China Price Index: Raw Materials Continue to Drive Glyphosate Price; Glufosinate Could Hit $50/Kg

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he provides insight into a slew of factors, from raw materials supply and manufacturing regulation to higher shipping costs and weather events, that are transpiring to elevate prices of most major product categories.

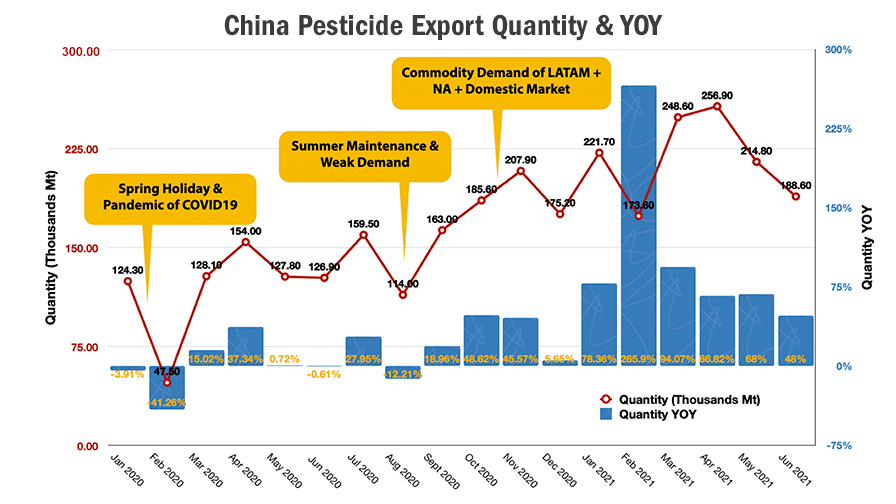

ICAMA released the latest agrochemical exporting data for June 2021, which aligns with the cyclical exporting trends for China. In summer, Chinese manufacturers need maintenance, and after the strong demand of North America and Asia-Pacific, the exporting volume will be lower from July to August compared to previous months due to facility maintenance.

Agrochemical exports have historically increased after August. Q4 will be the hot season for global allocation of commodity for supply channels. The exporting volume will be in high level in Q4. And then the volumes will fall during January and February during Chinese Spring Holiday, when companies operate at lower capacities.

In 2021, the export volumes in March and April were strong compared to 2020, largely due to disruptions in the supply chain globally as a result COVID-19 pandemic that disturbed the global purchasing rhythm. Since then, global distributors needed to manage lead time in advance.

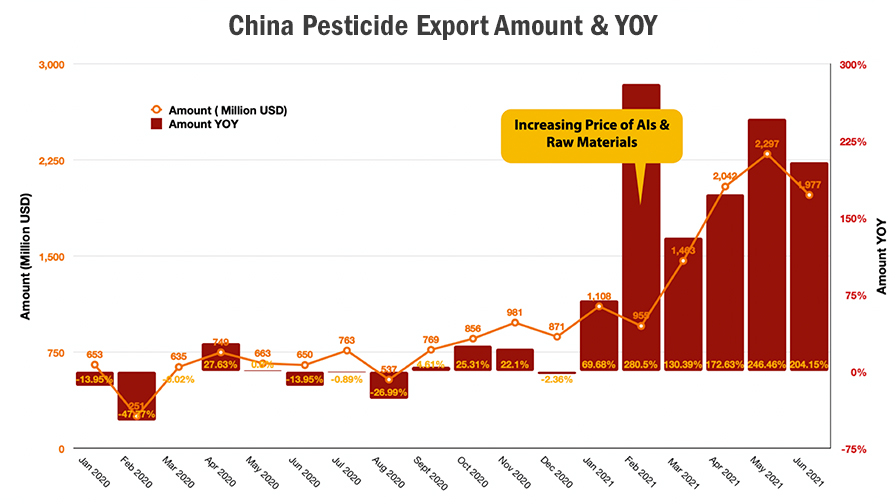

There have been many consequences of the new purchasing paradigm that requires more lead time to secure products, notably bigger volume contracts and more pressure on financing to maintain higher safety inventory. During the global COVID-19 pandemic, such procurement strategy increased the cost of inventory and required longer credit lines for buyers. Global distributors are facing huge cashflow challenges. The distribution channel has needed to increase their prices to maintain net profit growth. On the other hand, financing costs for manufacturers have also been increasing due to the long-term credit line support to buyers. Currency fluctuations brought operational risk and pressure on margins for all parties in the value chain.

Global demand is an invisible hand that is controlling market trends. High prices will be influencing the demand in the market as distributors work to secure their inventory amid uncertainty.

Some well-informed distributors prepared for the higher prices when they figured out the key active ingredient prices were rising. The inventory from Nov 2020 to April 2021 are in warehouses and distribution pipelines and has been converted to formulated products. These inventory levels will leverage the future demand of farmers. By anticipating, the consumption of high price AIs in 2021 will become a key factor for 2022 demand of AIs from China, which will be especially impactful for glyphosate.

The global crop protection market is dominated by GMO planting. The key GMO programs drive the consumption of non-selective herbicides. Liberty Link, Enlist E3, and Roundup Ready 2 Xtend are the key brands of GMO varieties. Glufosinate, glyphosate, 2,4-D, and dicamba are the key active ingredients in dominant position of the non-selective herbicide market.

Glyphosate is the cost-saving non-selective herbicide with the segmentation like the “water in the supermarket”. The competition is in “cents” level. The discount of payment in advance is the valid way for customer acquisition. However, when global herbicide resistance (HR) happens, it is difficult to control HR not only for branded glyphosate + 2,4-D, but also for the glyphosate formulation produced by generic companies. Glufosinate, especially like L-glufosinate becomes the critical weapon for trouble shooting on HR in the future.

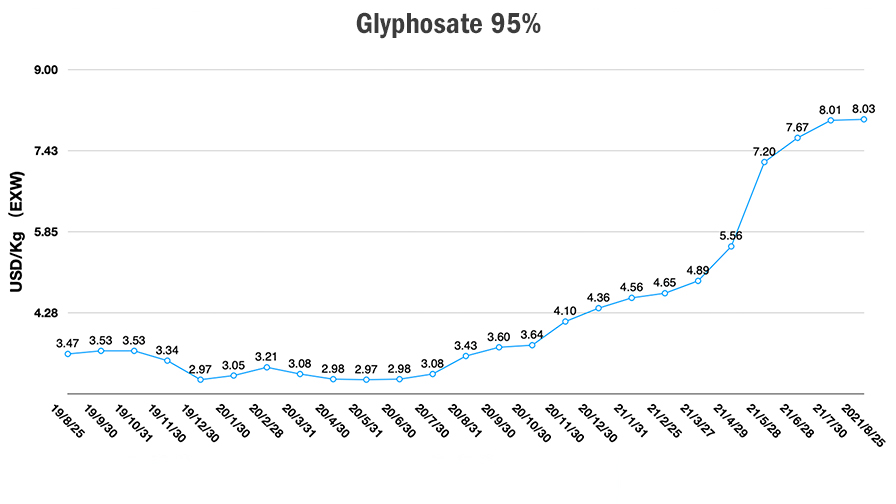

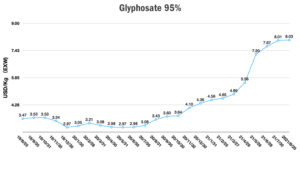

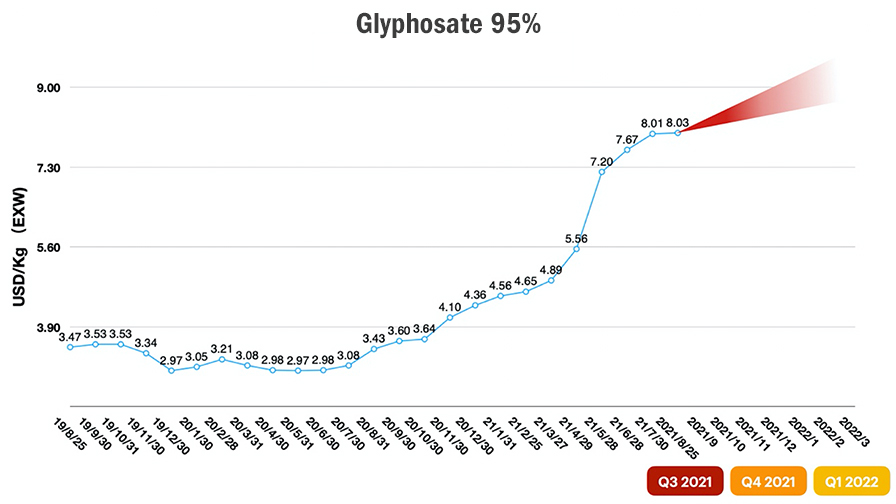

Based on the intricate market situation, the glyphosate price is trending true to expectations. Supply gaps have driven the glyphosate price. Its price had the highest growth rate in April and May 2021 as a result of intensive demand for safe inventory and high raw material price. Since June, the global demand was affected by the high price level. And it started to bring pressure on farmers from July. As the product of “water in supermarket”, the price increasing would make the demand curve movement to the lower quantity demand. With high inventory of glyphosate, the consumption of high-priced glyphosate will be difficult in the next six months.

Combined with quantitative easing (QE) monetary policy and the influencing factors like high raw material price, strong demand from LATAM, and China domestic market demand, glyphosate prices are expected to rise. Environment protection inspection is continuous and serious for Chinese manufacturers. On the other hand, recent limitation of electricity became the most important challenge to the China agrochemical industry. It seems to be part of the government’s action on carbon neutrality before the south of China goes into cold season. The limitation of electricity and environment protection inspection pushed pending of new order fulfillment in China.

According to the experience of 2008 Olympic Games, national ceremony will cause restriction on environment protection audit. So, there will be low operation rate for Beijing Winter Olympic Game from Jan. 2022 to Feb. 2022. The ordinary production could be back in March of next year.

Moreover, the largest U.S. producer of glyphosate is offline due to the impacts of Hurricane Ida. Bayer Crop Science confirmed its Luling, LA, site was offline as of Monday. And the duration of the pause in production is still unknown. The supply disruption of a key glyphosate producer is pushing the price of glyphosate back to the level we saw in 2008, up to 9 USD/Kg to 10 USD/Kg EXW from China suppliers. Because the uncertainty of production of China, the glyphosate price is expected to rise dramatically in the next six months.

However, demand in the northern hemisphere will be lower through winter months, and the Bayer CropScience capacity should be back online in time to absorb the future demand rather before the value chain needs to seek alternate suppliers. So, the predictive pricing level of glyphosate from China would be 8.5 USD/Kg EXW to 9.5 USD/Kg EXW in coming six months. Stable in high level and soft landing down would be highly possible after March 2022.

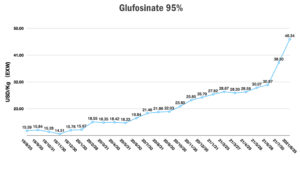

Glufosinate is under different situation. It depends on the balance of supply and demand. Currently the global demand of glufosinate shall be around 60 thousand Mt. The China capacity is around 30 thousand Mt with expansion up to 50 thousand Mt in total. BASF has 12,000 Mt capacity of glufosinate-ammonium (GA). And they will concentrate GA production by closing a production site at Muskegon, Michigan (U.S.), and one production plant in Knapsack (Germany) before 2022. UPL also has ambition on glufosinate production investment. Their 5,000 Mt capacity has potential to be expanded to 10,000 Mt in near future.

Today’s glufosinate products consist of the active L-glufosinate ammonium and the inactive D-glufosinate ammonium. BASF acquired Glu-L (L-glufosinate) Technology from AgriMetis in September 2020. It turned the global supply heading to the L-glufosinate which can save almost 50% dosage in the farmland. With the potential to be the alternative solution of burn down, glufosinate’s challenge is always the cost for farmers. If the L-glufosinate can be promoted well, the glufosinate market share could have a long-term high growth to reach more than $1 billion as anticipation in a decade.

From the aspect of market demand, glufosinate is mainly segmented as controller of herbicide resistance. It is widely introduced into GMO and Non-GMO markets. In August 2021, Corteva Agroscience launched Conkesta E3 soybeans in Brazil, which is the world’s largest GMO planting territory. The new GMO soybean launch by Corteva will surely develop glufosinate application in Brazil. Moreover, that shows that the channel’s inventory of glufosinate will have been ready.

On the other hand, the generic glufosinate market competition becomes more serious. UPL and ADAMA are ambitious to be present in glufosinate market. The Brazilian companies like CCAB, Nortox, and Ourofino are cultivating on the such segment by differentiation and R&D.

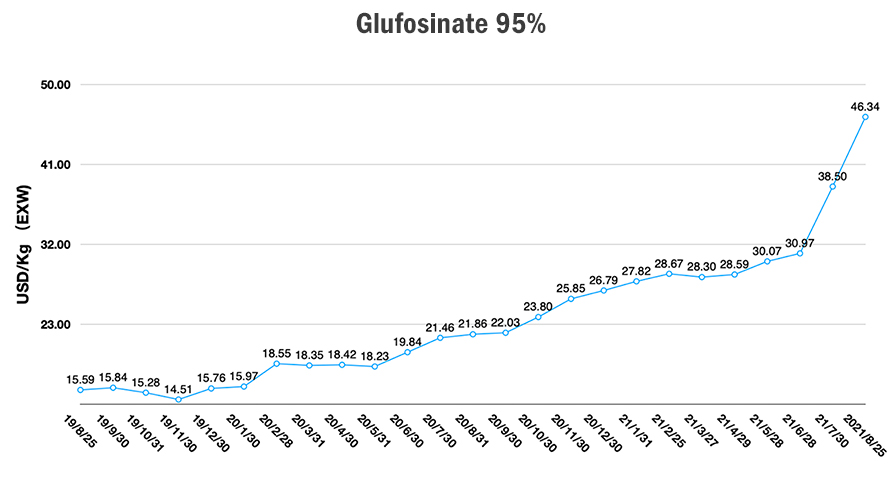

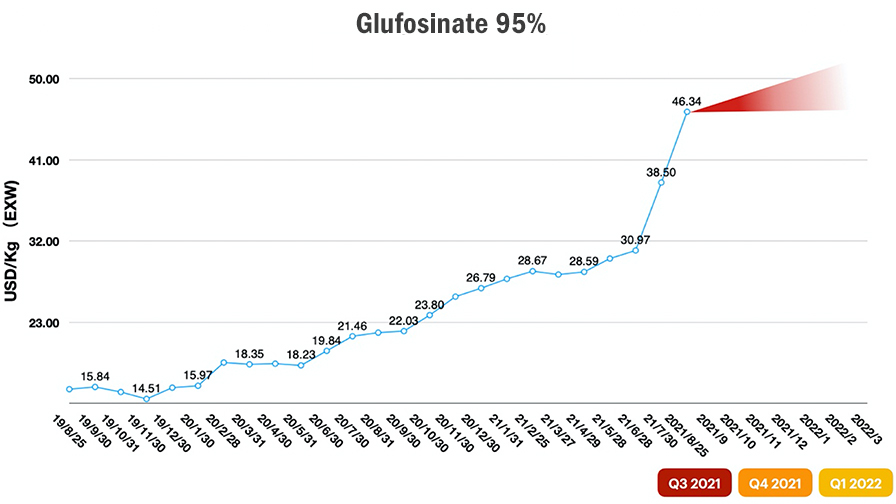

Regarding the glufosinate supply, the China glufosinate market price rocketed sky high from June 2021. The key reason was Lier’s suspension of production. The short supply from leading manufacturers brought disruption of China glufosinate supply. Moreover, the additional capacity of glufosinate did not enter into supply channels in time. The hesitation of potential capacity increasing from China delayed to show up. It led to the consequence of high market price together with tight inventory in the market. Like mentioned before, the limitation of electricity and environment protection inspection are affecting the entire Sichuan province. Fuhua and Lier could be affected sooner than later, and it will keep driving the glufosinate prices higher amid lower capacity and inventories.

In August 2021, the glufosinate 95% AI price reached $46/Kg EXW. But demand for the overpriced AI amid lower-priced options is not overwhelming, so global inventories should be sufficient to meet the need of farmers who planted the companion seed. And for near-term planting in the Southern Hemisphere, multinationals will be able to guide seed decisions of their clients.

There is a high possibility that capacity of glufosinate will rise in coming six months. But the limitation on electricity and emphasis on environment protection could disrupt the new capacity from alleviating prices in the near term. Due to the higher price of glyphosate, the demand on glufosinate will become stronger.

There was a two-month gap of glufosinate supply. So, the customers’ “Just in Time (JIT)” strategy shall still face challenge in Q4 2021. But the investment on potential glufosinate capacity is on the way. So, the predictive pricing level of glufosinate from China would be 45 USD/Kg EXW to 50 USD/Kg EXW in the coming six months. If new cargo comes into the supply market, the price of glufosinate could be back to reasonable level quickly.

As the Delta variant circles the globe in 2021, there are significant challenges to labor forces, ports, and production around the world, and China is no different. Due to the interruption of global supply chain, it is difficult to keep consistent supply from production sites to the end markets. Freight cost increased by shipping companies will surely bring higher costs to all parts of the supply chain, and it is unavoidable. By the end of 2021, the global inflation caused by the quantitative easing monetary policy and shortage of commodity supply will be the biggest risks to an economic bubble. For those who lived through the glyphosate bubble in 2008 and thought it was a one-time occurrence, here we go again. Glyphosate’s history is repeating itself, and this time it has company.