrality by 2060. Only competitive manufacturers can contribute to this goal. So the factor will impact M&A of the China agrochemical industry to achieve more market competitiveness.

For global end users, China will also develop sustainable formulations for farmers to face the challenges on climate change and impact from the pandemic. The novel sustainable formulation, such as CS, OD, DF, and DF, will become instrumental in providing sustainable solutions for farmers around the world. Moreover, the drone (UAS) delivery of crop protection products with digital farming is becoming more widespread and will provide options for farmers to achieve the goal of carbon neutralization.

These national trends will surely impact the sourcing strategy from China. The dynamics between supply and demand will always drive the industry’s development. For sourcing from China, the agrochemical leader’s infrastructure decides the success of supply chain management. Some large, well-funded companies might not be suitable for the sourcing strategy perfectly. Some bright shining company may have deep risk even though they are publicly traded. This will force Chinese companies to dig deep into their supply chains to choose the best partners so benefits can be realized for all companies that in the channel. This relationship-based way of doing business will be important for Chinese leaders to help build trust in their organizations.

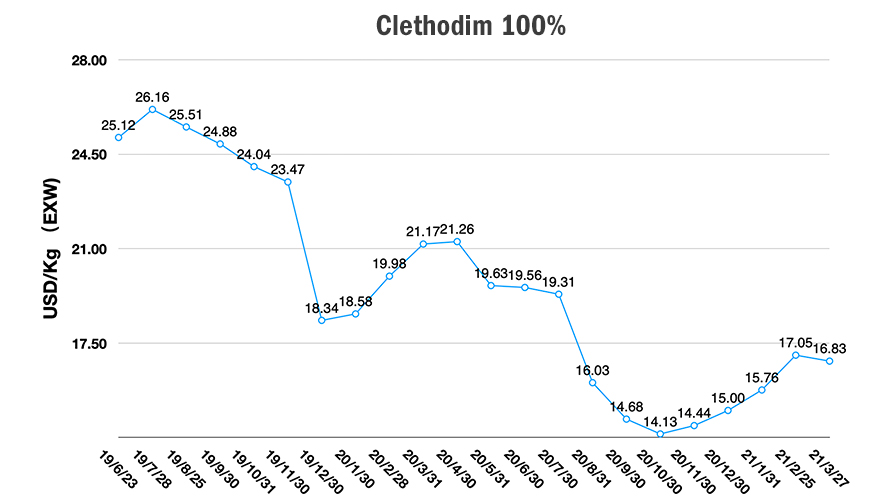

Currently, the high production/price-based model still dominates China, and the high inventory in the Chinese agrochemical market is driving prices weaker than manufacturers expected. Higher price trends could disturb the buyer’s purchasing strategy. The pressure of high raw material prices still exist, raising the cost of production while high inventories are starting to deflate prices for some AIs.

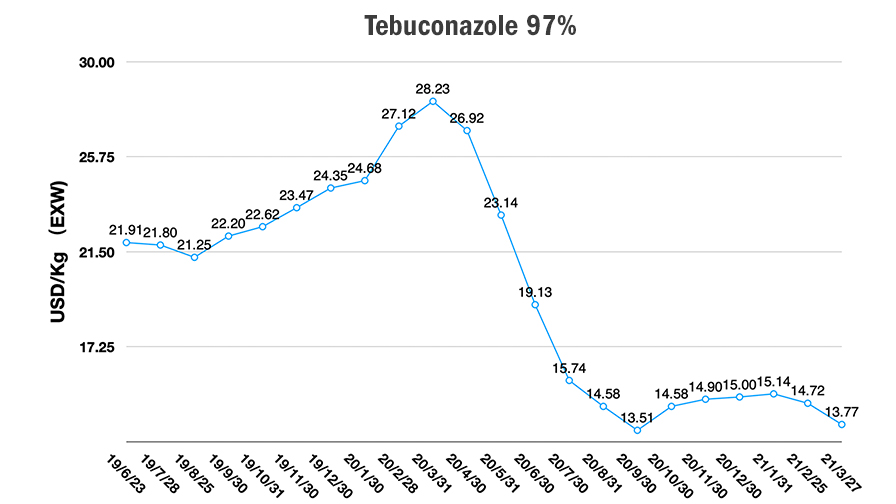

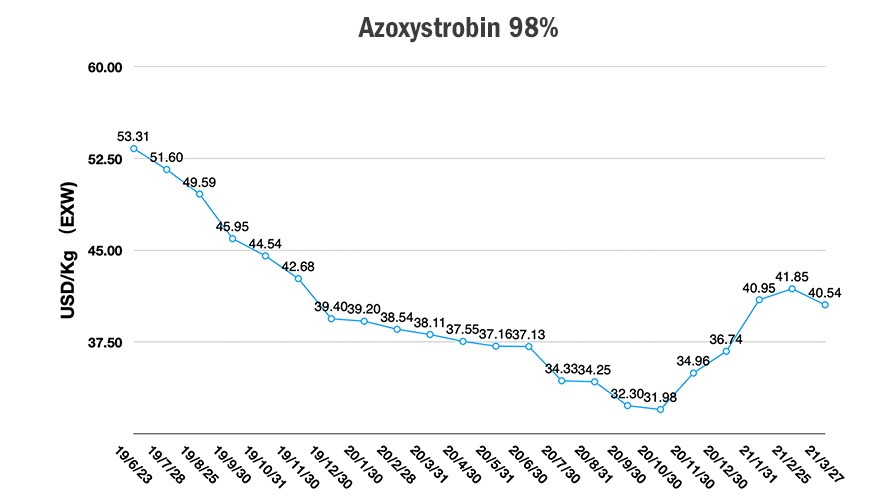

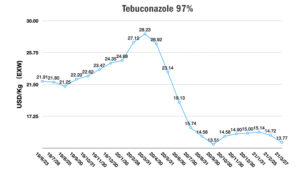

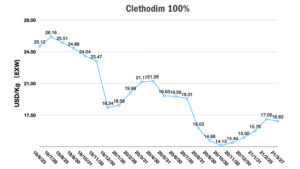

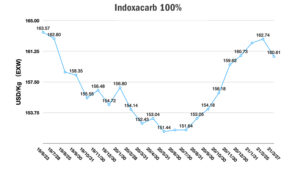

This is happening to some extent with triazoles. The demand on the azoxystrobin appears weak, and combined with strong supply, is pushing prices lower. Most of fungicide prices are starting to decrease since March. It is also because of the agrochemical application timing in the Northern Hemisphere. From May 2021, the LATAM demand will influence the market, and the prices of key fungicides on field crops could have chance to increase during the 3Q of 2021.

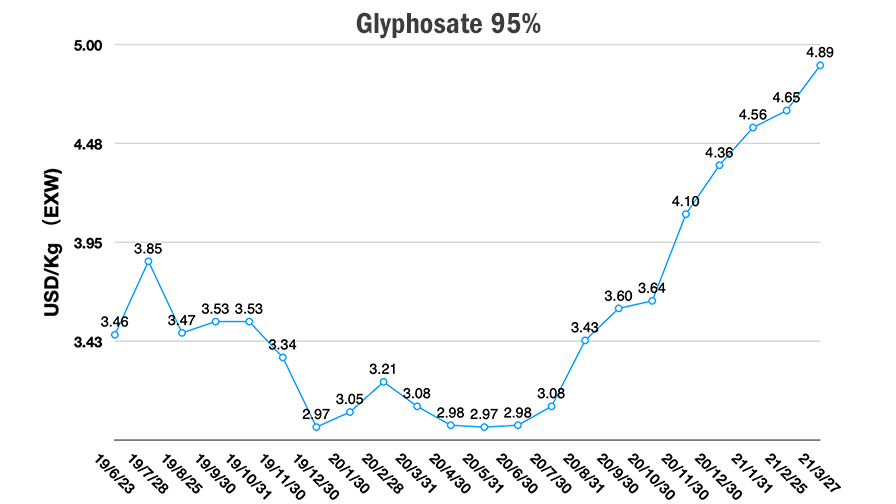

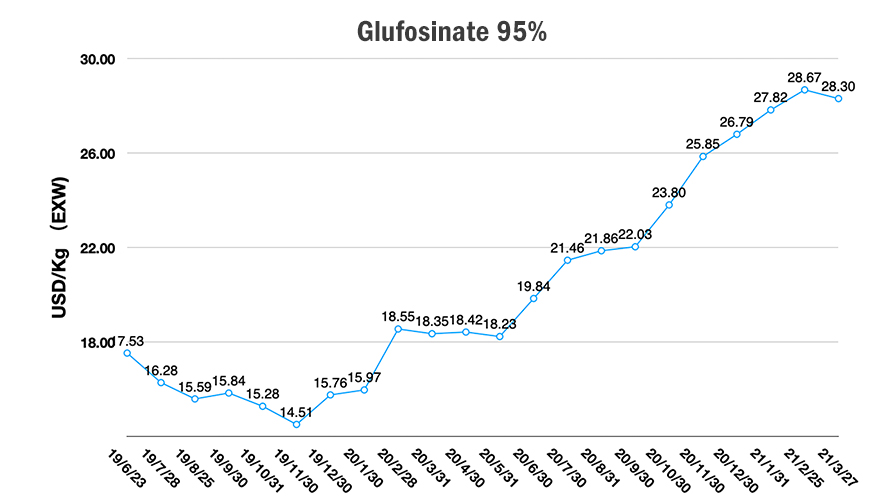

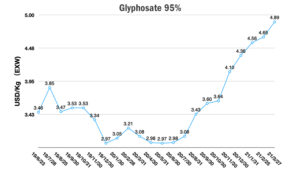

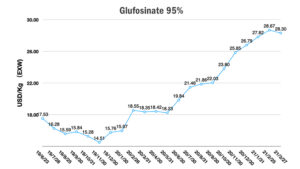

Glyphosate prices are expected to be high in 2021. Due to the higher raw material price of basic chemicals, glyphosate will have a stable higher pricing than 2020. But high EXW price, which includes transportation costs, might hurt the consumption in the ending market. Glufosinate is a typical case where high price could restrain the demand. It is obviously a basic law of economic about price and demand.

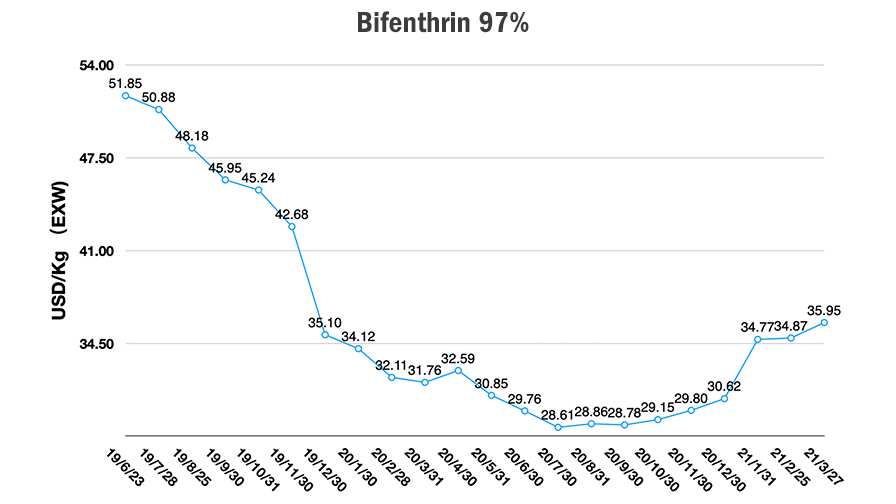

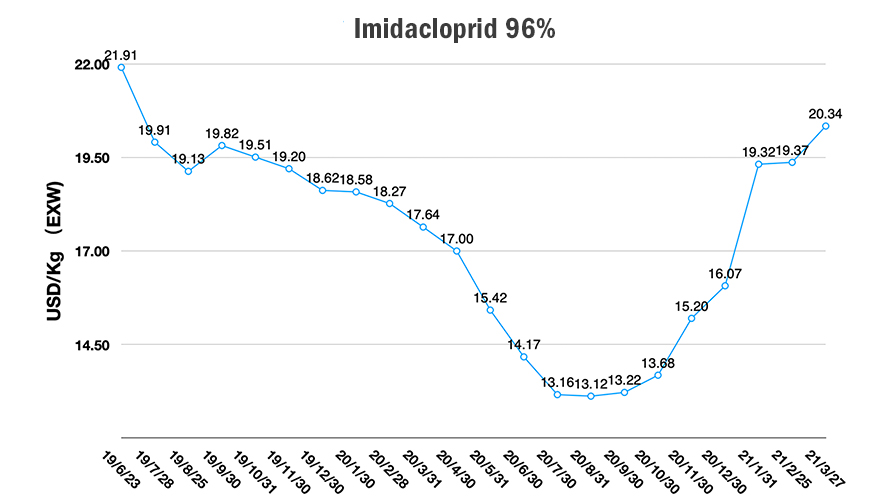

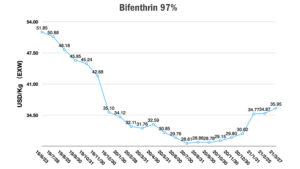

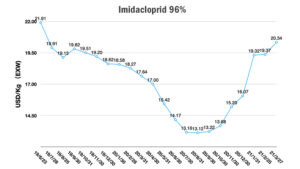

Because of high raw material cost, neonicotinoids reached the high pricing level in February, and the price touched the highest point in March 2021. In March, most prices of insecticides were relatively stable due to the stable high price of basic chemicals. Global market demand affects the quotation from key insecticides suppliers since the wining of order is important during the cold season. Fluctuation of exchange rate is also a factor that will affect some insecticide prices.